Oregon Estate Or Form Or-40 Instructions

Description

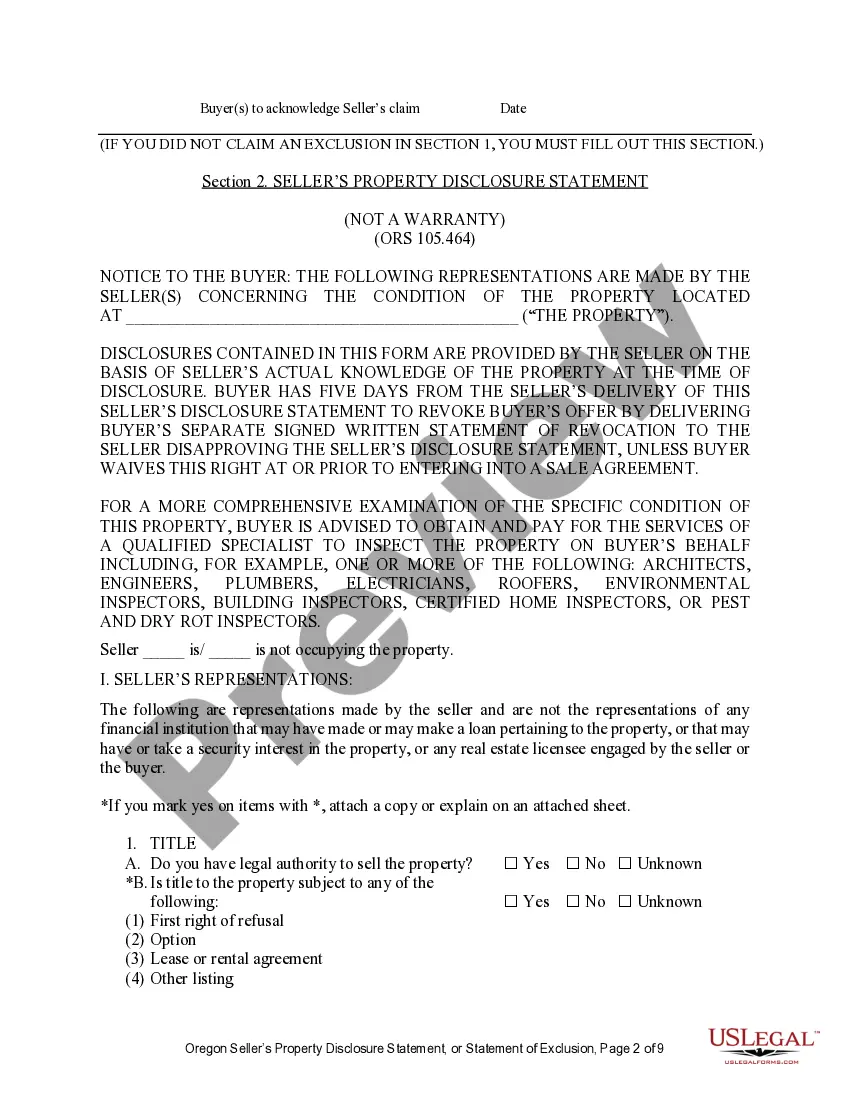

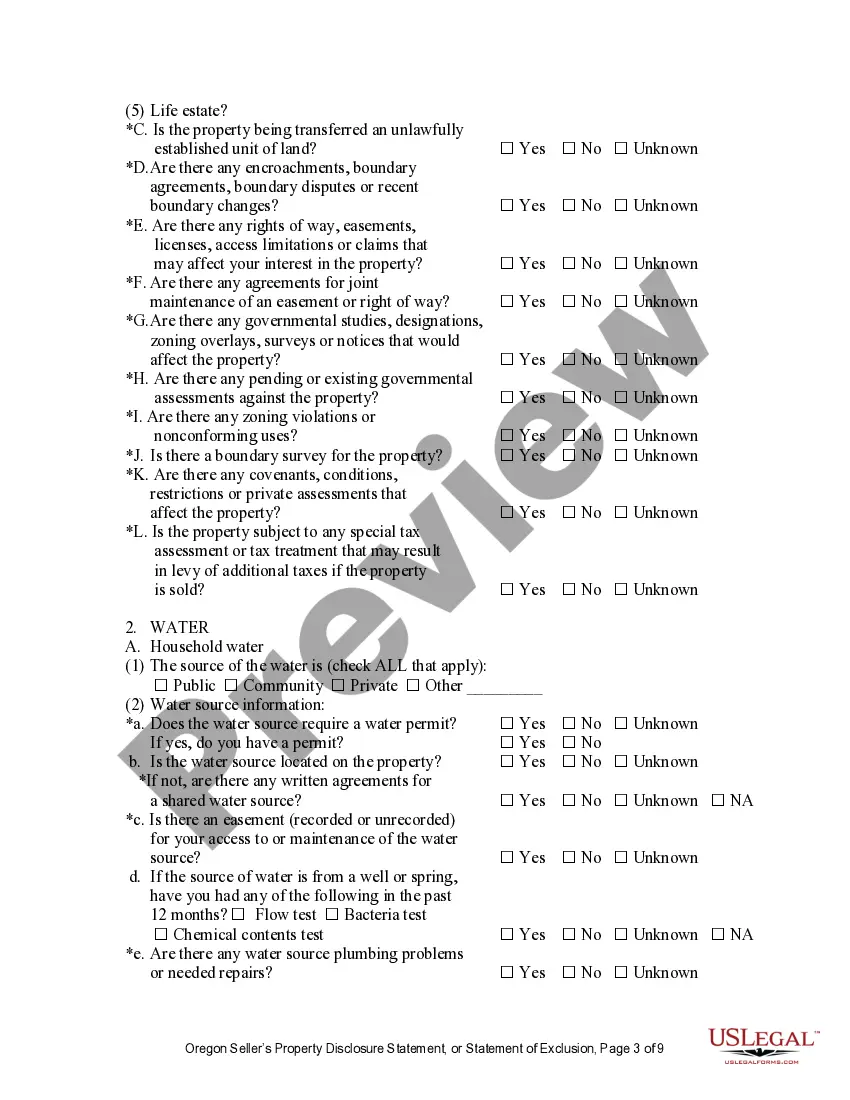

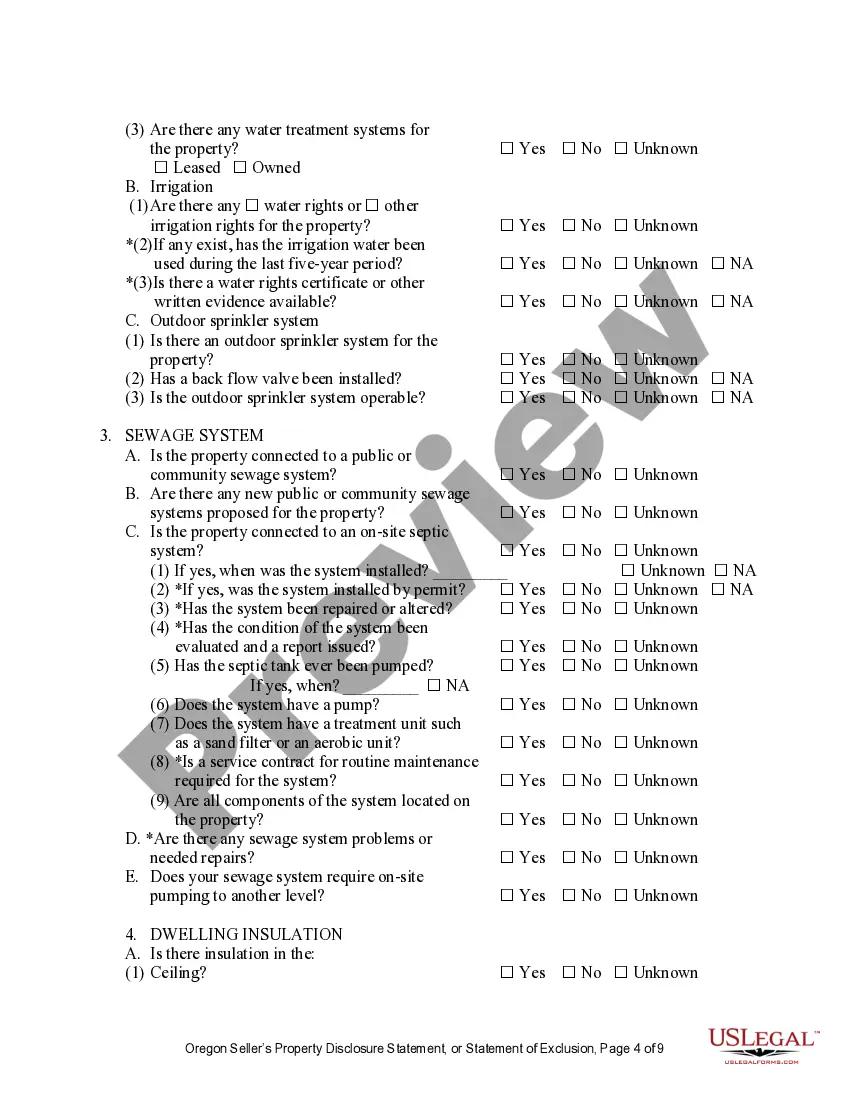

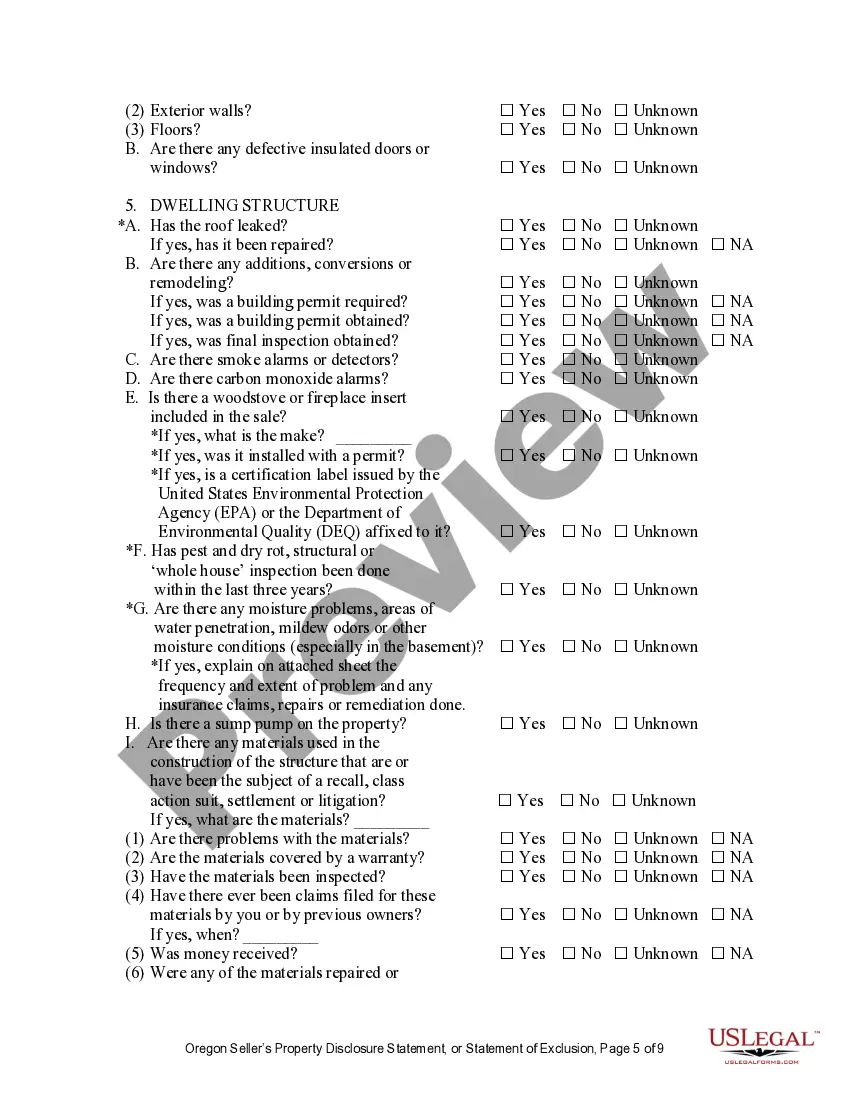

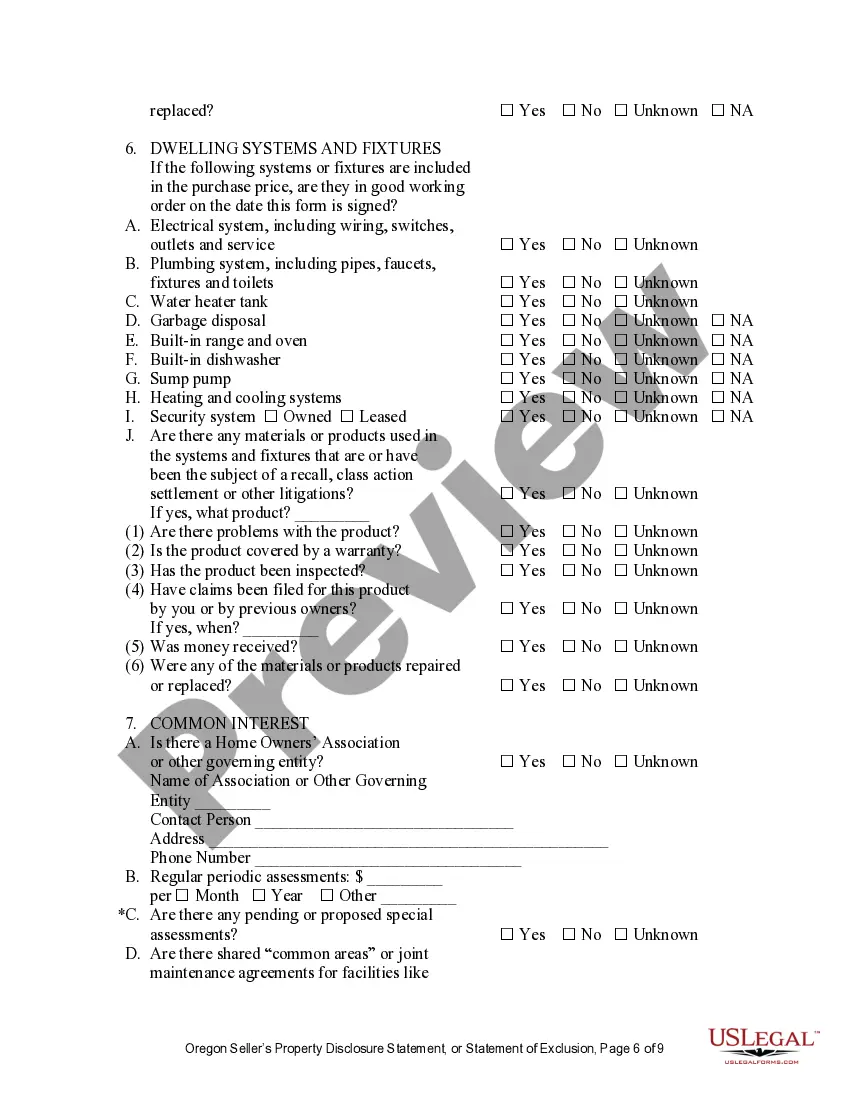

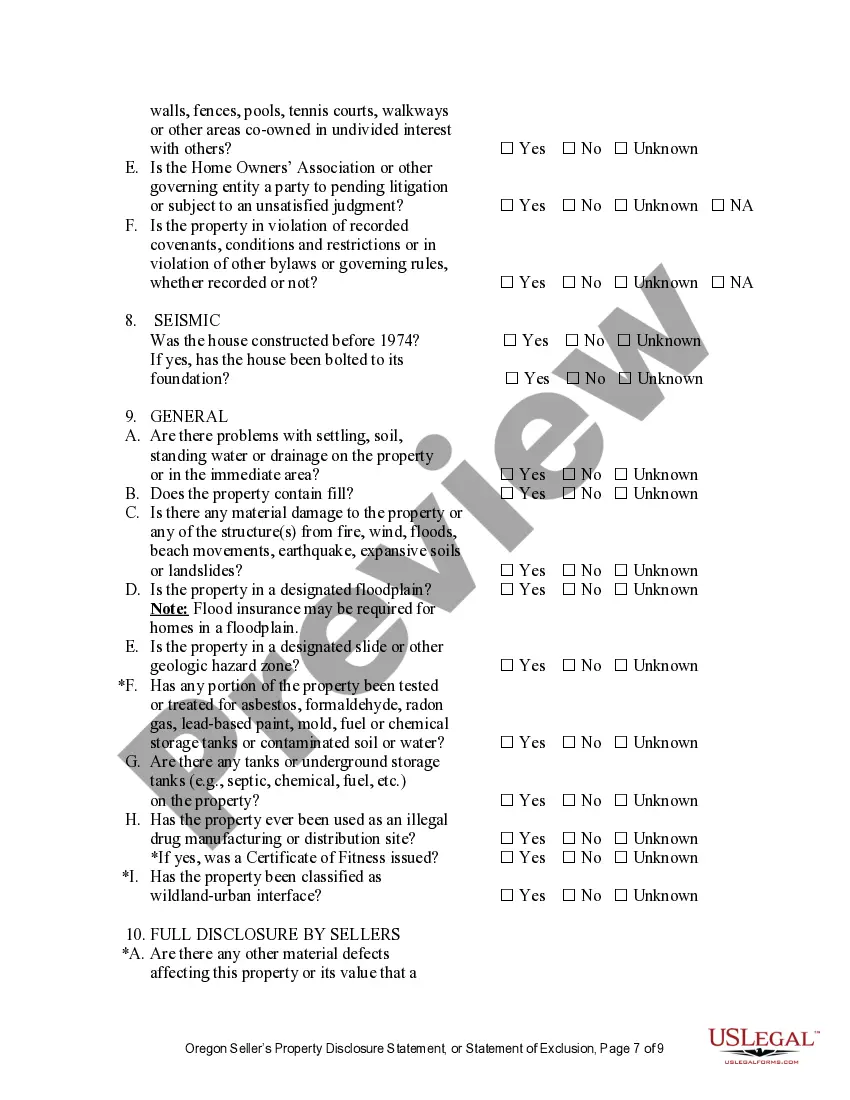

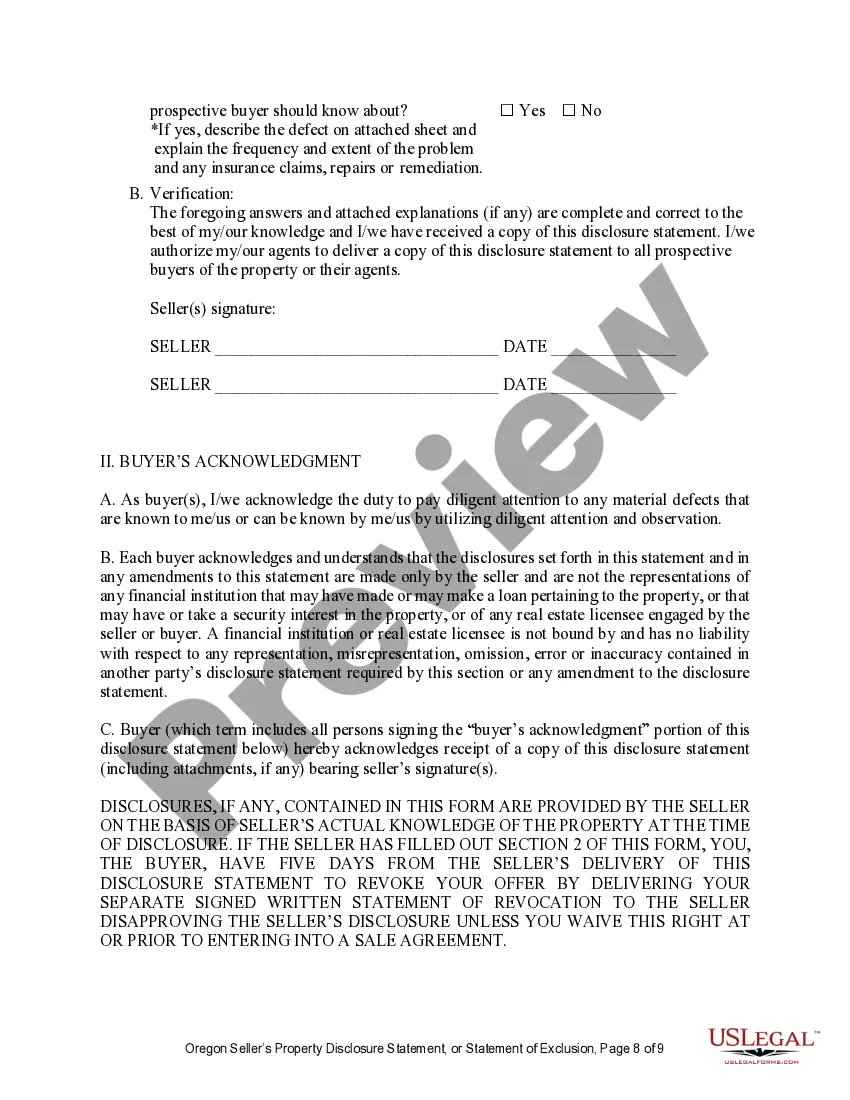

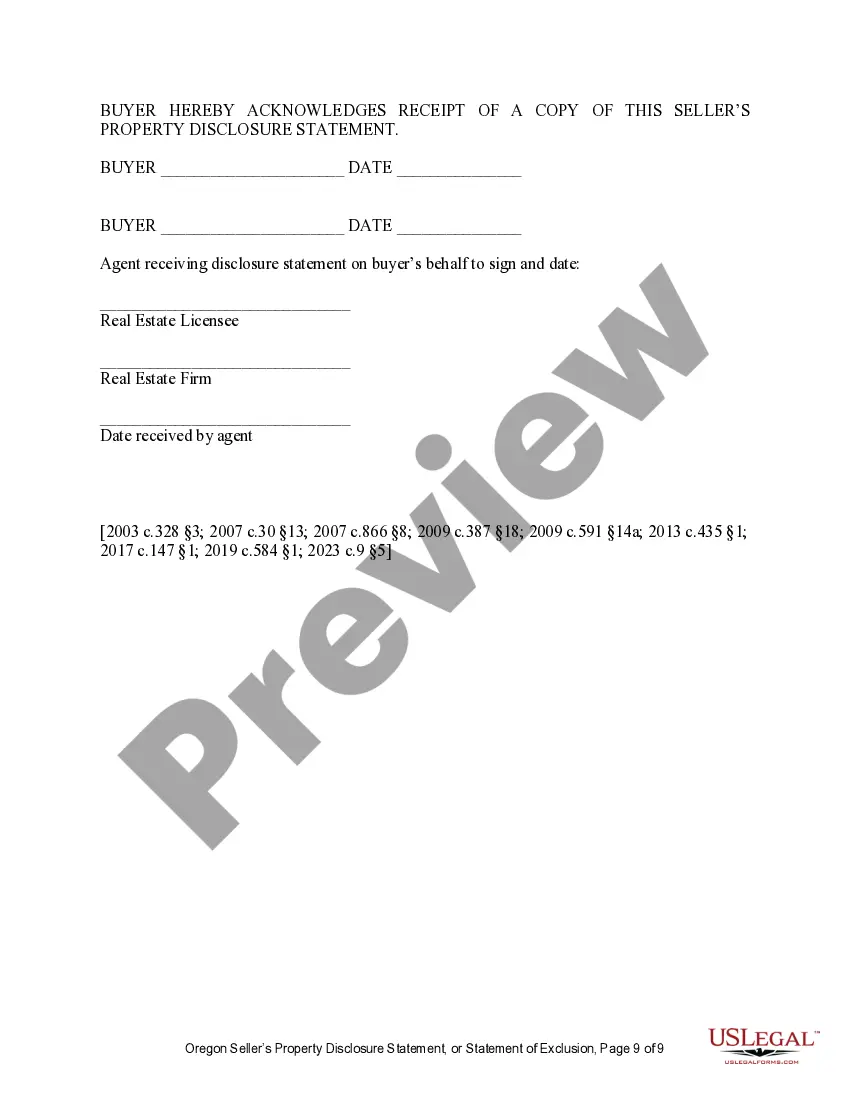

How to fill out Oregon Residential Real Estate Sales Disclosure Statement?

Dealing with legal paperwork and processes can be a lengthy addition to your daily routine.

Oregon Estate Or Form Or-40 Directives and similar documents usually necessitate that you locate them and comprehend the most effective method to fill them out correctly.

