Pennsylvania Revocation Trust With The State

Description

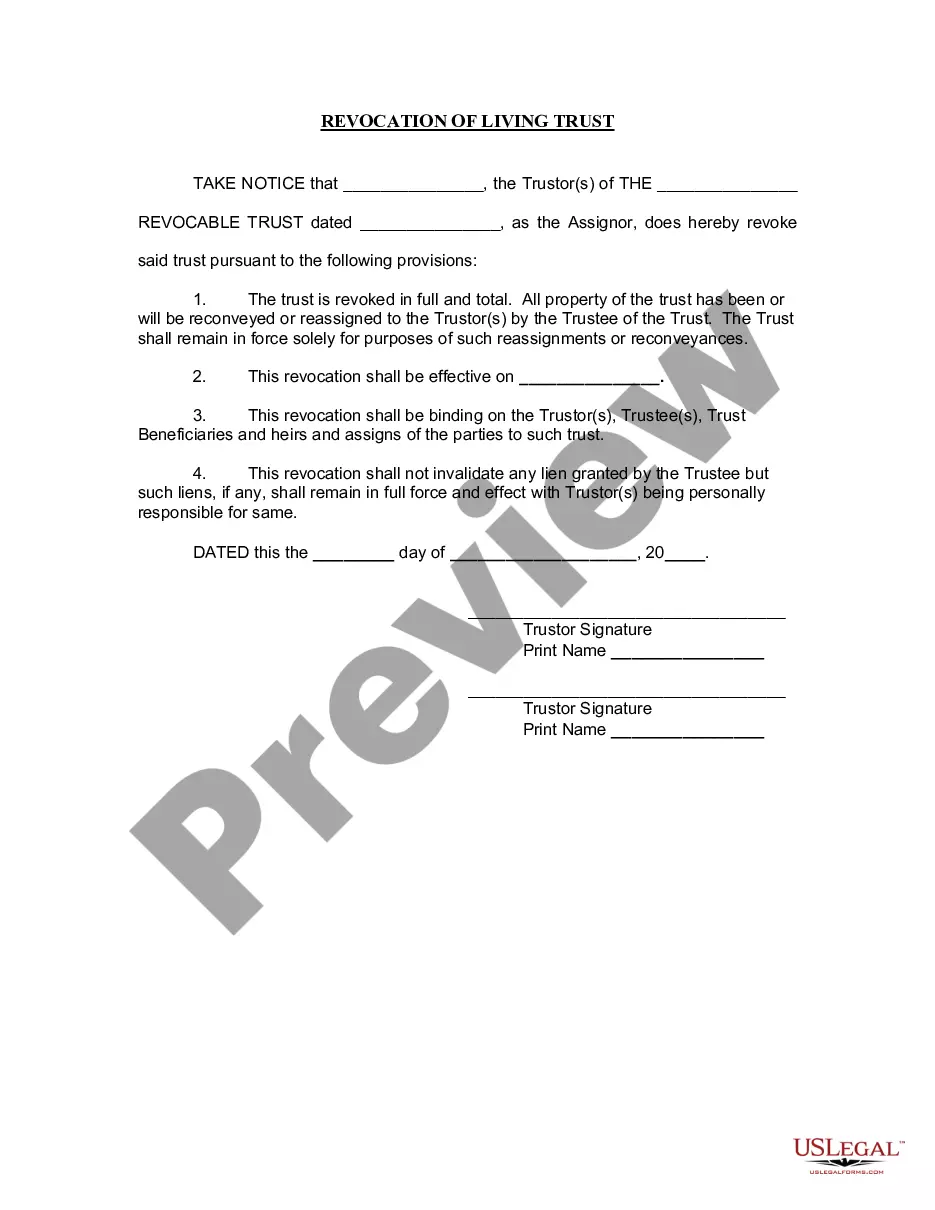

How to fill out Pennsylvania Revocation Of Living Trust?

