Durable Power Of Attorney Form For Florida

Description

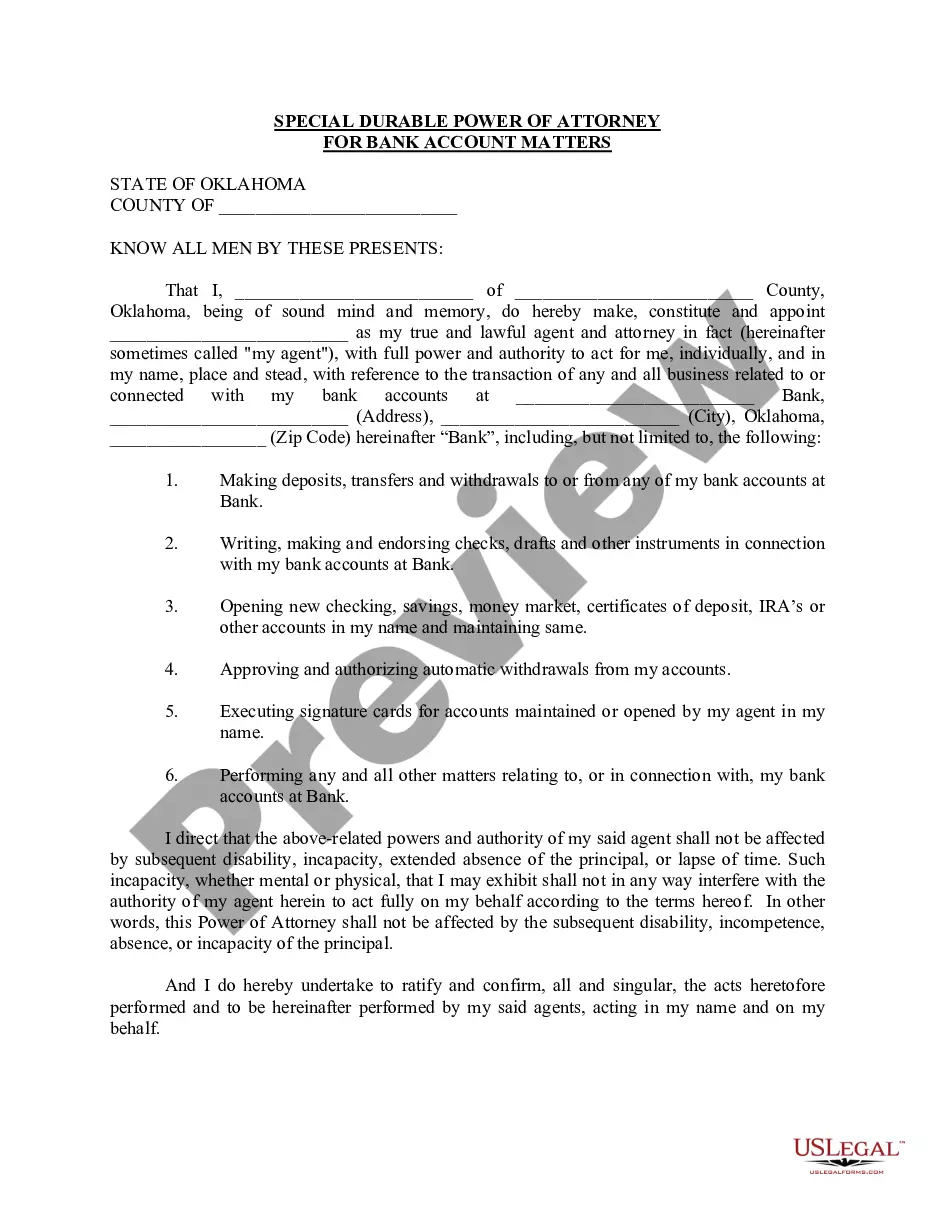

How to fill out Oklahoma Special Durable Power Of Attorney For Bank Account Matters?

- Log in to your US Legal Forms account if you've used the service before. Ensure your subscription is active; if not, renew it as per your payment plan.

- In the Preview mode, check the description of the durable power of attorney form. Confirm it fits your needs and complies with Florida regulations.

- If you need a different template, utilize the Search tab to find the appropriate document that suits your requirements.

- Once you locate the correct form, click the Buy Now button and select your desired subscription plan. Create an account to unlock access to the library.

- Complete your purchase by entering your payment information, either through credit card or PayPal.

- Download your completed form to your device. You can also access it later from the My Forms section in your profile.

US Legal Forms stands out with its extensive collection of over 85,000 templates, making it a leading choice for legal documents. The platform offers premium support from legal experts, ensuring that your forms are executed precisely and are legally sound.

In conclusion, obtaining a durable power of attorney form for Florida has never been easier with US Legal Forms. Start your journey today and ensure your legal needs are met efficiently!

