Nonresidential Simple Lease

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

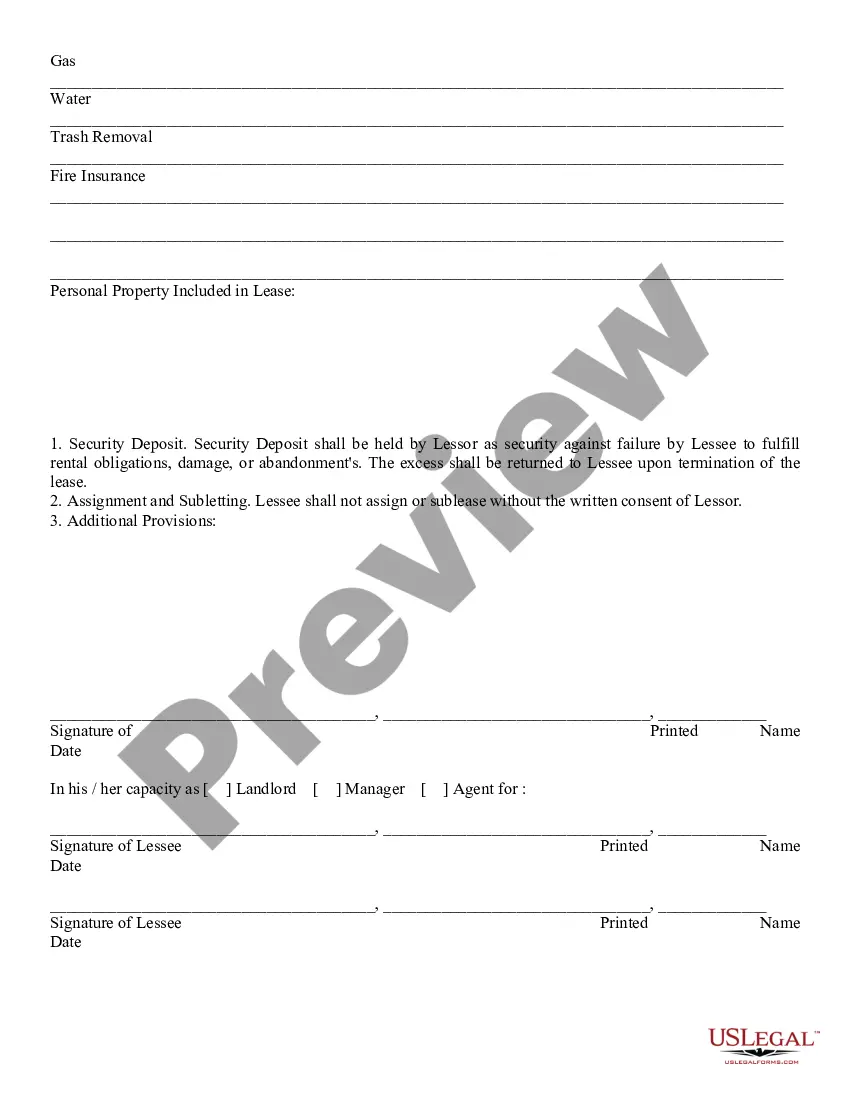

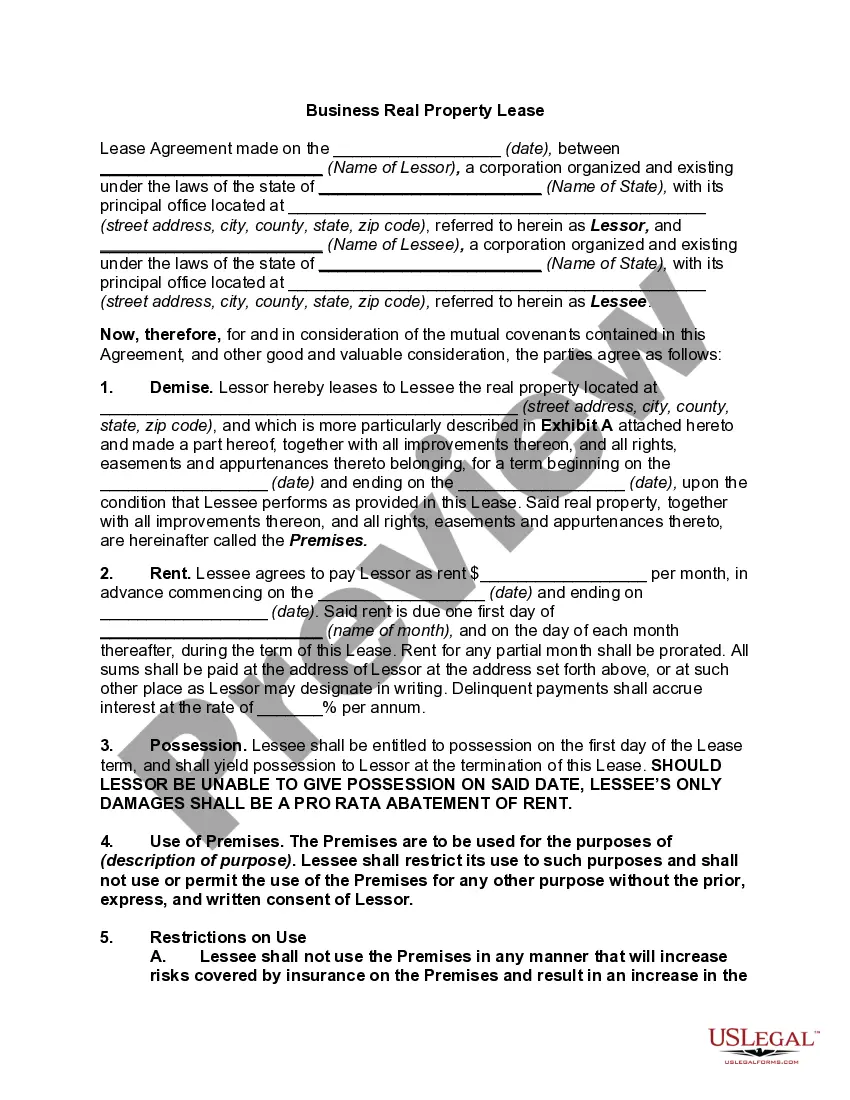

Nonresidential Simple Lease: A legal document between a landlord and a tenant used for properties not intended for residential use, such as offices or retail spaces. Lease Agreement: A general term referring to any agreement between two parties where one party agrees to rent property owned by another. Nonresidential Lease Agreement: Specifically refers to lease agreements for commercial property. Security Deposit Clause: A provision in a lease that involves the tenant providing a monetary deposit to cover damages or unpaid rent.

Step-by-Step Guide to Creating and Signing a Nonresidential Simple Lease

- Choose the Right Form: Ensure you are using a nonresidential lease form, which is different from a residential lease form.

- Create Lease Online: Utilize online platforms that allow you to customize and create lease agreements tailored to nonresidential properties.

- Include Necessary Clauses: Make sure to include essential clauses such as security deposit, payment terms, and property use restrictions.

- Review Landlord Tenant Rights: Both parties should understand their rights and duties under the lease and local laws.

- Esignature for Documents: Both parties can sign the lease digitally using platforms that support esignatures for a quicker and verified agreement.

- Download Lease Form: After signatures, download a copy of the agreement for record-keeping.

