Rhode Island Business Group On Health

Description

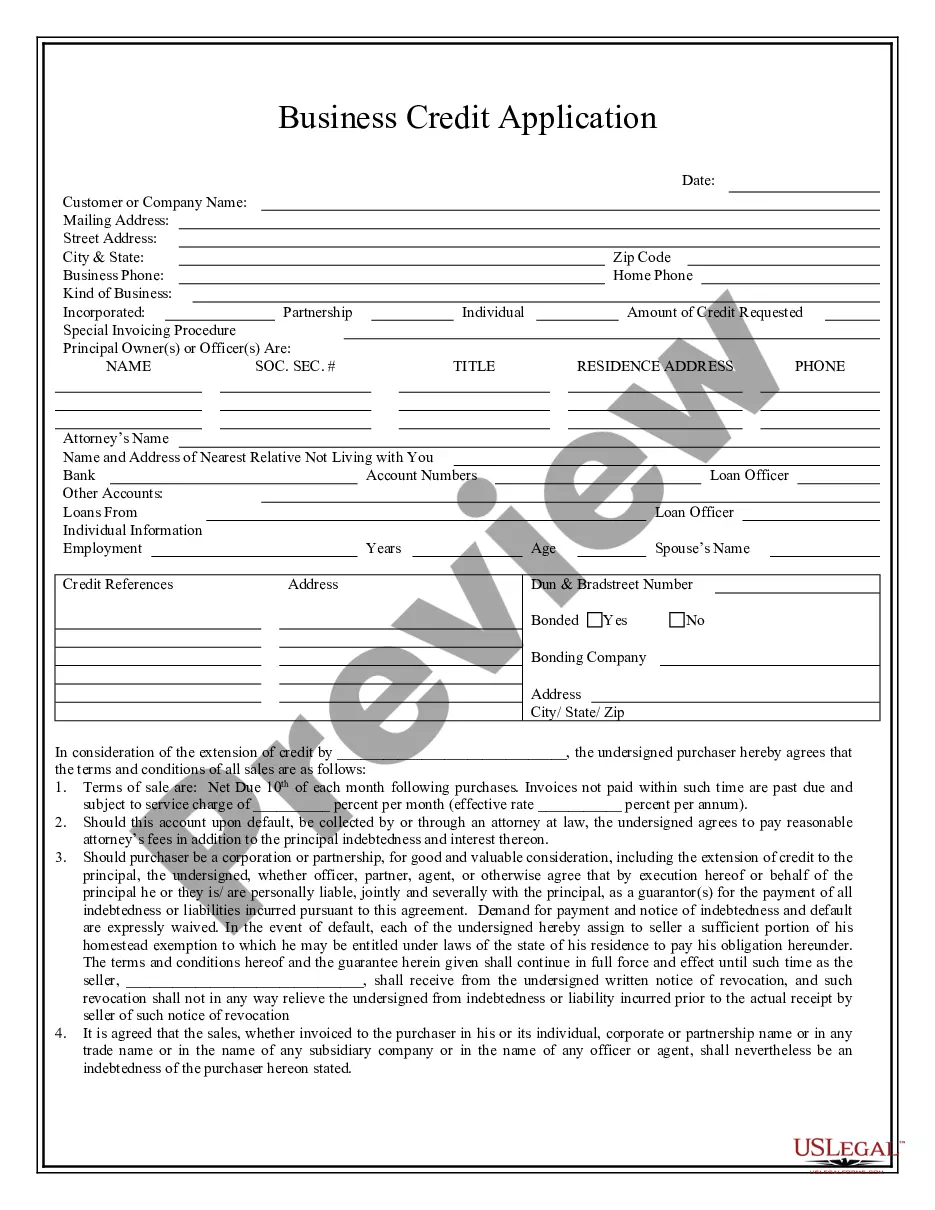

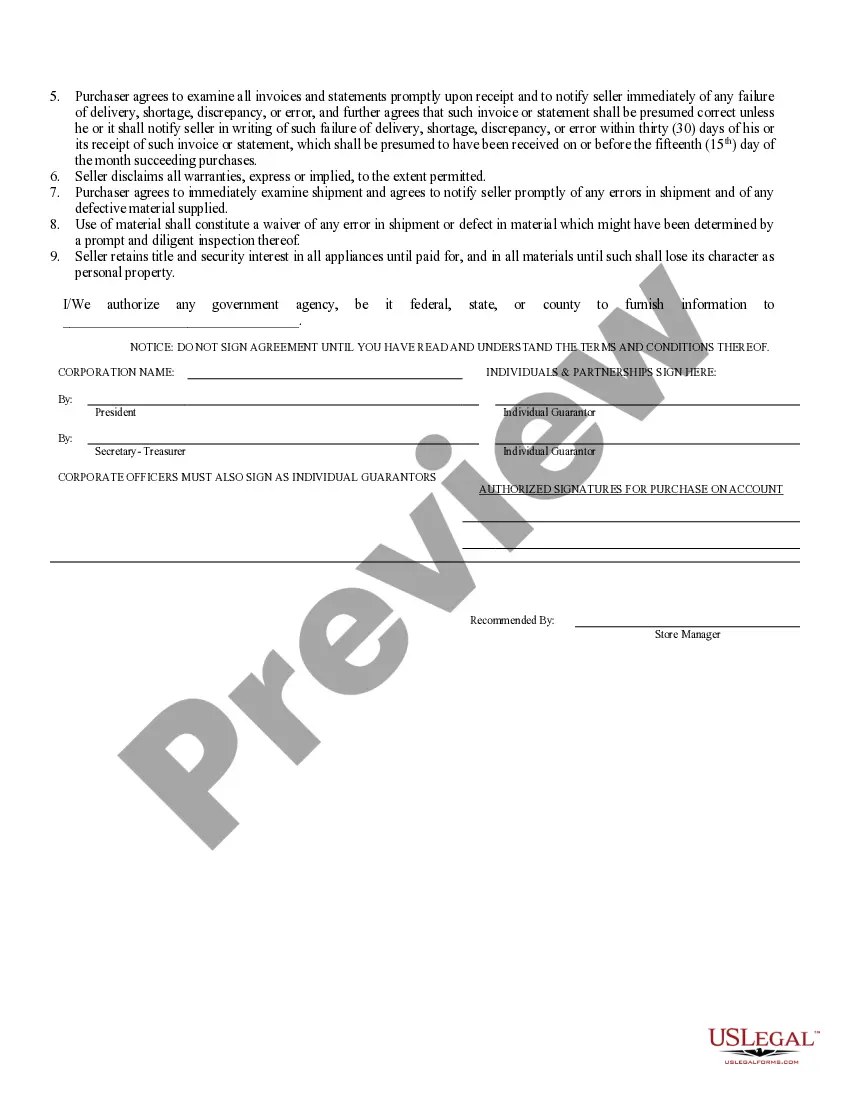

How to fill out Rhode Island Business Credit Application?

Using legal document samples that comply with federal and local regulations is a matter of necessity, and the internet offers a lot of options to choose from. But what’s the point in wasting time searching for the correctly drafted Rhode Island Business Group On Health sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the greatest online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and life situation. They are easy to browse with all papers arranged by state and purpose of use. Our professionals stay up with legislative changes, so you can always be sure your paperwork is up to date and compliant when obtaining a Rhode Island Business Group On Health from our website.

Getting a Rhode Island Business Group On Health is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the preferred format. If you are new to our website, follow the steps below:

- Analyze the template using the Preview option or through the text description to make certain it fits your needs.

- Look for a different sample using the search tool at the top of the page if necessary.

- Click Buy Now when you’ve found the right form and opt for a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Select the best format for your Rhode Island Business Group On Health and download it.

