Pennsylvania Formal Notice of Intent to File Lien by Corporation

Understanding this form

The Formal Notice of Intent to File Lien by Corporation is a legal document that informs property owners of a subcontractor's intent to file a lien for unpaid work. This form serves as a vital step to protect the rights of subcontractors who have provided labor or materials, ensuring they receive payment. It should be noted that this notice is distinct from other preliminary notices, as it must be delivered at least 30 days prior to filing a lien claim and complies with specific legal requirements.

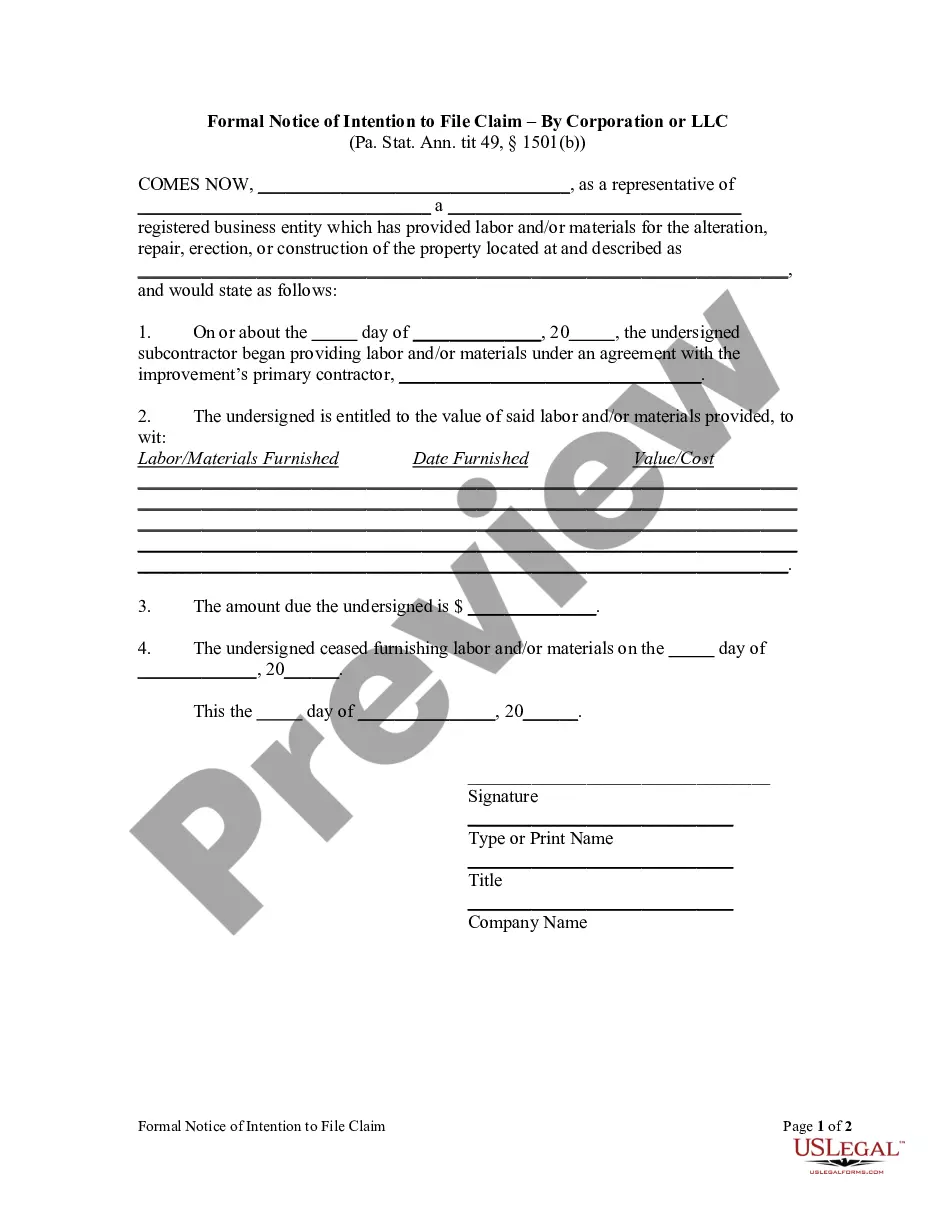

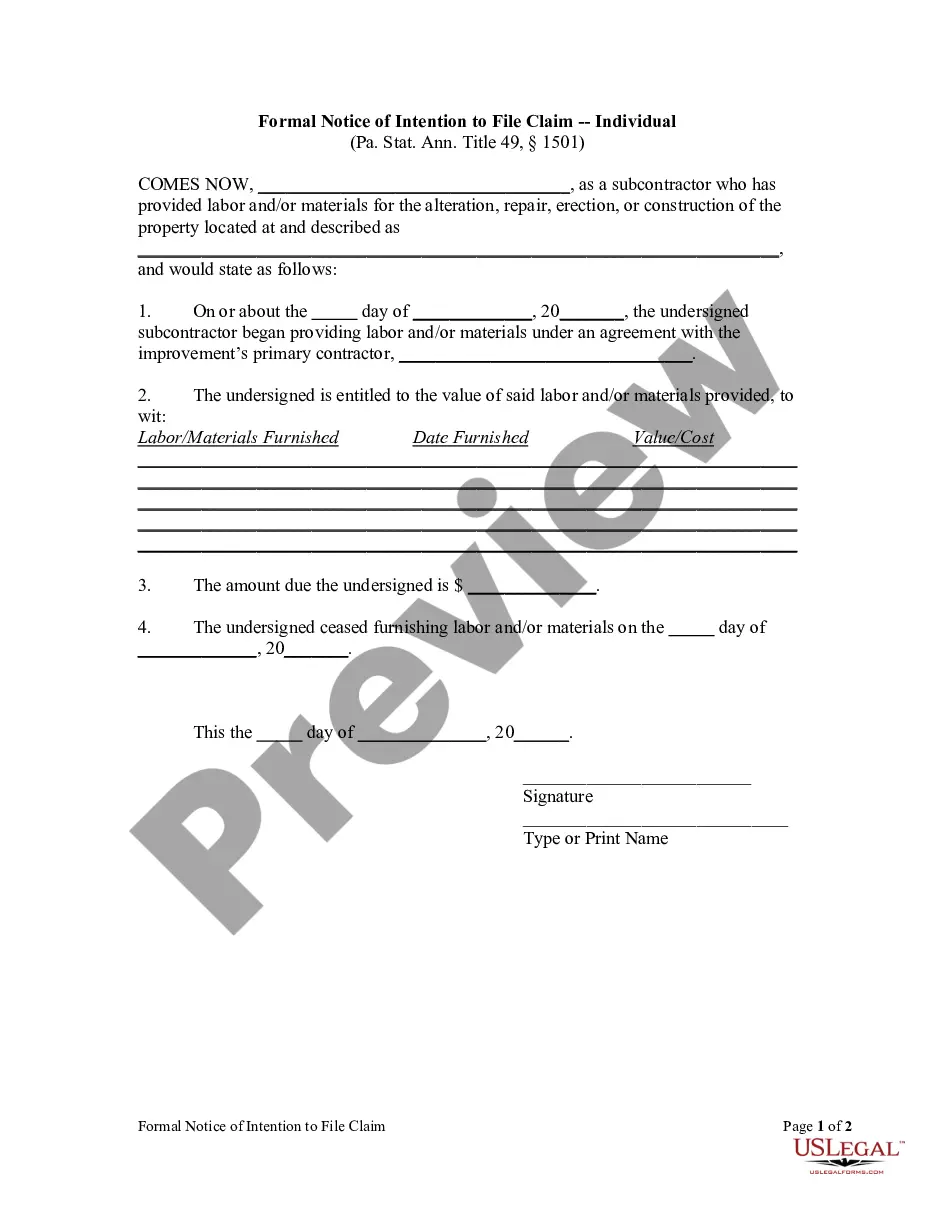

Form components explained

- Identification of the contractor, including business name and contact information.

- Details of labor and materials provided, including dates and values.

- Total amount due for labor and/or materials.

- Signature of the notifying party certifying the information is true and correct.

