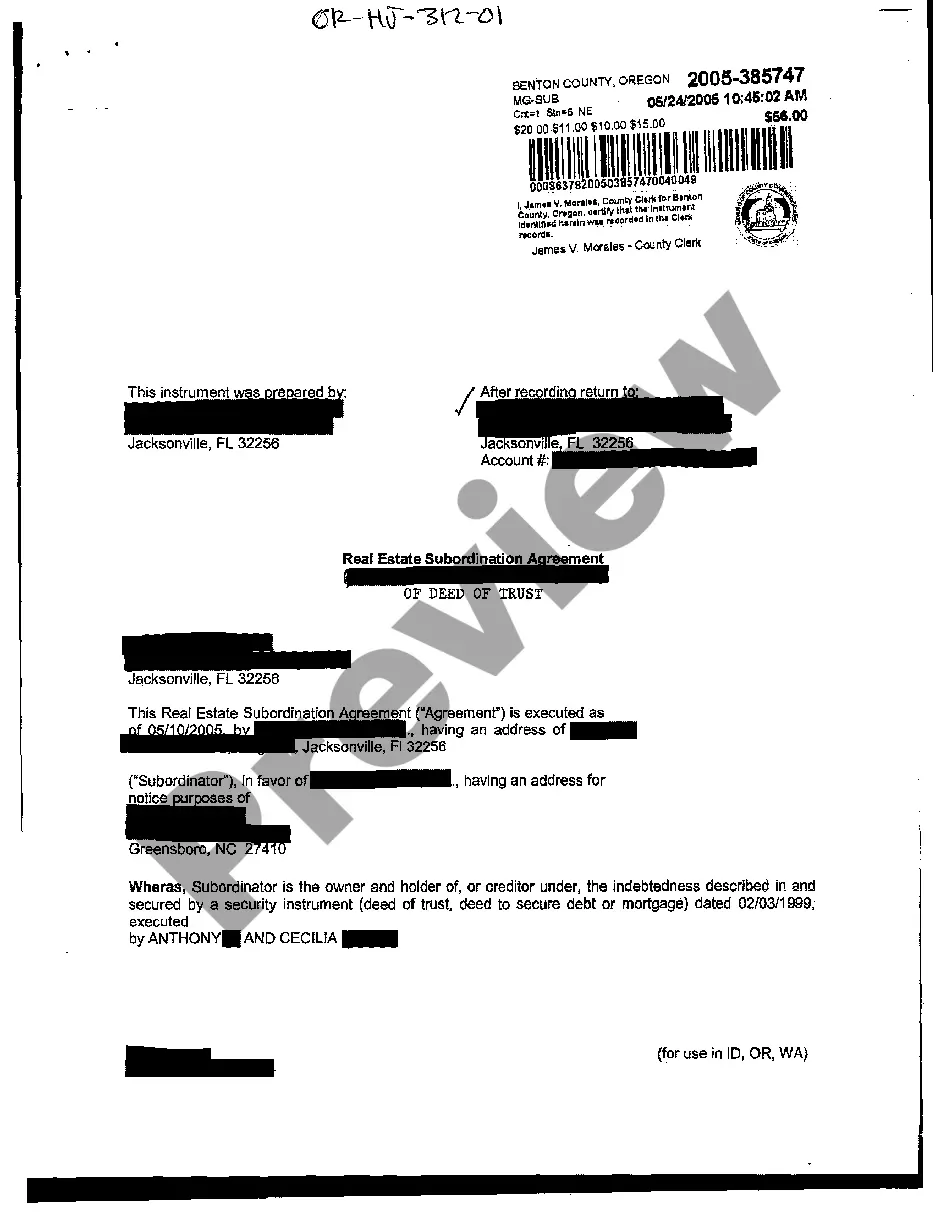

Blank Subordination Agreement With Bank

Description

How to fill out Oregon Real Estate Subordination Agreement?

Bureaucracy requires meticulousness and precision.

If you are not accustomed to completing documentation like the Blank Subordination Agreement With Bank on a daily basis, it may result in some uncertainty.

Selecting the appropriate template from the outset will guarantee that your document submission proceeds smoothly and avert any hassles of resending a file or repeating the same task from the beginning.

Obtaining the correct and current templates for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate bureaucratic uncertainties and enhance the efficiency of your form handling.

- Find the template using the search tool.

