Chapter 13 Bankruptcy Oregon For Dummies

Description

How to fill out Oregon Chapter 13 Plan?

Using legal document samples that meet the federal and local regulations is crucial, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the appropriate Chapter 13 Bankruptcy Oregon For Dummies sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the largest online legal catalog with over 85,000 fillable templates drafted by attorneys for any business and personal situation. They are easy to browse with all documents organized by state and purpose of use. Our specialists keep up with legislative updates, so you can always be confident your form is up to date and compliant when acquiring a Chapter 13 Bankruptcy Oregon For Dummies from our website.

Obtaining a Chapter 13 Bankruptcy Oregon For Dummies is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the right format. If you are new to our website, adhere to the instructions below:

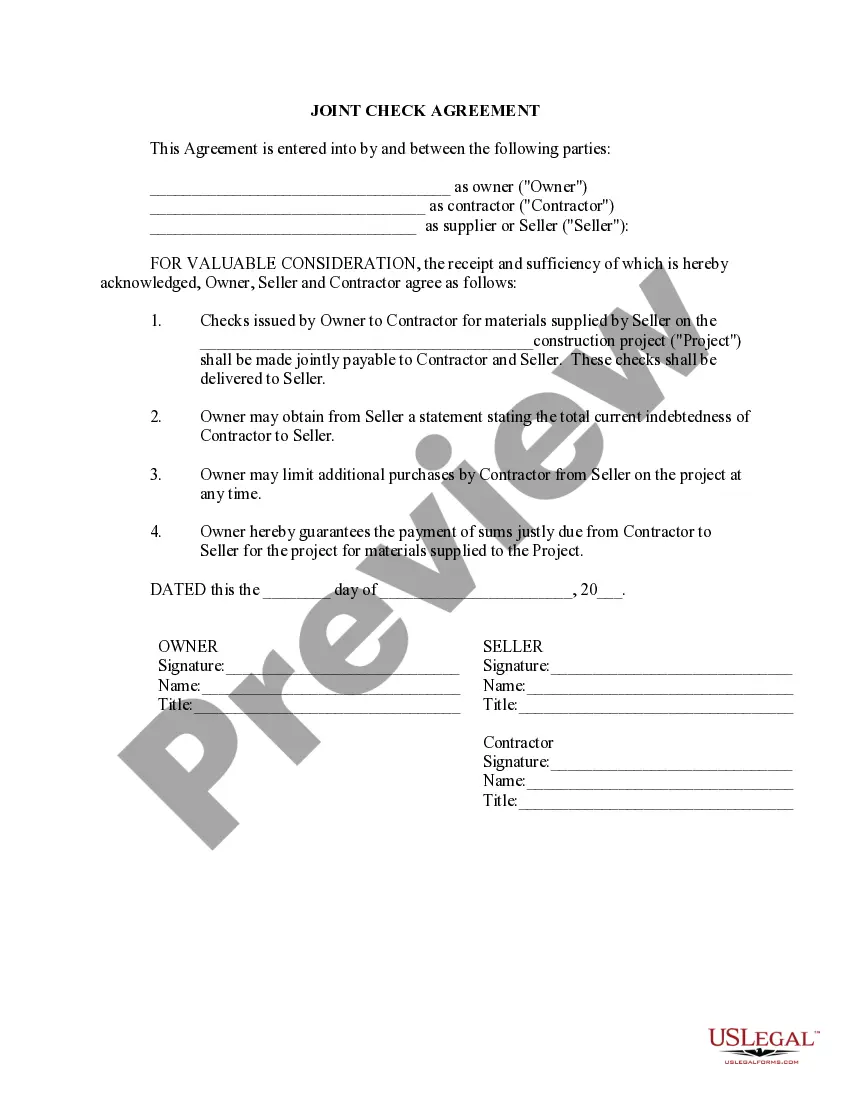

- Examine the template using the Preview option or through the text outline to ensure it meets your requirements.

- Look for another sample using the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the correct form and select a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Select the best format for your Chapter 13 Bankruptcy Oregon For Dummies and download it.

All documents you find through US Legal Forms are reusable. To re-download and fill out previously purchased forms, open the My Forms tab in your profile. Take advantage of the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Chapter 13 is a special part of the bankruptcy law. It lets you file a payment plan and gives you a way to repay all or part of your debts while protecting you or your co-signer from claims by creditors. The plan essentially sets out your debts and says how you intend to pay them.

How to File for Chapter 13 Bankruptcy Make sure Chapter 13 is the right choice. ... Analyze your debt. ... Value your property. ... Gauge your income. ... Fill out the bankruptcy forms. ... Take the required pre-filing course. ... File your forms and pay a fee. ... Provide the trustee with documents proving your income and other assets.

A chapter 13 bankruptcy is also called a wage earner's plan. It enables individuals with regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years.

A chapter 13 bankruptcy is also called a wage earner's plan. It enables individuals with regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.