Pennsylvania Public Disclosure Form Bco-23

Description

How to fill out Pennsylvania Residential Real Estate Sales Disclosure Statement?

Managing legal documents can be overwhelming, even for the most skilled experts.

If you are seeking a Pennsylvania Public Disclosure Form Bco-23 and do not have the opportunity to spend time searching for the accurate and latest version, the process might be challenging.

Gain access to a library of articles, guidelines, handbooks, and materials pertinent to your situation and requirements.

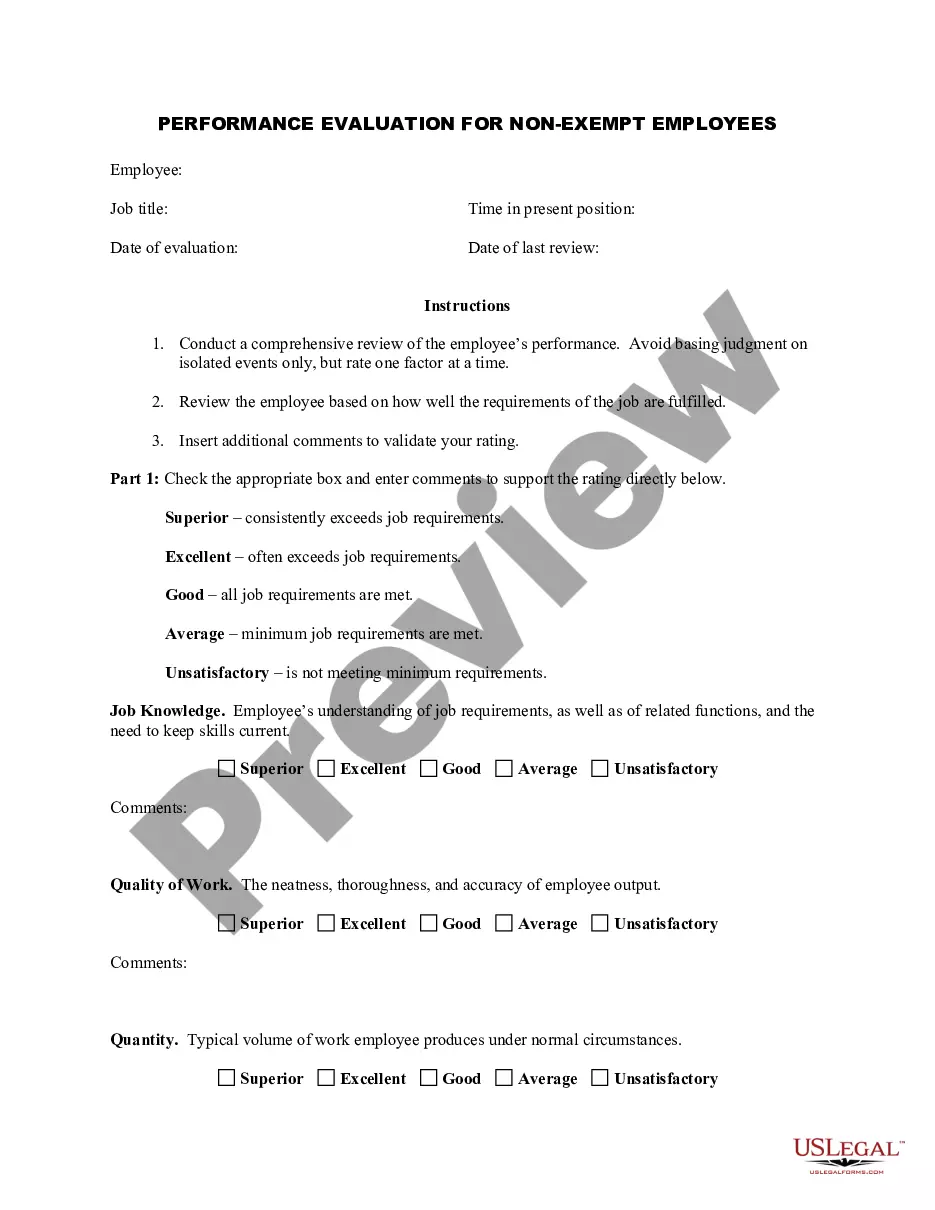

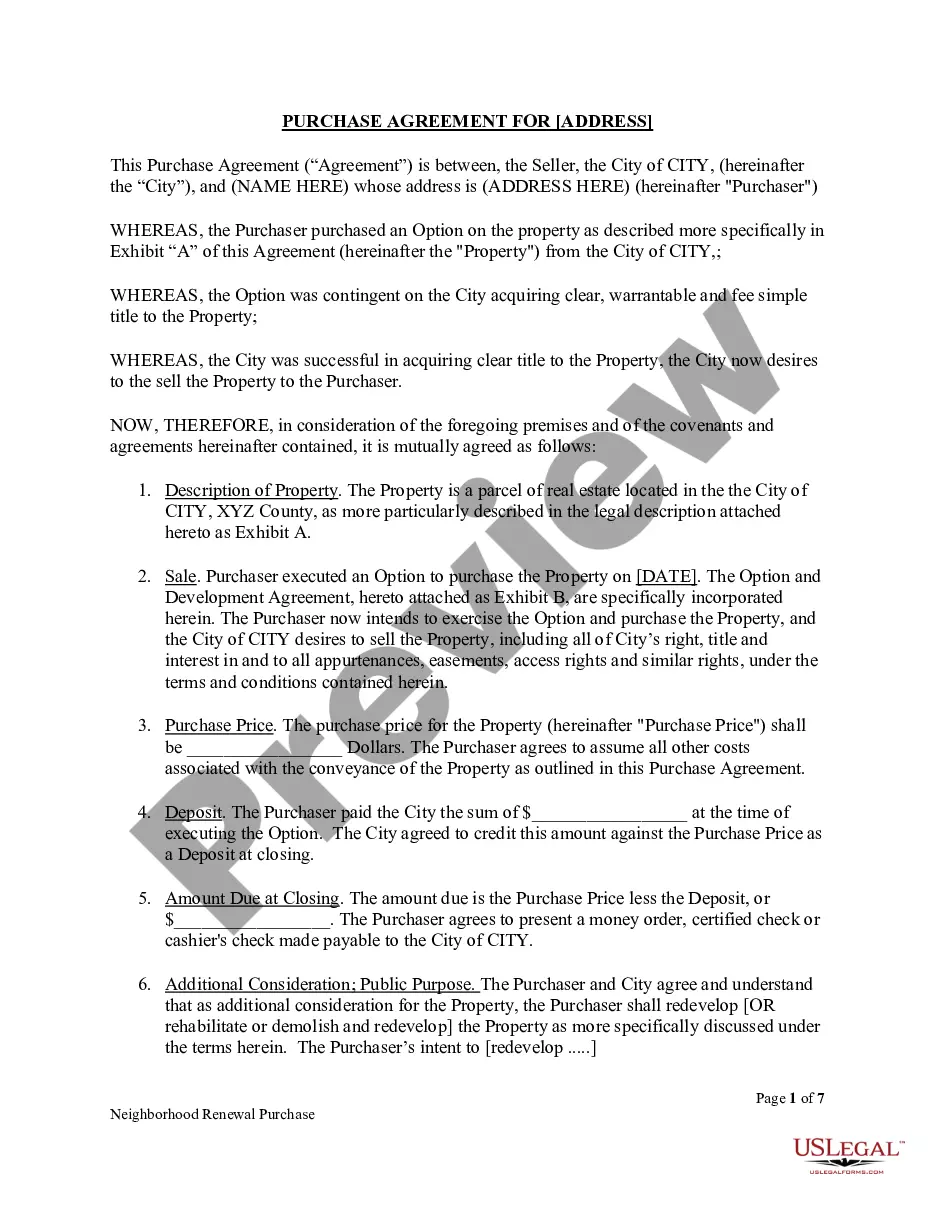

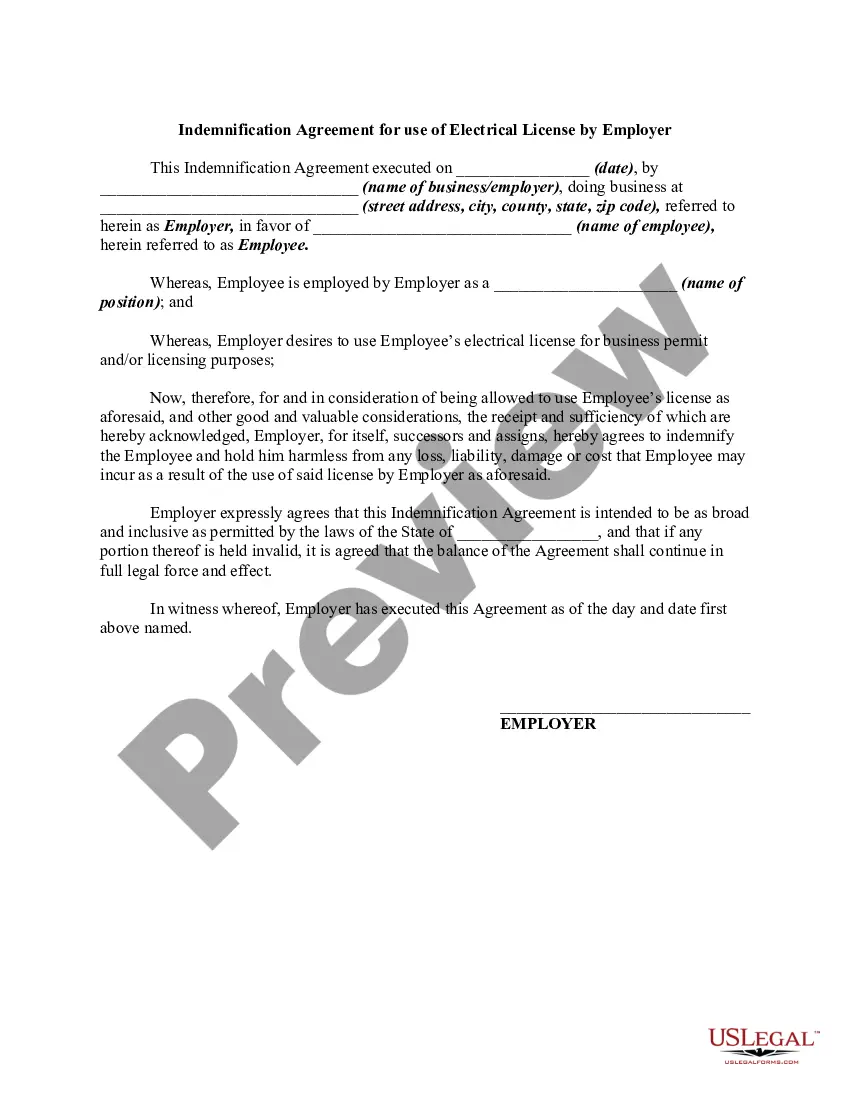

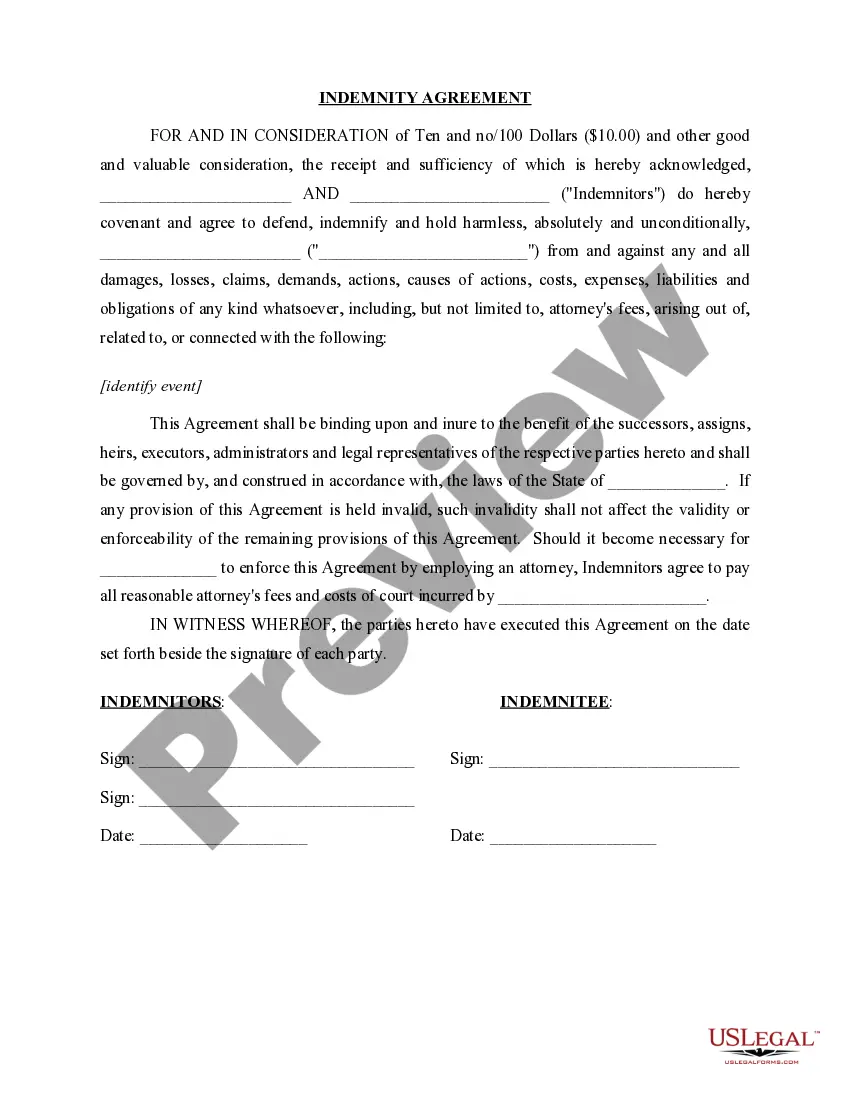

Save time and effort searching for the documents you require, and use US Legal Forms’ sophisticated search and Preview feature to retrieve Pennsylvania Public Disclosure Form Bco-23.

Leverage the resources of the US Legal Forms online library, supported by 25 years of expertise and reliability. Transform your daily document management into a seamless and user-friendly experience today.

- If you possess a subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check your My documents section to review the documents you’ve previously saved and manage your folders as needed.

- If you are a first-time user of US Legal Forms, create an account to gain unlimited access to all the benefits of the library.

- Follow these steps after accessing the form you need.

