Closing Costs With Rocket Mortgage

Description

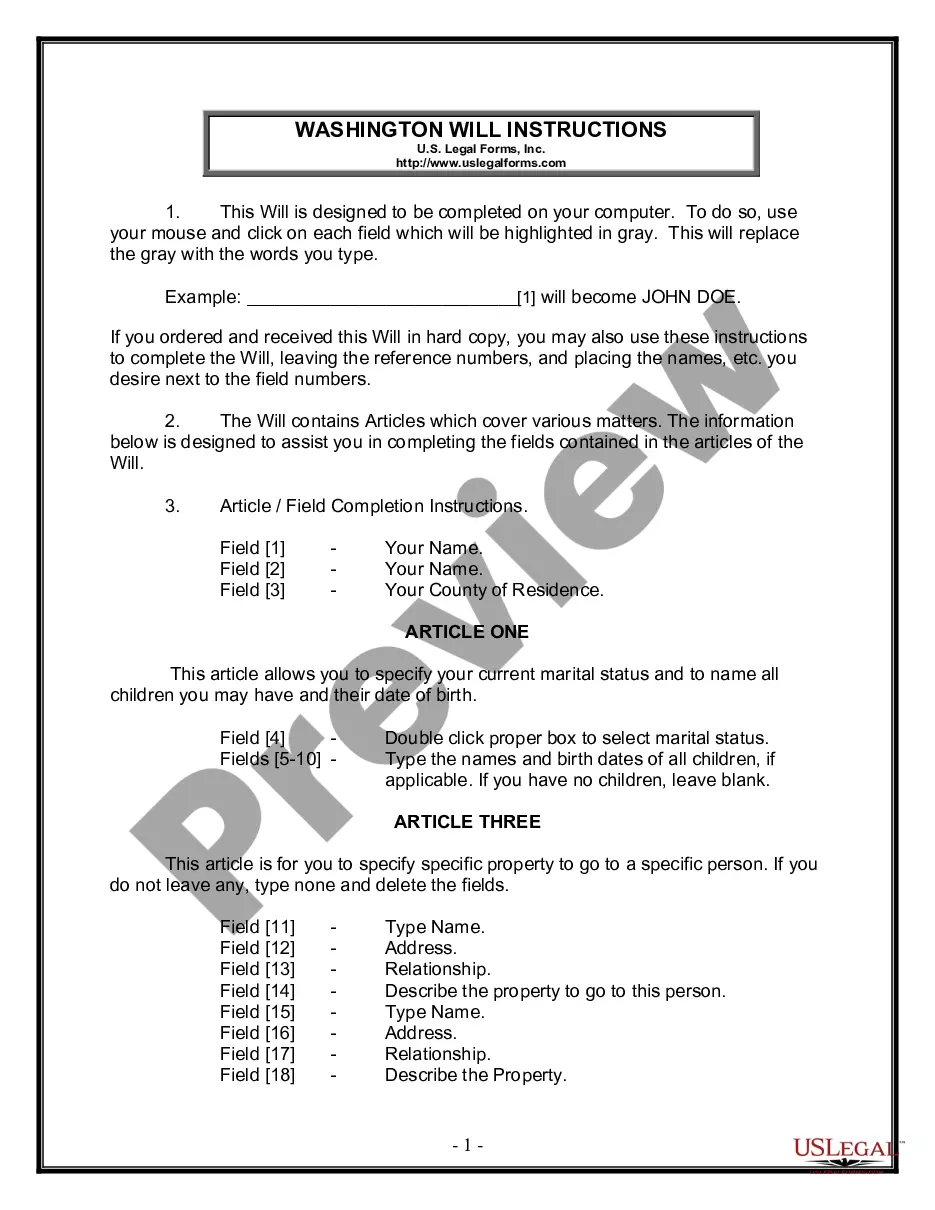

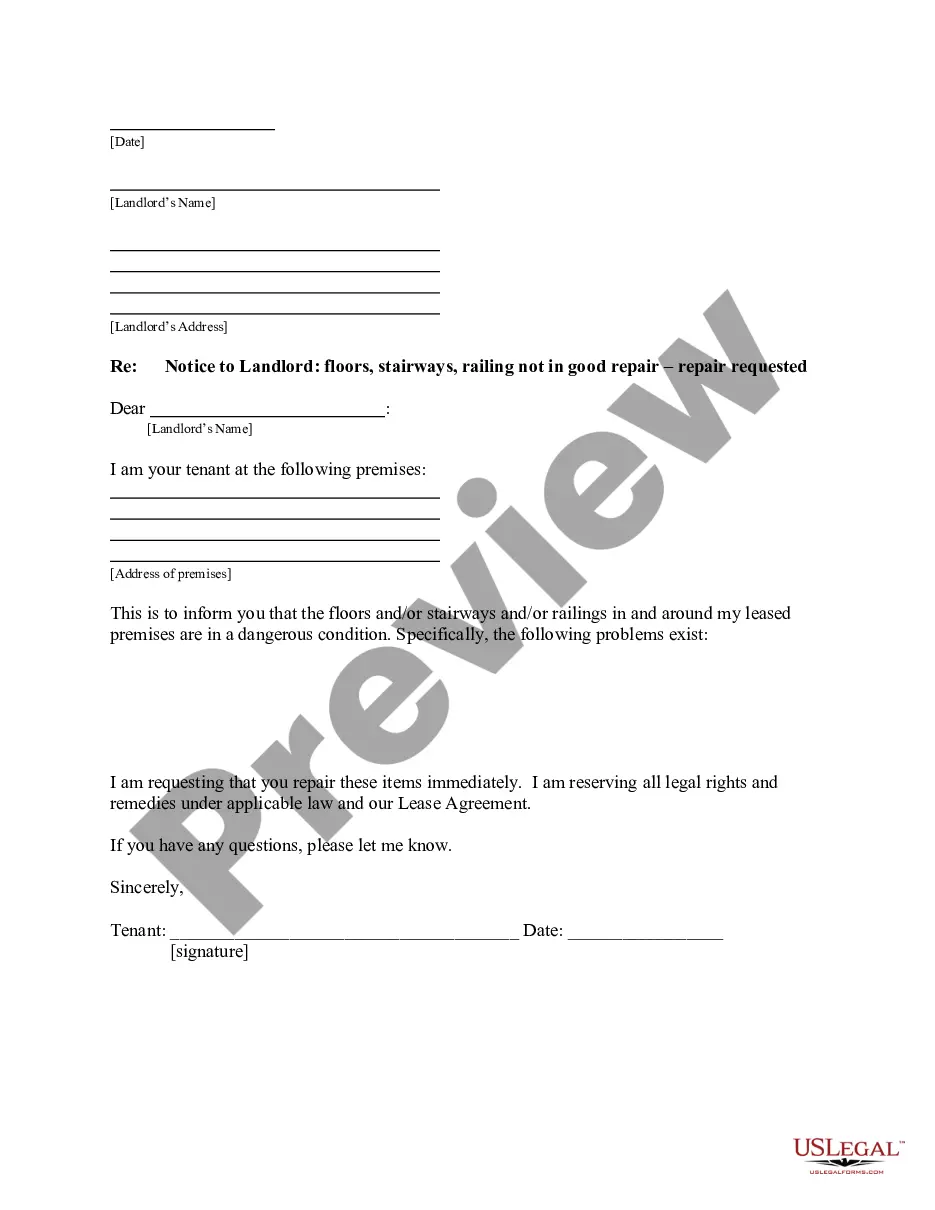

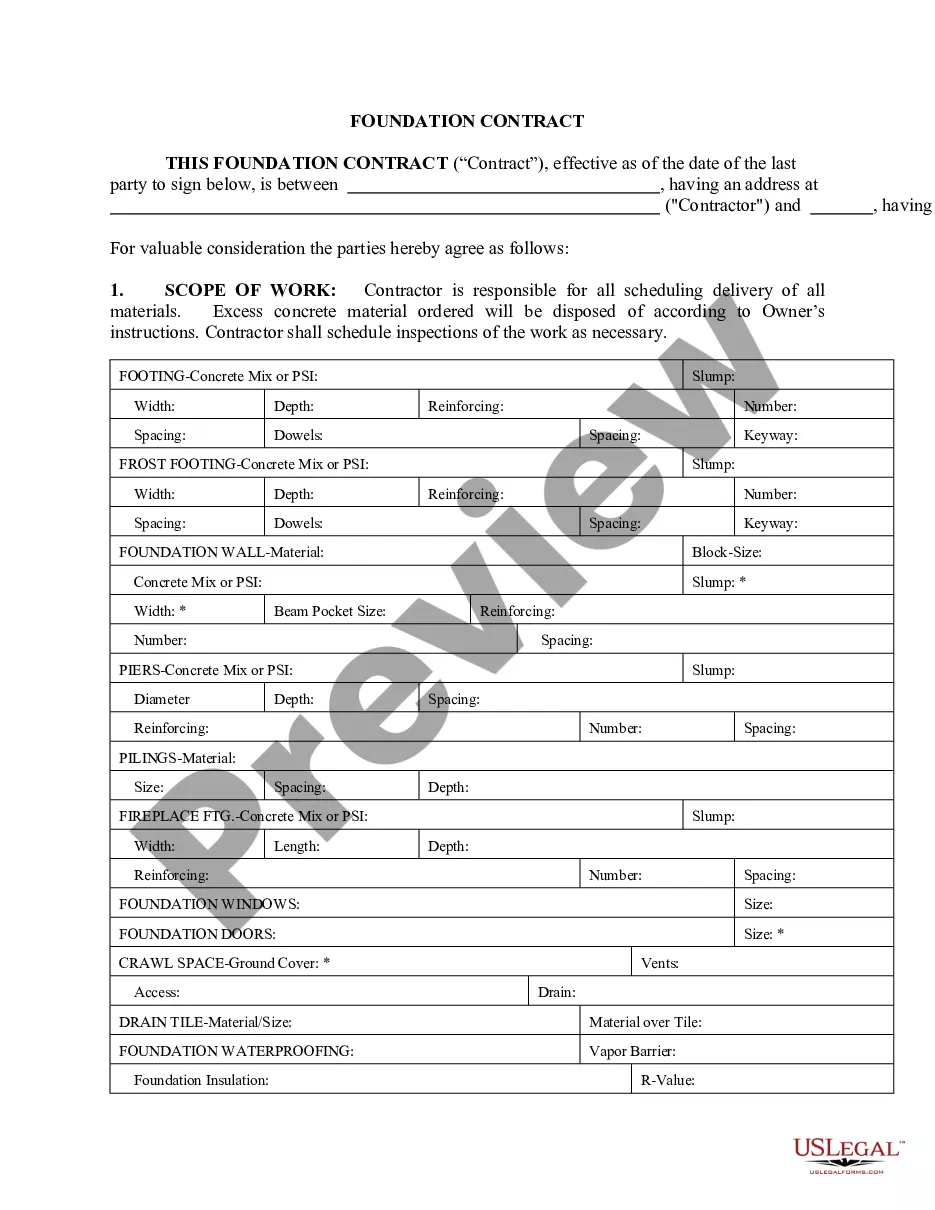

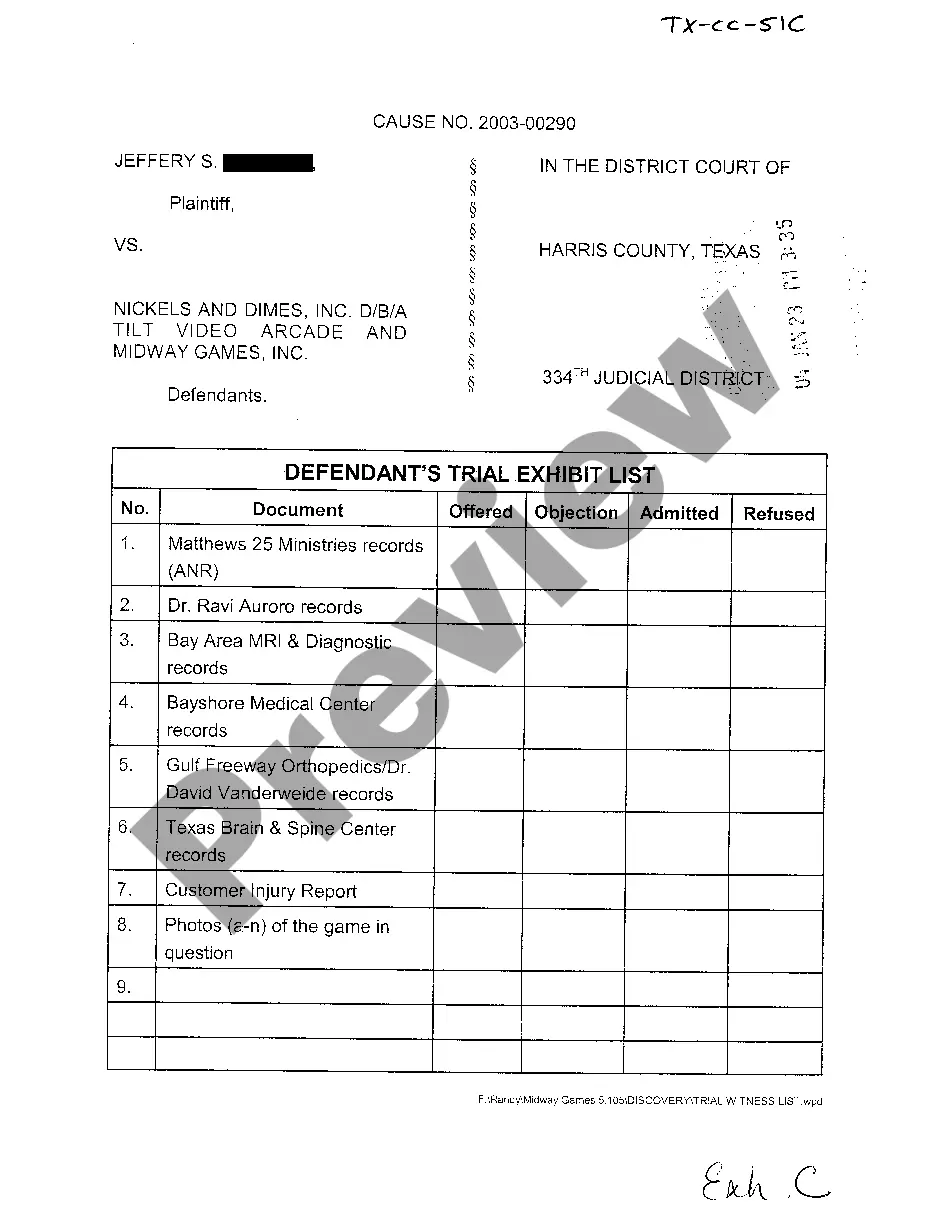

How to fill out South Carolina Closing Statement?

Legal management can be perplexing, even for experienced professionals.

When you're searching for Closing Costs With Rocket Mortgage and don’t get the opportunity to dedicate time to finding the correct and current version, the processes might be overwhelming.

Tap into a valuable resource pool of articles, guides, and materials pertinent to your circumstances and requirements.

Save time and effort looking for the documents you need, and leverage US Legal Forms’ sophisticated search and Preview feature to locate Closing Costs With Rocket Mortgage and obtain it.

Make the most of the US Legal Forms online catalog, backed by 25 years of experience and reliability. Enhance your daily document management with a seamless and user-friendly process today.

