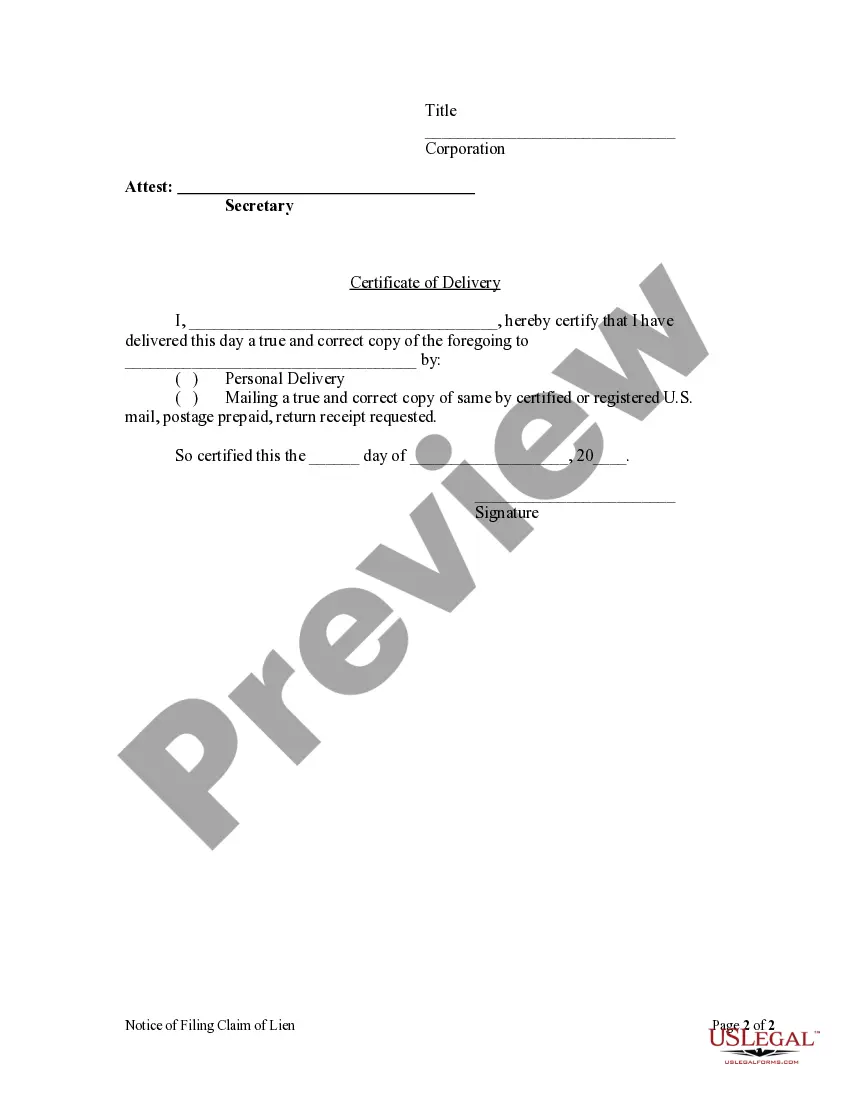

Filed Liens

Description

How to fill out Oregon Notice Of Filing Of Lien Claim By Corporation?

- If you're returning to US Legal Forms, log in to your account and ensure your subscription is active. Click on the Download button to save your needed form template.

- For first-time users, start by browsing the extensive library. Preview the form and read its description to ensure it aligns with your local requirements.

- Use the search feature if you need another form. Find any inconsistencies and refine your search until you find a template that suits you.

- Proceed to purchase the document by clicking 'Buy Now'. Choose your preferred subscription plan and create an account for ongoing access.

- Complete your purchase by entering your payment details or leveraging your PayPal account for convenience.

- Finally, download your form and save it on your device. Access it anytime through the 'My Forms' section of your profile.

By following these straightforward steps, you can ensure that you're using US Legal Forms to its fullest potential. The platform offers a robust collection of over 85,000 forms, making it a valuable resource for both individuals and attorneys.

Take control of your legal documentation today! Visit US Legal Forms and start filing liens with confidence.

Form popularity

FAQ

To determine if a title has filed liens, start by requesting a title search through a local title company or legal service. This search will reveal any existing liens against the property title. Alternatively, you can check public records to learn about any filed liens. Utilizing platforms like USLegalForms can simplify this process and provide you with necessary documents.

Yes, filed liens are public records in Pennsylvania. This means anyone can access this information, which helps ensure transparency in property ownership. By checking the public records, you can find details about any liens attached to a property. This process provides essential insights for prospective buyers or lenders.

To fill out an affidavit form, begin by placing your name and contact information at the top. Clearly define the statements you are affirming as true, including necessary details related to the case or situation. Sign and date the document to validate your claims, ensuring it can effectively support any filed liens.

Filling out a lien affidavit follows a structured process. Start with your full legal name, the debtor's name, and the description of the obligation. Be sure to detail any payments made, and sign the document to finalize it. This affidavit plays a crucial role in supporting filed liens.

To complete a lien release, start by drafting a notice stating the lien is satisfied or released. Include details about the original lien and the payments made. Once signed, file this release with the appropriate authority to remove any filed liens from public records.

Filling out an affidavit of claim requires you to provide your name, address, and details of the claim being made. Include information about the debt owed, the parties involved, and the circumstances surrounding the claim. A well-prepared affidavit supports your position regarding filed liens.

To fill out a lien affidavit, start by gathering essential information about the parties involved and the specifics of the debt. Clearly state the amount owed and reference any associated contracts. Ensure you include your signature and the date. This affidavit is important because it officially documents filed liens.

A lien can significantly impact your financial situation and property rights. It can restrict your ability to sell your property or secure new financing, as lenders may view filed liens as a risk. Additionally, having a lien on your record may lower your credit score. Knowing your options for resolving liens can empower you to make informed decisions, and US Legal Forms is here to assist you with the necessary steps.

A recorded lien is a lien that has been officially documented in the public records. This action ensures that the claim is recognized legally, informing potential buyers or lenders about the existing debt. If you discover filed liens against your property, acting quickly can help you determine the best course of action. Our platform offers guidance on how to handle these situations effectively.

Indeed, a lien can be placed on your house without your knowledge, particularly if proper notification is not given during the filing process. This situation is common with unpaid debts or unpaid contractor fees. Staying aware of your property records can help you catch any filed liens before they become a bigger issue. Regular checks can empower you to address liens promptly.