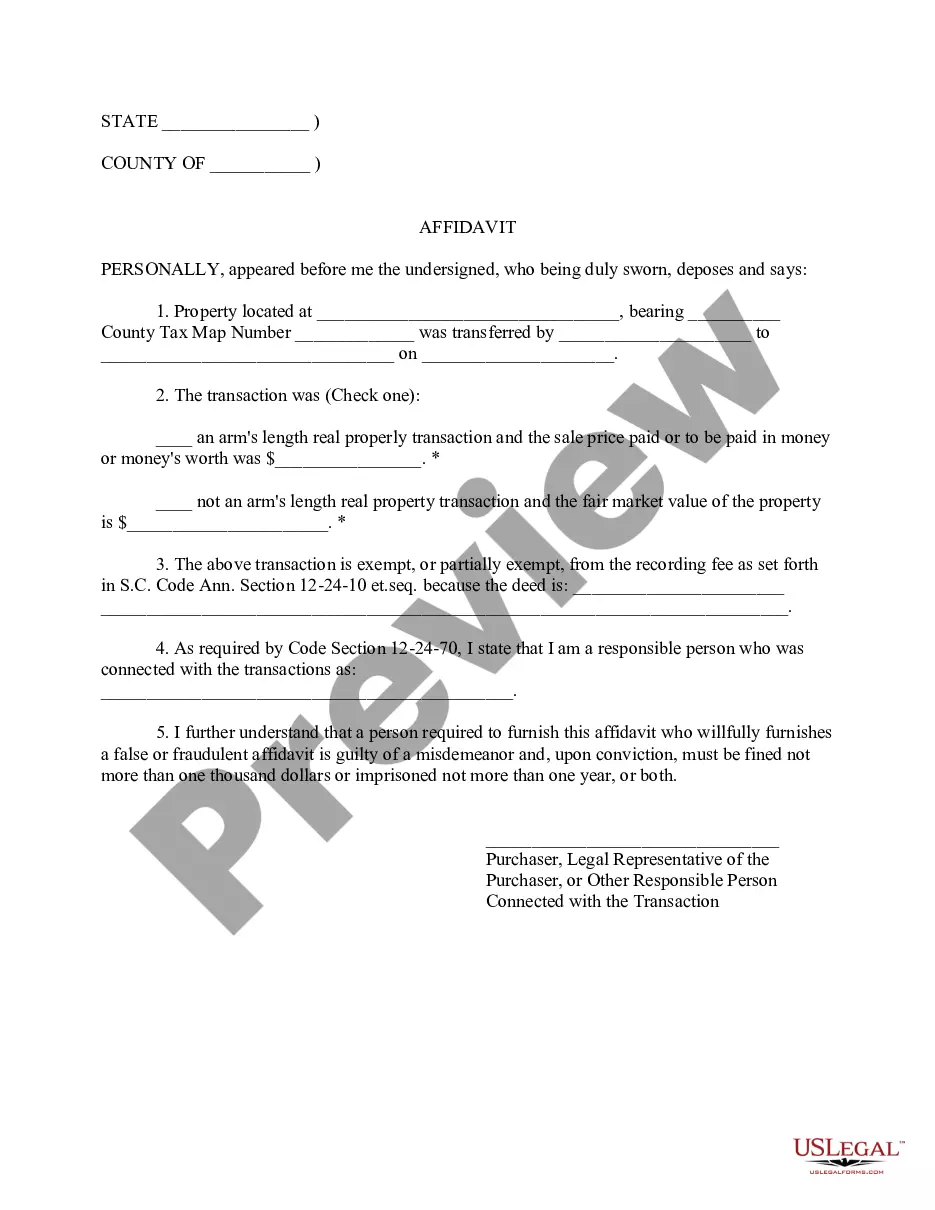

South Carolina Affidavit Of Consideration

Description

How to fill out South Carolina Affidavit Of Property Value?

Individuals typically link legal documentation with something intricate that solely a specialist can manage.

In a sense, this is accurate, as composing South Carolina Affidavit Of Consideration demands significant understanding of subject guidelines, encompassing state and county laws.

However, with US Legal Forms, everything has turned more attainable: ready-to-use legal documents for every life and business circumstance particular to state regulations are compiled in one online directory and are now accessible to everyone.

