Intent To Lien Letter Template For Insurance

Description

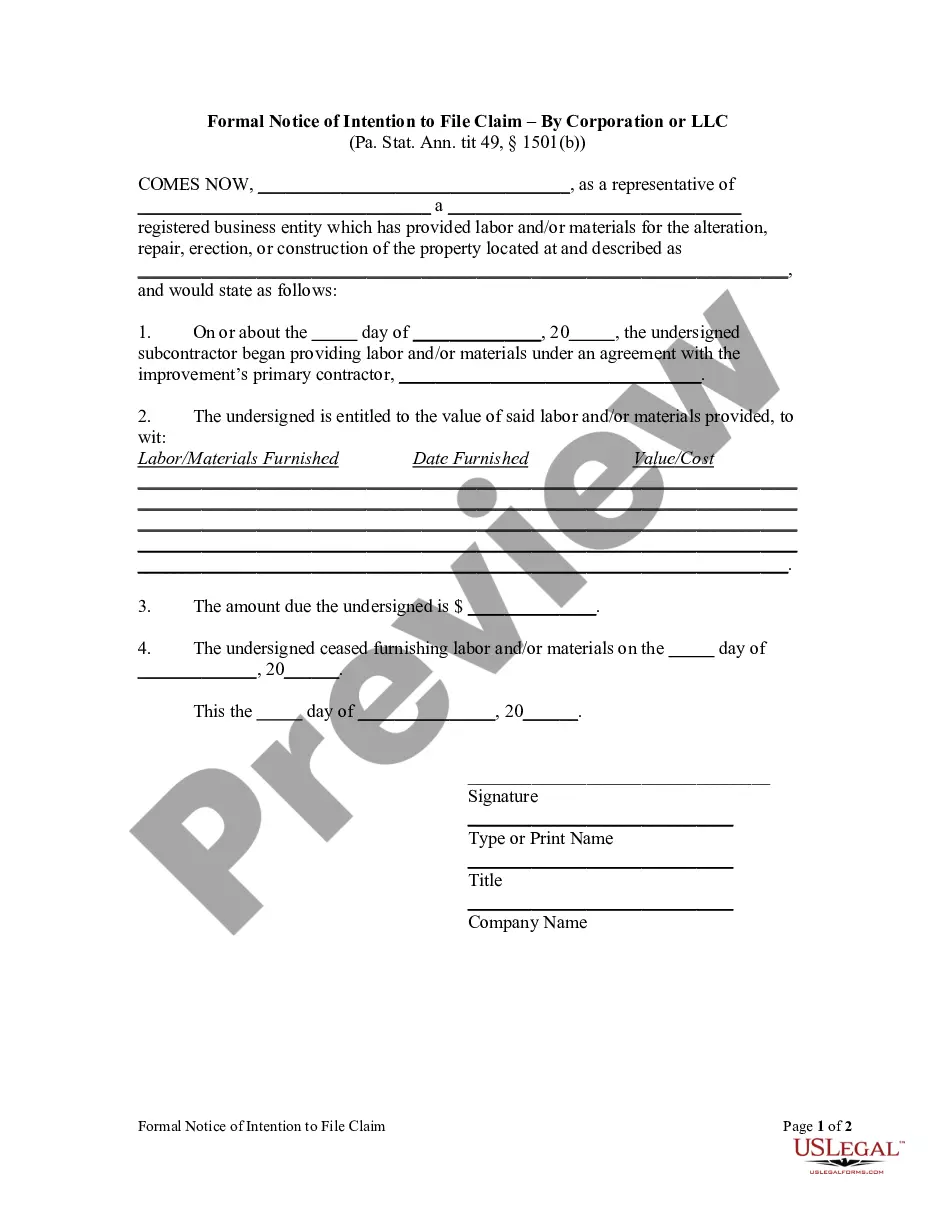