Consequently, whether you are managing financial, legal, or personal issues, possessing a thorough and accessible online collection of forms readily available will be immensely beneficial.

US Legal Forms is the premier online resource for legal templates, boasting over 85,000 state-specific forms and an array of tools to help you finalize your paperwork swiftly.

Is this your first time using US Legal Forms? Register and set up your account in just a few moments, and you’ll gain access to the form library and Oregon Estate Or Form Or-40 Directives. Then, follow the instructions below to finalize your form.

- Explore the library of pertinent documents available at your fingertips.

- US Legal Forms offers state- and county-specific templates that can be downloaded at any time.

- Protect your document management processes with a top-tier service that enables you to create any form in minutes without additional or hidden fees.

- Simply Log In to your account, find Oregon Estate Or Form Or-40 Directives, and download it instantly from the My documents section.

- You can also retrieve previously saved documents.

Form popularity

FAQ

If you are preparing to file an Oregon estate tax return, you may need to complete Oregon Form WR, which is a Will Registry form. This form helps to ensure that any legal documents associated with the estate are appropriately recorded. For clear guidance on whether you need to file this form, refer to the Oregon estate or Form OR-40 instructions, or consider using resources from US Legal Forms.

In Oregon, an estate tax return is required for estates with a value exceeding $1 million. If the gross value of your estate surpasses this threshold, you must file the return to satisfy Oregon estate or Form OR-40 instructions. Consult with a tax professional to understand your specific circumstances and ensure compliance.

