First Right Of Refusal Letter Real Estate Withdrawal

Description

Form popularity

FAQ

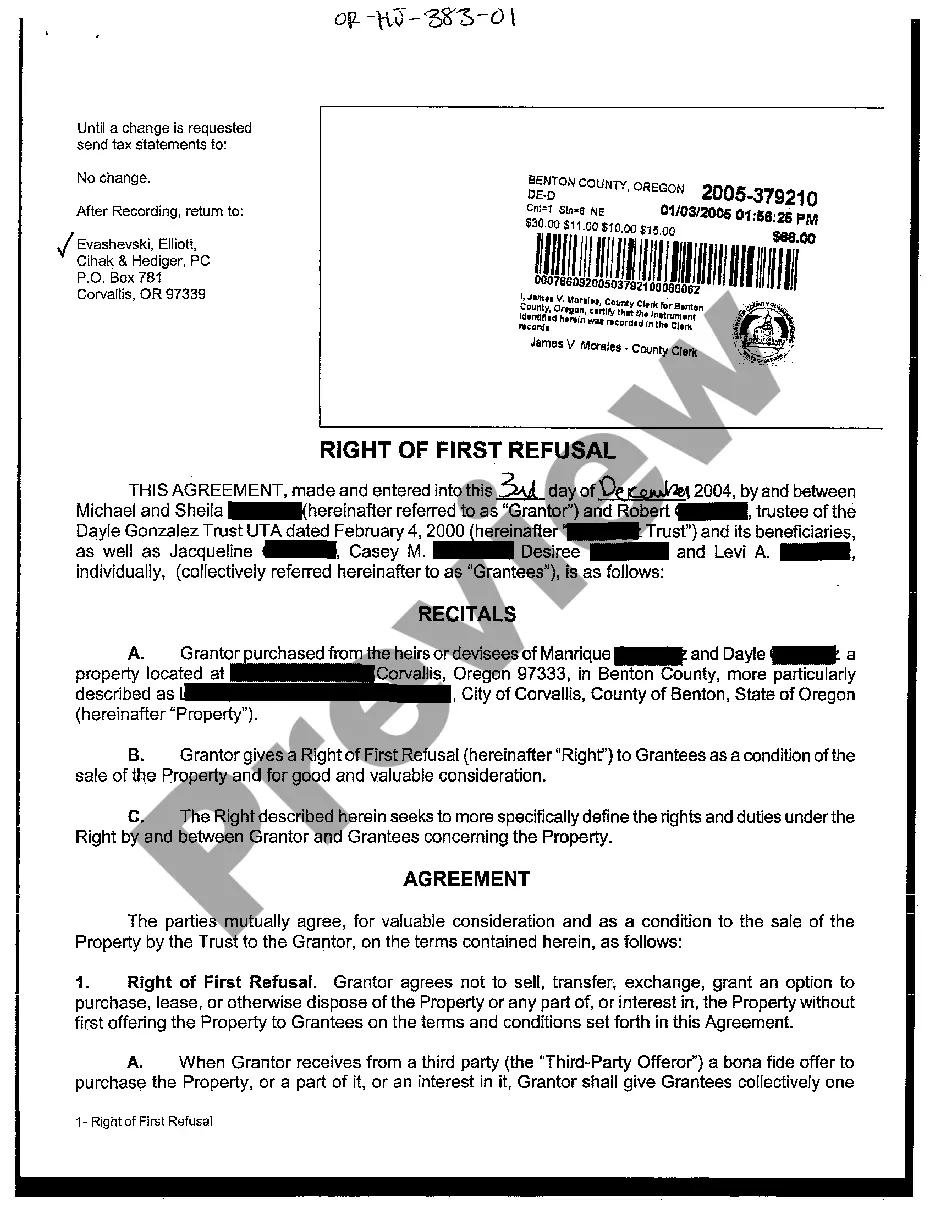

To obtain the first right of refusal, you will need to negotiate it as part of your property contract. Clearly express your desire for this right when entering discussions about the property in question. It is essential to document the agreement formally, and using a first right of refusal letter real estate withdrawal template can help outline the terms effectively. This can be a valuable strategy in securing properties of interest.