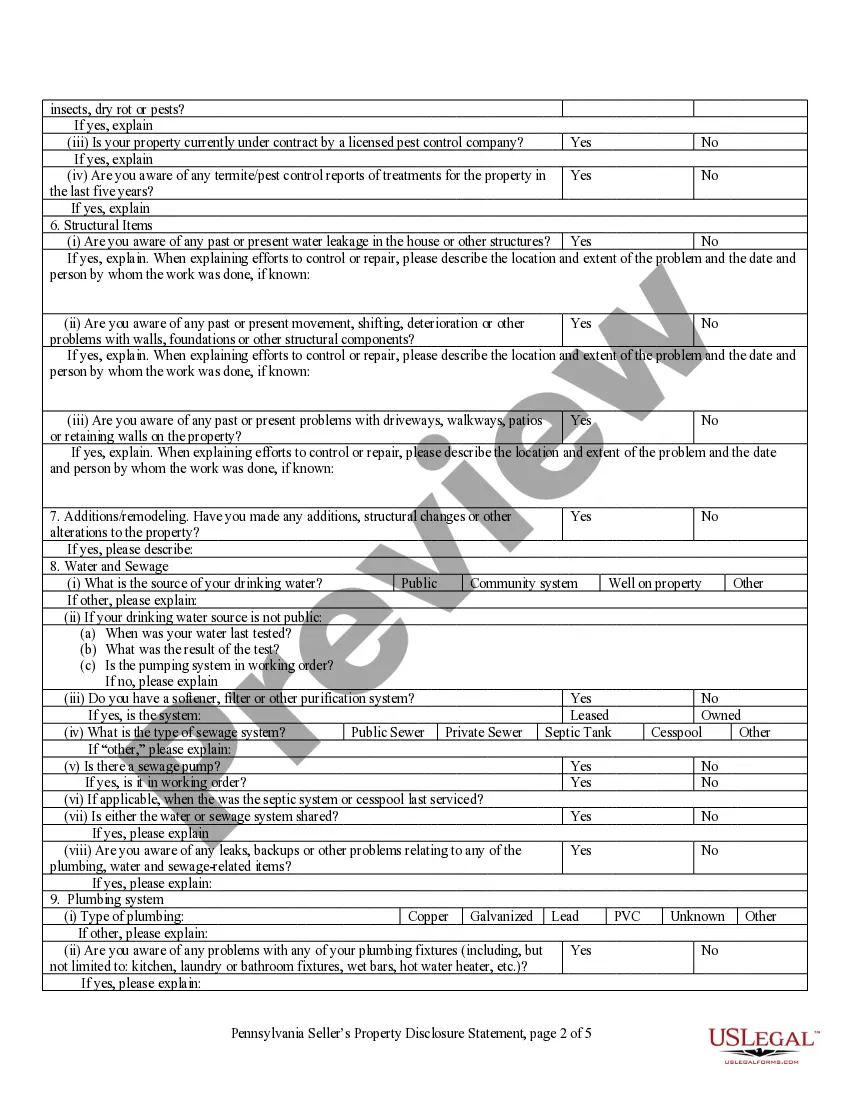

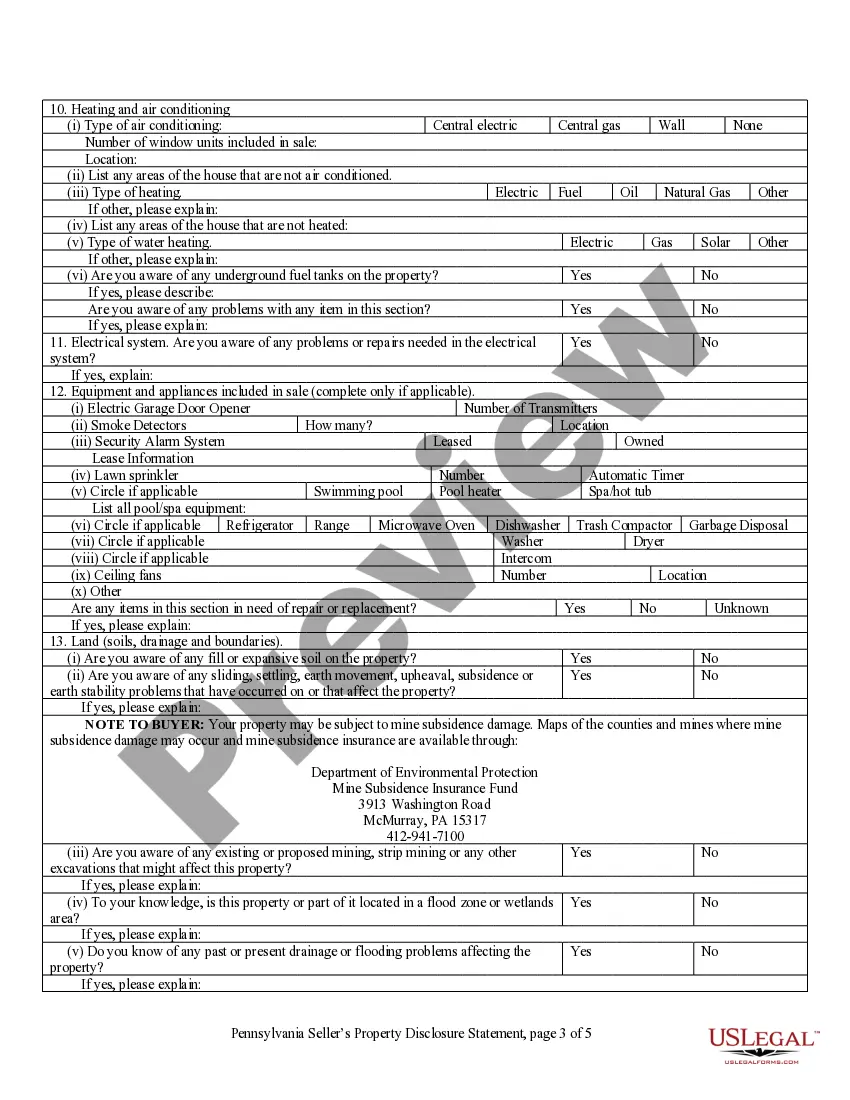

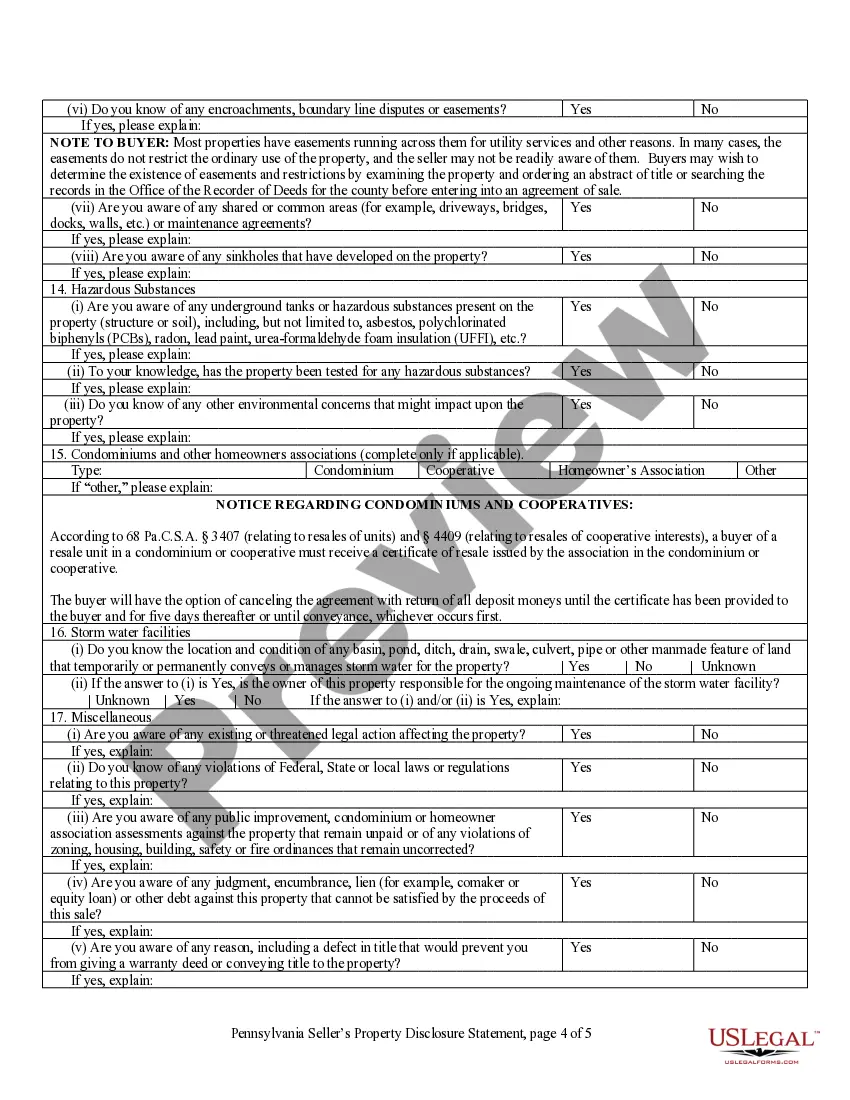

