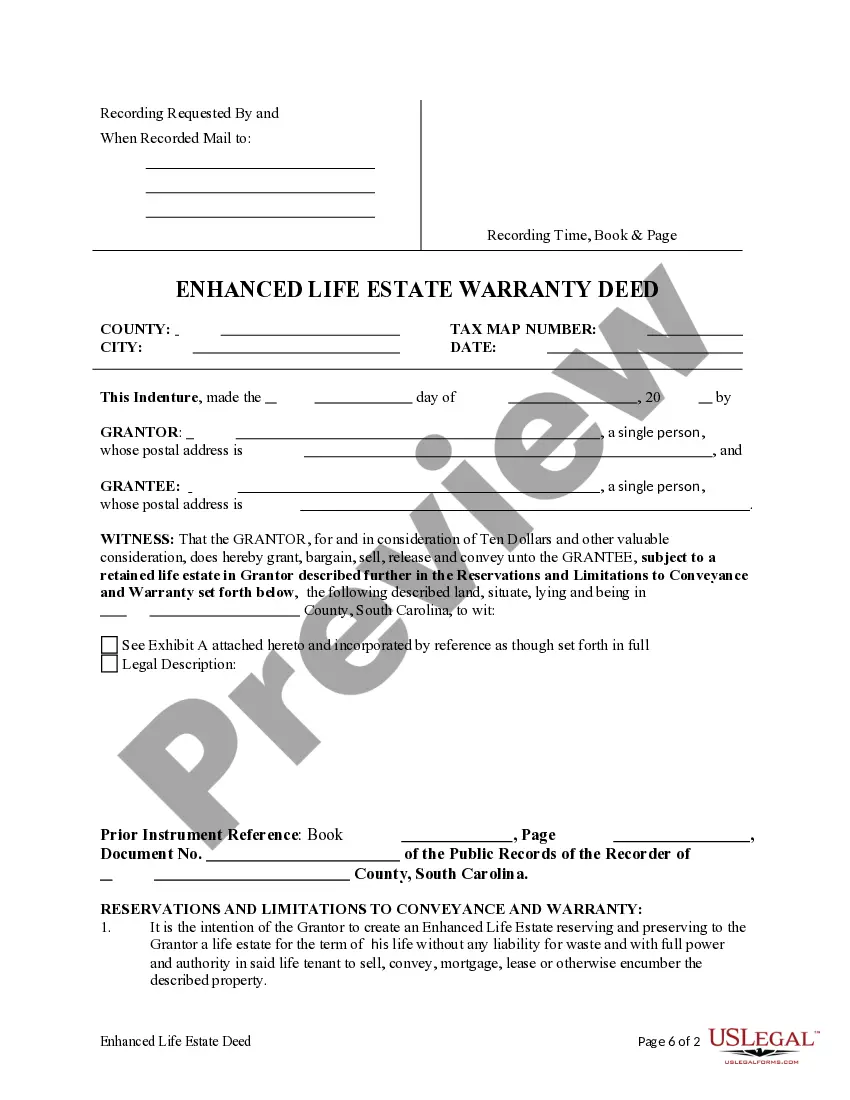

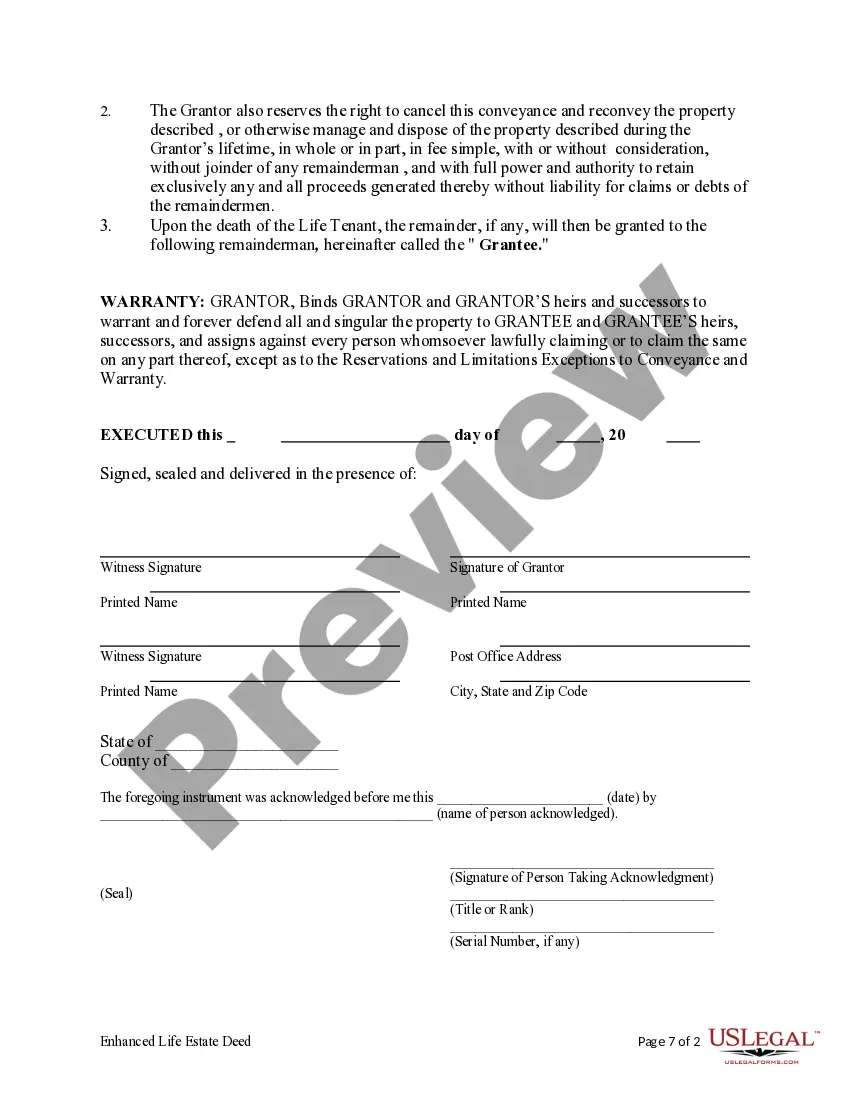

This form is a Warranty Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantee is an individual. Grantor conveys the property to Grantee subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. The Grantee must survive the Grantor or the conveyaqnce is null and void. This deed complies with all state statutory laws.