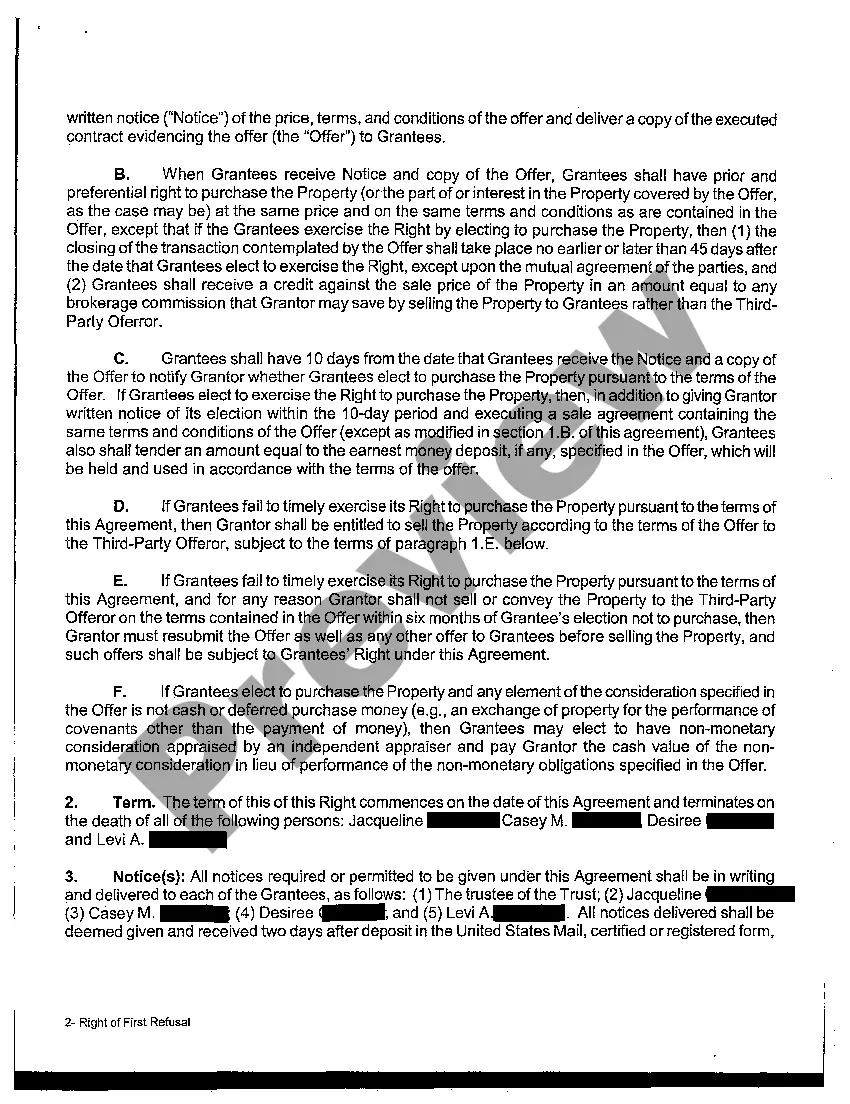

To exit from a right of first refusal agreement, review the contract to identify any specific terms or conditions regarding termination. It's advisable to communicate openly with the other party and negotiate a mutually agreeable exit strategy. In some cases, you might need to draft a formal withdrawal letter. Using a well-structured first right of refusal letter real estate withdrawal from US Legal Forms can simplify this process.

The difference between a right of first refusal (ROFR) and a right of first offer (RoFO) lies in the timing and nature of the agreements. With ROFR, the seller must offer the property to the holder after they decide to sell, whereas RoFO requires the seller to approach the holder first before listing the property. Understanding these distinctions can help you make informed decisions regarding real estate investments. Utilizing resources like the first right of refusal letter real estate withdrawal can clarify these options.

Having a right of first refusal is often considered beneficial, particularly for buyers who want to secure a property without immediate financial commitment. It allows potential buyers to express their interest and negotiate terms before the property goes on the market. However, it can also limit the seller's options. We recommend using a first right of refusal letter real estate withdrawal to establish clear terms.

The right of first refusal means that a person has the opportunity to buy a property before the owner sells it to someone else. Simply put, if the owner decides to sell, they must first offer it to the holder of this right. Understanding this concept is essential for anyone looking to navigate real estate transactions effectively, and using a first right of refusal letter can clarify the terms involved.