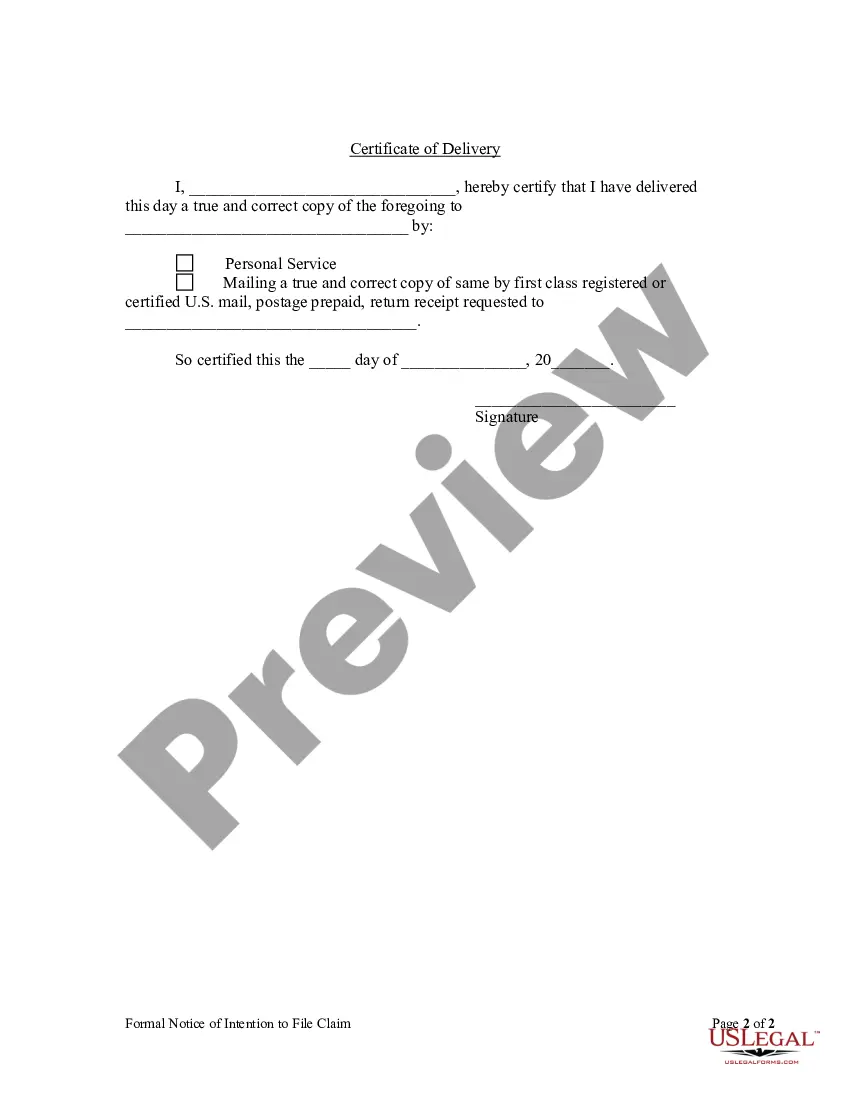

- Directions for serving the notice to the property owner.

Common use cases

This form should be used when a subcontractor has not been paid for work performed or materials supplied on a property. It is specifically required to notify the property owner that a lien may be filed if payment is not received within a designated timeframe. This is especially important in construction-related work where timely payment can significantly affect project timelines and financial stability.

Intended users of this form

- Subcontractors who have provided labor or materials on a property.

- Corporations engaged in construction or renovation projects.

- Entities seeking to secure their right to file a lien for nonpayment.

Instructions for completing this form

- Identify the contractorâs business name and contact information at the top of the form.

- List the labor and materials provided, including specific dates and values for each item.

- Calculate and enter the total amount due for the services rendered.

- Sign and date the form to certify that the information is accurate.

- Serve the completed notice to the property owner or their agent as required.

Is notarization required?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to deliver the notice within the required 30-day notice period before filing a lien.

- Not providing all necessary details regarding the labor and materials supplied.

- Omitting a signature or date on the notice.

- Incorrectly serving the notice, such as using the wrong delivery method.

Why complete this form online

- Immediate access to download and use the form at your convenience.

- Editability to input specific details related to your project.

- Reliability with templates drafted by licensed attorneys to ensure compliance with legal standards.

Legal use & context

- The form provides a legal basis for enforcing payment rights in construction-related services.

- It serves as proof that the contractor has attempted to notify the property owner of potential liens.

- Adhering to the proper procedures protects rights under mechanics' lien laws.

What to keep in mind

- Use the Formal Notice of Intent to File Lien by Corporation to protect your payment rights.

- It is important to serve this notice at least 30 days prior to filing a lien.

- Ensure accuracy and completeness to avoid common mistakes that could undermine its effectiveness.

Looking for another form?

Form popularity

FAQ

Even though these states may permit project participants to secure lien rights and claim a mechanics lien even without a written contract, it is generally best practice to have a signed written contract for work provided.

Fill out the Pennsylvania mechanics lien form. Fill out the PA lien form completely and accurately. File your lien claim with the county recorder. Serve a copy of the lien on the property owner.

Those who have the right to file a mechanic's lien in Pennsylvania are limited to second-tier subs and suppliers who have a claim of at least $500. In other words, anyone who contracted directly with the property owner, the prime contractor, or a subcontractor hired by the prime contractor are eligible for lien rights.

General contractors can waive lien rights for lower tier subcontractors by filing a Stipulation Against Liens on most residential projects and on all projects if the general contractor posts a payment bond.For all claimants, the Lien Claim must be filed in court within six months of the claimant's last work.

Fill out the Pennsylvania mechanics lien form. Fill out the PA lien form completely and accurately. File your lien claim with the county recorder. Serve a copy of the lien on the property owner.

Who Can File Mechanics' Liens? Contractors and subcontractors and sub-subcontractors who improve property can file mechanics' lien claims. The term contractor also includes architects and engineers, but only if they supervise the improvements.

2. States where the lien law doesn't require a written contract. In these states, contractors and suppliers are generally allowed to file a lien even if they don't have a written contract.These states typically permit parties with verbal, oral, or even implied contracts to claim lien rights.

Fill out the Pennsylvania mechanics lien form. Fill out the PA lien form completely and accurately. File your lien claim with the county recorder. Serve a copy of the lien on the property owner.