- Begin by logging into your US Legal Forms account if you're a returning user. Verify that your subscription is active before downloading any forms.

- If you're new to US Legal Forms, start by browsing the extensive collection of legal documents. Use the Preview mode to confirm that you are selecting the correct Pennsylvania revocation trust form that meets your needs.

- If the desired form is not available, utilize the Search function to find an appropriate alternative that aligns with your local jurisdiction requirements.

- Once you've identified the correct document, click 'Buy Now' to select a subscription plan that suits your needs. Registration will give you access to the full library of legal forms.

- Proceed to complete your purchase by entering your payment information, either via credit card or PayPal. Make sure to save any confirmation details.

- Finally, download your completed form to your device. You can find it anytime in the 'My Forms' section of your profile, allowing for easy access and modification whenever necessary.

By using US Legal Forms, you empower yourself with a wealth of resources and expert assistance. Their extensive library contains over 85,000 customizable legal forms, making it easier than ever to manage your legal needs.

Get started with your estate planning today! Visit US Legal Forms to access the Pennsylvania revocation trust forms and ensure your affairs are in order.

Form popularity

FAQ

The downsides of a revocable trust include the fact that it does not avoid probate entirely, which could lead to delays in asset distribution. Even with a Pennsylvania revocation trust with the state, your estate may still need to go through the probate process depending on jurisdiction and the value of your assets. Additionally, you must actively manage the trust, which can be time-consuming and complex. If you leave the trust unfunded or improperly managed, it may not serve its intended purpose.

One significant disadvantage of a revocable trust is that it does not provide asset protection from creditors. This means that if you encounter financial difficulties, your assets in a Pennsylvania revocation trust with the state can still be at risk. Additionally, the trust does not offer tax benefits, as income generated by the trust is still considered taxable to you. Furthermore, establishing and managing a revocable trust may require ongoing legal guidance, which can add to your costs.

The benefits of a Pennsylvania revocation trust are numerous. Primarily, it allows you to maintain control over your assets while making provisions for their distribution after your passing. Additionally, it can minimize probate delays and costs, ensuring your heirs receive their inheritance more swiftly. Platforms like US Legal Forms can assist you in setting up a revocable trust, providing you with the necessary resources to simplify the process.

Yes, a significant downside to a Pennsylvania revocation trust is the lack of asset protection. The assets you place in a revocable trust can be accessed by creditors, which might be a concern based on your financial situation. Moreover, the trust must be properly funded to function effectively, requiring time and attention to detail. Therefore, it's essential to evaluate your needs and possibly seek advice from an estate planning professional.

A Pennsylvania revocation trust does not eliminate the inheritance tax obligations for the assets within it. The assets transferred to a revocable trust are subject to Pennsylvania's inheritance tax, just like any other assets in your estate. Despite this, a revocable trust can help you manage your estate strategically. Engaging with platforms like US Legal Forms can guide you through the process, ensuring you understand your tax responsibilities.

One notable disadvantage of a Pennsylvania revocation trust is that it does not offer protection from creditors. Since you retain control over the assets in the trust, they remain vulnerable to potential claims. Additionally, creating and managing a revocable trust involves costs, such as legal fees and maintenance. It’s important to weigh these factors against the benefits when deciding if a revocable trust is right for you.

Using a revocable trust in Pennsylvania offers several advantages, primarily the control it provides over your assets. It allows you to specify how and when your assets will be distributed, which can be especially beneficial for minor children or individuals needing special care. Furthermore, a Pennsylvania revocation trust can help your beneficiaries avoid the lengthy probate process, resulting in quicker access to their inheritance. This approach can make a significant difference during a challenging time.

Individuals often choose a Pennsylvania revocation trust to manage their assets during their lifetime and after death. It allows you to make changes or revoke the trust while you are alive, giving you flexibility in your estate planning. Additionally, a revocable trust can help streamline the probate process, making it easier for your heirs to access the assets you've left them. This can lead to peace of mind for both you and your family.