Lady Bird Deed South Carolina Form 400

Description

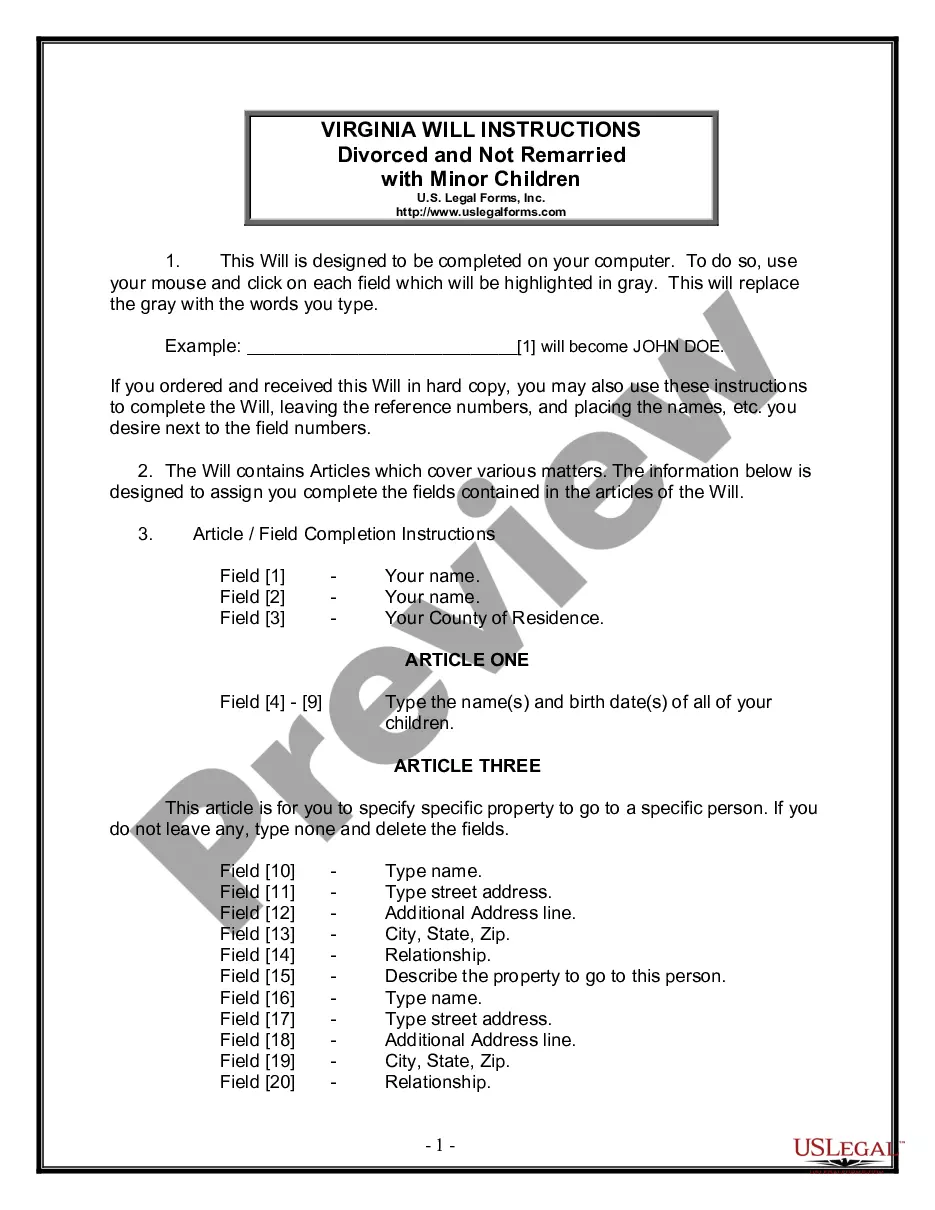

How to fill out South Carolina Enhanced Life Estate Or Lady Bird Warranty Deed From Individual To Individual?

Obtaining legal templates that comply with federal and local regulations is vital, and the internet provides numerous choices to select from.

However, what is the benefit of spending time hunting for the suitable Lady Bird Deed South Carolina Form 400 example online when the US Legal Forms digital library already compiles such templates in a single location.

US Legal Forms is the top online legal repository with more than 85,000 fillable documents prepared by lawyers for any professional or personal situation. They are easy to navigate with all documents categorized by state and intended use. Our experts stay updated with legislative modifications, ensuring you can always trust that your form is current and compliant when acquiring a Lady Bird Deed South Carolina Form 400 from our site.

All templates you find through US Legal Forms are reusable. To re-download and fill out previously saved forms, navigate to the My documents section in your account. Enjoy the most comprehensive and user-friendly legal paperwork service!

- Obtaining a Lady Bird Deed South Carolina Form 400 is fast and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log Into your account and save the document sample you require in the correct format.

- If you are visiting our site for the first time, follow the guidelines below.

- Review the template using the Preview feature or through the text outline to confirm it meets your requirements.

- Search for an alternate sample using the search function at the top of the page if necessary.

- Click Buy Now once you have found the appropriate form and select a subscription package.

- Create an account or Log In and make a payment via PayPal or credit card.

- Select the appropriate format for your Lady Bird Deed South Carolina Form 400 and download it.

Form popularity

FAQ

The Division has transitioned from the RI-7004 to the Form BUS-EXT. Details are contained in ADV 2022-38. For Tax Year 2022, if an extension is being filed for the RI- 1065, RI-1120S, RI-1120C, RI-PTE or RI-1120POL, the extension must be filed using the Form BUS-EXT.

