60 Days 60 Nights

Description

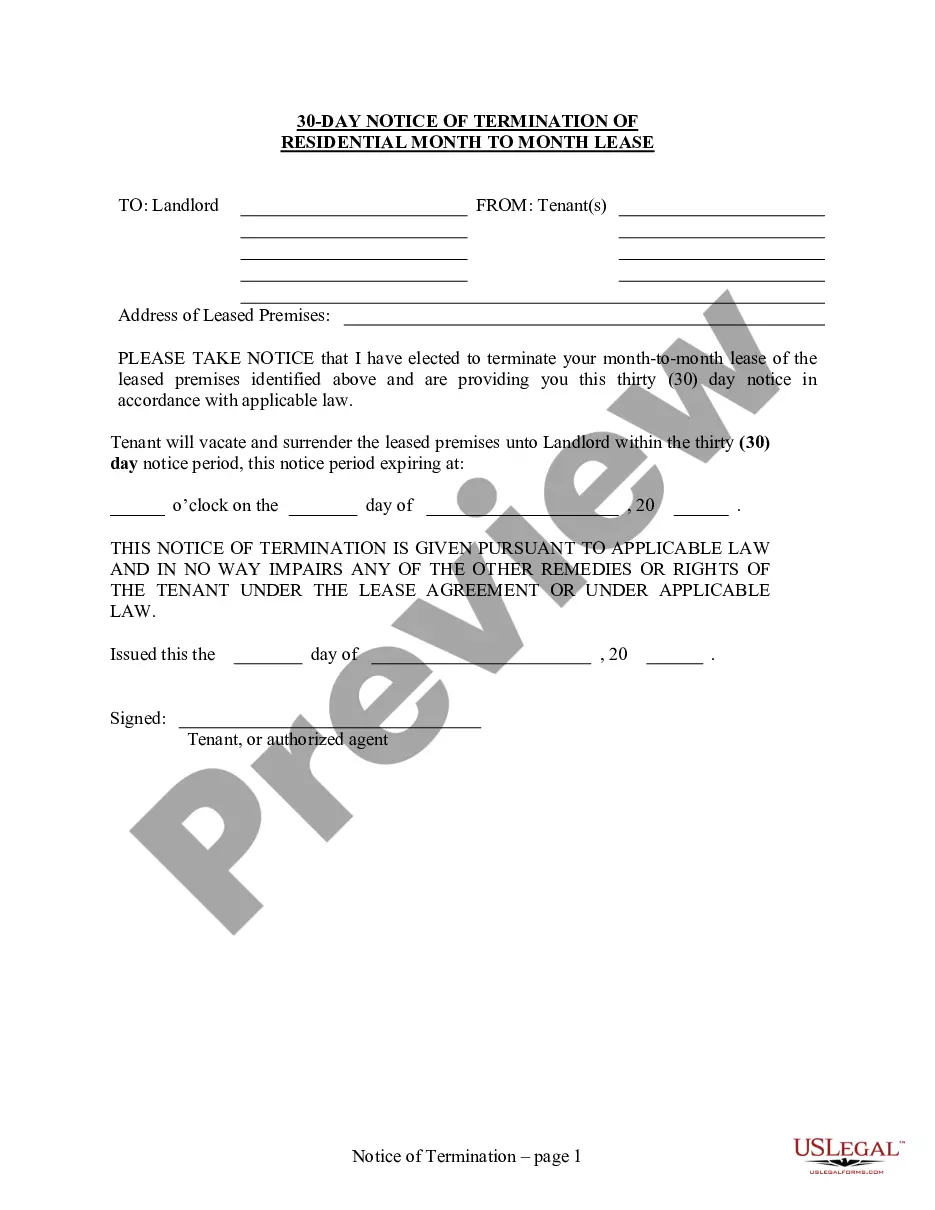

How to fill out Oregon 30 Day Or 60 Day Notice To Terminate Month To Month Lease For Residential From Tenant To Landlord?

- Log in to your existing account and ensure your subscription is active. Click the Download button to save the necessary form templates.

- If you're new to US Legal Forms, start by visiting the website and exploring the Preview mode. Look through the descriptions to ensure the form matches your jurisdiction.

- In case the chosen document isn’t suitable, utilize the Search feature to locate an appropriate template that meets your requirements.

- Once you've found the correct form, click the Buy Now button and select your desired subscription plan, creating an account as needed.

- Complete your purchase by entering your credit card information or using your PayPal account for quick transaction processing.

- After payment, download your form directly to your device. You can also access it anytime from the My Forms menu in your account.

Utilizing US Legal Forms not only provides a robust collection of over 85,000 templates but also offers the chance to connect with premium experts for support. This ensures that your documents are completed accurately and meet legal requirements.

Start your journey with US Legal Forms today and simplify your legal documentation process. Visit the website to unleash the full potential of your subscription!

Form popularity

FAQ

There has been speculation about the future of 60 Days In, but they have not definitively stopped making new episodes. The show continues to draw interest from viewers who enjoy its unique perspective on the incarceration experience. For updates on new seasons or episodes, stay connected with 60 Days 60 Nights online. Engaging with the community can also provide insights into what's happening next.

Stephanie, a notable participant in 60 Days In, did not actually go to jail for any crime shown on the program. Her role was primarily focused on experiencing life behind bars for the duration of the show. By doing so, she contributed valuable insights into the lives of inmates. This experience aligns perfectly with the theme of 60 Days 60 Nights, highlighting the challenges in the correctional system.

Many fans wonder if 60 Days In is real or staged. The premise of the show involves participants spending time in jail to observe and report on the system. While certain elements may be arranged for safety, the experiences are genuine, reflecting real interactions among inmates and corrections staff. This authenticity is what makes the 60 Days 60 Nights journey captivating.

As of now, 60 Days In has not been officially cancelled. The show has maintained a strong fan base, which often prompts discussions about its future. Additionally, updates on new seasons can be found on various streaming platforms and social media. If you're looking for more details, the 60 Days 60 Nights community often shares the latest news.

Yes, it is common for the IRS review process to take around 60 days, although some cases may take longer. This duration allows the IRS to ensure all tax filings are accurate and compliant. If your review exceeds this timeline, consider using resources like ulegalforms for further support.

The IRS may be taking longer to review your tax return due to several factors, including an increase in submissions and the need for clarifications. Reviews often align with the 60 days 60 nights theme, reflecting a typical duration, yet extraordinary circumstances may lead to longer waits. Stay proactive by checking the IRS website for updates on your status.

To calculate the 60 day rollover period, start counting from the day you receive your distribution. Include every calendar day until you reach 60 days, ensuring you complete your rollover by the deadline. For specific guidance, ulegalforms can help simplify rollover processes and timelines.

Waiting 60 days for a tax refund can be frustrating, but this period allows the IRS to perform thorough checks. This review helps ensure that all submissions are accurate and comply with tax regulations. If you experience delays beyond this period, consider reaching out to the IRS or using ulegalforms for assistance.

While many people might expect a quicker turnaround, document reviews by the IRS often take around 60 days. However, delays can occur if additional information is needed or if there are inconsistencies in the documents submitted. Keeping your records organized can help streamline the process and may reduce your waiting time.

The IRS typically does not have a set timeframe for reviews, but many taxpayers notice that reviews can take around 60 days. Various factors can influence this timeframe, including the complexity of the tax return and the volume of returns the IRS is processing. Staying informed through the IRS's online tools can help you understand your status.