Pennsylvania Revocation Trust With The Same Person

Description

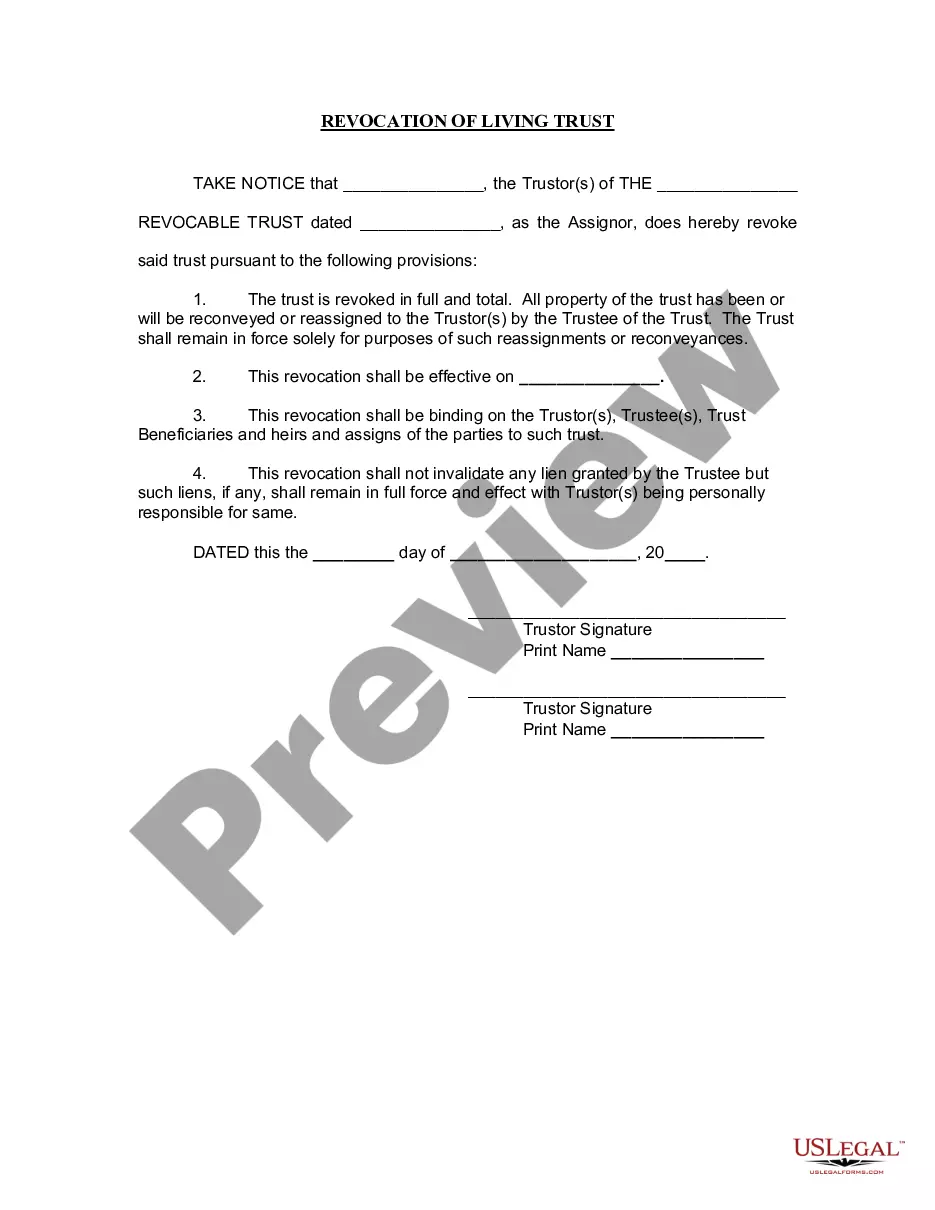

How to fill out Pennsylvania Revocation Of Living Trust?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active; renew it if necessary before proceeding.

- For first-time users, start by checking the available document previews. Ensure you select the right form for your specific local jurisdiction needs.

- Should you need a different template, utilize the search feature to locate the appropriate form. Confirm it aligns with your requirements before proceeding.

- Purchase your selected document by clicking the Buy Now button and choose a subscription plan that suits you. You will need to create an account to access the full library.

- Complete your payment process using your credit card or PayPal to finalize the subscription.

- Download your completed form to your device. You can always find it later in the 'My Forms' section of your profile.

Utilizing US Legal Forms provides users with access to a vast library of over 85,000 easily fillable legal forms, surpassing competitors in both variety and affordability.

Empower yourself today with US Legal Forms and experience the convenience of precise legal documentation. Start your journey to establishing your Pennsylvania revocation trust now!

Form popularity

FAQ

Deciding whether to put assets in a trust hinges on your parents' financial situation and goals. A trust can provide significant benefits, such as avoiding probate and protecting assets from potential creditors. Encouraging them to consider a Pennsylvania revocation trust with the same person might be wise, as it offers flexibility and control over their estate.

