60 Days Later

Description

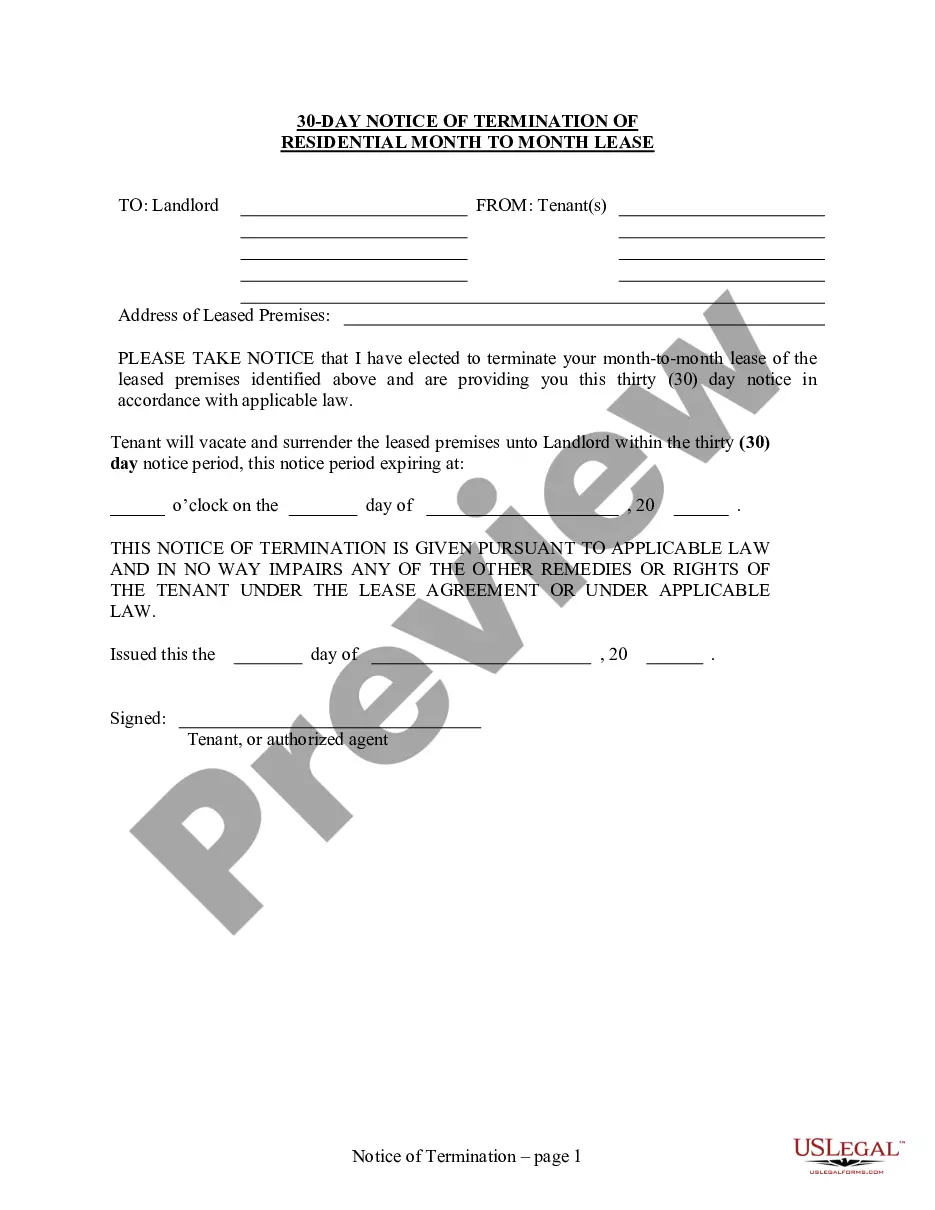

How to fill out Oregon 30 Day Or 60 Day Notice To Terminate Month To Month Lease For Residential From Tenant To Landlord?

- Log in to your US Legal Forms account if you've previously used the service. Make sure your subscription is active for uninterrupted access.

- Preview the legal form you need and check its description. Confirm that it aligns with your requirements and local regulations.

- If you need a different template, utilize the search bar to find what best suits your needs.

- Click on the 'Buy Now' button to purchase your chosen document and select your preferred subscription plan.

- Complete your purchase by entering your payment details or using PayPal to finalize your subscription.

- Download the template to save it on your device. You can also access it later in the 'My Forms' section of your account.

By following these straightforward steps, you can efficiently obtain the legal forms you need. With US Legal Forms, you’ll benefit from a robust collection of templates and expert assistance, ensuring your documents are both accurate and legally valid.

Start leveraging the power of US Legal Forms today and simplify your legal documentation process!

Form popularity

FAQ

Yes, you can electronically file past due tax returns, but the process may depend on how late you are. If you file 60 days later or more, some electronic filing services may not allow submission. To ensure your return goes through smoothly, check with reliable platforms. uSlegalForms provides the tools you need for proper electronic submissions.

Even if you don't owe taxes, there may still be penalties for filing late. The IRS encourages timely submission to maintain accurate records, so delays can lead to complications, especially if you file 60 days later. It's wise to file on time to avoid any unexpected issues. uSlegalForms can help you stay on track with your deadlines.

While it can take up to 60 days for the IRS to review a submitted tax return, this duration is not guaranteed. Typically, the review time can vary significantly based on multiple factors. Being proactive and ensuring your submission is complete can help shorten the waiting period. Using uSlegalForms can assist with this by streamlining your filing process.

You can generally file a late tax return for the previous three years. If you go beyond that timeline, it may become increasingly difficult to claim any due refunds. Filing your return 60 days later may not allow for access to certain credits. Our resources can guide you through filing returns from previous years easily.

Yes, you can still file your taxes after the April 15 deadline. However, if you file 60 days later, you may face penalties for late submission. It is important to file your return as soon as possible to reduce the potential costs. Our platform can help you navigate this process and ensure your return is filed correctly.

Generally, it is best to file your tax return as soon as possible if you miss the April 15 deadline. Filing more than 60 days after this date can lead to increased penalties. Timeliness is crucial, as the longer you wait, the more complicated your tax situation may become. To simplify the process, uSlegalForms offers solutions to help manage late filings.

If you fail to file your tax return by April 15, the IRS may impose penalties and interest on any taxes you owe. This could lead to a more complicated situation should you file 60 days later. You may also risk losing your refund, should you have one coming. Always consider filing on time to avoid these headaches.

The tax deadline is effectively at midnight on April 15. This means you must submit your tax returns by then to avoid penalties. If April 15 falls on a weekend or holiday, the deadline may shift to the next business day. Be sure to submit your return on time to minimize any issues 60 days later.

While 60 days does not fit neatly into a standard two-month period, it can apply depending on the months involved. For example, if February is one of the months, expect only 59 days. If your planning revolves around key legal deadlines, consider how 60 days later fits into your timeline.

Generally, there are not exactly 60 days in two months. Depending on the specific months chosen, you will usually find either 59 or 61 days. Therefore, when aiming to plan something for 60 days later, always check the specific dates.