Life Estate Deed

Description

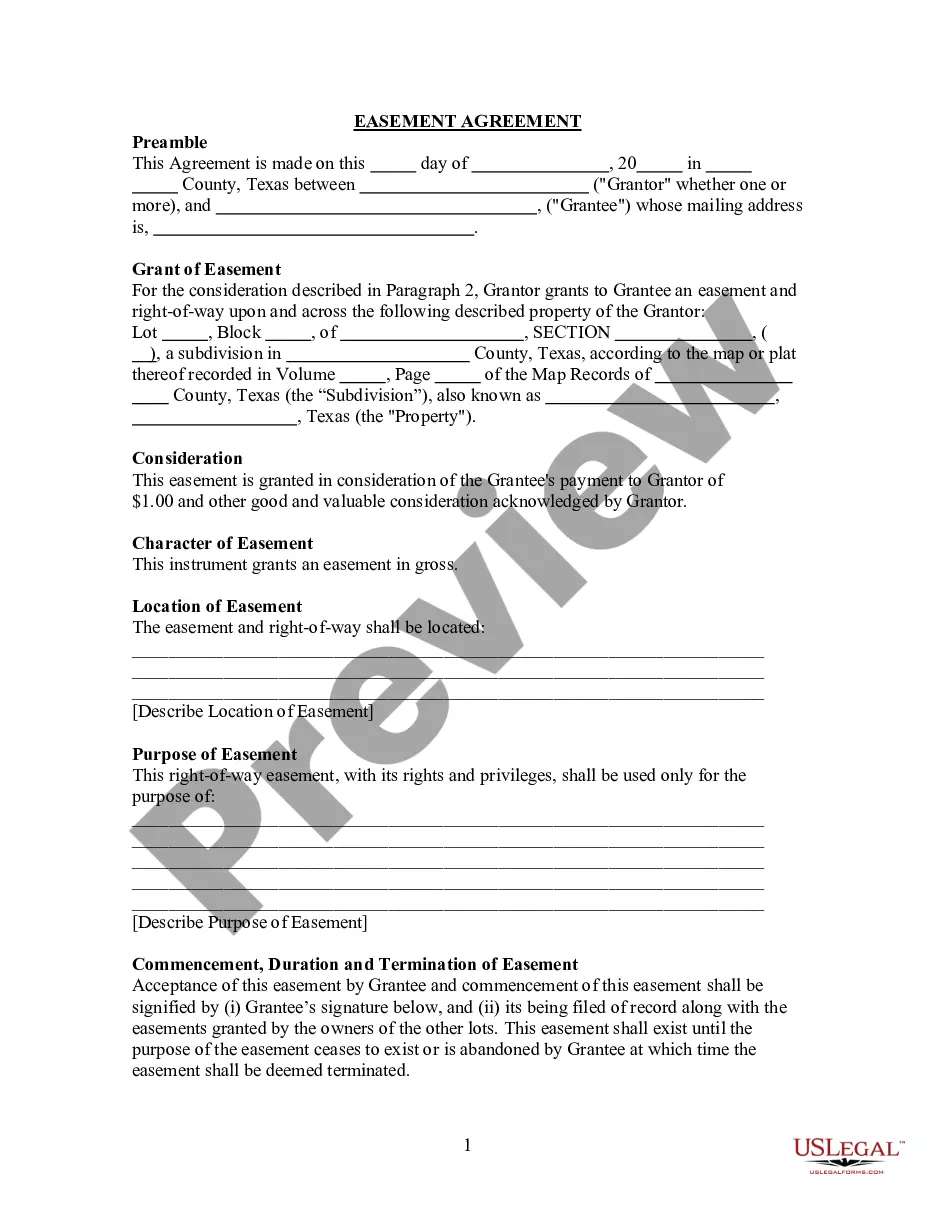

How to fill out Oregon Life Estate Deed From An Individual To An Individual.?

- If you are a returning user, log into your account to download the life estate deed form you need. Ensure your subscription is active; if not, renew according to your preferred payment plan.

- For new users, begin by exploring the Preview mode and description of the life estate deed. This will ensure that you are selecting the correct form that aligns with your state’s legal requirements.

- If adjustments are needed, utilize the Search tab at the top to find alternate templates that meet your specifications and legal standards.

- Once you find the right form, select the Buy Now button and choose your desired subscription plan, then create an account to access the extensive library of documents.

- Complete your purchase by entering your payment information, either through a credit card or PayPal, to finalize your subscription.

- After purchase, download the life estate deed to your device. You can also access it anytime later in the My Forms section of your profile.

Securing a life estate deed through US Legal Forms is straightforward, allowing you to navigate the complexities of legal documentation with ease.

With over 85,000 forms and the option to consult legal experts, US Legal Forms is your go-to resource for ensuring your documents are completed correctly and legally sound. Start your journey today!