Choose the format for your document and click Download. Print your document or upload it to an online editor for a faster completion. All templates in our catalog are reusable: once obtained, they remain saved in your profile. You can access them anytime needed via the My documents tab. Discover all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85k current documents organized by state and area of use, so searching for South Carolina Affidavit Of Consideration or any other specific template only requires a few minutes.

- Previously registered users with an active subscription must Log In to their account and click Download to acquire the form.

- New users to the service will first need to create an account and subscribe before being able to save any files.

- Here is the step-by-step guide on how to obtain the South Carolina Affidavit Of Consideration.

- Examine the page content closely to make sure it meets your requirements.

- Review the form description or check it through the Preview option.

- Search for another sample via the Search field above if the prior one does not fit you.

- Click Buy Now when you come across the suitable South Carolina Affidavit Of Consideration.

- Select a pricing plan that accommodates your requirements and budget.

- Create an account or sign in to continue to the payment page.

- Make payment for your subscription using PayPal or with your credit card.

Form popularity

FAQ

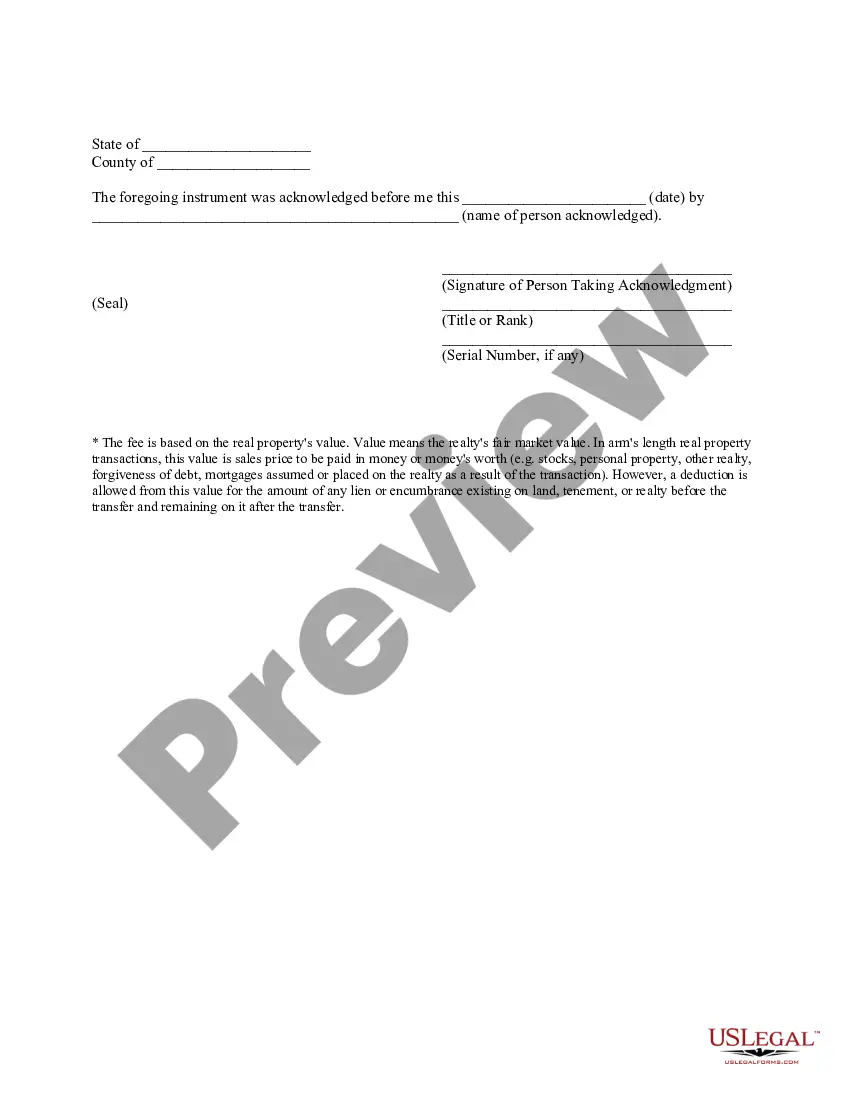

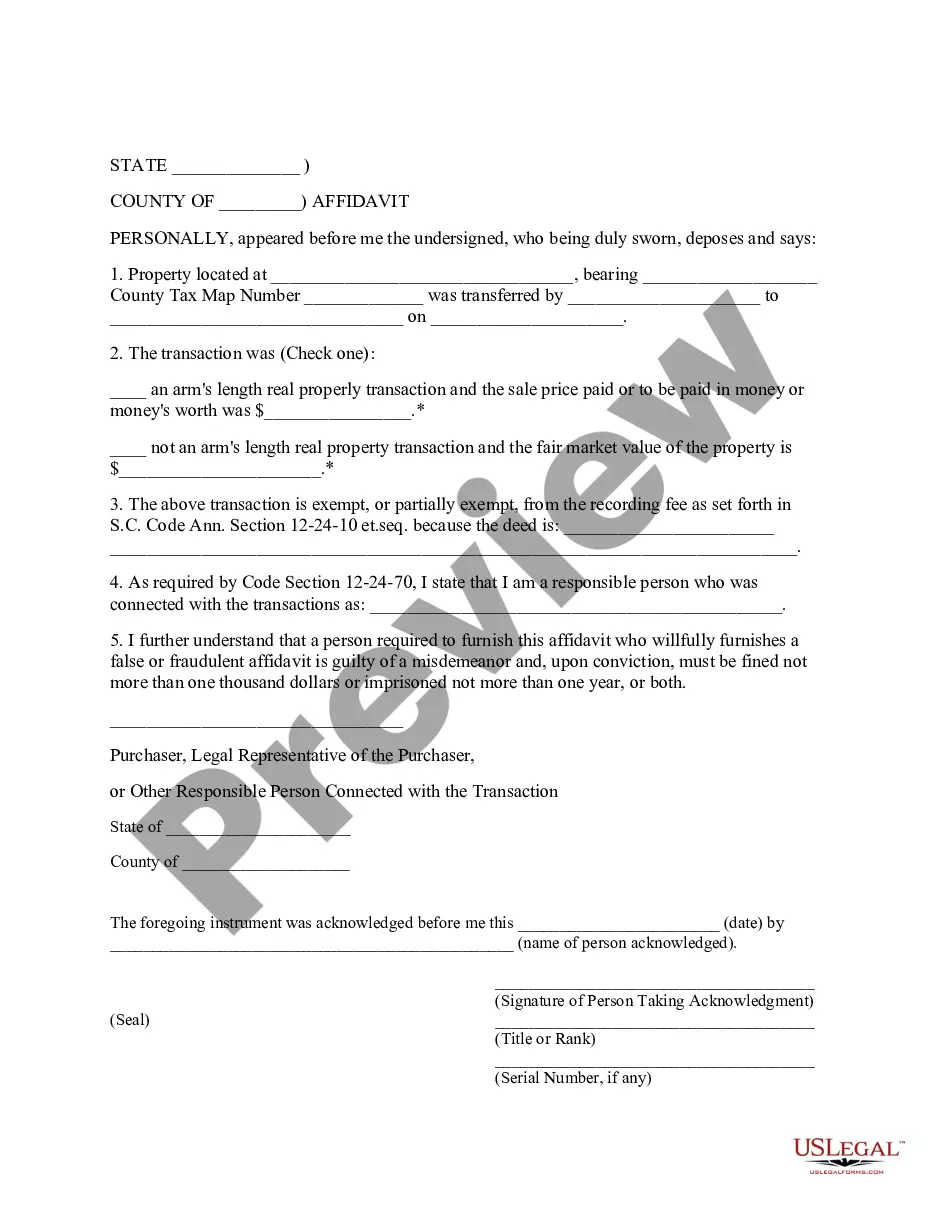

The South Carolina deed recording fee is imposed for the privilege of recording a deed, and is based on the transfer of real property from one person or business entity to another. The fee is generally imposed on the grantor of the real property, although the grantee may be secondarily liable for the fee.

In South Carolina, the grantor must sign the deed in front of two witnesses and in the presence of an individual authorized by the state to administer an oath. Record the completed deed at the local county Recorder's office, along with an Affidavit of True Consideration (S.C. Code Ann.

How to Write a South Carolina Quitclaim Deed Preparer's name and address. Name and mailing address of the person to whom the recorded deed should be sent. County where the real property is located. The consideration paid for the property. Grantor's name and address. Name and address of the grantee.

The fee is $1.85 on realty value of $100-$500 and $1.85 ($1.30 for state portion and $0.55 for county portion) for each $500 increment afterwards.

It is customary for the seller of the property to pay all real estate transfer taxes in South Carolina. The transfer taxes are usually due at the time of closing, alongside other fees such as appraisal fees or agent fees.