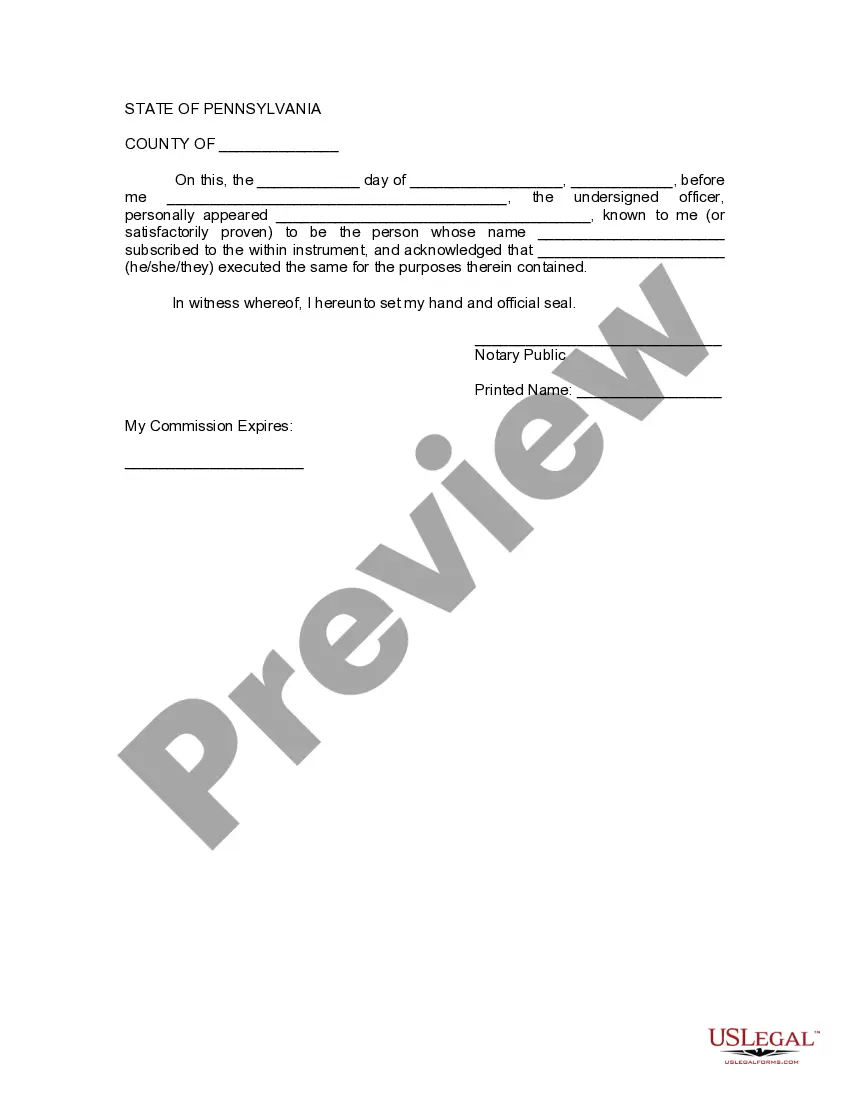

Revoking a revocable trust is usually a straightforward process. It typically involves drafting a formal document that states your intention to dissolve the trust. If you have established a Pennsylvania revocation trust with the same person, this can be done efficiently, allowing you to reclaim control over your assets as needed.

One significant downfall of having a trust is the administrative burden it can create. Trusts require careful tracking and management, often leading to confusion among beneficiaries. Nevertheless, with a Pennsylvania revocation trust with the same person, you can simplify this process, ensuring clear guidance on asset distribution.

Putting assets in a trust can limit your access to those assets if you need them in a financial emergency. Some might find it difficult to manage the trust, especially if it involves multiple beneficiaries. However, creating a Pennsylvania revocation trust with the same person allows for easier management, as you retain personalized control over your assets.

A trust can be terminated through revocation by the creator, when the trust purpose has been fulfilled, or by the passage of time defined in the trust document. Each method offers different implications for the assets and beneficiaries involved. If you're managing a Pennsylvania revocation trust with the same person, understanding these termination methods can inform your decisions.

An example of a trust revocation might involve a living trust where the creator decides that they no longer need the trust structure. They would create a formal document that states their desire to revoke the trust, ensuring all parties understand the change. For those using a Pennsylvania revocation trust with the same person, this process allows for flexibility as life circumstances evolve.

Avoid placing life insurance policies or retirement accounts in a revocable trust, as these assets often have designated beneficiaries. Furthermore, certain public benefits or government assets may be negatively impacted by inclusion in a trust. When creating your Pennsylvania revocation trust with the same person, it's essential to carefully consider which assets to include.

An example of revocation includes the formal process of terminating an existing trust by the creator. This may involve a written document declaring the revocation and detailing the reasoning behind it. If you are managing a Pennsylvania revocation trust with the same person, you can easily initiate this process to reflect your current wishes.

An example of trust revocation occurs when the creator of the trust formally decides to dissolve it. This can be done by executing a revocation document that outlines the reasons for the revocation. With a Pennsylvania revocation trust with the same person, the creator may decide to modify or completely revoke the trust based on changing circumstances.

To set up a revocable trust in Pennsylvania, begin by drafting the trust document, specifying the assets, beneficiaries, and trustee. It's advisable to seek legal assistance to ensure it meets state laws. Once created, you will need to fund the trust with your assets, which helps you maintain control and flexibility, especially with a Pennsylvania revocation trust with the same person.