Risk Analysis for Nonresidential Simple Leases

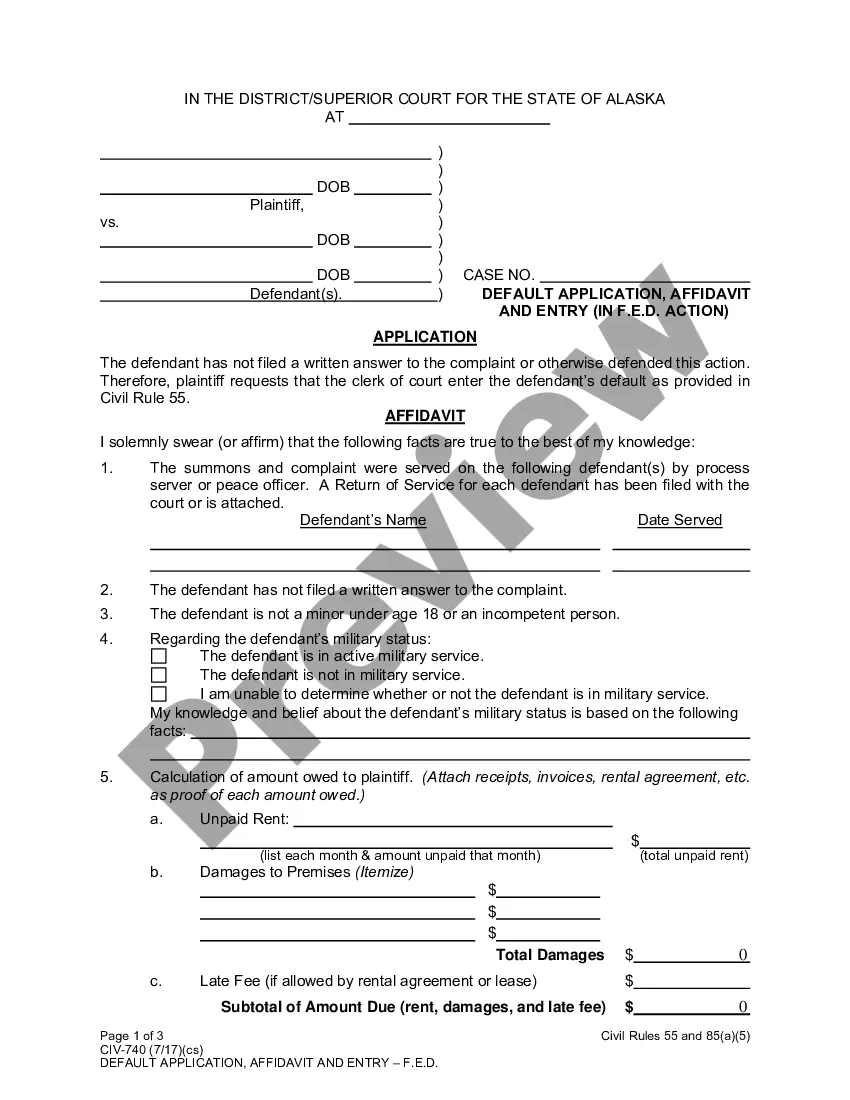

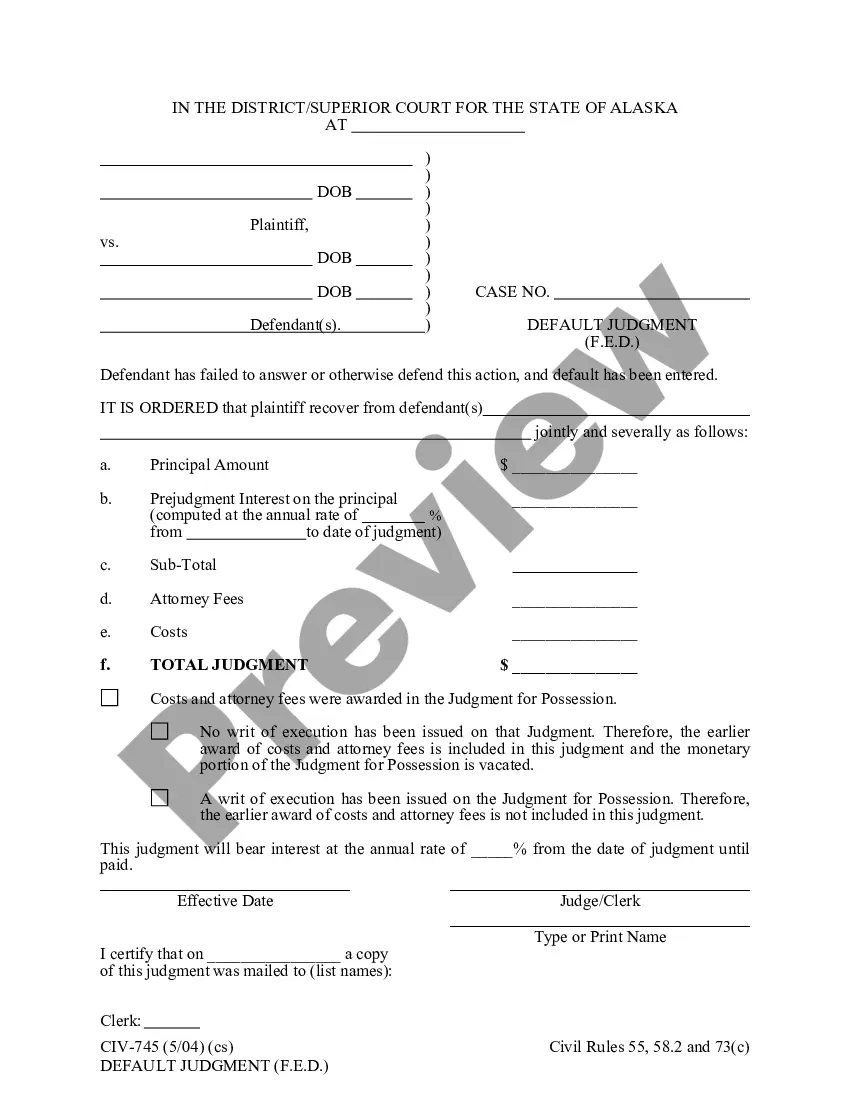

Nonresidential leases carry risks like unforeseen property costs, disputes over lease terms, and potential litigation if contract clauses are not clearly defined and agreed upon. Security deposit disputes are particularly common, emphasizing the need for a clear security deposit clause.

Best Practices in Nonresidential Leasing

- Clearly Define Terms: Clearly articulate the terms regarding the use of the property, payment, maintenance responsibilities, and termination conditions.

- Consult a Lawyer: Have a legal expert review the lease to ensure compliance with local laws and that all essential terms are covered.

- Regular Reviews: Periodically review the lease terms and conditions to ensure they continue to meet the needs of both parties and adapt to any changes in the law or the business environment.

Common Mistakes & How to Avoid Them

- Overlooking Property Inspection: Always inspect the property thoroughly before signing the lease to avoid agreeing to rent a property with existing damages or issues.

- Ignoring Legal Requirements: Ensure that your lease complies with all relevant zoning, safety, and accessibility laws to avoid legal repercussions.

- Neglecting Detailed Documentation: Maintain thorough and detailed records of all transactions and communications related to the lease.

How to fill out Nonresidential Simple Lease?

Aren't you tired of choosing from hundreds of samples each time you require to create a Nonresidential Simple Lease? US Legal Forms eliminates the lost time countless American people spend surfing around the internet for suitable tax and legal forms. Our professional crew of attorneys is constantly modernizing the state-specific Templates library, so it always provides the proper files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have a subscription need to complete quick and easy actions before being able to download their Nonresidential Simple Lease:

- Use the Preview function and look at the form description (if available) to make certain that it’s the correct document for what you’re looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the appropriate template to your state and situation.

- Make use of the Search field at the top of the webpage if you want to look for another document.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Get your file in a required format to finish, print, and sign the document.