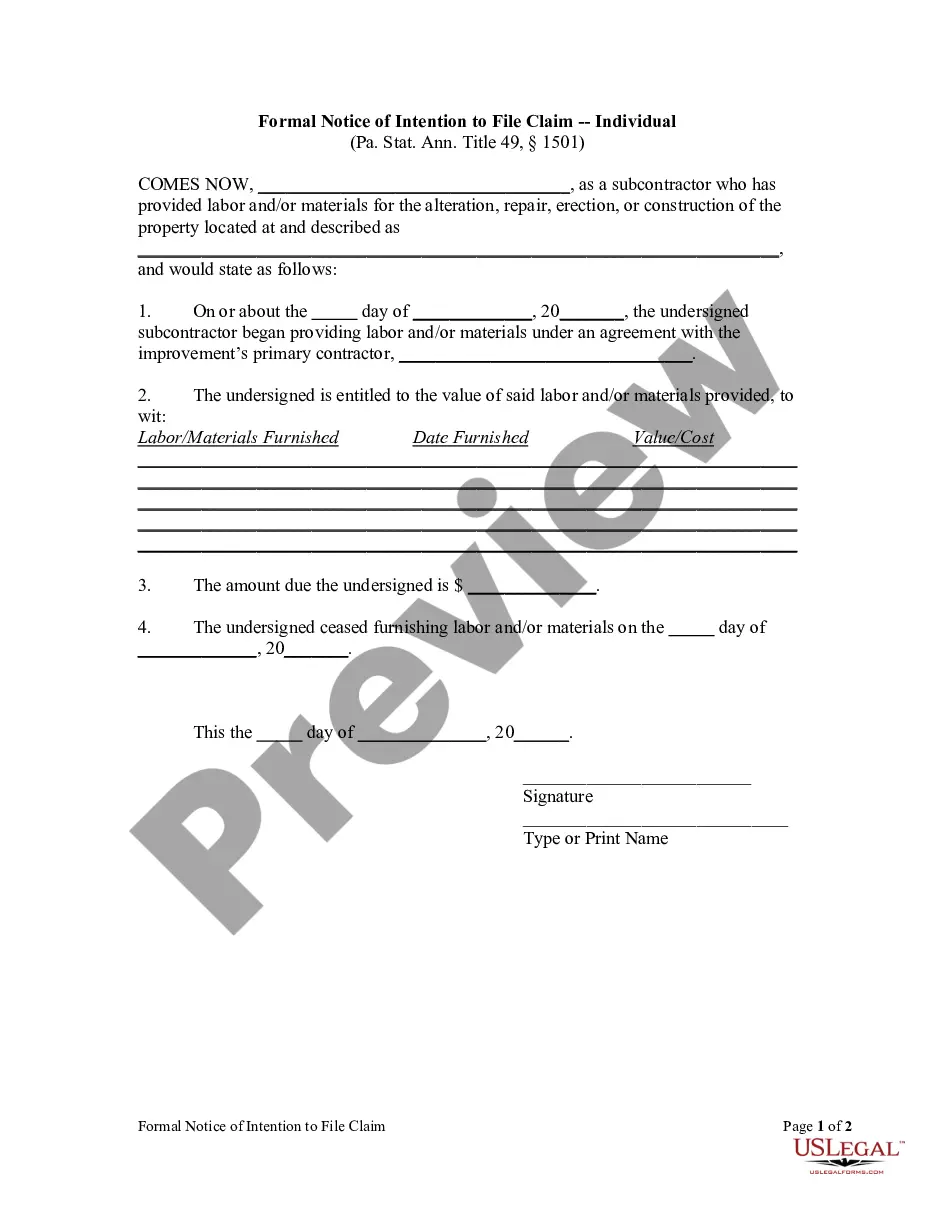

How to fill out Pennsylvania Formal Notice Of Intent To File Lien By Corporation?

