Revocation Living Trust For Foreigners

Description

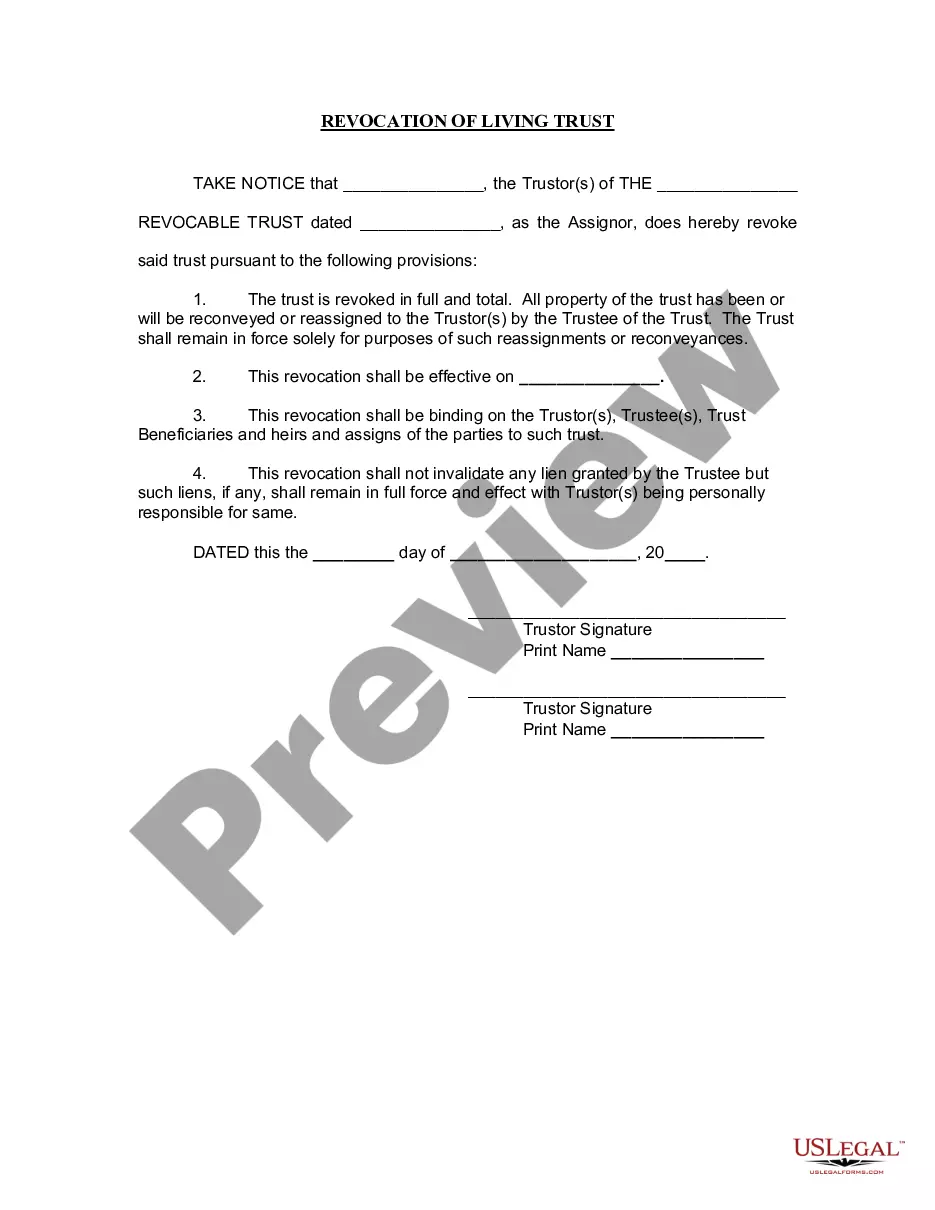

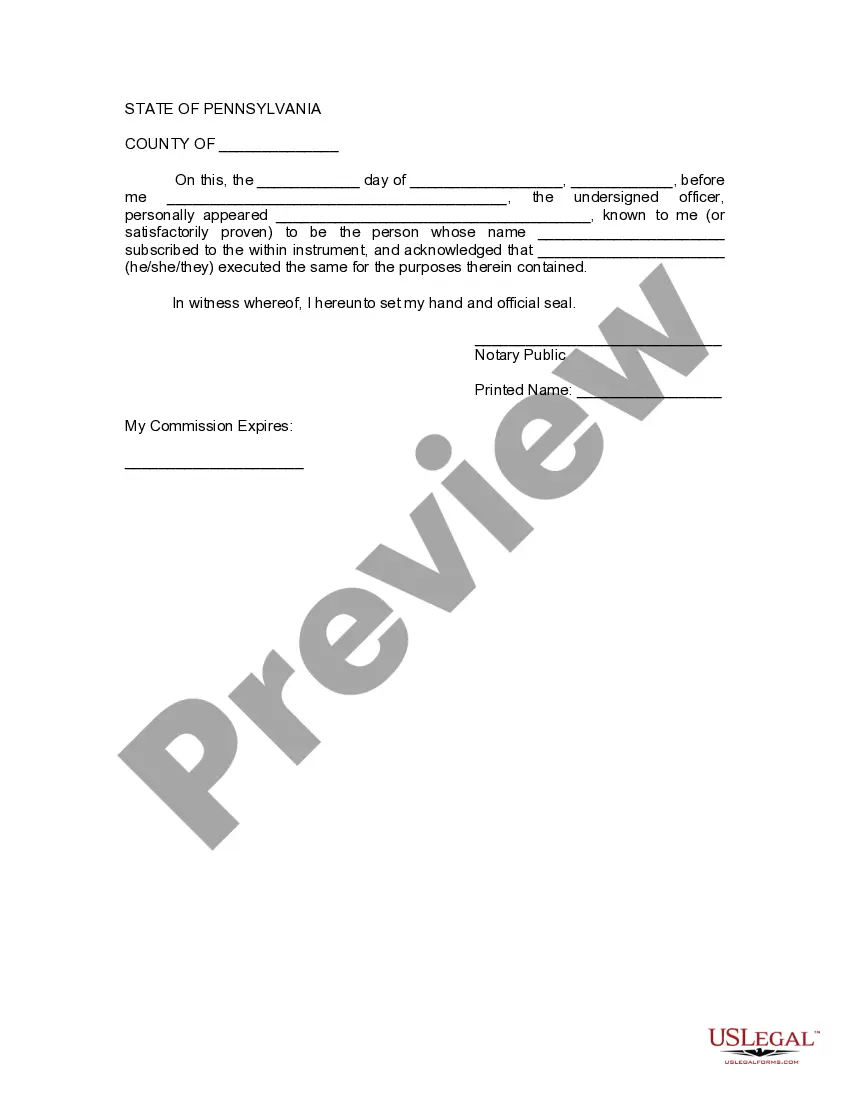

How to fill out Pennsylvania Revocation Of Living Trust?

- Log in to your existing US Legal Forms account if you're a returning user. Ensure that your subscription is active; renew it if necessary.

- Preview the available forms related to revocation living trusts. Confirm the selected template aligns with your specific needs and complies with local jurisdiction requirements.

- If you don't find the right form, utilize the Search feature to locate the correct template.

- Once you've identified the appropriate document, click the 'Buy Now' button and select the subscription plan that suits you. Creating an account is necessary to access the library.

- Proceed with your purchase by entering your payment details, either via credit card or PayPal.

- Download the completed form and save it on your device. You can access it anytime through the 'My Forms' section of your profile.

By leveraging US Legal Forms, you gain access to an extensive library of over 85,000 customizable legal documents, ensuring you have the tools necessary for precise and legally sound results.

Ready to get started? Visit US Legal Forms today and simplify your estate planning needs.

Form popularity

FAQ

A trust revocation declaration typically includes a statement that nullifies the original trust and specifies the assets involved. For instance, a person could create a revocation living trust for foreigners and later issue a declaration to revoke it, stating all assets should revert to their name. This document can help clarify intentions and prevent legal complications.

One of the biggest mistakes is failing to keep the trust updated with changing family dynamics or financial situations. If your parents utilize a revocation living trust for foreigners, they must understand how their choices affect beneficiaries over time. Regular reviews and updates are essential to ensure the trust serves its intended purpose effectively.

Encouraging your parents to consider a trust can be beneficial, particularly if they wish to manage their assets efficiently. Using a revocation living trust for foreigners can also help bypass probate, ensuring a smoother transition of assets. However, it’s crucial to discuss their specific needs and the implications of setting up a trust with a legal expert.

