Writ Of Execution South Carolina Withholding

Description

How to fill out South Carolina Writ Of Execution?

Utilizing legal document examples that comply with federal and state regulations is essential, and the internet provides numerous options to select from.

However, what is the use of spending time searching for the appropriate Writ Of Execution South Carolina Withholding template online when the US Legal Forms digital repository already hosts such documents collected in one location.

US Legal Forms is the largest virtual legal repository with over 85,000 fillable documents created by lawyers for any business and personal circumstances.

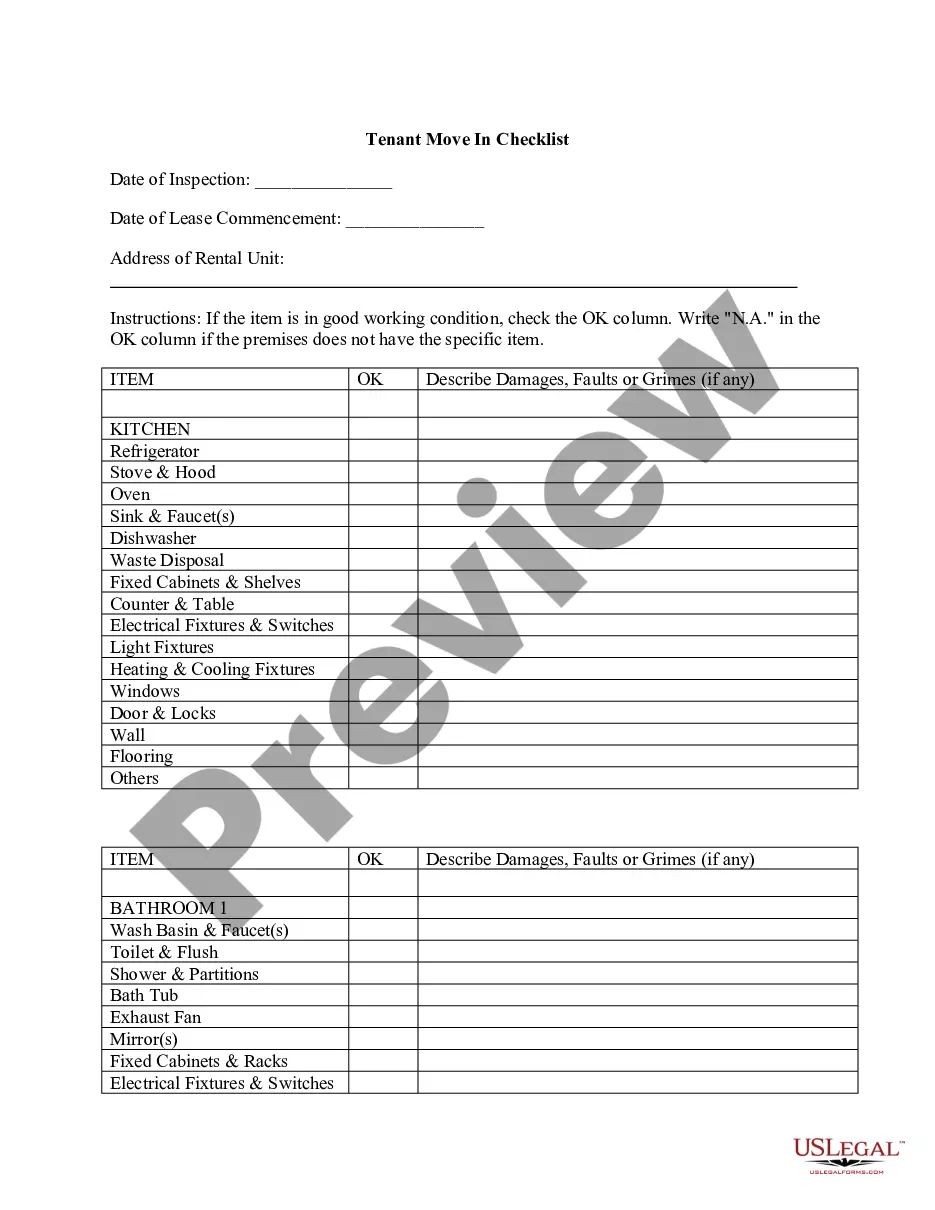

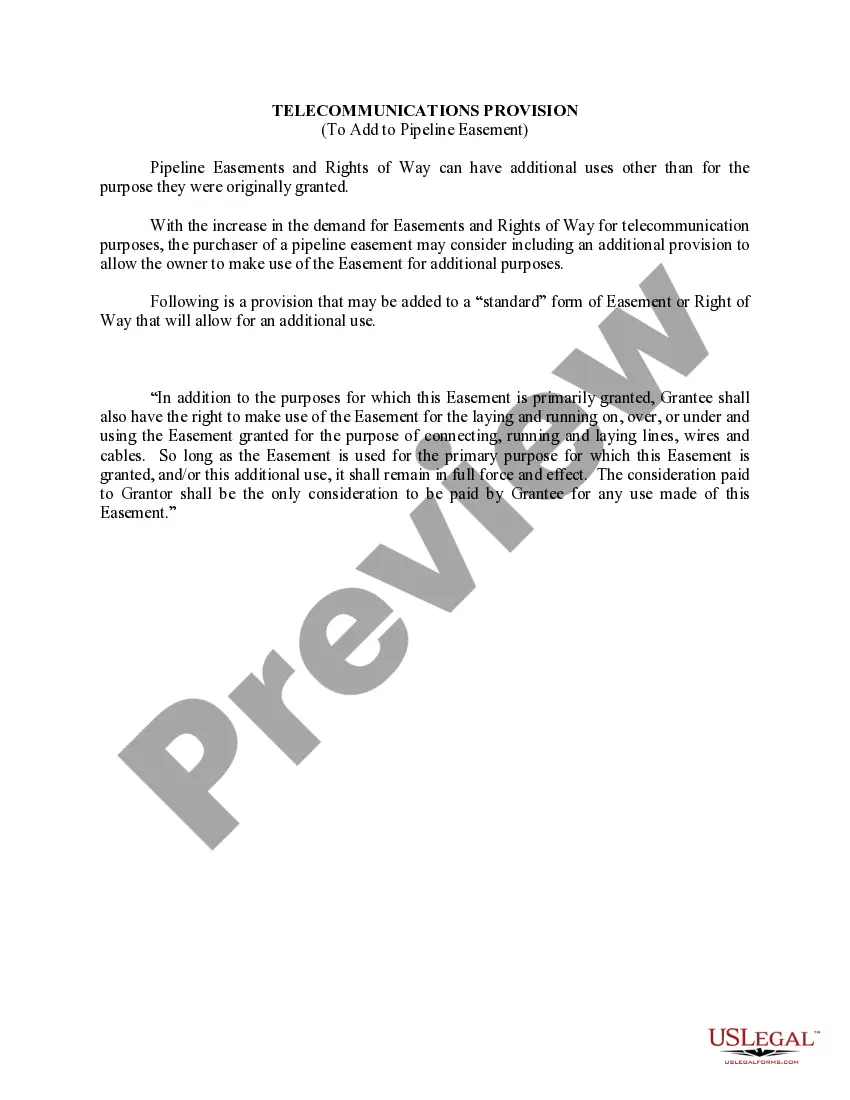

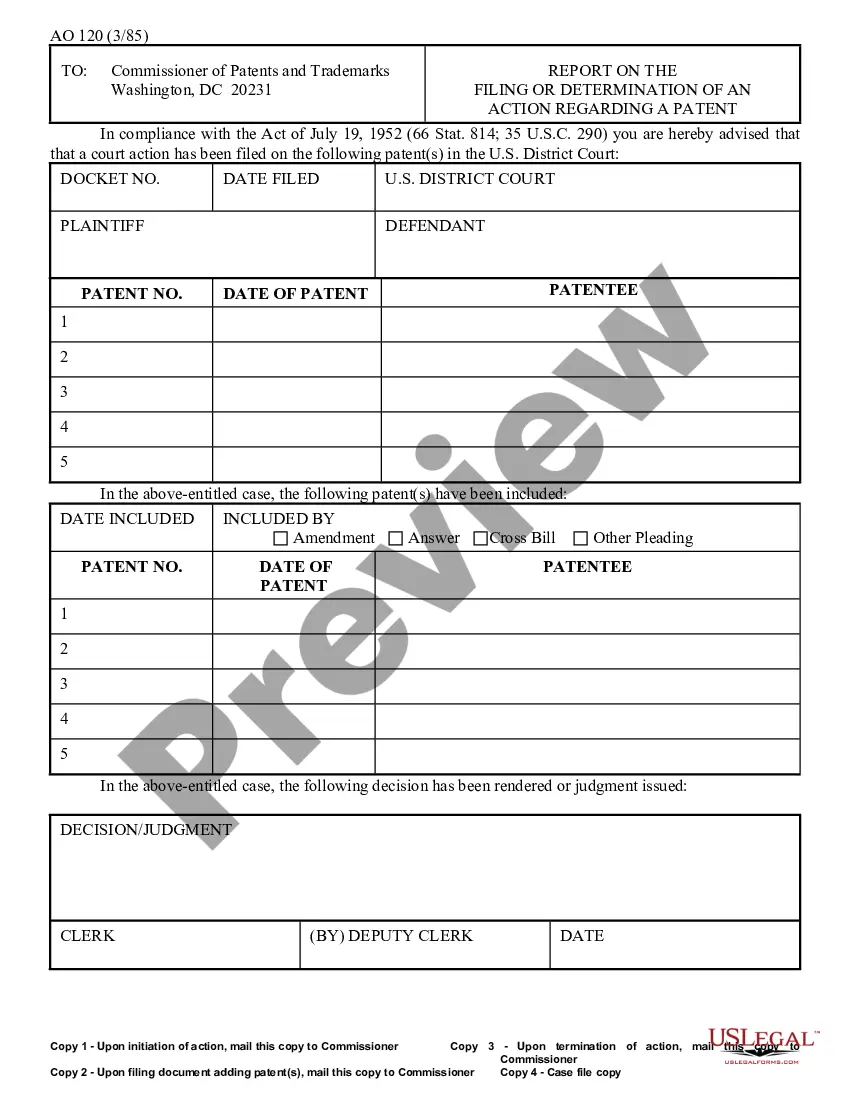

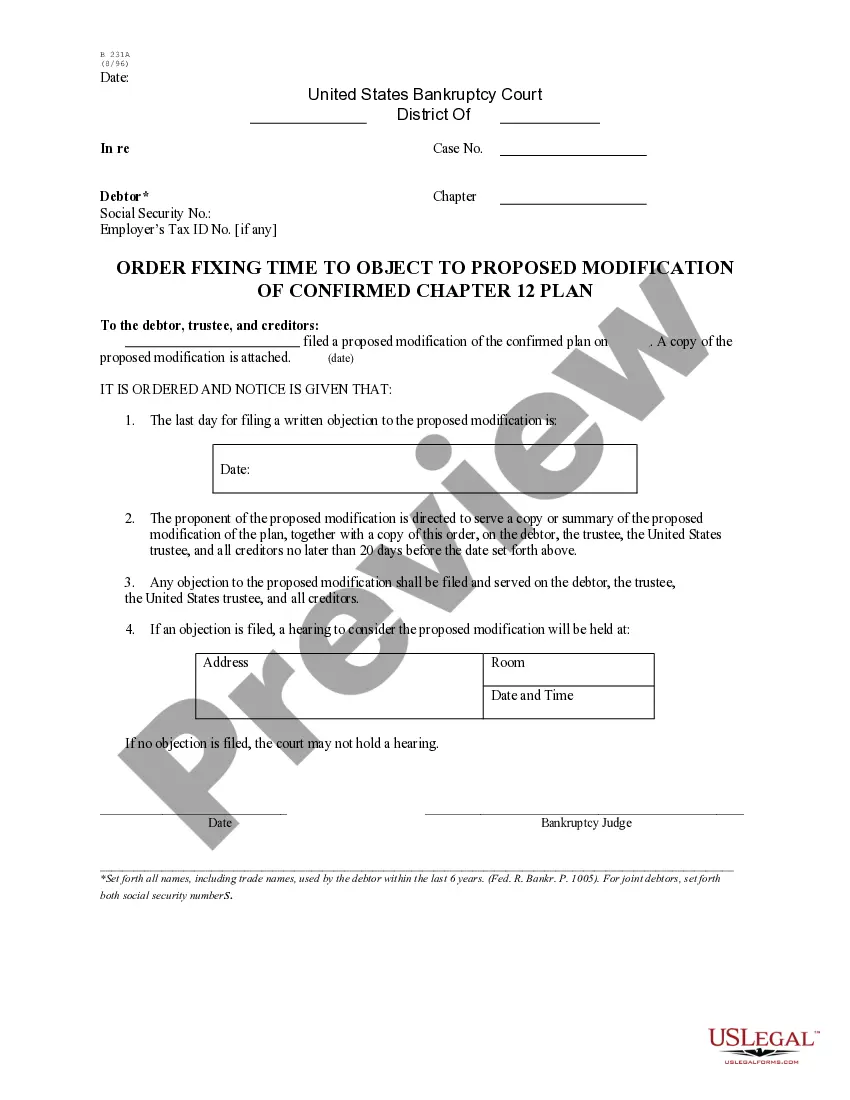

Review the template using the Preview function or through the text outline to make sure it fulfills your needs.

- They are straightforward to navigate with all forms sorted by state and intended use.

