Pennsylvania Real Form With Land

Description

How to fill out Pennsylvania Residential Real Estate Sales Disclosure Statement?

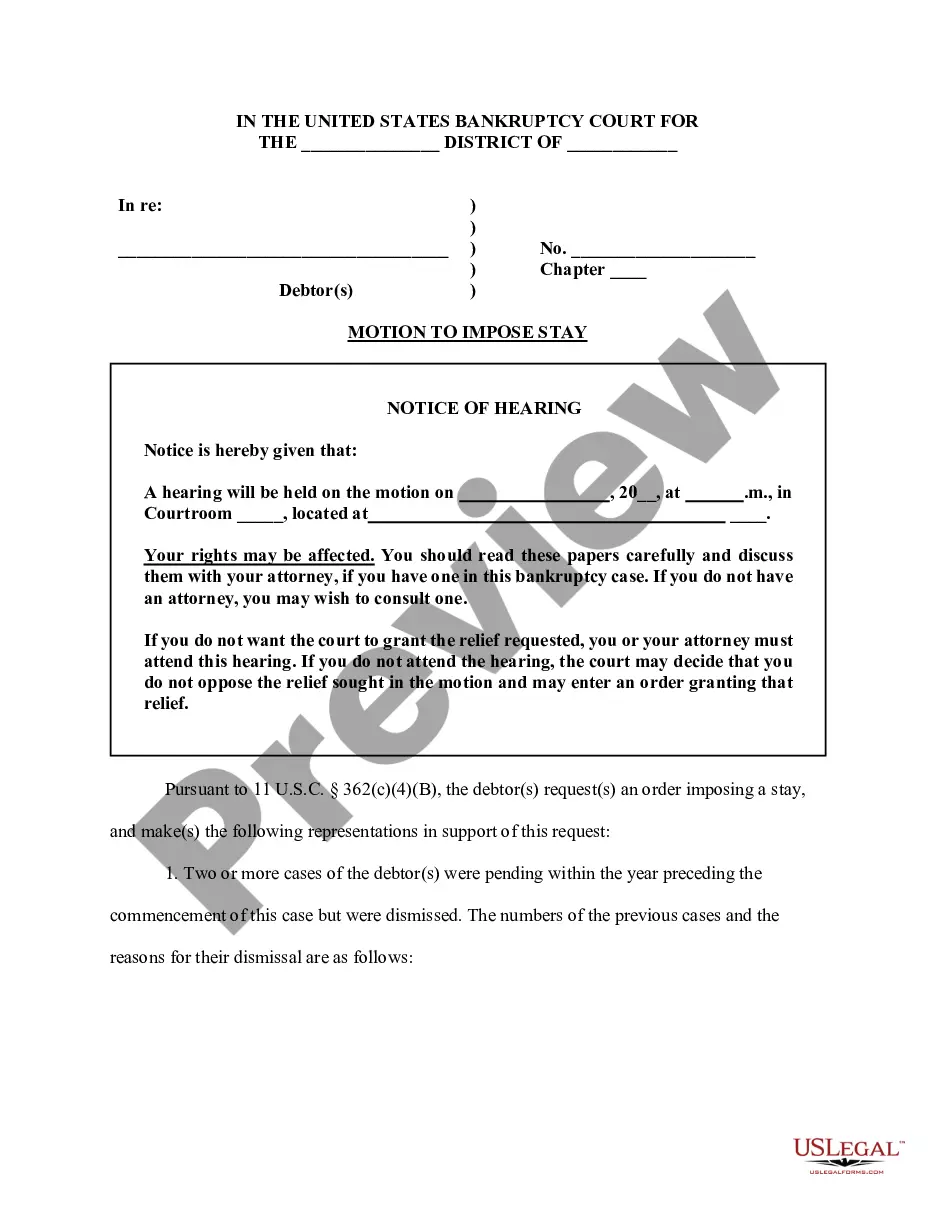

Drafting legal paperwork from scratch can sometimes be intimidating. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re looking for a an easier and more affordable way of preparing Pennsylvania Real Form With Land or any other documents without jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual collection of over 85,000 up-to-date legal forms addresses virtually every element of your financial, legal, and personal affairs. With just a few clicks, you can instantly access state- and county-specific templates diligently put together for you by our legal professionals.

Use our website whenever you need a trustworthy and reliable services through which you can quickly locate and download the Pennsylvania Real Form With Land. If you’re not new to our website and have previously set up an account with us, simply log in to your account, locate the form and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No worries. It takes minutes to register it and explore the catalog. But before jumping directly to downloading Pennsylvania Real Form With Land, follow these recommendations:

- Review the document preview and descriptions to make sure you are on the the form you are looking for.

- Make sure the form you choose complies with the regulations and laws of your state and county.

- Choose the right subscription option to buy the Pennsylvania Real Form With Land.

- Download the form. Then fill out, certify, and print it out.

US Legal Forms has a good reputation and over 25 years of experience. Join us today and transform form completion into something simple and streamlined!

Form popularity

FAQ

In Pennsylvania, all real estate, unless specifically exempted, is subject to tax (see ¶20-010). There is no statutory definition of "real property" or "real estate." In general, any improvements of a permanent nature attached to the land are considered realty.

There are three methods to value the property at date of death: sale price, appraisal value or county tax assessment multiplied by the common level ratio factor. The Department of Revenue allows up to 15 months after the date of death to report a sale price. If using a sale price, report the gross sale price.

If you are a PA resident, nonresident or a part-year PA resident, you must file a 2022 PA tax return if: ? You received total PA gross taxable income in excess of $33 during 2022, even if no tax is due with your PA return; and/or ? You incurred a loss from any transaction as an individual, sole proprietor, partner in a ...

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

A Pennsylvania property deed must contain the current owner (the grantor), the new owner (the grantee), a legal description of the property, and the signature of the grantor before the transfer. But there are also less common ways to use property, which require several different types of property deeds.