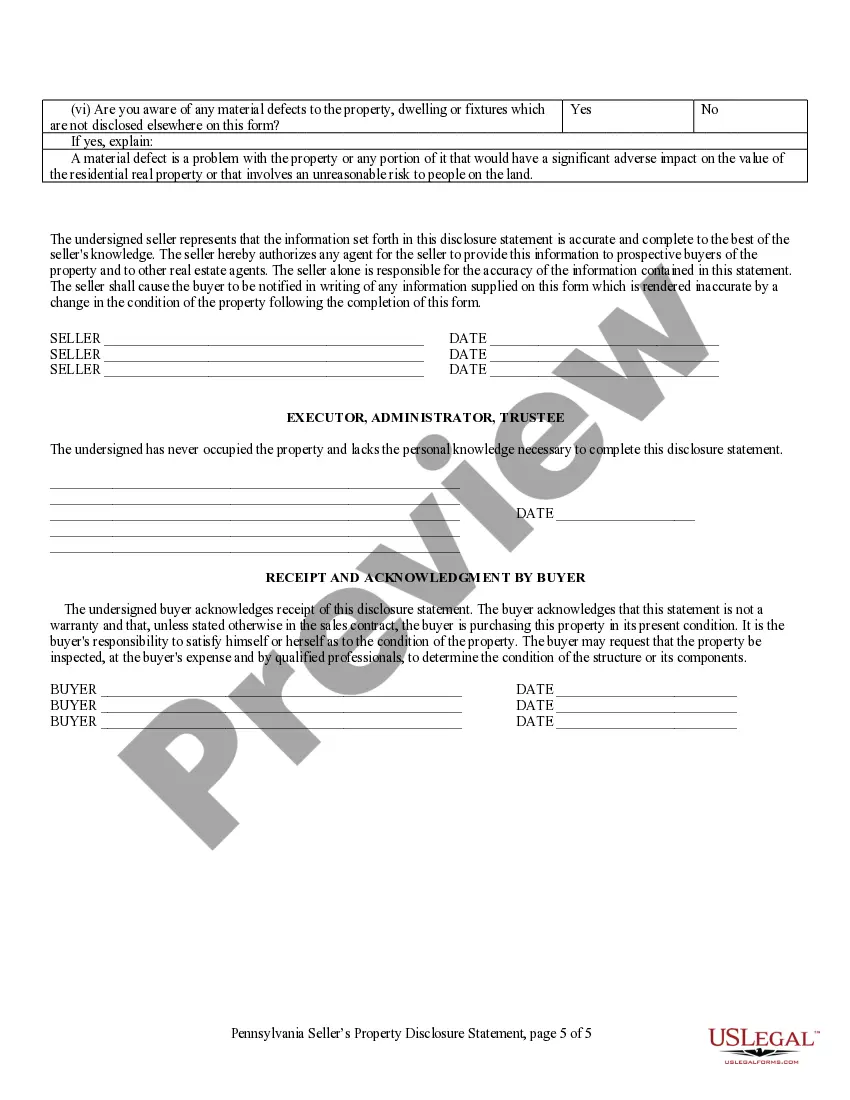

- Confirm it is the correct form by previewing it and examining its description.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses all your needs, from personal to corporate paperwork, in one convenient location.

