Rental Lease Application With A Landlord

Description

Form popularity

FAQ

Most landlords typically require tenants to earn three times the rent amount to ensure affordability. This standard serves to confirm that you can comfortably manage rental payments. When completing your rental lease application with a landlord, be prepared to provide proof of your income to demonstrate your financial stability.

Rental applications can get denied for various reasons, and it's estimated that around 30% of applications face rejection due to factors like insufficient income or poor credit history. Understanding common denial factors can help you better prepare your rental lease application with a landlord. Always strive to provide accurate and comprehensive information to lower your chances of denial.

To make your rental application stand out, consider including a cover letter that briefly explains your situation and reliability as a tenant. Including references who can vouch for your character and payment history can also be beneficial. Being proactive and ensuring your rental lease application with a landlord is complete and professionally presented can give you an edge.

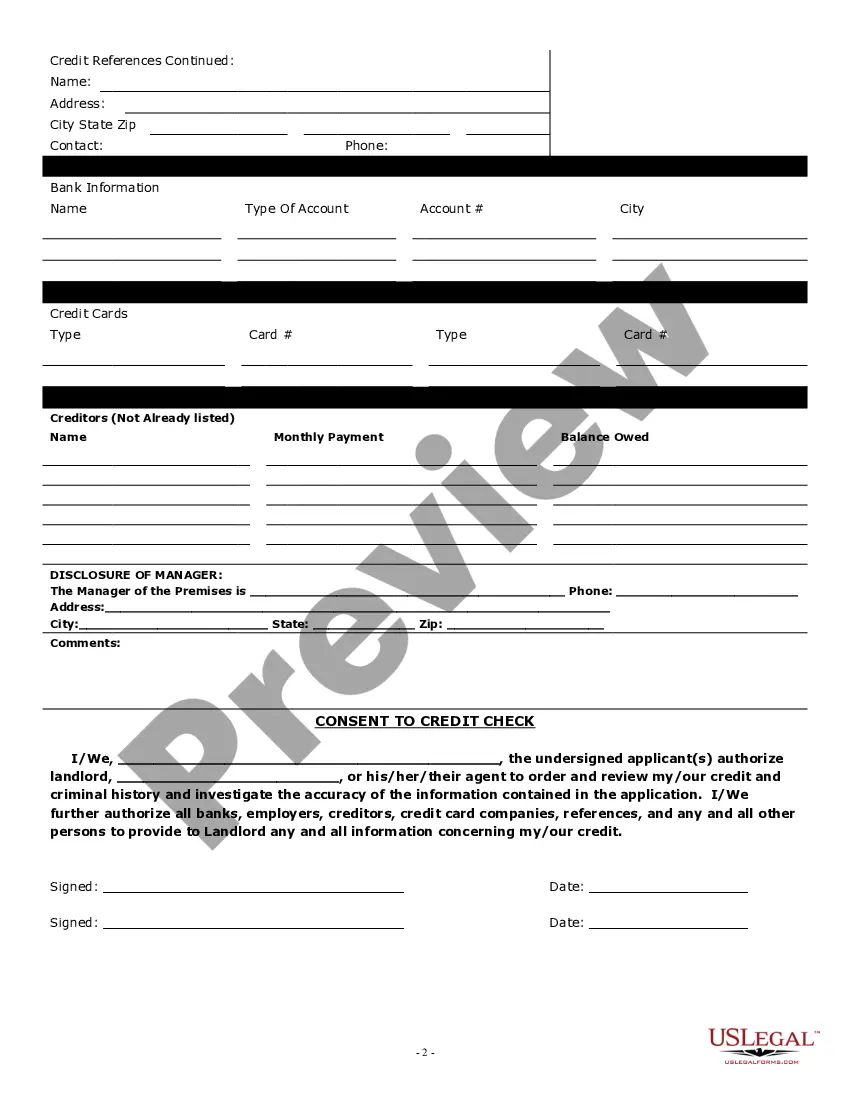

Filling out a landlord application requires careful attention to detail. Begin by reviewing the application thoroughly to understand what information is requested. Provide accurate income information, rental history, and any references, as these elements can make a significant difference during the rental lease application with a landlord.

Red flags on a rental application can include incomplete information, discrepancies in income, or a history of evictions. Other warning signs may involve multiple address changes in a short time or a poor credit history. Paying attention to these aspects can help you understand what landlords might see during the rental lease application with a landlord process.

To fill out a landlord application effectively, first gather all necessary documents such as proof of income, identification, and rental history. Start with your personal information, including your current address and employment details. Answer all questions honestly, as this rental lease application with a landlord must reflect your true circumstances.

When reviewing a lease, be on the lookout for vague terms or unclear obligations that can lead to misunderstandings later. Additionally, assess any unusually high fees or penalties that may signal a problematic relationship with the landlord. A comprehensive understanding of your rental lease application with a landlord protects your interests and sets a foundation for a positive rental experience.

Common red flags on rental lease applications include incomplete or inconsistent information, lack of rental history, and low credit scores. Watch for unknown income sources or significant gaps in employment, as these may signal potential issues. A thorough review can help landlords identify the best candidates while ensuring a harmonious rental experience.

A rental lease application with a landlord may be denied for several reasons, including poor credit history, insufficient income, or negative landlord references. Criminal history can also impact your approval, depending on the landlord's policies. It is crucial to be transparent in your application to avoid surprises.

To stand out on a rental lease application with a landlord, you should provide accurate information and highlight your positive rental history. Include references from previous landlords who can vouch for your reliability. Demonstrating financial stability, such as a steady income and good credit score, can also enhance your application.