Objection To Accounting Probate

Description

Form popularity

FAQ

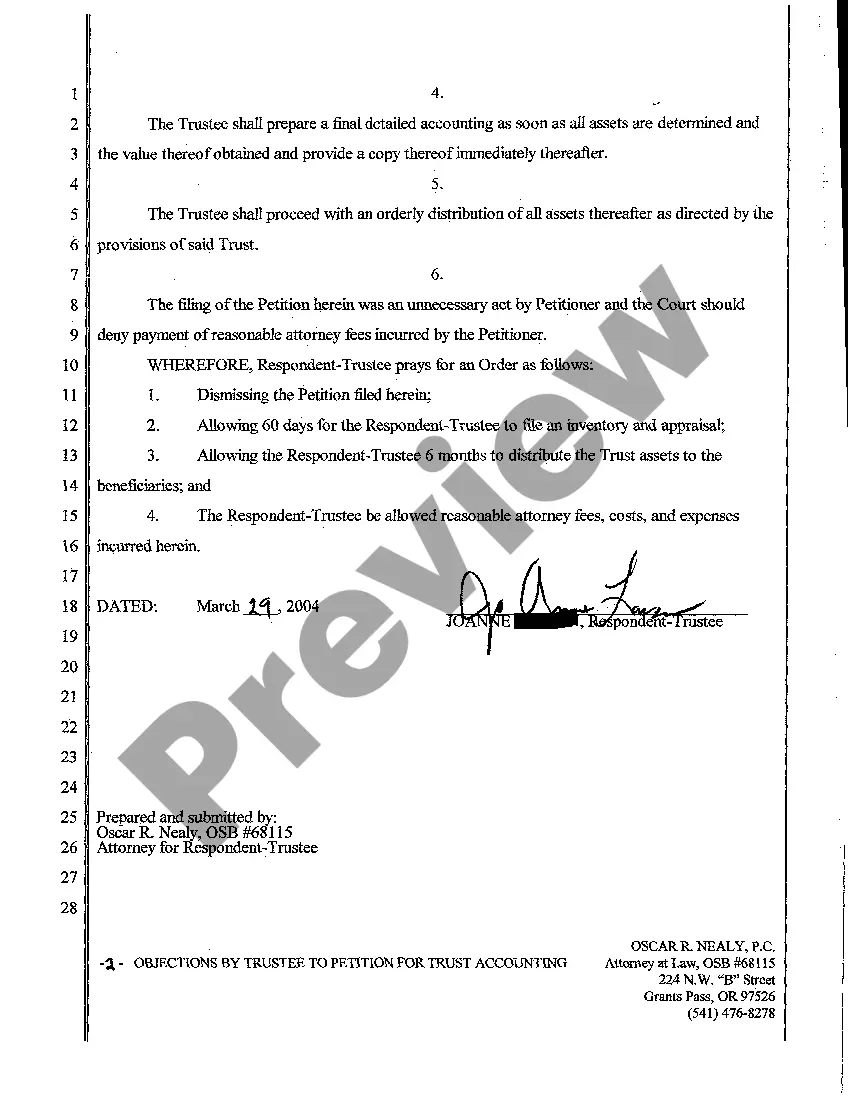

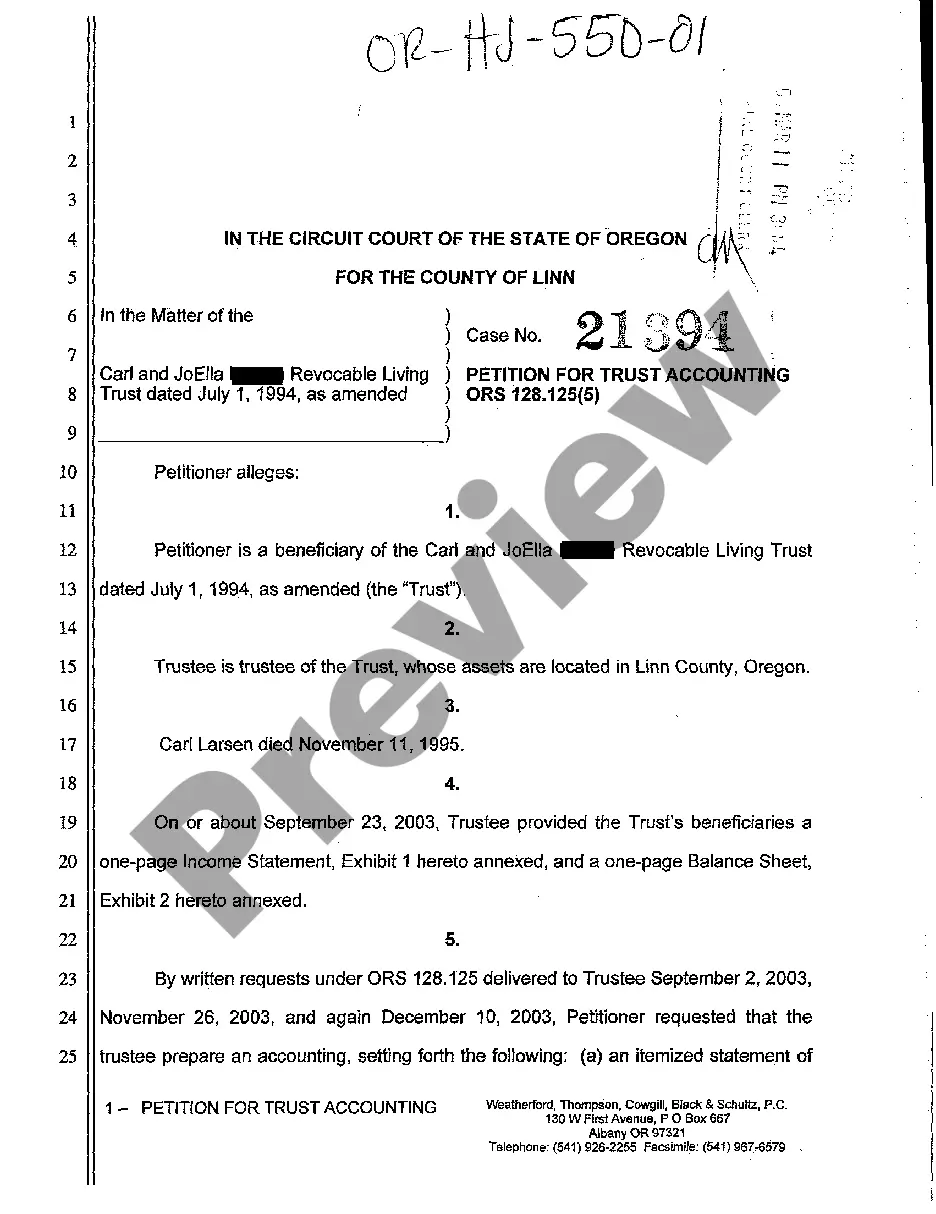

The final accounting of the estate provides a comprehensive summary of all financial transactions completed during the probate process. It details the distribution of assets, payments to creditors, and any financial adjustments made by the executor. If you suspect mismanagement, this final accounting can serve as a basis for your Objection to accounting probate, allowing you to seek a fair resolution.

Fiduciary accounting involves managing funds on behalf of another person, usually through a trust or an estate. For example, an executor will create a fiduciary account to track income generated from estate assets and the corresponding distributions to beneficiaries. If you encounter discrepancies, it might lead to an Objection to accounting probate, underscoring the importance of accurate fiduciary accounting.

The final estate refers to the total value of the assets that remain once all debts and claims have been settled. It represents what is left for distribution to the beneficiaries after the completion of probate. Having clarity on the final estate is essential if you're preparing for an Objection to accounting probate, as it helps establish the baseline for your case.

