Approved Transfer On Death Deed Form For Oregon

Description

How to fill out Oregon Transfer On Death Deed From Husband And Wife / Two Individuals To Two Individual Beneficiaries.?

- Begin by logging into your US Legal Forms account if you're a returning user. Ensure your subscription is active; renew if necessary.

- If you're a new user, check the form preview and description to confirm that you've selected the correct template that satisfies your requirements.

- If there are discrepancies, utilize the search function to find an alternative template that meets your needs.

- Purchase the document by clicking on the 'Buy Now' button and selecting your desired subscription plan. Register for an account for comprehensive access.

- Complete your purchase by entering your payment information, whether via credit card or PayPal.

- Download the form to your device; you can access it anytime through the 'My Forms' section in your profile for future use.

In conclusion, US Legal Forms simplifies the document acquisition process, empowering both individuals and attorneys with a vast library of over 85,000 legally sound forms. This extensive resource makes it easy to find what you need quickly and efficiently.

Start your journey with US Legal Forms today and ensure your legal documents are completed correctly!

Form popularity

FAQ

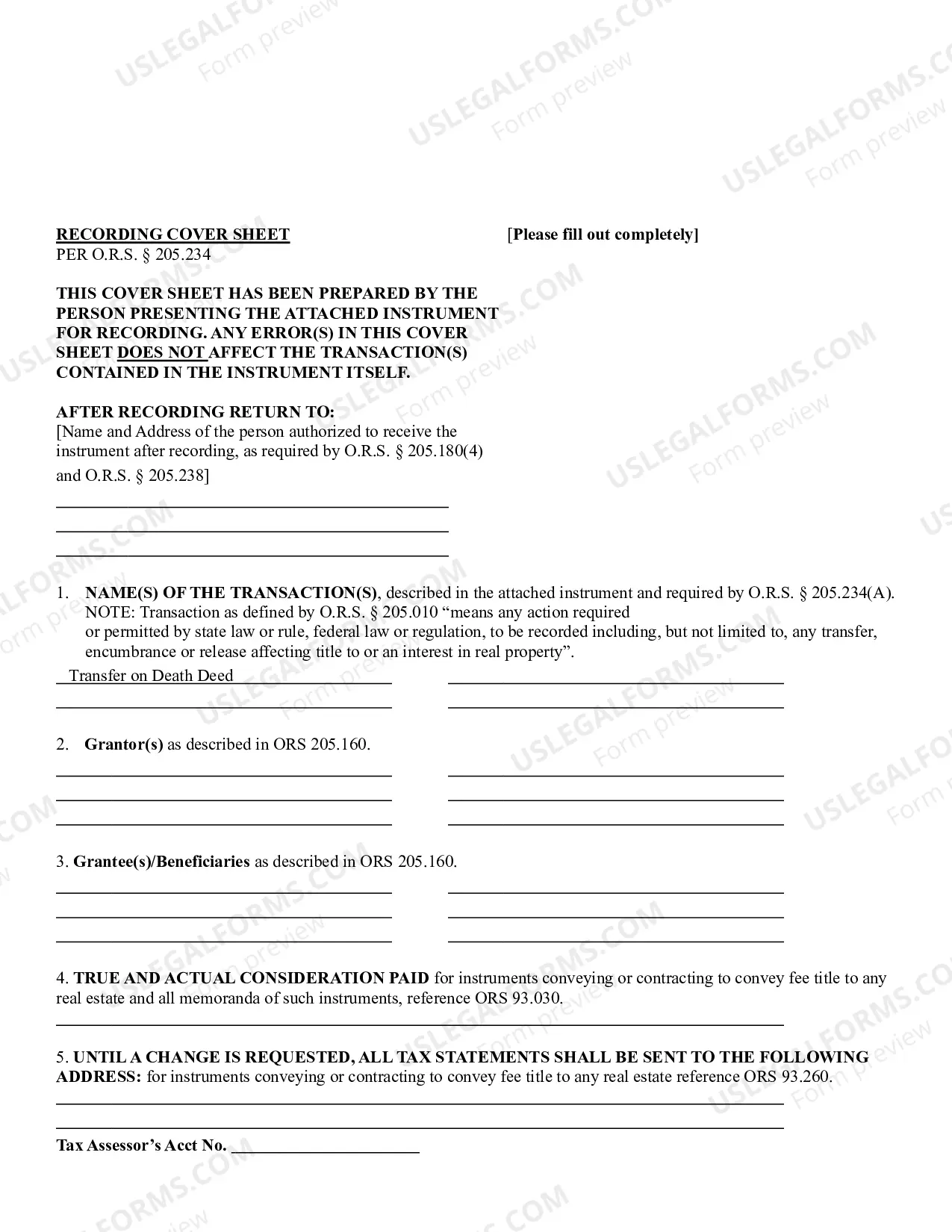

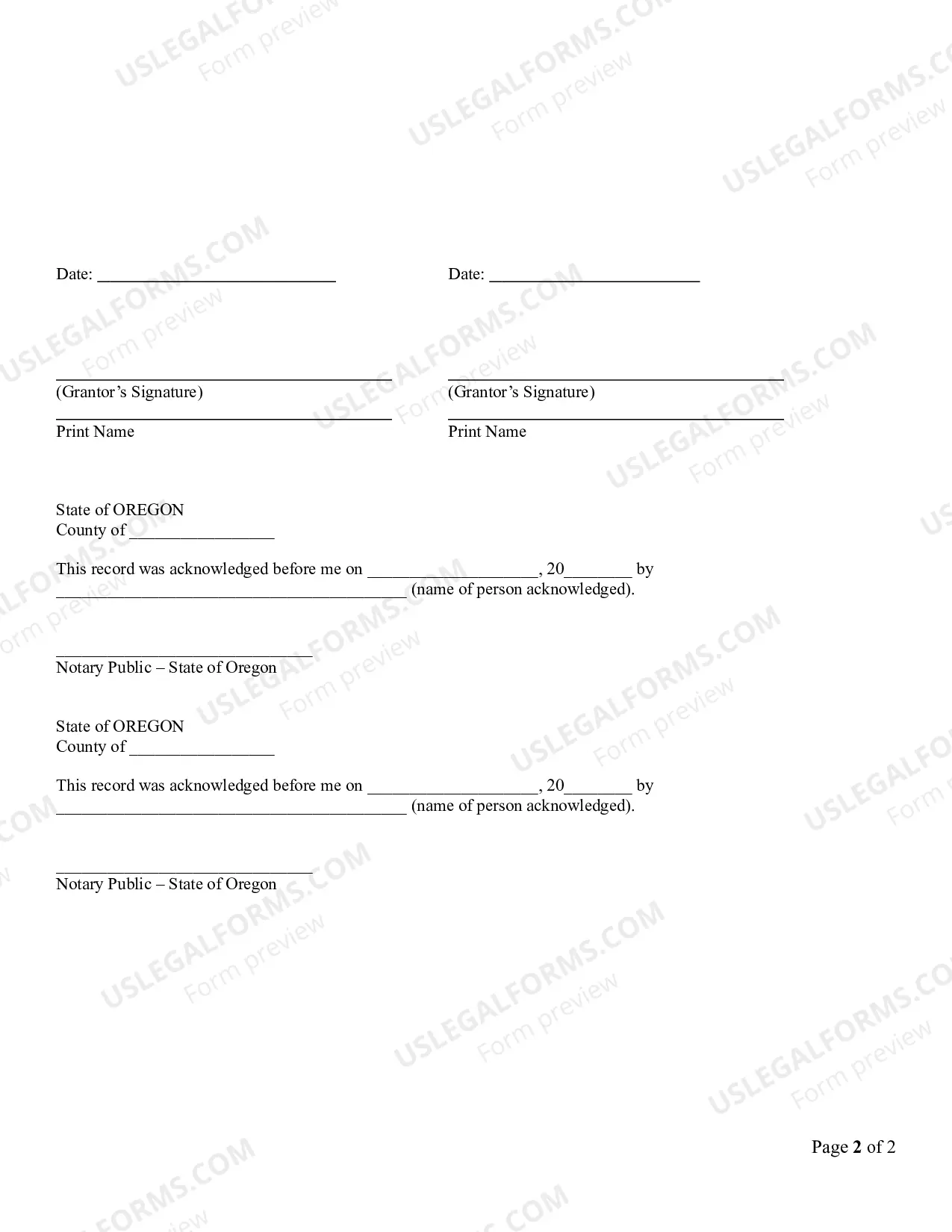

To obtain an approved transfer on death deed form for Oregon, you should start by visiting a reputable legal form provider, such as USLegalForms. Their platform offers easy access to the necessary forms tailored specifically for Oregon's requirements. After acquiring the form, complete it with accurate information about the property and the beneficiary. Finally, ensure you have the document notarized and recorded with the county clerk to finalize the transfer on death deed.

To file a transfer on death deed in Oregon, you must first complete the approved transfer on death deed form for Oregon. After filling out the form, you need to sign it in front of a notary public. Finally, submit the completed deed to the county recorder's office for recording. Using US Legal Forms can simplify this process by providing you with the necessary templates and guidance for filing.

One potential disadvantage of a transfer on death (TOD) deed is that it may not offer protection against creditors after the owner’s death. While the property avoids probate, any outstanding debts may still impact the estate. Furthermore, if the beneficiary does not survive the property owner, the deed could become ineffective. It is wise to consult legal professionals to understand the implications of using an approved transfer on death deed form for Oregon.

You can obtain an approved transfer on death deed form for Oregon from various legal sources, including government websites and document preparation services. Additionally, US Legal Forms offers a user-friendly platform where you can find and download this form tailored to Oregon's requirements. Ensuring you have the correct document is crucial for a smooth property transfer process.

