Pennsylvania Trust Execution Requirements

Description

How to fill out Pennsylvania Amendment To Living Trust?

Drafting legal paperwork from scratch can often be daunting. Some cases might involve hours of research and hundreds of dollars spent. If you’re searching for a simpler and more affordable way of preparing Pennsylvania Trust Execution Requirements or any other documents without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our virtual catalog of over 85,000 up-to-date legal documents addresses virtually every element of your financial, legal, and personal affairs. With just a few clicks, you can instantly get state- and county-compliant forms carefully prepared for you by our legal specialists.

Use our platform whenever you need a trusted and reliable services through which you can easily locate and download the Pennsylvania Trust Execution Requirements. If you’re not new to our website and have previously set up an account with us, simply log in to your account, locate the form and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No worries. It takes little to no time to set it up and explore the catalog. But before jumping straight to downloading Pennsylvania Trust Execution Requirements, follow these tips:

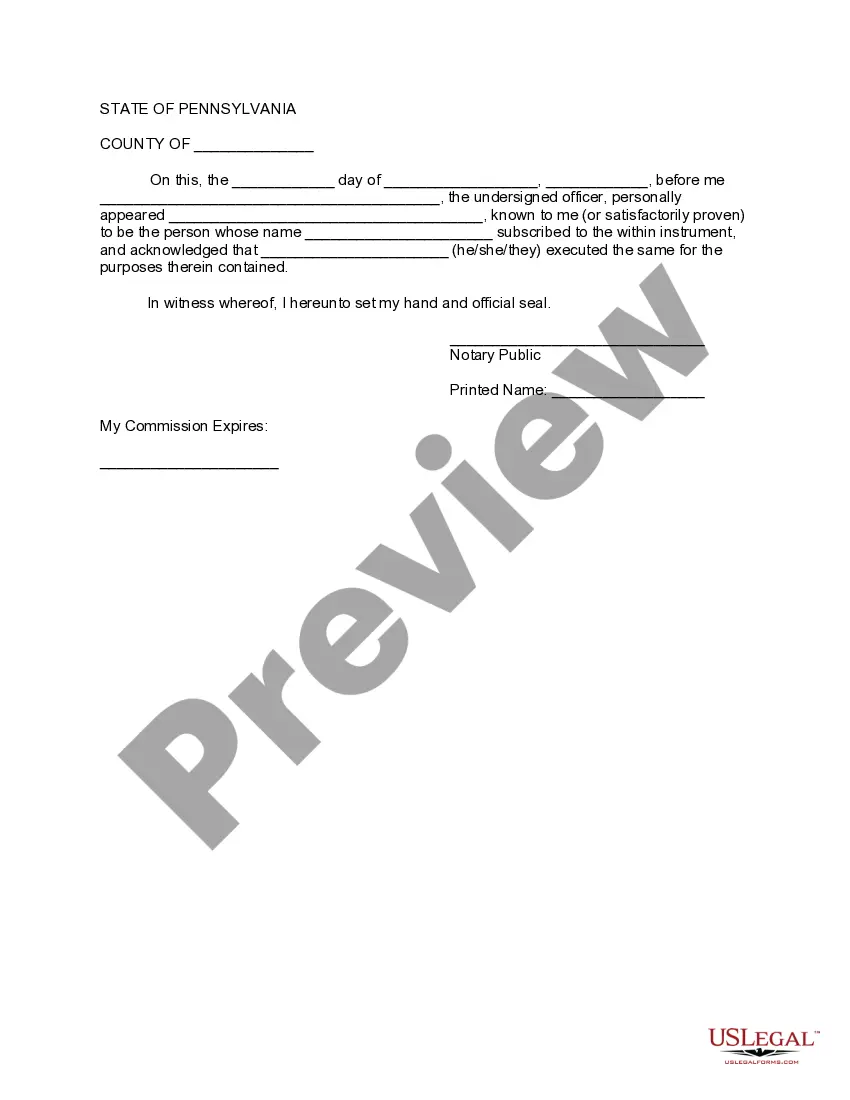

- Check the document preview and descriptions to ensure that you are on the the document you are looking for.

- Make sure the template you choose conforms with the requirements of your state and county.

- Choose the right subscription option to purchase the Pennsylvania Trust Execution Requirements.

- Download the form. Then fill out, sign, and print it out.

US Legal Forms boasts a good reputation and over 25 years of experience. Join us now and transform document execution into something easy and streamlined!

Form popularity

FAQ

The process of settling an estate involves naming a personal representative, collecting estate assets, filling appropriate forms with the Register of Wills, notifying heirs, providing a public notice, paying all debts and taxes, and distributing the remaining assets to heirs named in the will or under the laws of ...

Under Pennsylvania law, executors have a duty to provide an accounting to beneficiaries. An accounting is a detailed report that outlines the assets, liabilities, income, and expenses associated with the estate, as well as the executor's actions in managing and distributing the estate.

*Notice includes the following: (1) The fact of the trust's existence. (2) The identity of the settlor. (3) The trustee's name, address and telephone number. (4) The recipient's right to receive upon request a copy of the trust instrument.

The will also needs to be signed by two witnesses who were present at the will's execution by the creator of the will and who also witnessed each other signing the will document. In order to be able to create a legally valid will in Pennsylvania, the testator must be at least 18 years of age or older.

Overview of Estate Administration in Pennsylvania Find the Will, or alternatively, figure out if you need a will. ... Figure out who the personal representative is: the ?executor? or ?administrator.? ... Determine whether to probate. ... Prepay the inheritance taxes. ... Marshall the assets and pay the debts.