Revocation Living Trust For Property

Description

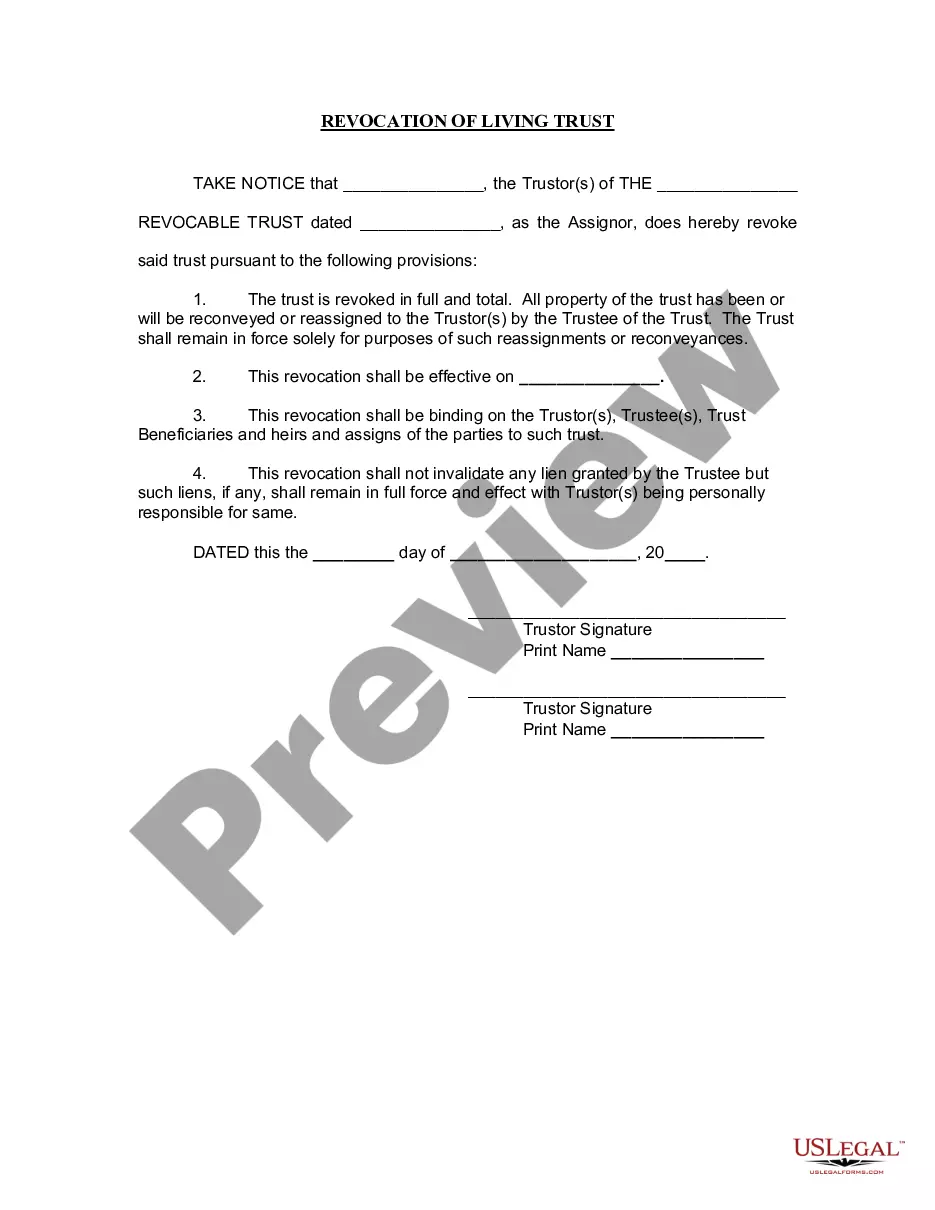

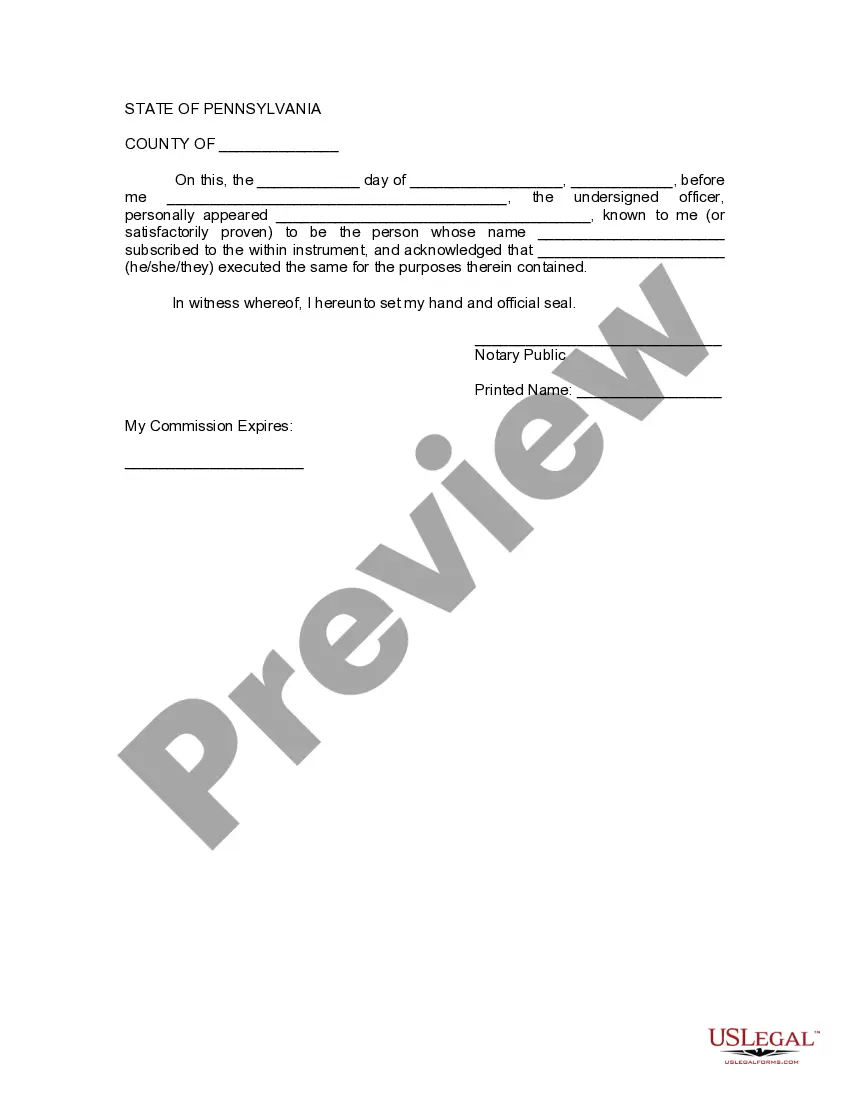

How to fill out Pennsylvania Revocation Of Living Trust?

- If you're already a US Legal Forms user, log into your account and download the revocation living trust template by clicking the Download button, ensuring your subscription is active.

- If this is your first time, start by reviewing the available templates in Preview mode to find one that aligns with your needs and local compliance.

- If you don't find the right template, use the Search bar to locate alternatives that meet your requirements.

- Once you’ve selected the right document, click on the Buy Now button and choose the most suitable subscription plan, ensuring you register for full access.

- Complete your purchase by providing your payment details via credit card or PayPal.

- Finally, download your completed form and save it to your device, ensuring it can be accessed again via the My Forms section of your profile.

Utilizing US Legal Forms simplifies the process of creating a revocation living trust for property. With a vast library of over 85,000 easily editable documents and the option to receive expert assistance, you can ensure accuracy and compliance in your legal forms.

Start your journey toward effective estate management today. Visit US Legal Forms to get your revocation living trust template now!

Form popularity

FAQ

Yes, you can easily amend a revocation living trust for property at any time during your lifetime, as its revocable nature allows flexibility. If your circumstances or preferences change, you simply create an amendment that overrides the previous terms of the trust. This feature ensures that your trust remains relevant and effective over time. For assistance with making amendments, consider using a reliable platform like uslegalforms to guide you through the process.

While a revocation living trust for property offers flexibility, it also has some disadvantages. One primary concern is that it does not provide asset protection from creditors or lawsuits. Additionally, establishing a trust may involve initial costs and ongoing administrative requirements. It's vital to weigh these factors against the benefits when deciding if a revocable living trust is right for you.

You should review and update your revocation living trust for property whenever significant changes occur in your life. This includes events like marriage, divorce, the birth of a child, or significant changes in asset values. Regularly reassessing your trust ensures that your property distribution aligns with your current wishes. Generally, a good practice is to review your trust every few years or when life changes happen.