- If you possess a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to review the documents you have previously downloaded and to organize your folders as you see fit.

- If this is your inaugural visit to US Legal Forms, create a free account and gain unrestricted access to all advantages of the library.

- Here are the steps to follow after accessing the form you need.

- Ensure it is the correct form by previewing it and reviewing its details.

- Confirm that the sample is valid in your state or county.

- Click Buy Now when you are ready.

- Select a subscription plan.

- Choose the format you desire, and Download, complete, eSign, print and send out your document.

- Access state- or county-specific legal and organizational documents.

- US Legal Forms addresses any requirements you may have, from personal to commercial paperwork, all in one place.

- Utilize advanced tools to complete and manage your Closing Costs With Rocket Mortgage.

Form popularity

FAQ

Rocket Mortgage has gained a solid reputation in the mortgage industry, largely due to its innovative technology and ease of use. Many customers appreciate the transparency that comes with understanding their closing costs with Rocket Mortgage. However, like any service, experiences can vary, so conducting thorough research and reading reviews can help you determine if it meets your needs. You might also find resources on platforms like UsLegalForms useful in evaluating your options.

You can generally expect the total to be between 1 and 5% of the price you are paying to buy your home. Payment for closing costs can sometimes be financed with your loan, in which case it will be subject to interest charges. Alternatively, you can pay your closing costs in cash, similar to your down payment.

Closing costs are typically 3% ? 6% of the loan amount. This means that if you take out a mortgage worth $200,000, you can expect to add closing costs of about $6,000 ? $12,000 to your total cost. Closing costs don't include your down payment, but you may be able to negotiate them.

On average, it takes about 30 ? 45 days to close on a home, from filling out your mortgage loan application to showing up at the closing table. Closing day, the day you sign your final paperwork, lasts about 1 to 2 hours as long as everything goes as planned.

Average closing costs for the buyer run between about 2% and 6% of the loan amount. That means, on a $300,000 home loan, you would pay from $6,000 to $18,000 in closing costs in addition to the down payment. The most cost-effective way to cover the costs is to pay them out-of-pocket as a one-time expense.

Timing Requirements ? The ?3/7/3 Rule? The initial Truth in Lending Statement must be delivered to the consumer within 3 business days of the receipt of the loan application by the lender. The TILA statement is presumed to be delivered to the consumer 3 business days after it is mailed.