You can find your Oregon tax liability directly on Form OR-40, typically in the section designated for reporting your total tax due. This form is structured to guide you, ensuring you accurately calculate your tax obligations. Using Oregon estate or Form OR-40 instructions will help you navigate the form correctly. If you're unsure, consider seeking help from tax professionals or resources such as US Legal Forms.

To search for cases witin the state of Nevada Users may access individual PACER or Case Management/Electronic Case Files (CM/ECF) for the state of Nevada by logging in to the Court PACER website .

Public Records Requests: To view documents if you are a member of the public, submit a public records request on the court's website at .nevada.courts.ca.gov. Case information is available to the public by making an account on this portal.

To search for cases witin the state of Nevada Users may access individual PACER or Case Management/Electronic Case Files (CM/ECF) for the state of Nevada by logging in to the Court PACER website .

The Nevada Supreme Court and Court of Appeals have established a cost-free Public Portal allowing access to all recent court documents. The Pubic Portal screen, also known as Appellate Case Management System, will ask for Case Number (top left) or you can provide a Case Caption (usually the named parties in the case).

You will need to come to the courthouse with your photo ID and have a clerk look up the case for you. You can look up your family court case online by visiting the District Court Portal or the Clark County Courts Records Inquiry. You can search by case number or by a party's name.

When Does Child Support End in Nevada? The revised statute explicitly states that an order pertaining to the payment of child support shall terminate once the child reaches 18 years old or, if still in high school, the order ends upon the child graduating high school or turning 19 years old.