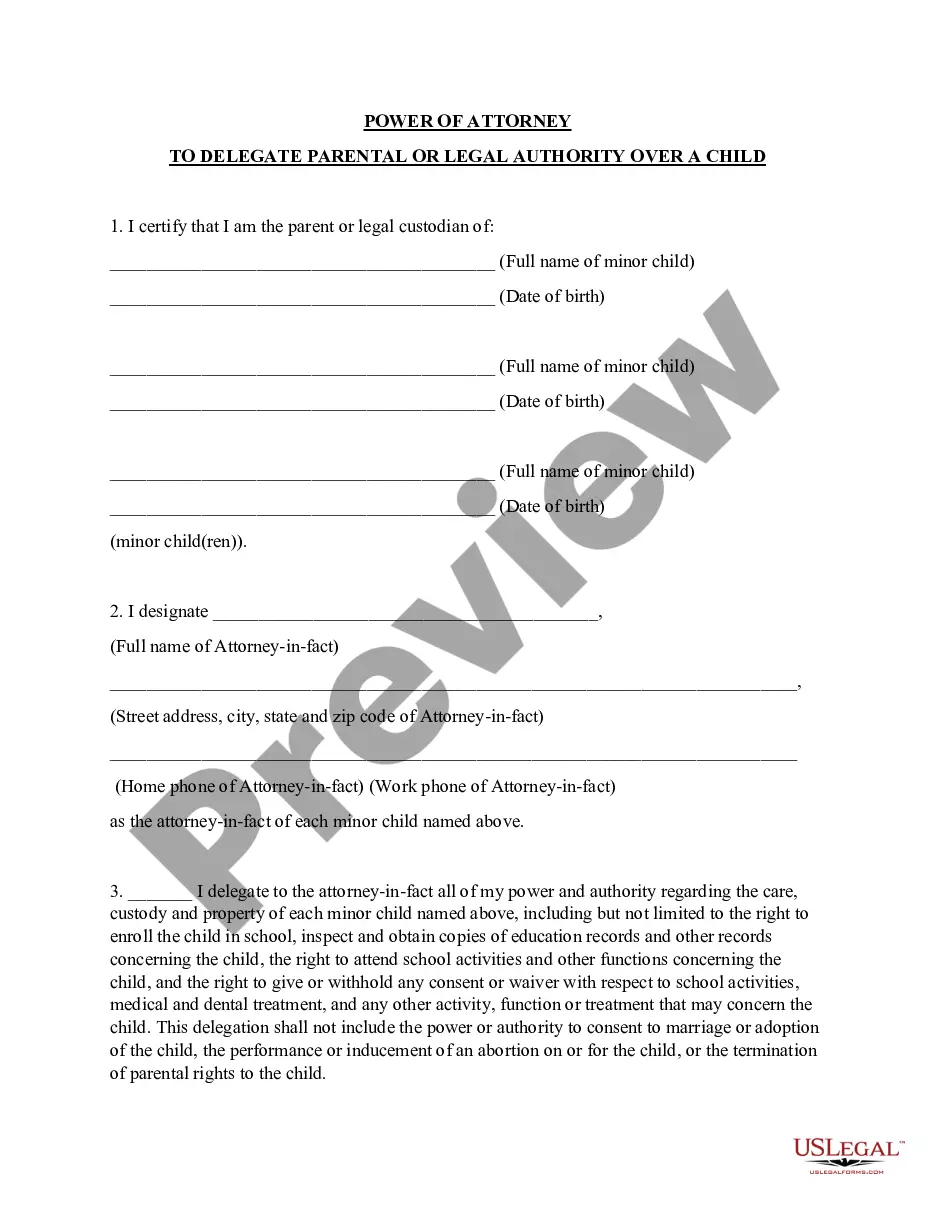

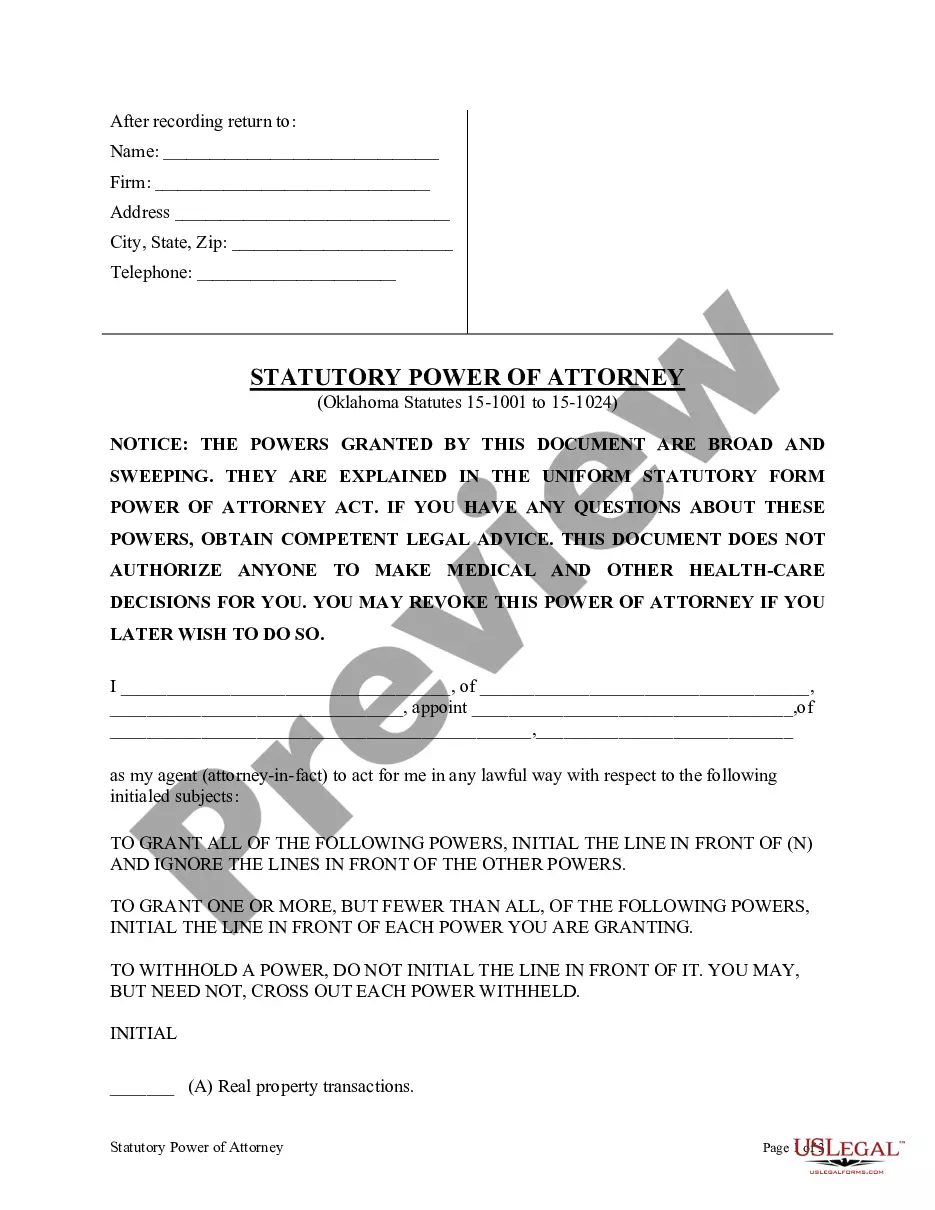

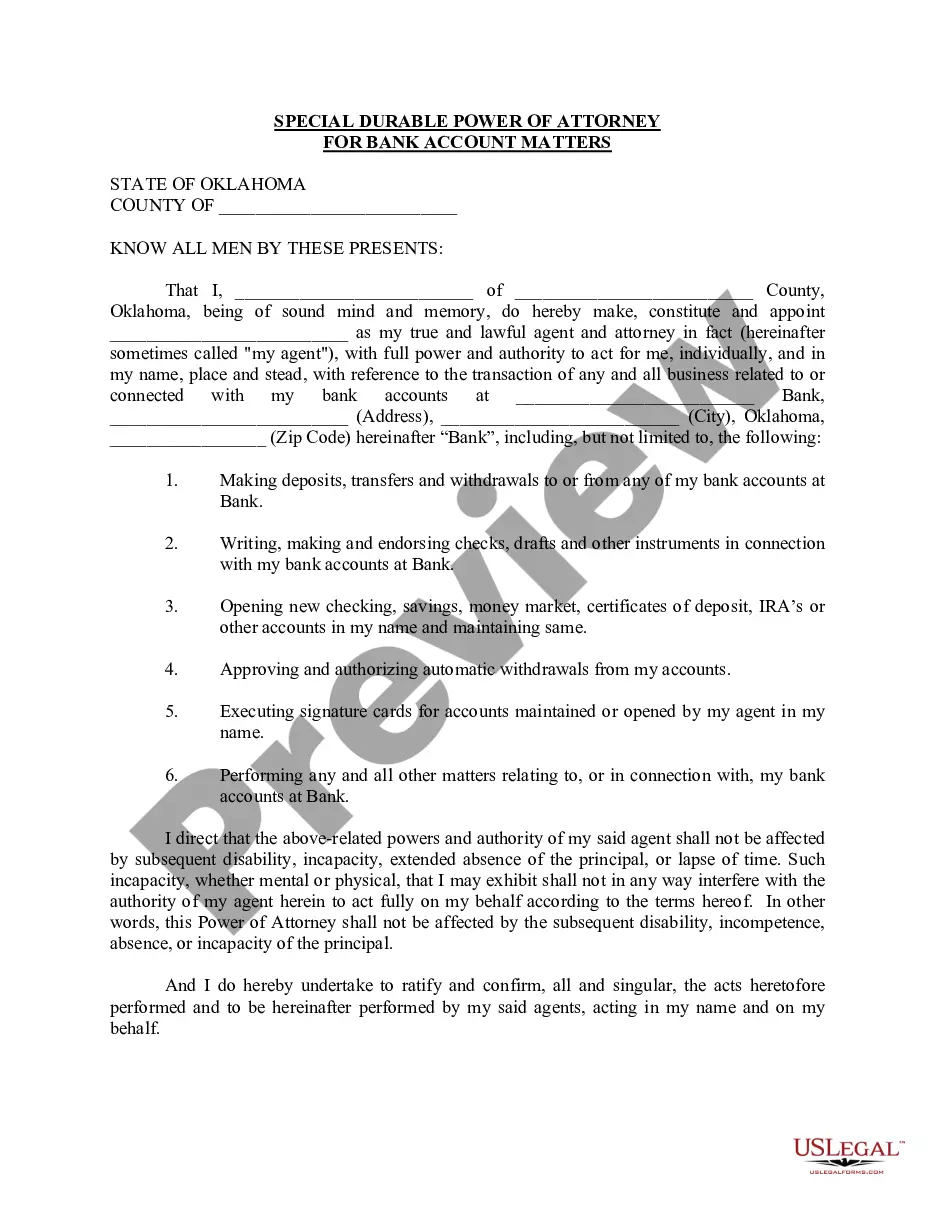

What is Power of Attorney?