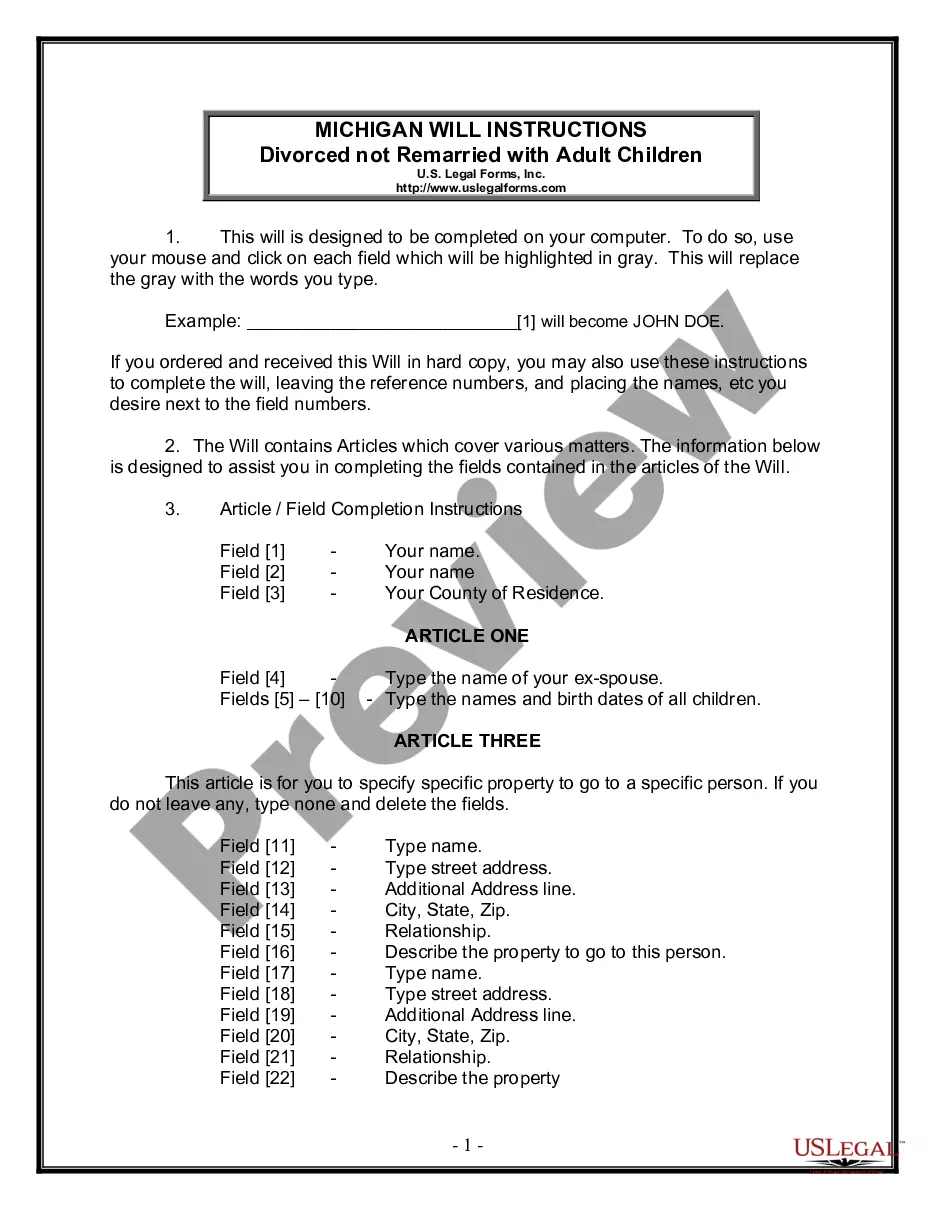

It’s clear that you cannot instantly become a legal expert, nor can you quickly learn how to draft an Intent To Lien Letter Template For Insurance without a unique set of expertise.

Producing legal documents is a lengthy endeavor that demands particular education and abilities. So why not entrust the creation of the Intent To Lien Letter Template For Insurance to the professionals.

With US Legal Forms, one of the most extensive collections of legal documents, you can find everything from court filings to templates for office communication.

If you require any other form, restart your search.

Create a free account and select a subscription plan to acquire the template. Hit Buy now. Once your purchase is finalized, you can obtain the Intent To Lien Letter Template For Insurance, complete it, print it, and send or mail it to the relevant individuals or organizations.

- We recognize the significance of compliance and adherence to federal and local laws and guidelines.

- Therefore, on our platform, all forms are specific to locations and current.

- Let’s get started with our site and obtain the necessary form in just minutes.

- Locate the form you need using the search feature at the top of the webpage.

- View it (if this feature is available) and read the accompanying description to ascertain if the Intent To Lien Letter Template For Insurance is what you seek.