- Our experts stay informed about legislative alterations, ensuring that you can always trust your form is current and compliant when obtaining a Writ Of Execution South Carolina Withholding from our site.

- Acquiring a Writ Of Execution South Carolina Withholding is simple and swift for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the template you require in your chosen format.

- If you are new to our site, follow the steps outlined below.

Form popularity

FAQ

A writ of garnishment in South Carolina is a legal order that allows a creditor to collect a debt by intercepting funds owed to the debtor from a third party. This process often involves the garnishment of wages, bank accounts, or other income sources. If you are dealing with a writ of execution in South Carolina withholding, understanding garnishment is essential, as it directly impacts how debts are enforced. For personalized assistance, consider using US Legal Forms, which provides easy access to legal documents and guidance related to garnishment and execution.

A writ of garnishment and a writ of execution serve different purposes in the legal process. A writ of garnishment allows a creditor to collect a portion of a debtor's wages or bank account directly, while a writ of execution is used to enforce a court judgment by seizing the debtor's property. In South Carolina, when dealing with the intricacies of a writ of execution, you may encounter withholding measures that can impact your financial situation. For comprehensive assistance, consider using USLegalForms, which provides resources and forms tailored to navigate the complexities of writs in South Carolina.

You can close your account: at MyDORWAY.dor.sc.gov. Log in, select the More tab, then click Close a Tax Account to get started. by marking the Close Withholding Account box and including a close date on your WH-1605 or WH-1606 return You are required to file a return through the closing date.

You can close your account: at MyDORWAY.dor.sc.gov. Log in, select the More tab, then click Close a Tax Account to get started. by marking the Close Withholding Account box and including a close date on your WH-1605 or WH-1606 return You are required to file a return through the closing date.

South Carolina employers must submit and remit payroll taxes withheld from employee wages. The frequency of payments depends on the amount withheld. If the total withholding amount is less than $500 per quarter, payments are due quarterly by the last day of the month following the end of the quarter.

Generally, where the court's judgment requires payment of money, the most common remedy in magistrate's court is execution. The process to enforce a judgment for the payment of money shall be by writ of execution and shall be conducted as provided by law.

File and pay online at MyDORWAY.dor.sc.gov. Do not mail when filing online. You must file a return even if no SC Income Tax has been withheld during the quarter. You must file a WH-1606 if the account was open for any portion of the calendar year.