Pennsylvania 2

Description

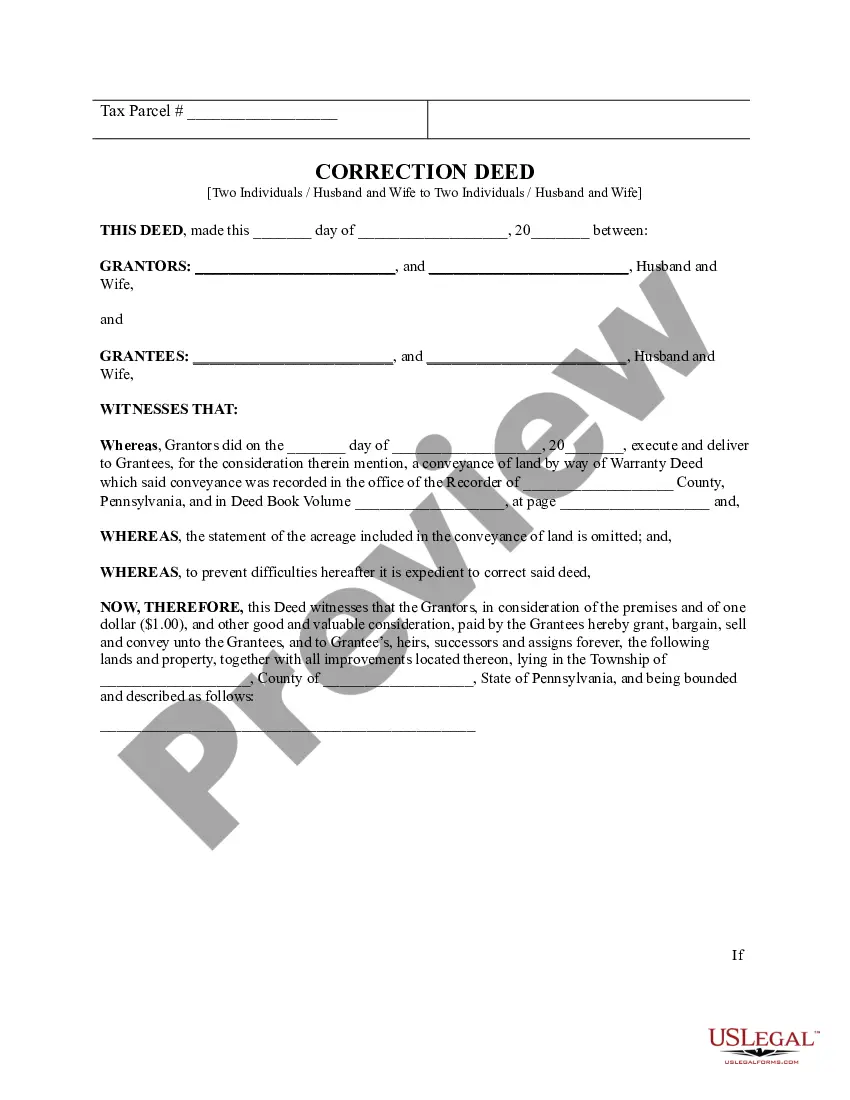

How to fill out Pennsylvania Correction Deed -?

- Log into your US Legal Forms account if you're a returning user. Ensure your subscription is active; if not, renew it based on your plan.

- For new users, begin by previewing form descriptions to select a document that suits your requirements and complies with local Pennsylvania regulations.

- Utilize the search function to find alternative templates if needed or if you encounter discrepancies.

- Proceed to purchase the document by clicking the 'Buy Now' button, and choose your preferred subscription plan, creating an account if necessary.

- Finalize your payment using either a credit card or PayPal to secure access to your selected forms.

- Download your chosen legal document for completion and store it safely, with the option to revisit it under the 'My Forms' section.

In conclusion, US Legal Forms not only offers a diverse array of legal templates, but also connects you with expert assistance for precise form completion.

Take control of your legal needs today – start accessing Pennsylvania 2 forms with US Legal Forms now!

Form popularity

FAQ

To achieve Level 2 certification in Pennsylvania, you need to first hold Level 1 certification and fulfill specific requirements. This includes completing continuing education credits, gaining a minimum number of teaching hours, and passing any additional assessments. The process may seem daunting, but utilizing platforms like uslegalforms can simplify applying and understanding your certification requirements.

Teaching in Pennsylvania without certification is generally not permitted in public schools. However, some private institutions may hire individuals without certification. To ensure a successful teaching career, obtaining the appropriate certification is highly recommended, as it opens doors to more opportunities in Pennsylvania.

To work as a preschool teacher assistant in Pennsylvania, you typically need at least a high school diploma. Some positions may require specific training or coursework in early childhood education. You'll also benefit from having strong communication skills and a passion for helping young children learn.

Pennsylvania's Pick 2 program allows aspiring teachers to choose two different subjects for certification during the application process. This flexibility helps candidates tailor their teaching credentials to match their interests and career goals. Understanding the Pick 2 system is essential for anyone pursuing a teaching career in Pennsylvania.

Level 2 certification in Pennsylvania represents a higher level of qualification for educators. This certification usually requires more experience, continuing education, and the completion of additional assessments. Achieving Level 2 status demonstrates your commitment and expertise in the field of education in Pennsylvania.

To become a certified paraprofessional in Pennsylvania, you must first complete a high school diploma or equivalent. Then, you should finish a training program focused on education services. Finally, passing the required assessments will grant you the necessary certification to work as a paraprofessional in Pennsylvania's schools.

Reading a W-2 might seem tricky at first, but it gets easier with practice. Start by familiarizing yourself with the boxes on the form, which contain information about your earnings and the taxes withheld. Look closely at Box 1, which displays your wages, and Box 2 for federal tax withheld. By understanding these simple components, you will effectively interpret your W-2 for your tax returns in Pennsylvania.

Filling out a Pennsylvania title requires careful attention to details. Start by entering the vehicle's information, such as make, model, year, and VIN. Next, fill in the current owner's name and address, and provide any necessary lienholder information if applicable. Ensure that all fields are complete and accurate before submitting to avoid any delays or issues.

Yes, as an employer, you are responsible for filling out the W-2 forms for your employees. This process includes accurately reporting wages and tax withholdings throughout the tax year. It's essential to ensure that the information reflects your payroll records to meet Pennsylvania's requirements succinctly. Consider using platforms like uslegalforms to guide you through filling out these forms efficiently.

Filling out a W-2 involves several straightforward steps. First, enter your business's name, address, and Employer Identification Number (EIN) in the appropriate fields. Next, include your employee's details, such as name, address, and Social Security number. Finally, complete the wage and tax sections carefully, ensuring that all amounts align with the payroll records you have, especially for Pennsylvania employees.