Form popularity

FAQ

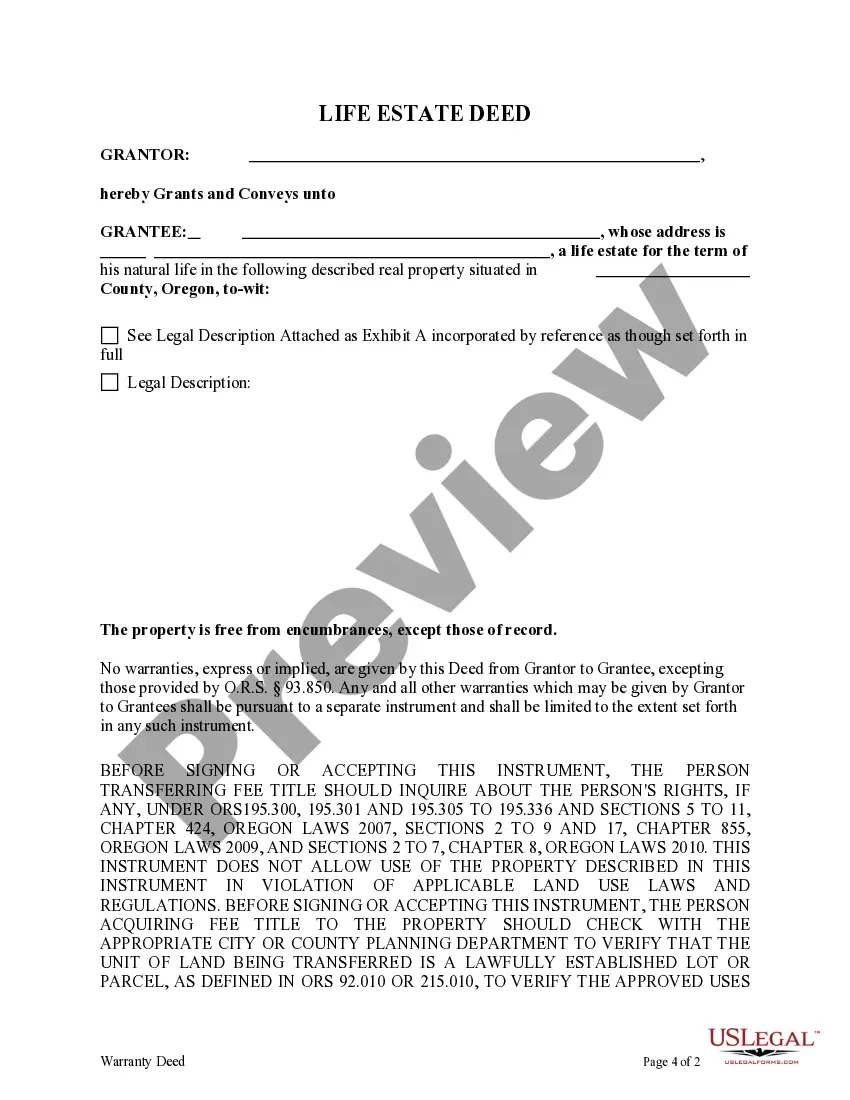

The life estate deed lists the name of the life tenant and the remaindermen. The life tenant is the individual who has the right to live in the property for their lifetime, while the remaindermen are the individuals who will inherit the property afterward. This arrangement clearly defines ownership and ensures that both parties understand their rights.

While a life estate deed has various advantages, it also has drawbacks. One major concern is that the life tenant cannot sell or mortgage the property without consent from the remaindermen. Additionally, any major repairs or alterations may require agreement from all parties involved, which can complicate property management.

An example of a life estate is when an individual, let's call her Mary, deeds her house to her children but retains the right to live in it for her lifetime. In this case, Mary's children will become the owners of the property after her death without going through probate. This arrangement exemplifies how a life estate deed can provide peace of mind and protect family property.

When using a life estate deed, the property typically retains appreciated value, which may affect taxes. The life tenant may still be responsible for property taxes during their lifetime, while the remaindermen inherit a stepped-up basis upon transfer. It is advisable to consult with a tax professional to fully understand the specific tax implications related to life estate deeds.

No, a will cannot override a life estate deed. The life estate deed specifies the future owners of the property, and these designations stand regardless of what a will states. Therefore, it’s essential to understand how a life estate deed fits within your overall estate planning to avoid unintended consequences.

A life estate deed allows an individual to maintain control over a property during their lifetime while ensuring that the property passes directly to beneficiaries after their death. This arrangement helps avoid probate, saving time and expenses associated with the court process. Additionally, a life estate deed provides clarity in property ownership, which can prevent disputes among family members.

To claim a life estate, you should first obtain a life estate deed that clearly defines your rights and the beneficiaries. You will need to execute this deed according to your state’s laws, typically involving signing it in front of a notary and recording it with the local county office. Once properly executed, you maintain ownership rights for your lifetime. For assistance with the process, consider using US Legal Forms to access reliable templates and guidance tailored to your needs.

A life estate deed is often referred to as a life estate or a life tenancy deed. This legal document grants an individual the right to use and benefit from a property during their lifetime. Upon their passing, the property passes automatically to the designated beneficiaries. Understanding the terminology surrounding a life estate deed can simplify estate planning and ensure your wishes are met.

A life estate deed can have specific tax implications that you should understand. Generally, the property is still part of your estate for tax purposes, which means it could affect estate taxes. However, you may benefit from a step-up in basis when the property is transferred to beneficiaries upon your death. To navigate these complexities effectively, consider utilizing the resources available on the US Legal Forms platform, which provides valuable information on life estate deeds and their tax consequences.

A life estate deed creates a unique ownership arrangement where you retain rights to your property during your lifetime. After your death, the property automatically transfers to the designated beneficiaries. This means that if you have a will that states otherwise, the life estate deed takes precedence, and the property will not pass according to your will. Thus, it is important to consider your overall estate plan when using a life estate deed.