Form popularity

FAQ

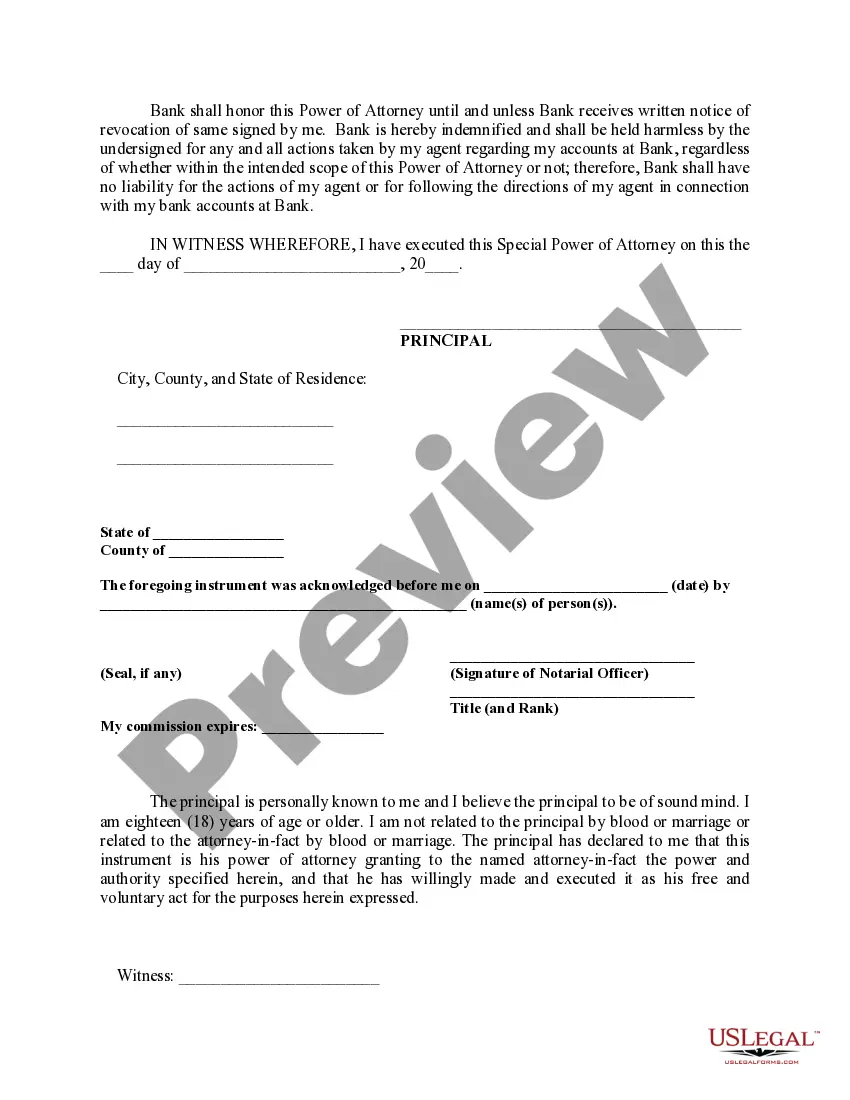

To fill out a durable power of attorney form for Florida, start by gathering the necessary information about yourself and your chosen agent. Clearly indicate the powers you are granting and any limitations, if applicable. It's essential to sign the form in front of a notary public to ensure it meets Florida legal requirements. Using a reliable platform like US Legal Forms can simplify this process, providing you with templates that ensure compliance with local regulations.

Yes, a Florida power of attorney must be notarized to be valid. The law requires signatures to be witnessed by a notary public, which adds a layer of protection against fraud. This notarization process also ensures that the durable power of attorney form for Florida is recognized and enforceable in legal matters. Creating this document through a reliable service, like USLegalForms, can facilitate proper execution.

The most powerful form of power of attorney is the durable power of attorney. This type remains effective even if you become incapacitated, allowing your chosen agent to make critical financial and healthcare decisions on your behalf. This is especially advantageous in emergencies when quick action is necessary. Using a durable power of attorney form for Florida ensures your desires remain intact during challenging times.

A legal power of attorney cannot make decisions related to your will or estate plan, nor can it make healthcare decisions if a living will exists. Additionally, a power of attorney cannot make personal decisions that require your explicit consent. It’s crucial to be clear about what powers you do and do not wish to delegate when using a durable power of attorney form for Florida.

One key disadvantage of a power of attorney is the potential for abuse. If someone misuses the authority granted in a durable power of attorney form for Florida, it can lead to financial exploitation or poor decision-making. Moreover, the principal may find it difficult to revoke the power of attorney once it is established. Therefore, it's essential to choose a trustworthy individual to act on your behalf.

The legal requirements for a durable power of attorney form for Florida include being of sound mind, being at least 18 years old, and signing the document in front of a notary public. The powers granted should be explicitly mentioned in the form, ensuring clarity of intent. Additionally, it is essential to have a witness present during the signing, especially for financial matters. Using reliable resources like USLegalForms can help ensure you meet all legal stipulations effectively.

An attorney does not need to draft your advance directive in Florida, but legal assistance may be beneficial. Your advance directive must adhere to state laws, which outline necessary components and formalities. Having a clear and valid document ensures your health care wishes are honored. For ease and peace of mind, consider using services like USLegalForms that guide you through drafting your advance directive correctly.

Yes, you can write your own durable power of attorney form for Florida, but it must meet specific legal requirements. It is essential to include your name, the agent's name, and the powers granted. Additionally, the document should be signed in front of a notary public to ensure its validity. For your assurance, you might consider using templates from USLegalForms, which simplify the process while ensuring compliance.

When handling tax matters under a durable power of attorney form for Florida, you may need IRS Form 2848, the Power of Attorney and Declaration of Representative. This form allows you to appoint someone to handle tax issues on your behalf. Ensure your designated representative is someone you trust, as they will have access to sensitive information. Using a checklist from trusted sources, like USLegalForms, can streamline this process.

A durable power of attorney form for Florida does not need to be drafted by an attorney, but it is often advised. While you can create one independently, using a professional can ensure that all legal requirements are met. It also helps avoid mistakes that could invalidate the document, protecting your interests. Platforms like USLegalForms provide templates and guidance for creating your durable power of attorney form for Florida effectively.