A Pennsylvania revocation trust does not avoid state inheritance tax. In Pennsylvania, assets placed in a revocable trust are still considered part of your estate for tax purposes. Therefore, beneficiaries will be responsible for the inheritance tax when you pass away. It's wise to consult with a professional to understand the implications of a revocable trust in estate planning.

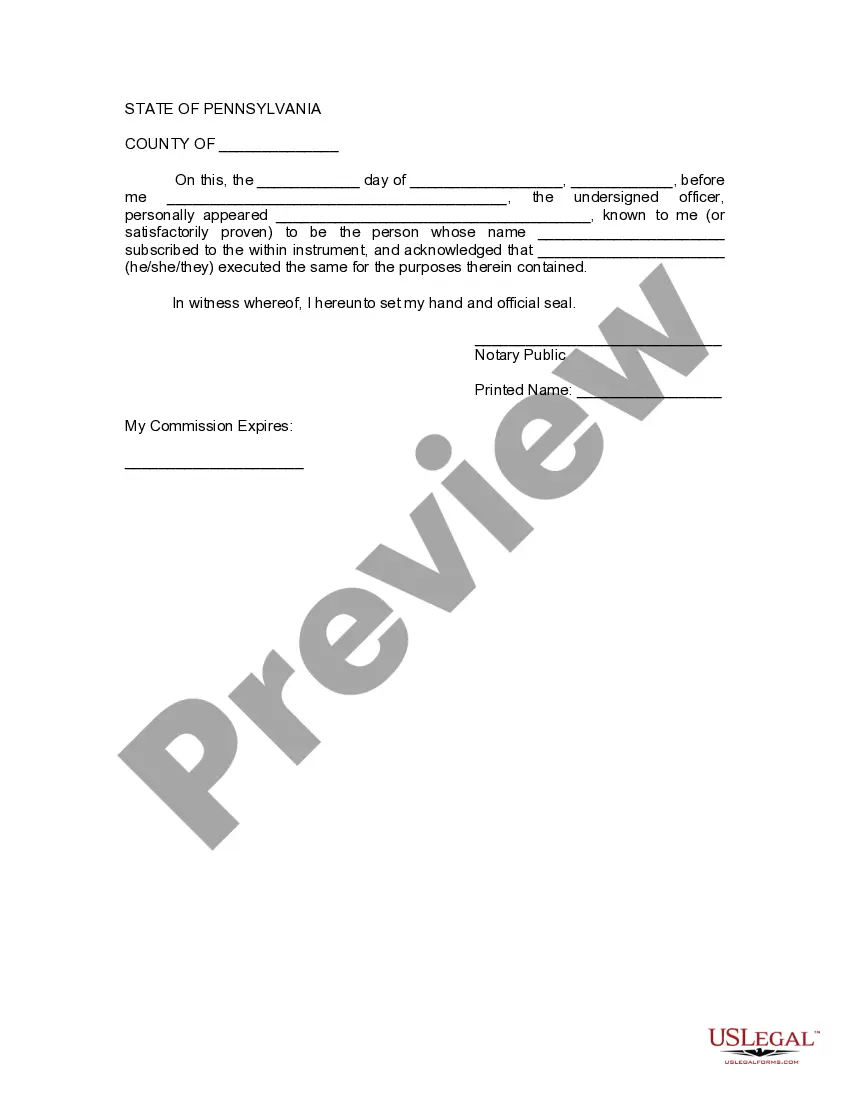

Setting up a revocable trust in Pennsylvania involves drafting a trust agreement that clearly outlines the terms and purpose of the trust. You will need to transfer your assets into the trust and designate a trustee to manage it. Utilizing platforms like US Legal Forms can simplify the process, providing templates and guidance for establishing a Pennsylvania revocation trust with the state, making it easier to secure your assets and plan for the future.