Form popularity

FAQ

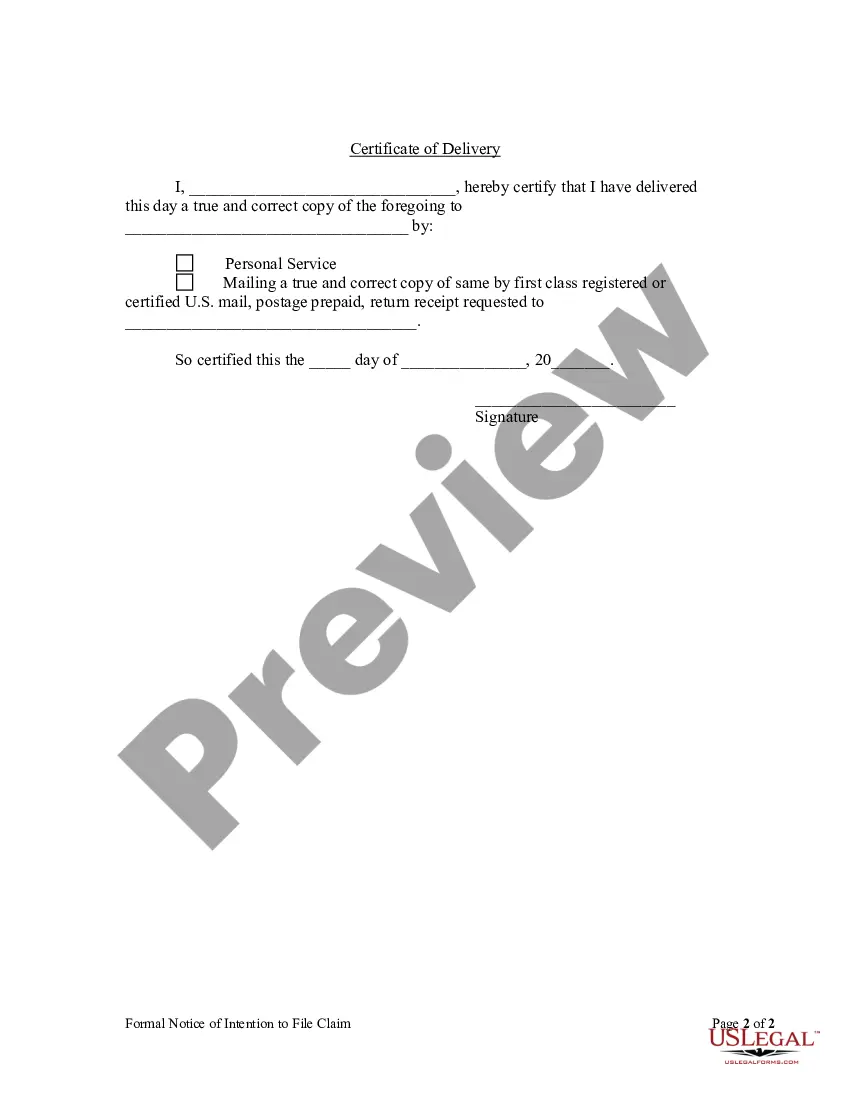

To complete a lien release, you must include critical details such as the lienholder’s name, the property description, and the amount satisfied. Ensure that both parties sign the document, which then must be filed with the appropriate authority to officially clear the lien. If you are unsure, consider using an 'intent to lien letter template for insurance' from uslegalforms for guidance. This can simplify the process and provide clarity.

A lien waiver is a document that indicates an agreement between parties to forgo future claims to a property, while a lien release formally removes a lien that has already been placed on a property. Understanding this distinction is essential during transactions involving property or construction. When utilizing an 'intent to lien letter template for insurance', make sure to choose the correct type of document for your needs.

Several states mandate notarization of lien waivers to enhance their legal standing. Generally, these states ensure that both parties confirm their identities when signing the document. You should check local regulations to confirm the requirements specific to your state. Using an 'intent to lien letter template for insurance' can help you understand these requirements easily.

Filling out a lien waiver involves providing specific details about the transaction, including the parties involved, the amount due, and any relevant dates. Look for a reliable 'intent to lien letter template for insurance' to make the process easier. Make sure to read the form carefully and fill in all required fields accurately. This step helps protect both parties and can prevent potential disputes.

A lien request letter is a formal document that requests the placement of a lien on a person's property to secure payment for owed debts. This letter is crucial for creditors as it provides a legal basis to claim funds owed. The Intent to lien letter template for insurance simplifies this process by offering a structured format to draft a request. Using such templates can enhance clarity and professionalism in your communications.

Yes, in certain situations, a lien can be placed on your property even without a contract. This often occurs in situations involving unpaid debts or services rendered. However, to protect your interests, it's a good idea to use an Intent to lien letter template for insurance, which can provide formal notice and prevent potential complications. Always consult legal guidelines in your state to understand your rights and obligations.

In Minnesota, a lien is a legal right or interest that a lender has in another person's property, granted until a debt owed by the owner is satisfied. Typically, to enforce a lien, a creditor must follow specific procedures, which can include providing an Intent to lien letter template for insurance. This letter serves to notify the property owner of the lender's legal claim. Understanding these rules is vital for both creditors and property owners to avoid disputes.

A letter of intent to file a lien is a preliminary document that communicates your intention to take legal action against a property for an unpaid debt. It serves as a warning to the property owner before the actual lien is filed. Utilizing an intent to lien letter template for insurance can help you draft this letter with clarity and precision, ensuring all necessary details are included for legal validity.

In Utah, to enforce a lien, you must first file the lien claim in the appropriate county office. Following the filing, notify the property owner about the lien. Using an intent to lien letter template for insurance can help you prepare the notification correctly, ensuring compliance with all legal requirements to effectively enforce your lien.

To write a letter of intent for a lien, begin with a clear statement of intent, identifying the property in question. Include details about the debt and any relevant dates, along with your identification as the lien claimant. Using an intent to lien letter template for insurance can greatly assist you in formatting and phrasing your letter correctly, making your intent clear and legitimate.