Limited Lianility

Description

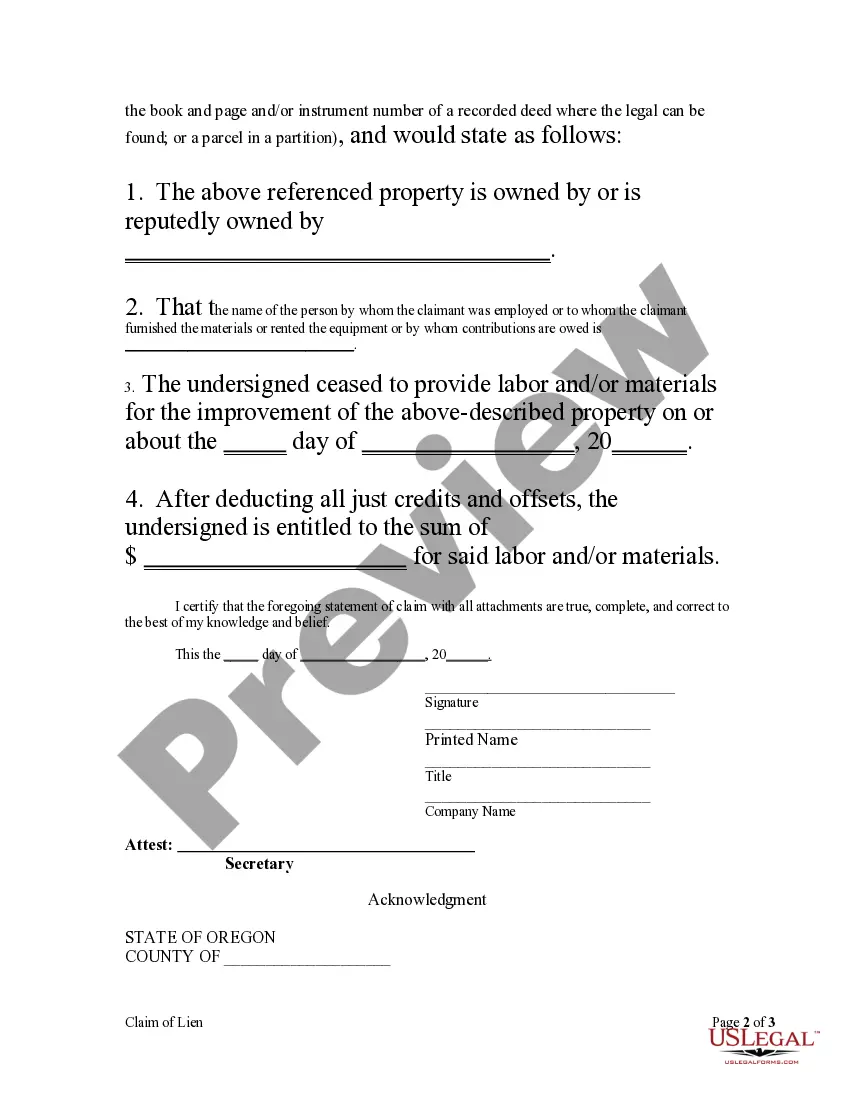

How to fill out Oregon Claim Of Lien By Corporation?

- Log in to your account on US Legal Forms if you're a returning user. Ensure your subscription is active.

- Preview the desired form. Check its description to confirm it aligns with your jurisdiction requirements.

- Search for additional templates if necessary. Use the search bar to find the right document if you encounter any issues.

- Purchase the document. Click on the Buy Now button and select a subscription plan that suits you. You'll need to create an account to access the forms.

- Complete your transaction. Enter your payment details or use PayPal to finalize your subscription.

- Download the form to your device. You can access it anytime from the My Forms section in your account.

By following these steps, you ensure that your legal documents are accurate and compliant, providing peace of mind in your endeavors.

Start your journey with US Legal Forms today to benefit from their robust collection and expert assistance in legal form completion.

Form popularity

FAQ

Getting a limited liability corporation involves several key steps. First, you should select a suitable name and ensure it is available in your state. After that, filing the necessary formation documents, such as Articles of Organization, is crucial. To simplify this process, you can use U.S. Legal Forms, which provides resources and guidance to help you establish your limited liability corporation efficiently.

To form a limited liability corporation, start by choosing a unique name that complies with state regulations. Next, you will need to file Articles of Organization with your state's business filing office. After that, obtaining an Employer Identification Number (EIN) from the IRS is essential for tax purposes. Finally, consider utilizing a platform like U.S. Legal Forms to streamline your LLC formation process.

One downside of a limited liability corporation (LLC) is the potential for self-employment taxes, which can increase your tax burden. Additionally, while limited liability protects your personal assets, it does not eliminate liability for business debts completely. Furthermore, you might face additional paperwork and state requirements, which can be daunting. Understanding these factors can help you better navigate the benefits of limited liability.

Limited liability means that business owners are only responsible for debts up to the amount they invested in the business, while unlimited liability implies that owners are personally accountable for all business debts. In a limited liability scenario, personal assets remain protected, offering peace of mind to business owners. In contrast, with unlimited liability, owners risk losing personal property if the business fails. Understanding these differences is vital when choosing the appropriate legal structure for your business.

A limited liability company (LLC) is a flexible business structure that merges the benefits of corporations and partnerships. It provides limited liability protection to its owners while allowing for pass-through taxation, where profits are taxed at the individual level rather than the business level. This structure is ideal for small to medium-sized businesses looking for protection against personal liability. With an LLC, you can enjoy the freedom and simplicity of running a business while minimizing risks.

Having limited liability is beneficial for business owners because it protects their personal assets from business-related risks. This allows entrepreneurs to take calculated risks without the fear of losing everything they own. Limited liability also boosts investor confidence, as investors generally prefer to engage with businesses that offer this protection. Overall, limited liability is a fundamental aspect of starting and managing a secure business.

Limited liability refers to a legal structure where a business's owners are not personally responsible for its debts and obligations. This means that if the business fails or faces legal claims, only the business’s assets are at risk, not the owners’ personal belongings. This concept encourages entrepreneurship since it reduces the personal financial risk faced by business owners. It also highlights the importance of choosing the right business structure.

Limited liability insurance is a type of coverage that protects business owners from financial loss due to claims against their business. This insurance ensures that the owners’ personal assets are not at stake if the business is sued. By securing limited liability insurance, you're safeguarding your personal finances while running your business. It’s an essential part of risk management for any limited liability structure.

Filing your personal and business taxes together is often the most straightforward approach for single-member LLCs. This method keeps your financial information consolidated, simplifying the filing process. However, it’s important to maintain clear records of your business expenses to maximize your deductions. To help with this, US Legal Forms provides structured guidance on the tax filing process.

No, LLC and personal taxes do not get filed together in the traditional sense. Instead, the LLC's income passes through to your personal tax return, reported on Schedule C. Thus, it is important to ensure that both types are accurately reported. To ensure compliance and clarity, consider exploring the filing resources available at US Legal Forms.