Rhode Island Irrevocable Trust Laws

Description

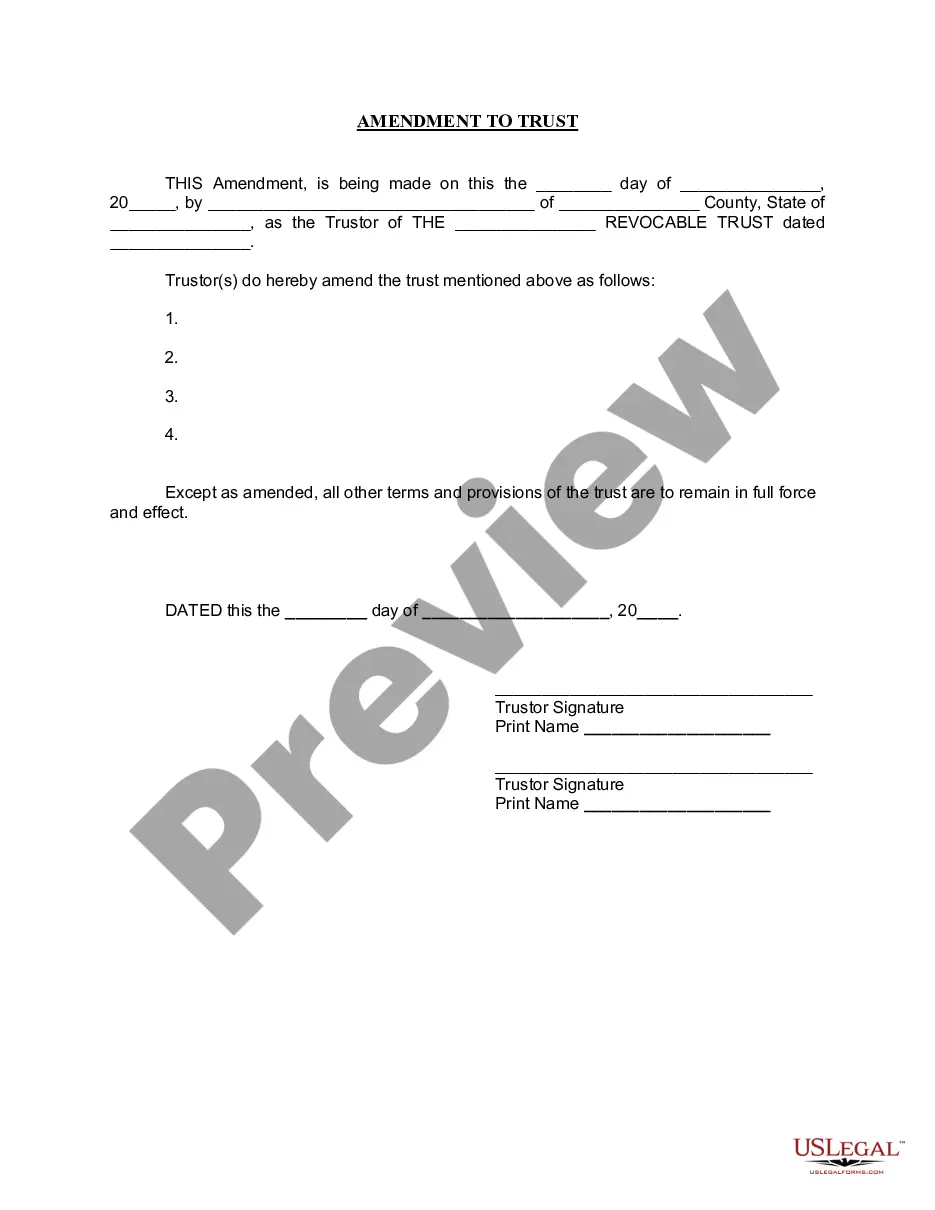

How to fill out Rhode Island Amendment To Living Trust?

Using legal document samples that meet the federal and state regulations is crucial, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the correctly drafted Rhode Island Irrevocable Trust Laws sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and life situation. They are easy to browse with all papers organized by state and purpose of use. Our experts keep up with legislative updates, so you can always be confident your form is up to date and compliant when obtaining a Rhode Island Irrevocable Trust Laws from our website.

Getting a Rhode Island Irrevocable Trust Laws is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the preferred format. If you are new to our website, adhere to the instructions below:

- Examine the template using the Preview option or via the text outline to make certain it meets your requirements.

- Locate another sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve found the right form and select a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your Rhode Island Irrevocable Trust Laws and download it.

All documents you find through US Legal Forms are reusable. To re-download and complete previously purchased forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

When an irrevocable trust disburses funds, the trust takes a taxable deduction for the amount distributed and issues a tax form to the beneficiary. This form, known as a K-1, shows the total disbursement received and includes a breakdown of the amount that is attributed to interest income versus principal balance.

IRS Form for Irrevocable Trust The legal name of the trust, the Trustee name and address must be given to the IRS. Next, the Trustee should file the Form 1041 ? ?U.S. Income Tax Return for Estates and Trusts? with the IRS ? if the Irrevocable Trust has more than $600 in taxable income generated annually.

Since an irrevocable trust is under the trustee's care, they will be responsible for filing Form 1041 and reporting the income stream. This differs from a revocable trust, where the grantor controls the trust and reports income on their personal Form 1040.

A revocable living trust can be changed by your during your life. An irrevocable living trust is permanent. A living trust Rhode Island bypasses probate, the court proceeding that verifies and enforces a will. Probate takes months and involves the cost of an attorney, executor, and court expenses.

Unless the assets are included in the taxable estate of the original owner (or ?grantor?), the basis doesn't reset. To get the step-up in basis, the assets in the irrevocable trust now must be included in the taxable estate at the time of the grantor's death.