Pennsylvania Estate Form For Tax Return

Description

How to fill out Pennsylvania Residential Real Estate Sales Disclosure Statement?

Legal document managing might be overwhelming, even for skilled experts. When you are searching for a Pennsylvania Estate Form For Tax Return and do not have the a chance to spend in search of the right and updated version, the operations may be demanding. A strong online form library can be a gamechanger for everyone who wants to handle these situations successfully. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms accessible to you at any moment.

With US Legal Forms, you can:

- Access state- or county-specific legal and business forms. US Legal Forms covers any needs you could have, from personal to organization papers, all in one place.

- Make use of innovative resources to finish and control your Pennsylvania Estate Form For Tax Return

- Access a resource base of articles, instructions and handbooks and resources related to your situation and requirements

Save effort and time in search of the papers you will need, and use US Legal Forms’ advanced search and Review feature to discover Pennsylvania Estate Form For Tax Return and acquire it. In case you have a membership, log in to the US Legal Forms profile, search for the form, and acquire it. Take a look at My Forms tab to view the papers you previously saved as well as to control your folders as you see fit.

If it is your first time with US Legal Forms, register a free account and have unlimited use of all benefits of the platform. Here are the steps to take after accessing the form you need:

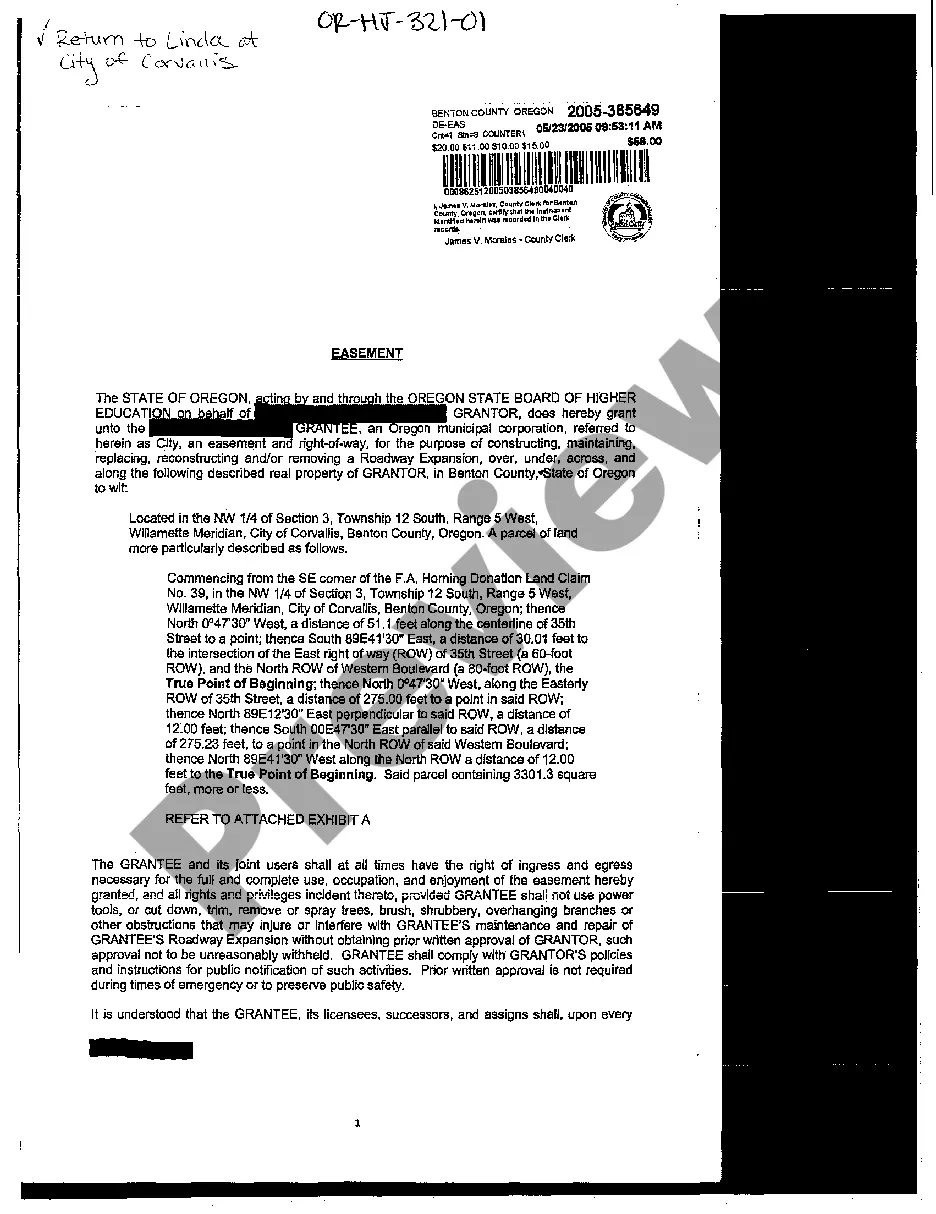

- Validate it is the correct form by previewing it and reading through its description.

- Be sure that the sample is accepted in your state or county.

- Choose Buy Now once you are ready.

- Choose a subscription plan.

- Find the file format you need, and Download, complete, eSign, print and deliver your document.

Benefit from the US Legal Forms online library, backed with 25 years of experience and reliability. Change your daily document management into a easy and easy-to-use process right now.

Form popularity

FAQ

Generally, an executor prepares the final income tax returns for the deceased person. The executor files the final federal and state income tax returns as if the deceased person was still alive using IRS Form 1040 and the required tax forms of the state in which the deceased lived.

Inheritance tax forms, schedules and instructions are available at .revenue.pa.gov. You may also order any Pennsylvania tax form or schedule by calling, toll-free 1-800-362-2050. Schedules A through G are used to report assets of the estate. Schedules H and I are used to report debts and deductions of the estate. Inheritance Tax General Information - PA Department of Revenue pa.gov ? Documents ? rev-720 pa.gov ? Documents ? rev-720

Income tax on income generated by assets of the estate of the deceased. If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes. File an Estate Tax Income Tax Return | Internal Revenue Service irs.gov ? individuals ? file-an-estate-tax-inco... irs.gov ? individuals ? file-an-estate-tax-inco...

An inheritance tax return must be filed for every decedent (or person who died) with property that may be subject to PA inheritance tax. The tax is due within nine months of the decedent's death. After nine months, the tax due accrues interest and penalties. File and pay inheritance taxes | Services | City of Philadelphia City of Philadelphia (.gov) ? death-probate-and-inheritances City of Philadelphia (.gov) ? death-probate-and-inheritances

Preparing the Pennsylvania Inheritance Tax Return The Probate Attorney typically prepares the Inheritance Tax Return. Pennsylvania Inheritance Tax; Everything You Need To Know klenklaw.com ? estate-inheritance-taxes ? pe... klenklaw.com ? estate-inheritance-taxes ? pe...