- Verify that the Blank Subordination Agreement With Bank you’ve located is suitable for your state or area.

- Access the preview or review the description detailing the application of the template.

- If the result aligns with your requirements, click the Buy Now button.

- Choose the suitable option among the proposed subscription plans.

- Log In to your account or sign up for a new one.

- Finalize the purchase using a credit card or PayPal payment method.

- Download the document in your preferred file format.

Form popularity

FAQ

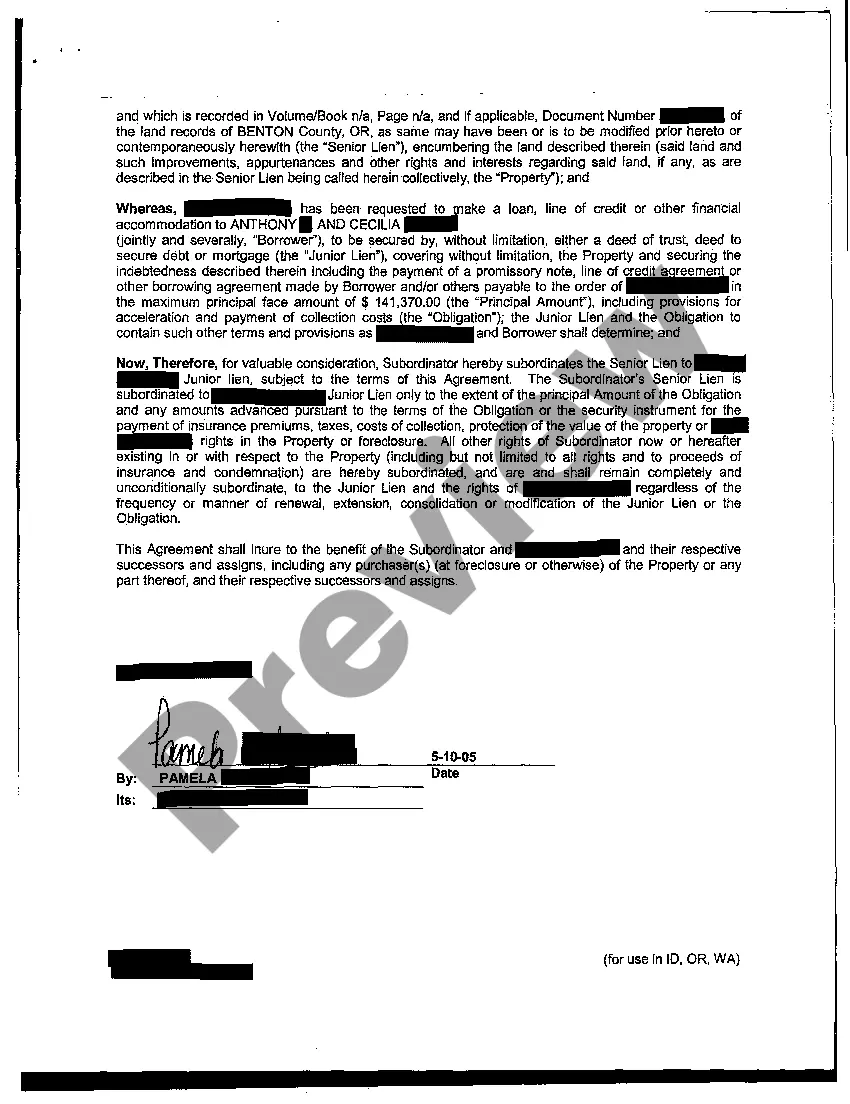

- A subordination agreement is an agreement between two lien holders to modify the order of lien priority.

Subordination is the process of ranking home loans (mortgage, HELOC or home equity loan) by order of importance. When you have a home equity line of credit, for example, you actually have two loans your mortgage and HELOC. Both are secured by the collateral in your home at the same time.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.

Subordinate financing is debt financing that is ranked behind that held by secured lenders in terms of the order in which the debt is repaid. "Subordinate" financing implies that the debt ranks behind the first secured lender, and means that the secured lenders will be paid back before subordinate debt holders.

Subordination is essentially where a related creditor agrees to make no claim for payment of their loans until the assets (fairly valued) of the company exceeds its liabilities. Subordination agreements fall within the scope of section 8F of the Income Tax Act which deals with hybrid debt instruments.