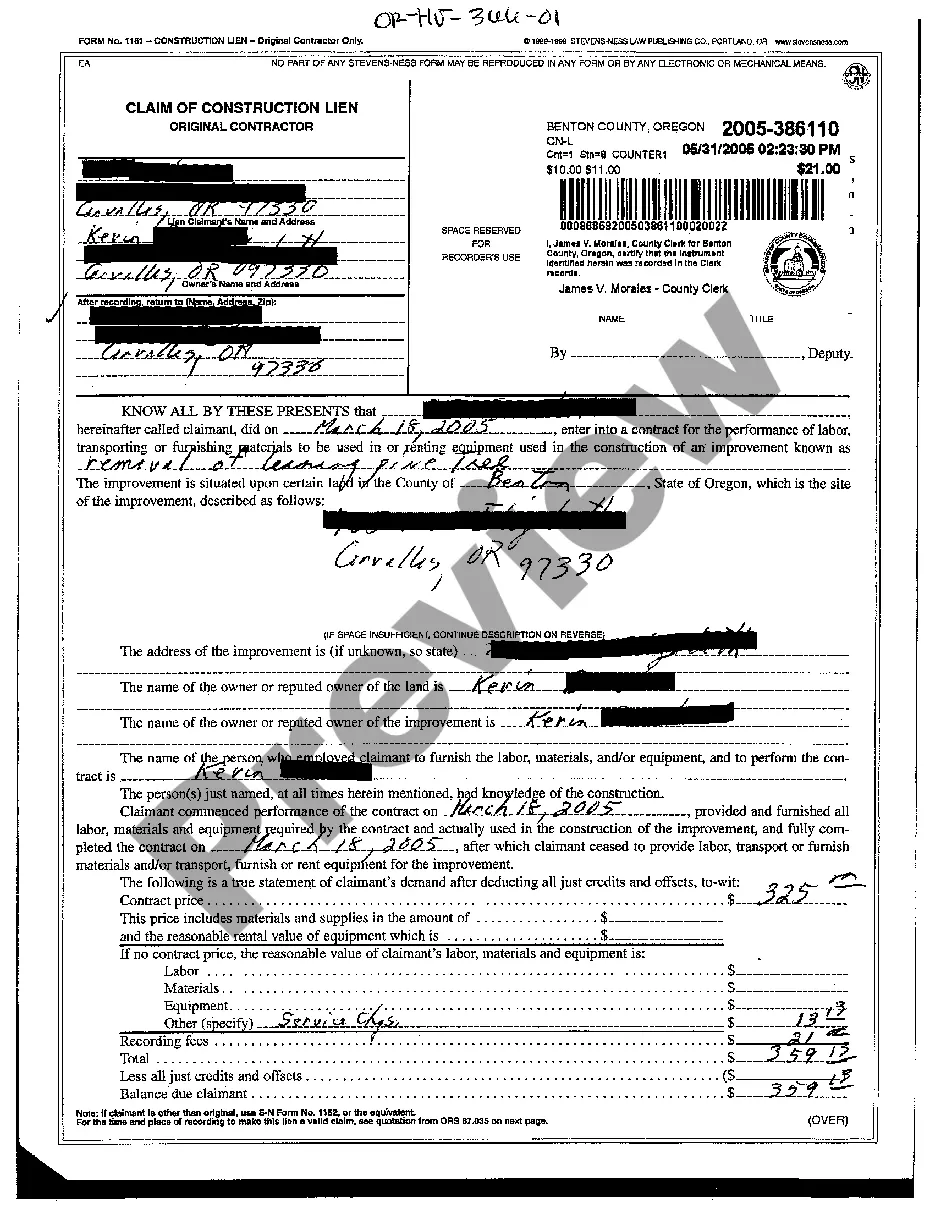

Oregon Construction Lien Form

Description

How to fill out Oregon Claim Of Construction Lien?

Bureaucracy requires exactness and correctness.

If you do not deal with completing documentation like the Oregon Construction Lien Form on a daily basis, it could result in some misunderstandings.

Choosing the appropriate template from the outset will guarantee that your document submission will proceed smoothly and avoid any hassles of re-sending a document or repeating the same task from the beginning.

If you are not a subscribed user, finding the required template will involve a few additional steps: Locate the template using the search bar.

- You can always acquire the correct template for your paperwork at US Legal Forms.

- US Legal Forms is the most extensive online forms library that holds over 85 thousand templates for various sectors.

- You can acquire the latest and most pertinent version of the Oregon Construction Lien Form by simply searching it on the site.

- Find, store, and maintain templates in your account or verify with the description to ensure you possess the right one ready.

- With an account at US Legal Forms, you can gather, keep in one place, and browse through the templates you have saved for easy access.

- When on the site, click the Log In button to sign in.

- Next, navigate to the My documents page, where the inventory of your forms is kept.

- Review the descriptions of the forms and save the ones you need at any time.

Form popularity

FAQ

To obtain a copy of a lien release from the IRS, you typically need to request this through a written application or by submitting Form 4506. In your request, specify that you're seeking a copy of the lien release applicable to the Oregon construction lien form you are concerned with. Ensure you provide necessary details to help the IRS identify the specific lien release associated with your accounts. Patience is vital, as processing this request can take some time.

