Oregon Resale Certificate Cost

Description

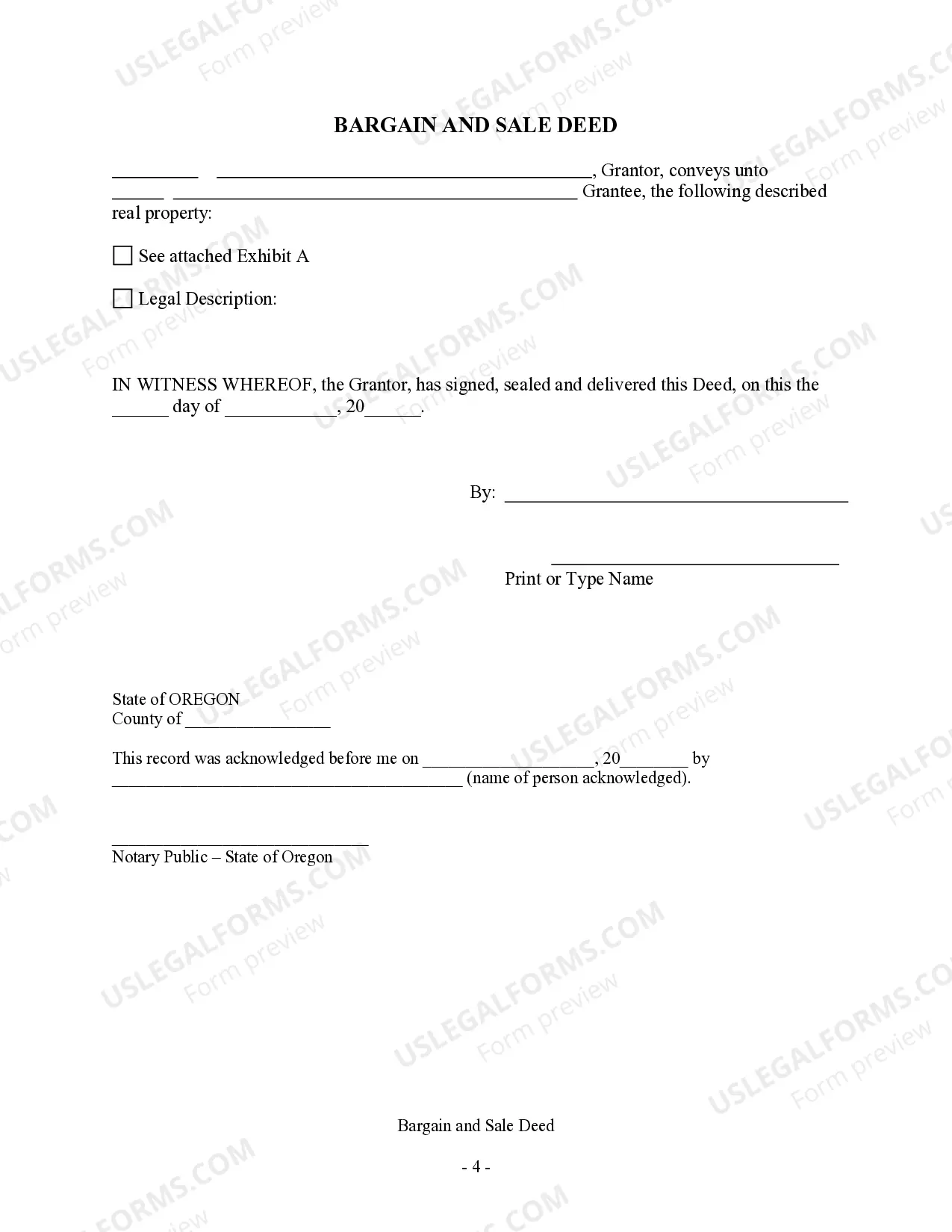

How to fill out Oregon Bargain And Sale Deed - Individual To Individual?

Creating legal documents from the ground up can occasionally be overwhelming.

Some situations may require extensive research and significant financial investment.

If you're seeking a simpler and more economical method for preparing the Oregon Resale Certificate Cost or any other documents without unnecessary obstacles, US Legal Forms is continually available to you.

Our online repository of over 85,000 current legal templates covers nearly every element of your financial, legal, and personal matters.

But before rushing to download the Oregon Resale Certificate Cost, keep these suggestions in mind: Verify the form preview and descriptions to confirm you have identified the correct document. Ensure the selected form complies with the laws and regulations of your state and county. Select the appropriate subscription option to obtain the Oregon Resale Certificate Cost. Download the form, then fill it out, certify it, and print it. US Legal Forms boasts an impeccable reputation backed by more than 25 years of experience. Join us today and simplify the process of form execution!

- With just a few clicks, you can instantly access state- and county-specific documents expertly crafted by our legal professionals.

- Utilize our website whenever you need reliable services to swiftly locate and download the Oregon Resale Certificate Cost.

- If you’re already familiar with our services and have an established account, simply Log In to your account, find the form, and download it or re-download it any time through the My documents tab.

- Don't have an account? No problem. Registering takes minimal time, allowing you to browse the catalog.

Form popularity

FAQ

You do not need to register for an account to file an appeal. If you wish to mail your appeal, you should include the Taxpayer Appeal Form (TAX-610) that came with your NOA and include supporting documentation that outlines why you are appealing.

Ways to Get Your. Vermont Income Tax Forms. Download fillable PDF forms from the web. Order forms online. Order forms by email. Order forms by phone. For a faster refund, e-file your taxes! For information on free e-filing and tax assistance for qualified taxpayers, visit .tax.vermont.gov.

To amend a return that has already been amended, complete the following steps. Open the previously amended return. Verify that the information on Form 1040 matches the information reported on the previous amended return. ... Open the Amend screen in the Separate Filings folder. Choose Edit > Delete screen data.

Email: tax.rett@vermont.gov Hours: Mon, Tue, Thu, Fri, a.m. - p.m. We can also help with questions regarding Land Gains Tax, Real Estate Withholding, Land Gains Withholding Tax, and Property Transfer Tax.

Use Vermont Form IN-111, Vermont Income Tax Return to file your amended return. Verify you are using the form for the correct year and that you are including all schedules (IN-112, IN-113, IN-153, etc.) submitted with your original filing even if the information on these schedules has not changed.

File an amended return using Form 1040-X, Amended U.S. Individual Income Tax Return as soon as possible. Include any forms and/or schedules that you're changing and/or didn't include with the original return. Return the refund check with a letter of explanation.

You can file Form 1040-X, Amended U.S. Individual Income Tax Return electronically with tax filing software to amend tax year 2020 or later Forms 1040 and 1040-SR, and tax year 2021 or later Forms 1040-NR. If amending a prior year return originally filed on paper, then the amended return must also be filed on paper.

Email: tax.rett@vermont.gov Hours: Mon, Tue, Thu, Fri, a.m. - p.m. We can also help with questions regarding Land Gains Tax, Real Estate Withholding, Land Gains Withholding Tax, and Property Transfer Tax.