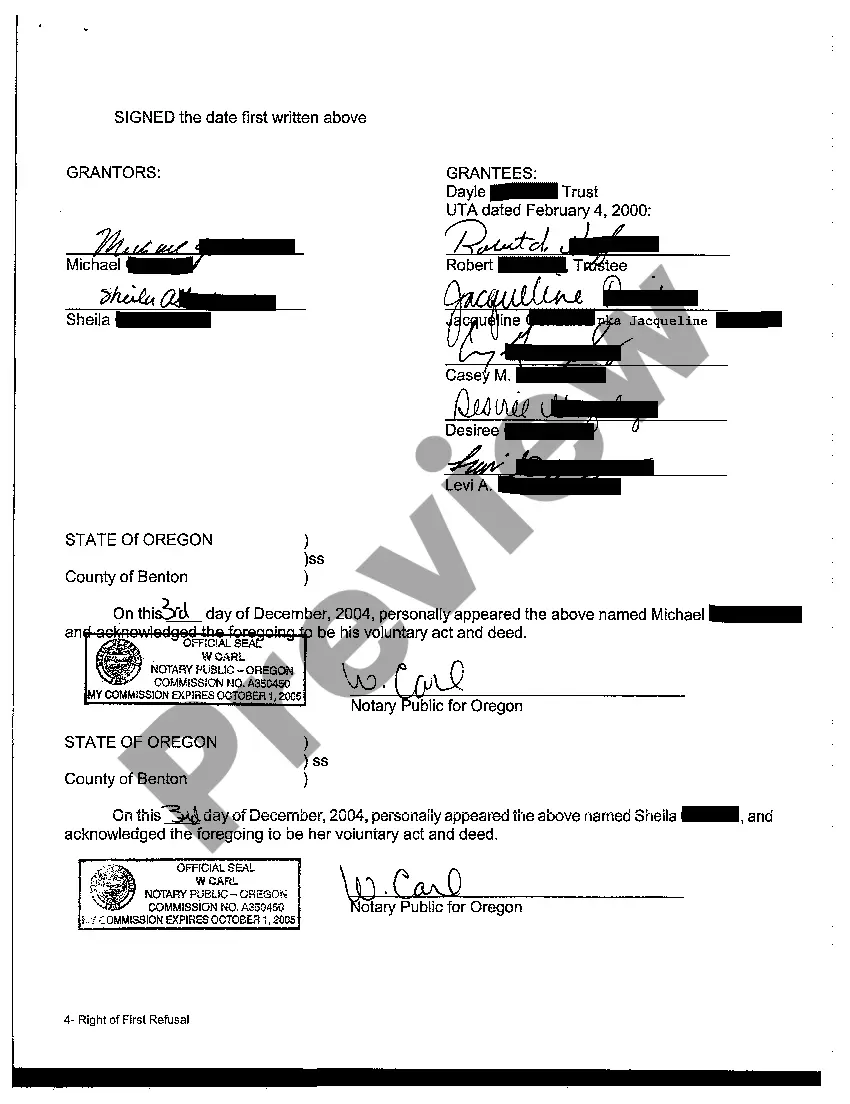

Right of first refusal extinguishment occurs when a property owner decides to terminate the right of first refusal granted to another party. This situation can arise when the owner sells the property or chooses to take the property off the market. If you need to draft a first right of refusal letter for a real estate withdrawal, US Legal Forms offers templates and guidance to simplify the process.

To waive the first right of refusal, the holder must provide a clear and written notice to the property owner. This letter should specify the intent to waive the right and must typically include key details about the property. Crafting this notice accurately is vital, which is why using a first right of refusal letter template from US Legal Forms can simplify the process. This approach ensures that the waiver is legally sound and meets all necessary requirements.

The extinguishment of the right of first refusal occurs when the right is officially terminated, usually through a written agreement between the parties. This can happen when the property owner and the holder of the right agree to waive it, or if certain conditions are met that nullify the right. Understanding this process is essential, especially when preparing a first right of refusal letter for real estate withdrawal. Using a reliable platform like US Legal Forms can help you draft a comprehensive document to ensure all necessary details are addressed.

The downsides of a right of first refusal can include limited marketability for the seller, as potential buyers may be discouraged if they know someone has first rights. Additionally, the process can lead to disputes if terms are not clearly defined. This arrangement can also create delays in finalizing sales, which can be frustrating for sellers. Understanding these challenges can help you navigate the complexities of the first right of refusal letter in real estate withdrawals.

Recording a right of first refusal is generally not a requirement, but doing so offers added protection. By officially documenting the agreement, it becomes enforceable against third parties, ensuring the holder's interests are secure. In real estate transactions, this can prevent misunderstandings or legal challenges in the future. Therefore, utilizing a first right of refusal letter is wise when navigating real estate withdrawals.