Sc Boat Bill Of Sale With Vat

Description

How to fill out South Carolina Bill Of Sale For WaterCraft Or Boat?

Accessing legal document examples that adhere to federal and state regulations is essential, and the internet provides numerous options to select from.

However, what’s the benefit of spending time searching for the correct Sc Boat Bill Of Sale With Vat example online if the US Legal Forms digital library already contains such templates gathered in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable templates created by attorneys for various business and personal situations.

- They are easy to navigate with all documents organized by state and intended use.

- Our experts stay current with legal changes, ensuring that your paperwork is always accurate and compliant when obtaining a Sc Boat Bill Of Sale With Vat from our platform.

- Acquiring a Sc Boat Bill Of Sale With Vat is swift and straightforward for both existing and new clients.

- If you already possess an account with an active subscription, Log In and save the document template you require in the appropriate format.

- If you are unfamiliar with our site, follow the steps below.

Form popularity

FAQ

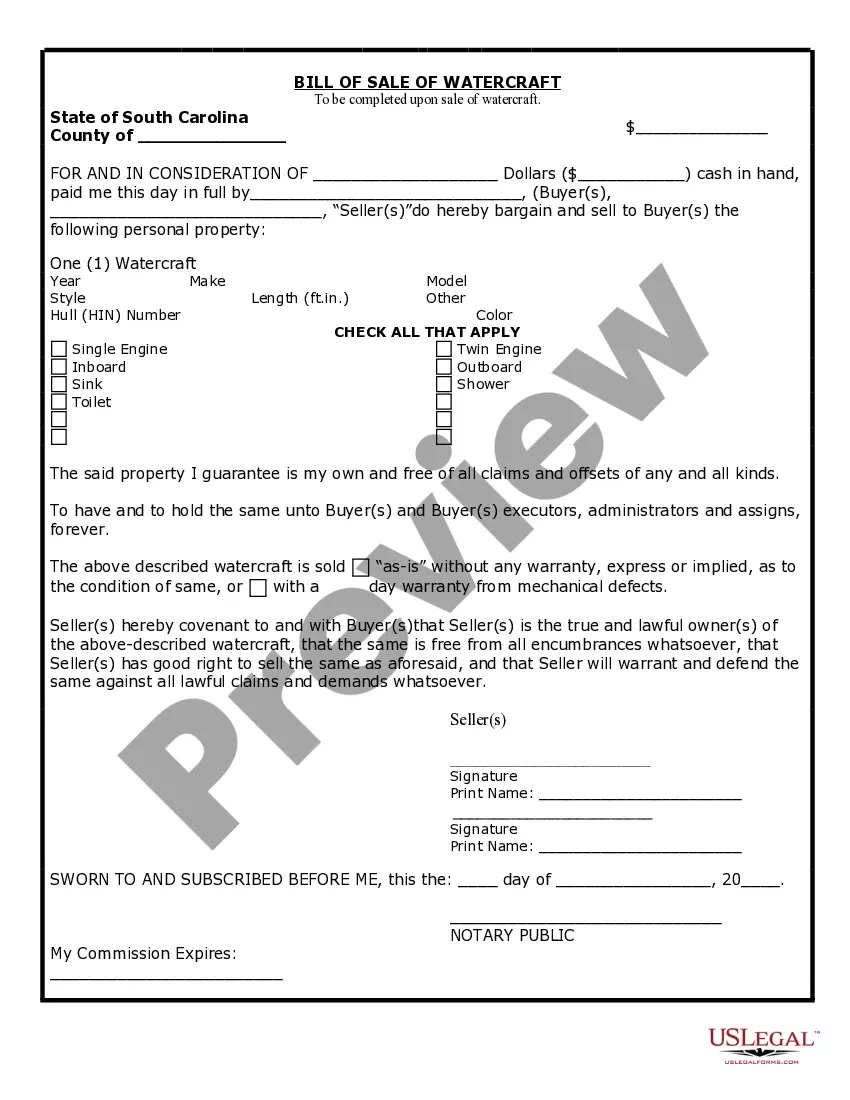

?Casual Excise Tax on sales of boats, motors, or airplanes may not exceed the $500 Maximum Tax. ?Any item subject to the $500 Maximum Tax is taxed at a state rate of 5% and is not subject to any local tax administered by the SCDOR.

The bill of sale or boat title must be presented as proof of ownership. Complete the Watercraft/Outboard Motor Application, which must be signed by the buyer and the seller.

Note: All marine equipment, registered as of January 1st of each year, which include boats and motors valued at $500 or less is exempt from property taxes. All marine equipment tax information is provided to the Auditor's Office by the South Carolina Department of Natural Resources and the United State Coast Guard.

It is part of the state registration process and is required to obtain the decals needed to operate boat in the state. The bill of sale will contain information about the buyer and the seller, a description of the boat, and the terms of the transaction.

A boat bill of sale includes information on the buyer, the seller, and the vessel. It also includes the transaction date, purchase price, and signatures of both the buyer and the seller. Boat owners in South Carolina must register their vessels with the South Carolina Department of Natural Resources.