A trust can be terminated in three primary ways: by fulfilling its purpose, through the revocation of the trust by its creator, or by court order. When you revoke a trust, particularly a revocation living trust for property, you can take back control of the assets. Understanding these methods can guide you in making informed decisions about your trust management.

Certain assets may not be ideal for inclusion in a revocation living trust for property. For example, retirement accounts such as 401(k)s and IRAs should typically not be transferred, as they may have tax implications. Additionally, any assets that you co-own or those that already have designated beneficiaries may not need to be placed in a trust.

Several factors can render a trust null and void, including improper execution or lack of legal capacity of the trust maker. If the trust purpose is illegal or if the required formalities were not met, it may also be invalid. When creating a trust, particularly a revocation living trust for property, ensure that all legal requirements are fulfilled to avoid such issues.

Placing your house in a revocation living trust for property is often seen as a beneficial strategy for estate planning. It allows your home to bypass probate when you pass away, simplifying the transfer process for your heirs. However, it’s essential to assess your personal situation and consult with a professional to determine if this approach aligns with your goals.

A revocation of living trust is the process of canceling or terminating a living trust arrangement. This action nullifies the legal contract, shifting the trust's assets back to your direct ownership. Understanding how a revocation living trust for property works is crucial, as it ensures that you can confidently manage your estate according to your wishes.

Putting your house in a revocation living trust for property can lead to a few disadvantages. First, transferring your home to the trust might affect your eligibility for certain tax deductions, such as property tax exemptions. Additionally, if your trust is not managed well, it could lead to complications during estate distribution, which may negate its intended benefits.

A form to dissolve a revocable trust typically includes a declaration of revocation and may require signature from the trust creator. This official document effectively terminates the trust’s authority over the assets and outlines the intended next steps for asset distribution. To ensure you have the right form and avoid pitfalls, check US Legal Forms, which provides customized solutions for revocation living trust for property.