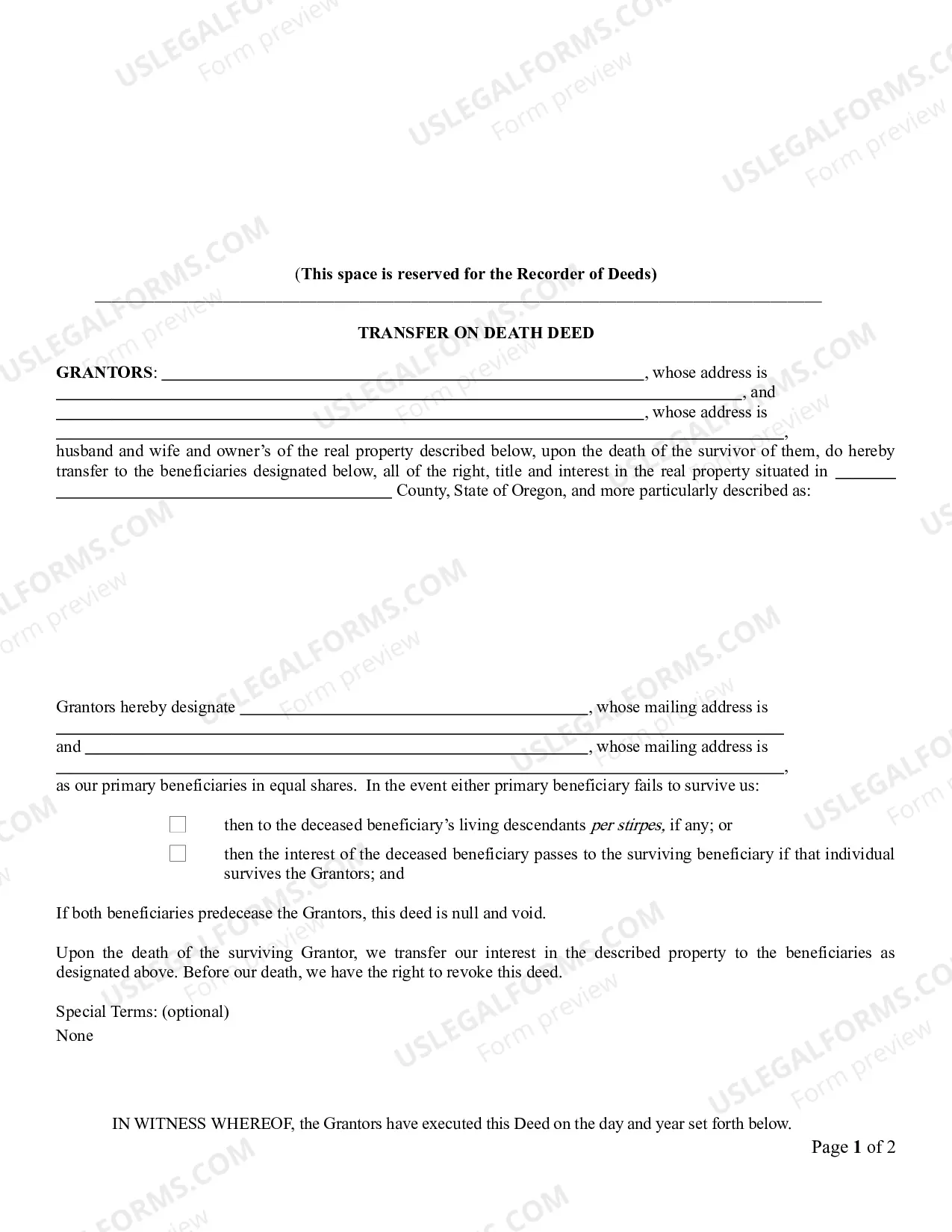

To transfer ownership of a property in Oregon, you can use the approved transfer on death deed form for Oregon. This deed allows one to transfer property automatically upon death without going through probate. It is important to ensure that the deed is properly completed and recorded to make the transfer valid. For personalized assistance, consider using US Legal Forms to access the right documents easily.

Writing a transfer deed requires careful attention to detail to ensure it adheres to state laws. You should include the names of the grantor and the beneficiary, a description of the property, and a clear statement of intent to transfer the asset upon death. For a seamless experience, consider using an Approved transfer on death deed form for Oregon from USLegalForms, which provides templates to help you draft accurate deeds with legal validity.

Some potential downsides of using a transfer on death deed include the lack of flexibility once the deed is signed and the possibility of disputes among heirs. If relationships change or family dynamics shift, the predetermined transfers could cause conflict. However, by using an Approved transfer on death deed form for Oregon, you can ensure that your intentions are clearly communicated, helping to mitigate misunderstandings.

Using an Approved transfer on death deed form for Oregon does not typically exempt assets from inheritance taxes. While the transfer itself may not go through probate, it’s essential to understand local tax laws that could still apply after death. Consulting with a tax professional will give you clarity on how to optimize your estate planning and minimize potential tax implications.

The choice between TOD accounts and using a beneficiary designation largely depends on individual needs and family dynamics. While TOD accounts automatically transfer assets upon the owner's death, beneficiary designations can sometimes provide more flexibility. Both methods have their pros and cons, so consider using an Approved transfer on death deed form for Oregon to clearly specify your wishes and reduce conflict among heirs.

Transfer on death (TOD) accounts can lead to confusion and disputes among heirs. If not properly documented, family members may disagree over assets, creating tension. Additionally, these accounts do not bypass probate if the asset holder changes their mind and wants to transfer the asset differently. Therefore, using an Approved transfer on death deed form for Oregon can provide clarity and prevent potential issues.