Pa Trust Tax Rate

Description

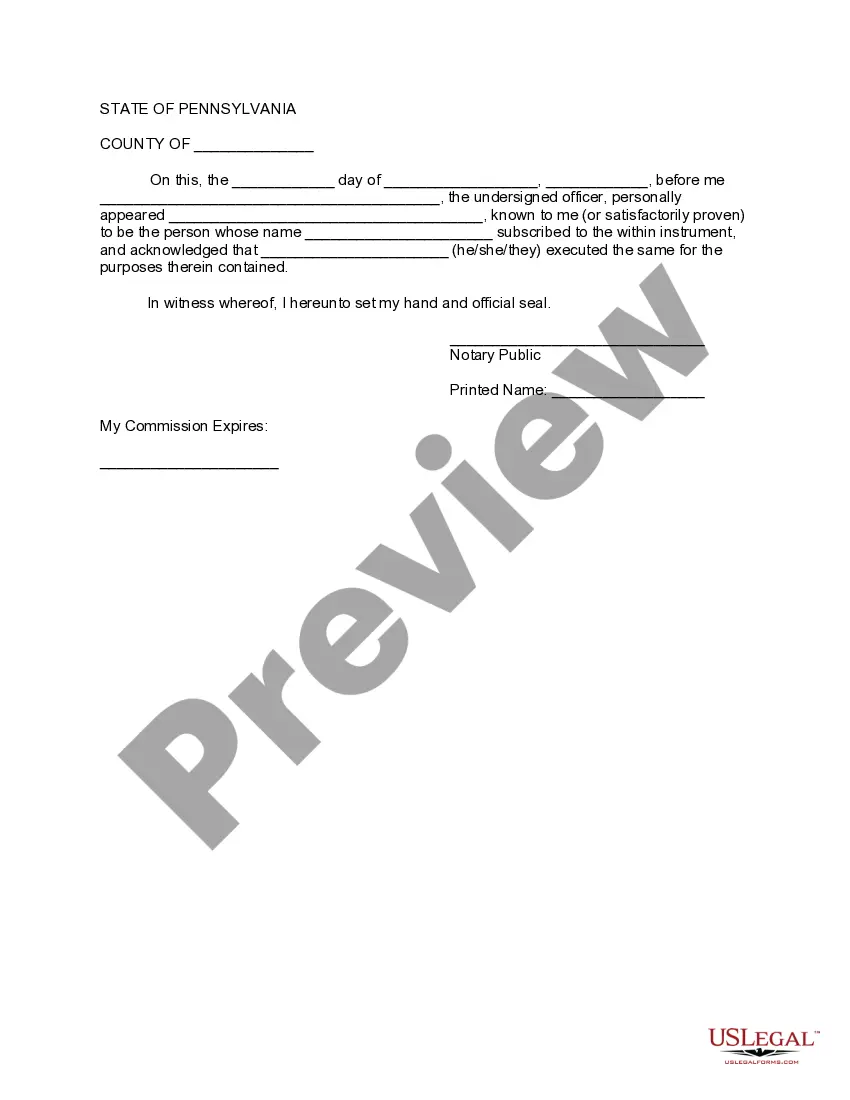

How to fill out Pennsylvania Amendment To Living Trust?

Managing legal documents and processes can be a lengthy enhancement to your schedule.

Pa Trust Tax Rate and similar forms often necessitate that you look for them and maneuver through the steps to fill them out correctly.

For this reason, if you are handling financial, legal, or personal affairs, employing a comprehensive and functional online directory of forms at your disposal will be greatly beneficial.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific documents and a variety of tools to assist you in completing your paperwork effortlessly.

Is this your first time using US Legal Forms? Create and establish a free account in a few minutes, which will grant you access to the form directory and Pa Trust Tax Rate. Then, follow the instructions below to fill out your form: Make sure you have the correct document by utilizing the Review feature and examining the form details. Click on Buy Now when prepared, and choose the monthly subscription plan that suits your requirements. Click Download, then fill out, endorse, and print the form. US Legal Forms boasts twenty-five years of expertise assisting users in managing their legal documents. Acquire the form you require today and simplify any procedure effortlessly.

- Explore the collection of relevant documents available with just a single click.

- US Legal Forms grants you access to state- and county-specific forms available for download at any time.

- Safeguard your document management processes by utilizing a reliable service that enables you to prepare any form in minutes without any extra or concealed fees.

- Simply Log In to your account, search for Pa Trust Tax Rate, and download it instantly in the My documents section.

- You may also retrieve forms you have previously saved.

Form popularity

FAQ

The PA 41 form is the Pennsylvania fiduciary income tax return that trusts must file annually. This form reports the income generated by the trust and calculates the tax owed based on the PA trust tax rate. Filing the PA 41 form accurately is essential to avoid penalties and ensure your trust meets its tax obligations. For guidance on completing this form correctly, USLegalForms provides templates and support.

To calculate trust taxable income, you start by determining the total income the trust generates, which includes interest, dividends, and capital gains. From this total, you then deduct any allowable expenses, such as trustee fees and investment expenses. The result is the taxable income subject to the PA trust tax rate. Using USLegalForms can simplify the calculation process and ensure compliance with Pennsylvania tax laws.

The new tax rate for trusts in Pennsylvania has been updated recently, and it is important for trustees to stay informed. Generally, the PA trust tax rate varies depending on the amount of taxable income generated. Keeping track of these changes can help you plan effectively for the tax implications of your trust. For assistance in managing these updates, USLegalForms offers resources tailored to your needs.

Trusts in Pennsylvania are subject to state income tax, which means the income generated by the trust is taxable. The PA trust tax rate applies to the trust's taxable income, which can include interest, dividends, and capital gains. Understanding how these taxes work is crucial for trust administrators and beneficiaries alike. For detailed information on managing trust taxes, consider using USLegalForms to streamline the process.

Filing taxes for a trust account involves several steps, starting with determining the trust's income and expenses. You will need to fill out IRS Form 1041, which is specifically for estates and trusts. It's essential to be aware of the Pa trust tax rate to ensure accurate tax payments. To streamline this process, US Legal Forms offers comprehensive tools and templates that can guide you through trust tax filing efficiently.

The withholding tax rate for trusts in Pennsylvania varies based on the income generated by the trust. Generally, trusts may be subject to a higher tax rate than individual taxpayers. Understanding the Pa trust tax rate is crucial for effective tax planning. For specific calculations and guidance, consider using resources from US Legal Forms to simplify the process.

The estimated tax rules apply to: ? Resident estates or trusts; and ? Nonresident estates or trusts that expect to have taxable income from sources within Pennsylvania. 100 percent of the product of multiplying the net PA taxable income shown on the 2020 PA-41 return by 3.07 percent (0.0307).

The tax rate for Pennsylvania Inheritance Tax is 4.5% for transfers to direct descendants (lineal heirs), 12% for transfers to siblings, and 15% for transfers to other heirs (except charitable organizations, exempt institutions, and government entities that are exempt from tax).

Federal income tax rates for trusts in 2023 are: For trust income between $0 to $2,900: 10% of income over $0. For trust income between $2,901 to $10,550: $290 + 24% of the amount over $2,901. For trust income between $10,551 to $14,450: $2,126 + 35% of the amount over $10,551.