Rhode Island Form 1040/1040NR ? Personal Income Tax Return for Residents, Nonresidents, and Part-Year. Rhode Island Form 1040H ? Property Tax Relief Claim. Rhode Island Form 1040MU ? Resident Credit for Taxes Paid to Another State. Rhode Island Form 1040MUNR ? Part-Year Resident Credit for Taxes Paid to Another State.

GENERAL INFORMATION. Form RI-1096PT is used to report the Rhode Island withholding of a pass-through entity with nonresident partners, members, benefi- ciaries and shareholders.

For those not subject to this electronic filing requirement: All forms supplied by the Division of Taxation are in Adobe Acrobat (PDF) format. Most forms are provided in a format allowing you to fill in the form and save it. To have forms mailed to you, please call 401.574. 8970 or email Tax.Forms@tax.ri.gov.

The RI-1040 Resident booklet contains returns and instructions for filing the 2022 Rhode Island Resident Individual Income Tax Return. Read the in- structions in this booklet carefully. For your convenience we have provided ?line by line instructions? which will aid you in completing your return.

Local IRS Taxpayer Assistance Center (TAC) ? The most common tax forms and instructions are available at local TACs in IRS offices throughout the country. To find the nearest IRS TAC, use the TAC Office Locator on IRS.gov.

All forms supplied by the Division of Taxation are in Adobe Acrobat (PDF) format. Most forms are provided in a format allowing you to fill in the form and save it. To have forms mailed to you, please call 401.574. 8970 or email Tax.Forms@tax.ri.gov.

Rhode Island ? like the federal government and many states ? has a pay-as-you-earn income tax system. Under that system, employers are required to withhold a portion of their employees' wages and to periodically turn over those withheld funds to the RI Division of Taxation.

These 2021 forms and more are available: Rhode Island Form 1040/1040NR ? Personal Income Tax Return for Residents, Nonresidents, and Part-Year. Rhode Island Form 1040H ? Property Tax Relief Claim. Rhode Island Form 1040MU ? Resident Credit for Taxes Paid to Another State.

Rhode Island requires that you use the same filing status as you used on your federal return, with the exception that married couples filing jointly for federal purposes may file their Rhode Island return(s) separately if one spouse is a RI resident and the other spouse is a nonresident.