As soon as you have followed the step-by-step instructions above, you'll always have the ability to log in and download whatever document you need for whatever state you want it in. With US Legal Forms, finishing Nonresidential Simple Lease samples or other legal files is simple. Get started now, and don't forget to examine your examples with certified lawyers!

Form popularity

FAQ

1The Gross Lease. The gross lease tends to favor the tenant.2The Net Lease. The net lease, however, tends to favor the landlord.3The Modified Gross Lease.

In a gross lease, the rent is all-inclusive. The landlord pays all or most expenses associated with the property, including taxes, insurance, and maintenance out of the rents received from tenants. Utilities and janitorial services are included within one easy, tenant-friendly rent payment.

Summary. There are different types of leases, but the most common types are absolute net lease, triple net lease, modified gross lease, and full-service lease. Tenants and proprietors need to understand them fully before signing a lease agreement.

What Is a Modified Gross Lease? A modified gross lease is a type of real estate rental agreement where the tenant pays base rent at the lease's inception, but it takes on a proportional share of some of the other costs associated with the property as well, such as property taxes, utilities, insurance, and maintenance.

A triple net lease is a lease structure where the tenant is responsible for paying all operating expenses associated with a property.As we've seen throughout this article, the modified gross lease is a lease structure where the landlord and the tenant both share the cost of operating expenses.

The modified net lease is a compromise between the gross lease and the triple net. The landlord and tenant usually set up a split of maintenance expenses, while the tenant agrees to pay taxes and insurance.The terms of a modified net lease are as varied as are building and tenant business types.

Gross leases tend to be the simplest lease structure for the tenant to understand because the tenant is not responsible for any operating expenses. This is in contrast to a modified gross lease which is when the tenant and the landlord both share in the responsibility for paying the property's operating expenses.

The Gross Lease. The gross lease tends to favor the tenant. The Net Lease. The net lease, however, tends to favor the landlord. The Modified Gross Lease.

A gross lease allows the tenant to pay a flat fee in exchange for the exclusive use of the property.For example, a tenant may ask the landlord to include janitorial or landscaping services.