Writing a letter requesting a lien release requires you to include essential details such as the property owner's name, the specific Oregon construction lien form number, and your contact information. Start your letter by clearly stating your intention to request a lien release and provide context, like the reason for the release. It’s helpful to be concise and direct while remaining polite throughout the letter. Once completed, you can easily send your letter to the appropriate parties.

For a lien release form, head to US Legal Forms, where you can easily locate the Oregon construction lien form. The site provides user-friendly navigation, making it straightforward to find the forms you need. By choosing US Legal Forms, you can ensure you are using a reliable and legally sound document. Additionally, you can download your chosen form instantly for your convenience.

You can obtain a lien release form directly from the US Legal Forms website. This platform offers a variety of legal forms, including the Oregon construction lien form, tailored to meet your needs. Accessing this resource simplifies the process, allowing you to find the exact lien release form suitable for your situation. Plus, you can trust that the forms are up-to-date and compliant with state requirements.

Typically, a lien cannot be placed without notification to the property owner. Legal requirements mandate that the person filing the lien must submit the Oregon construction lien form along with issuing a notice. Failure to notify the homeowner could invalidate the lien, making it crucial for affected parties to be aware of their rights.

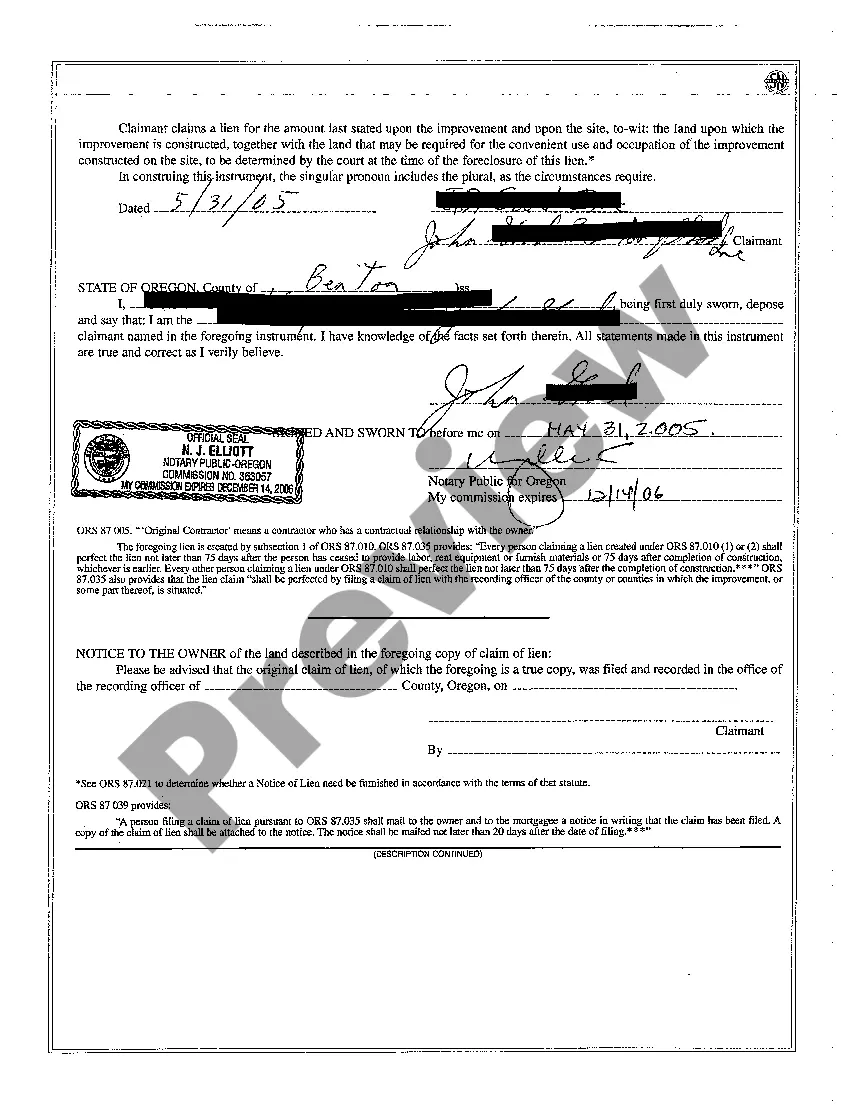

In Oregon, lien waivers do not necessarily need to be notarized to be valid. However, having a notarized lien waiver can provide additional protection and clarity for both parties involved. Using the appropriate Oregon construction lien form can streamline this process and help ensure that all necessary details are accurately recorded.

In Oregon, law requires that property owners be notified when a lien is placed on their property. While you might not be alerted right away, the filing process includes submitting the Oregon construction lien form and sending you a notification. It's essential to stay alert to any potential liens to protect your property rights.

While it is possible for a lien to be placed without your immediate knowledge, there are legal requirements that must be followed. For instance, the person filing the lien must submit the Oregon construction lien form, but they are also required to notify you. Prompt notification helps you address the situation and avoid further complications.

In Oregon, liens must be filed according to established rules set by state law. The party claiming the lien must file the Oregon construction lien form within a specific time frame after the work is completed or the materials are supplied. Additionally, a notice of the lien must be provided to the property owner, ensuring transparency and legal compliance.

No, someone cannot randomly place a lien on your house. A lien requires a specific legal process and valid reasons, typically involving unpaid debts related to property improvements or services. If you're facing lien issues, it's important to understand how to fill out the Oregon construction lien form correctly to protect your rights.