One downfall of having a trust is the potential lack of flexibility, as you may find it challenging to amend terms once established. If you are considering a revocation living trust for foreigners, it’s essential to understand how changes in residency or laws can impact your trust. Additionally, some people find the administrative duties surrounding a trust time-consuming and daunting.

A family trust can be complex, especially for foreigners navigating U.S. law. Also, a revocation living trust for foreigners might not be recognized in every jurisdiction, which could create legal complications. Additionally, misunderstandings between family members can lead to disputes over the trust's management and distribution.

One significant downside of placing assets in a trust is the initial setup and ongoing maintenance costs. Furthermore, if you have a revocation living trust for foreigners, changing terms or adding beneficiaries can sometimes lead to confusion or disputes. Lastly, trusts may not provide the same level of asset protection against creditors as other estate planning options.

A nursing home can potentially access funds from a revocable trust under certain circumstances, particularly if the grantor requires care and has limited assets outside the trust. However, if your revocation living trust for foreigners is structured properly, it may help protect your assets from being depleted for care. To safeguard your trust, consider working with a legal expert who can advise on protecting your interests effectively.

Yes, a non-US citizen can certainly be a beneficiary of a trust. In fact, many individuals utilize a revocation living trust for foreigners to designate non-citizen beneficiaries, ensuring their assets are managed according to their wishes. It's important to consult legal advice to navigate any specific regulations that may apply in your situation.

To revoke a revocable trust, you must follow the guidelines set forth in the trust document. Generally, this involves preparing a formal written revocation, which clearly states your intent to dissolve the trust. This process is straightforward, especially with the assistance of platforms like USLegalForms, which can guide you in ensuring that your revocation living trust for foreigners is carried out correctly.

The 5-year rule for trusts typically refers to the period that affects the assets placed in the trust regarding taxation and eligibility for Medicaid benefits. For a revocation living trust for foreigners, any changes to the trust's structure or ownership should consider this rule, as it can impact financial planning for heirs. Understanding this rule is essential for managing your trust effectively over time.