Or Landlord Withholding Security

Description

How to fill out Oregon Residential Landlord Tenant Rental Lease Forms And Agreements Package?

Finding a reliable destination to obtain the latest and most suitable legal templates is just part of the challenge when dealing with bureaucracy.

Identifying the appropriate legal documents necessitates precision and carefulness, which is why it is crucial to obtain samples of Or Landlord Withholding Security exclusively from trusted sources, such as US Legal Forms.

Eliminate the stress that comes with your legal documentation. Explore the extensive US Legal Forms library where you can locate legal templates, verify their applicability to your case, and download them instantly.

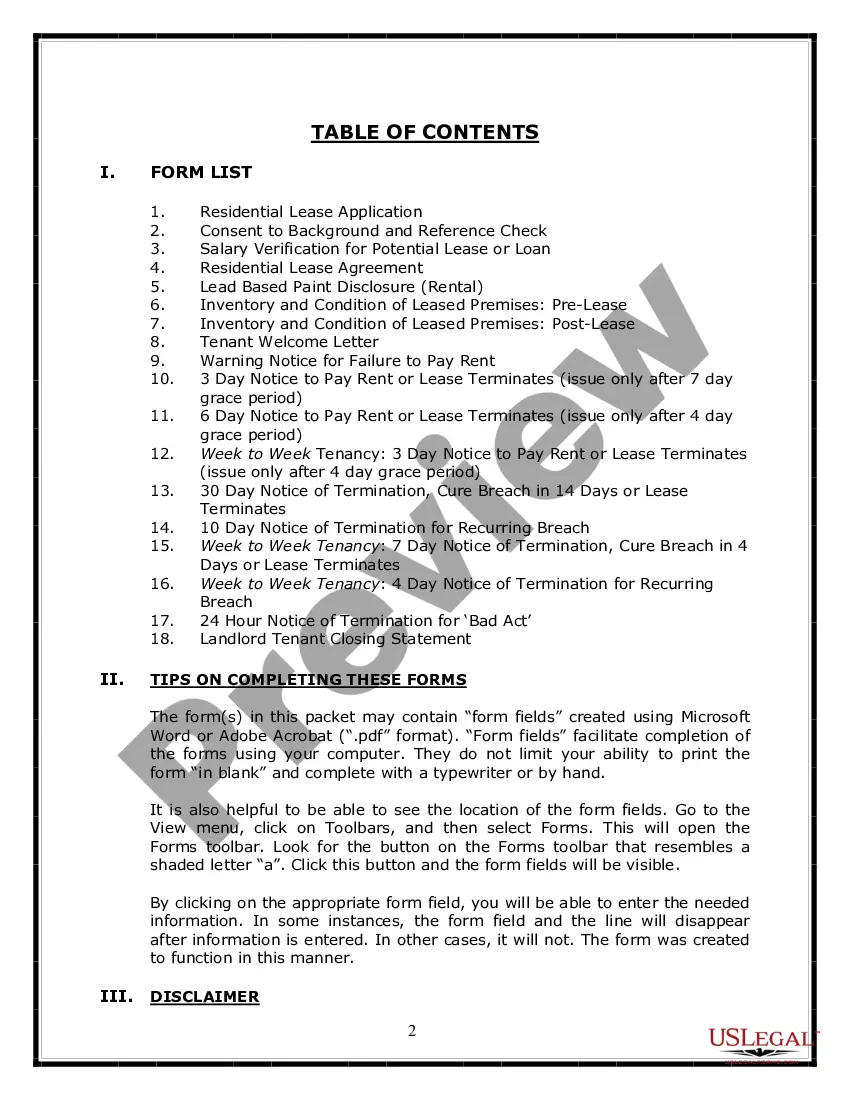

- Utilize the library navigation or search bar to discover your template.

- Review the form’s details to verify it meets the specifications of your state and county.

- Access the form preview, if available, to ensure it is the document you need.

- Return to the search to find the correct template if the Or Landlord Withholding Security does not satisfy your requirements.

- Once you are confident about the form’s suitability, download it.

- If you are a registered user, click Log in to verify and retrieve your selected forms in My documents.

- If you do not possess an account, click Buy now to acquire the form.

- Choose the pricing package that matches your needs.

- Proceed with the registration to finalize your transaction.

- Complete your acquisition by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Or Landlord Withholding Security.

- Once the form is on your device, you can modify it using the editor or print it out to fill it in by hand.

Form popularity

FAQ

Generally, landlords are only allowed to charge tenants if the carpet has actual damage or requires professional cleaning. In other words, the costs of routine carpet cleaning are yours to shoulder as the landlord.

Yes, it is required whenever we are paying out a check that is considered income to the owner. This is required so that our fiscal agent is able to verify that we are paying the proper owner of the property directly, which, for example, can be in the case of back rent, emergency car repair, deposit, etc.

The rules provide that the landlord must deliver or mail the security deposit, less any amounts properly withheld, to the last known address of the tenant within 21 days after the end of the rental agreement.

How to Sue for the Return of a Security Deposit up to $5,000. This kit has all of the forms and instructions for self-represented litigants to file for the return of their rental security deposit. To see the return of more than $5,000, you must file a Special Civil case. Note: You must be 18 to file a court case.

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Income paid to you. Real estate transactions. Mortgage interest you paid.