Odometer Disclosure Statement Pa Withholding

Description

How to fill out Pennsylvania Bill Of Sale Of Automobile And Odometer Statement?

Handling legal documents can be exasperating, even for the most seasoned experts.

When you require an Odometer Disclosure Statement Pa Withholding and lack the time to dedicate to finding the accurate and current version, the process can be overwhelming.

US Legal Forms fulfills any requirements you might have, ranging from personal to business documentation, all in one place.

Utilize cutting-edge tools to complete and manage your Odometer Disclosure Statement Pa Withholding.

Below are the steps to follow after accessing the form you need: Confirm that it is the correct form by previewing it and reviewing its details. Ensure that the template is recognized in your state or county. Click Buy Now when you are prepared. Choose a subscription plan. Select the file format you prefer, and Download, complete, sign, print, and submit your documents. Enjoy the US Legal Forms online library, backed by 25 years of experience and reliability. Transform your daily document management into a seamless and user-friendly process today.

- Access a wealth of articles, guides, and materials relevant to your situation and needs.

- Save time and effort in locating the documents you require, and use US Legal Forms’ advanced search and Preview tool to discover Odometer Disclosure Statement Pa Withholding and obtain it.

- If you hold a monthly subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Visit the My documents tab to view the documents you have previously saved and manage your folders as desired.

- If this is your first experience with US Legal Forms, set up a free account and gain unlimited access to all platform benefits.

- A comprehensive online form repository could revolutionize the way individuals manage these scenarios effectively.

- US Legal Forms stands as a leader in digital legal documents, offering over 85,000 state-specific legal forms available to you at any moment.

- With US Legal Forms, you can access state- or county-specific legal and business forms.

Form popularity

FAQ

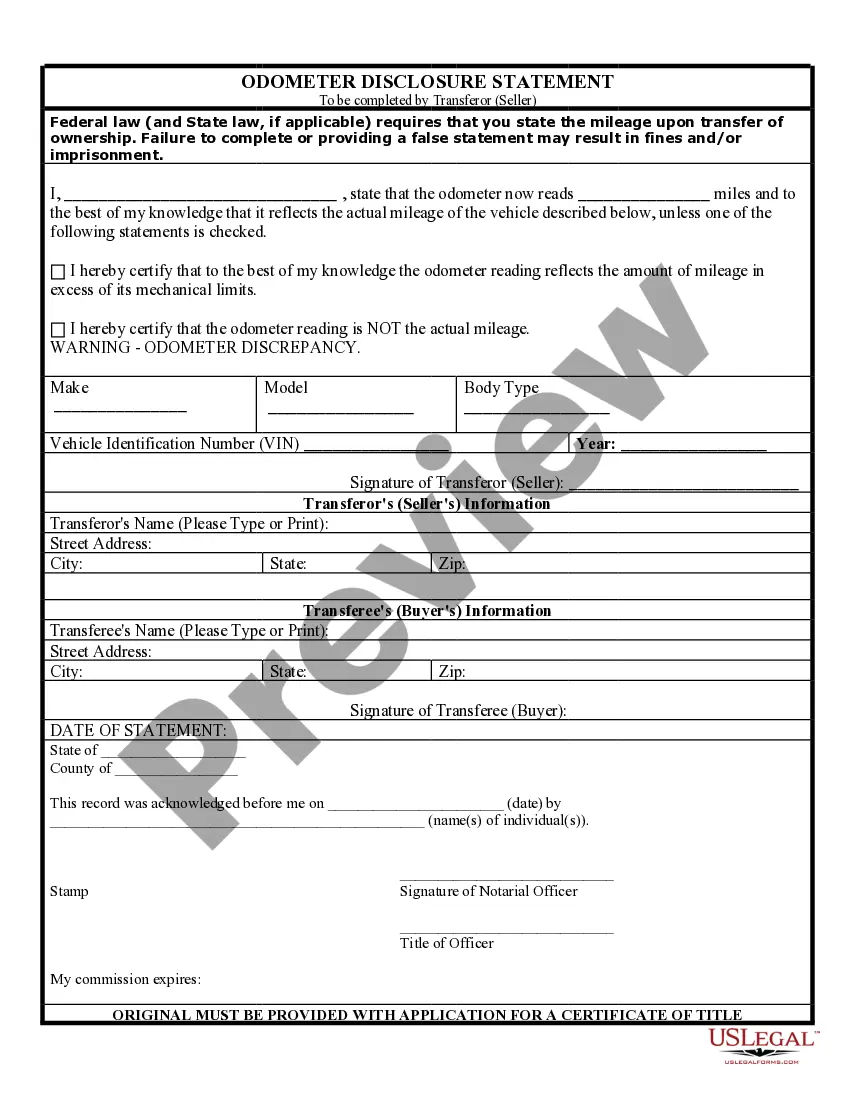

This written disclosure must be signed by the transferor, including the printed name, and shall contain the following information: (1) The odometer reading at the time of the transfer (not to include tenths of miles); (2) The date of the transfer; (3) The transferor's name and current address; (3a) The transferee's ...

In order to have a correction made to the mileage on a vehicle record, you will need to provide the last two years of the vehicle's inspection records or VIN-specific vehicle repair bills, which indicate the mileage at the time of the inspection or repair.

Odometer Fraud Laws If the odometer mileage is incorrect, the law requires a statement to that effect to be furnished on the title to the buyer. However, a vehicle is exempt from the written disclosure requirements if it's 20 years old or older, or a model year 2010 vehicle or older.

Federal and State law require that the seller states the mileage in connection with the transfer of ownership. Failure to complete the odometer statement, or providing a false statement, may result in fines and/or imprisonment.

The exempt mileage title is used when the mileage displayed on a vehicle's odometer cannot be verified as accurate due to exceeding the odometer's mechanical limits or being tampered with. It is issued by the DMV to protect potential buyers from paying more for a vehicle than it is actually worth.