All documents you locate through US Legal Forms are reusable. To re-download and fill out earlier purchased forms, open the My Forms tab in your profile. Enjoy the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

For tax year 2023 and 2022, the Monthly Penalty Rates are $57.92 for adults and $28.96 for children under age 18. Average Bronze Plan amount as determined by HealthSource RI. For calendar year 2023, the Average Bronze Plan amount is $350 per month.

Rhode Island's individual mandate penalty is calculated in the same manner as the ACA's individual mandate. The penalty is the greater of two amounts?the flat dollar amount ($695) or the percentage of income amount (2.5 percent of income).

EOHHS Secretary Richard Charest joined Gov. Dan McKee and other State leaders today to announce the new round of #Wavemaker fellows. ?Supporting our #healthcare workforce is a key part of our mission to ensure that all Rhode Islanders have access to high quality health services,? said Secretary Charest.

Health insurance is a requirement in the state of Rhode Island. If you go without continuous health coverage, you might pay a penalty when you file your Rhode Island income taxes for 2022. See below for more information about the health insurance mandate and how it might affect you.

Flat Dollar Amount Penalty - The maximum penalty amount is $2,085 (300% of the flat dollar amount penalty). For tax year 2023 and 2022, the Monthly Penalty Rates are $57.92 for adults and $28.96 for children under age 18. Average Bronze Plan amount as determined by HealthSource RI.