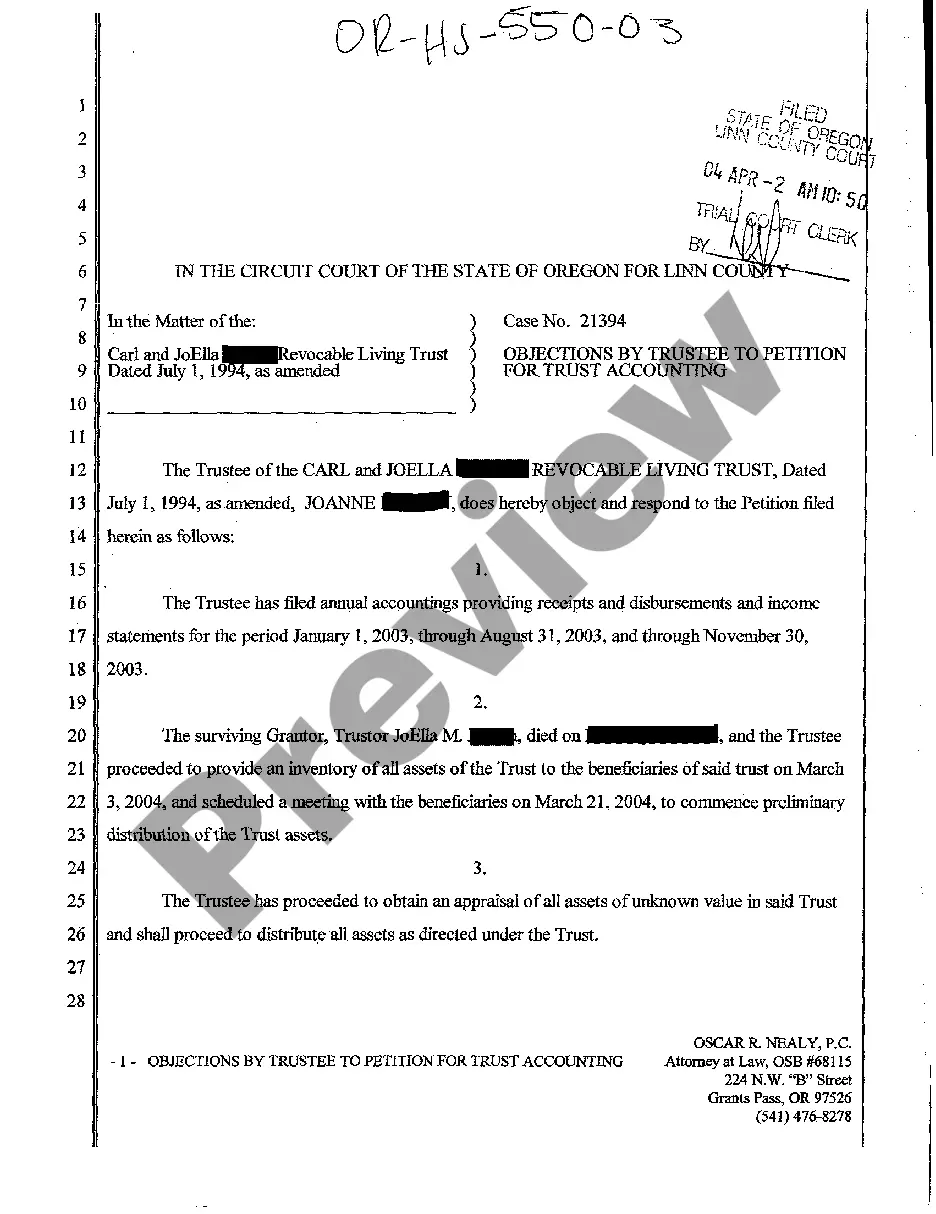

An accounting of the estate is a report provided by the executor that outlines all financial activities related to the estate. It typically includes listings of assets, liabilities, income, and expenses throughout the probate period. If you need to raise an Objection to accounting probate, reviewing this accounting is a necessary step in understanding the financial state of the estate.

Final accounts for an estate summarize all financial transactions handled by the executor. These accounts include details about the estate's income, payout distributions, and any outstanding debts. Understanding these accounts is essential, especially if you are considering an Objection to accounting probate, as they culminate the executor's management responsibilities.

The final account of the executor details how the executor managed the estate's assets. It shows all income, expenses, distributions, and any gains or losses. If you have an Objection to accounting probate, this final account is critical as it reflects the actions taken by the executor up to the estate's settlement.

The final step in the accounting process is to present the final report to the relevant parties for approval. This report should encapsulate all financial activities and outcomes related to the estate. If any disputes arise, particularly an Objection to accounting probate, lawyers and legal platforms like US Legal Forms can guide you through the next steps.

The final accounting process generally begins with the identification of all assets and liabilities. Next, you will prepare an accounting statement that details each transaction related to the estate. Afterward, submit this statement for approval from the court or interested parties. If there are objections raised, especially regarding accounting probate, be prepared to address them thoroughly.

Studying for your accounting final involves understanding key concepts and practicing problems. Create a study schedule that breaks down topics into manageable sections. Use resources like textbooks, online tutorials, and practice exams to reinforce your learning. If you face challenges with specific areas such as Objection to accounting probate, form a study group for collaborative learning.

Final accounting requires you to compile a comprehensive report of all assets and liabilities of the estate. Start by listing all income generated and each expense incurred throughout the probate process. Ensure that you meticulously document every transaction, including payments and distributions. If you encounter objections during this process, consulting resources like US Legal Forms can be helpful.