- Utilize advanced tools to fill out and manage your Pennsylvania Public Disclosure Form Bco-2.

Form popularity

FAQ

To form a 501(c)(3) in Pennsylvania, start by choosing a unique name for your organization and ensuring it complies with state regulations. Next, you will need to draft and file your Articles of Incorporation with the Pennsylvania Department of State. After your incorporation, you must apply for IRS recognition with the appropriate Pennsylvania public disclosure form bco-23 to obtain tax-exempt status. This process can be streamlined using platforms like uslegalforms, which offer step-by-step guidance and templates to simplify your application.

In Pennsylvania, a non-profit organization must have at least three board members, which helps ensure diverse perspectives and effective governance. These members should not be related to promote unbiased decision-making. Having a well-rounded board will also enhance your ability to fulfill your mission and ensure compliance with state regulations, such as those outlined in the Pennsylvania public disclosure form BCO-23. Building a strong board is vital for your organization's longevity and success.

A 990 tax form is an annual report that tax-exempt organizations, including non-profits in Pennsylvania, must file with the IRS. This form provides detailed information about an organization's finances, including income, expenses, and executive compensation. Filing the 990 is crucial for maintaining tax-exempt status and ensures compliance with federal requirements. Remember, the data captured may also impact the information required in the Pennsylvania public disclosure form BCO-23.

The PA BCO 10 must be filed by all Pennsylvania non-profits that are not recognized as tax-exempt under section 501(c) of the IRS code. This form enables the state to keep track of various non-profit organizations and their activities. If your organization has certain income or holds assets exceeding state thresholds, you will also be required to file the Pennsylvania public disclosure form BCO-23. Ensuring proper filing will help maintain your organization's good standing.

The 33% rule refers to a guideline that states that a non-profit organization must derive at least one-third of its income from public sources to maintain its tax-exempt status. This rule emphasizes the importance of public support for your initiatives. By adhering to this rule, you will ensure compliance with IRS regulations, including those related to the Pennsylvania public disclosure form BCO-23. It is advisable to keep detailed records of funding sources as part of your ongoing compliance.

The BCO 23 is the Pennsylvania public disclosure form that non-profits must file. It serves to disclose certain financial information about your organization to the public. The form plays an essential role in ensuring transparency and accountability within non-profits in Pennsylvania. By completing the BCO 23, you will demonstrate your commitment to transparency, which can enhance trust among your stakeholders.

To register a non-profit in Pennsylvania, you need to choose a name and ensure it is unique. Then, file the Articles of Incorporation with the Pennsylvania Department of State and include the Pennsylvania public disclosure form BCO-23. This form outlines your organization’s purpose, which is essential for tax-exempt status. After approval, you can apply for an EIN from the IRS to complete the registration process.

The bidding threshold in Pennsylvania indicates the minimum contract amount that triggers competitive bidding requirements for public contracts. When the contract value exceeds this threshold, businesses must follow specific bidding procedures to ensure fairness and transparency. Understanding this limit helps businesses plan their bids appropriately and comply with state regulations. For comprehensive details on compliance, the Pennsylvania public disclosure form BCO-23 provides valuable information.

The statute of charitable solicitation in Pennsylvania regulates how charities must conduct fundraising activities. These rules ensure that charitable organizations operate transparently and responsibly, protecting donors and recipients alike. Compliance with the statute often involves disclosing financial information, including submissions of the Pennsylvania public disclosure form BCO-23. For detailed guidance, platforms like USLegalForms can assist in navigating these requirements.

In Pennsylvania, the lobbying threshold defines the minimum spending or actions required before compliance is triggered. Organizations engaging in lobbying activities must file appropriate disclosures once they meet this threshold, which helps ensure accountability in advocacy efforts. It is essential to understand these guidelines to avoid penalties and maintain integrity. The Pennsylvania public disclosure form BCO-23 is a crucial document for transparency in these cases.