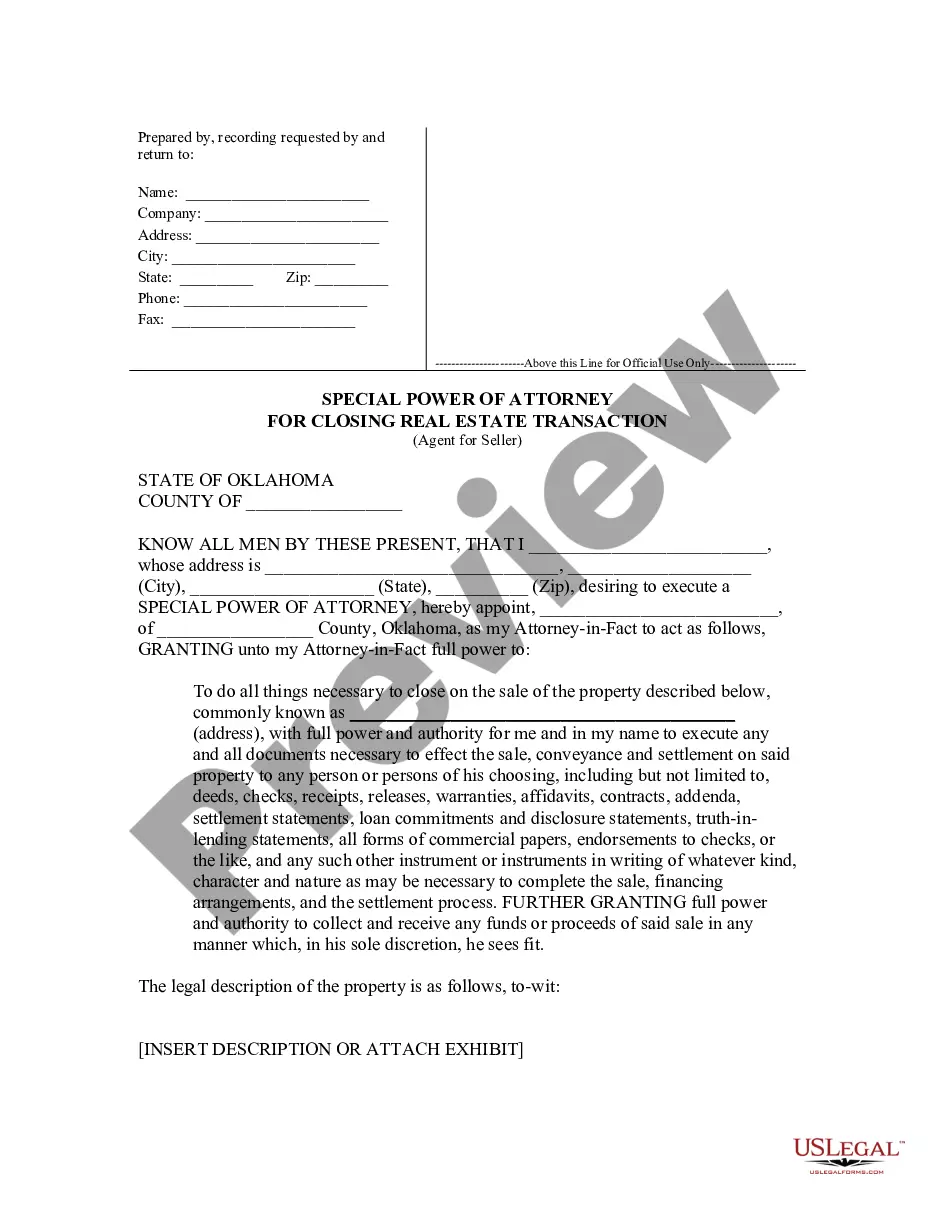

Power of Attorney is a legal document that lets one person authorize another to make decisions on their behalf. These documents are useful in various situations, including financial and healthcare matters. Explore state-specific templates for your needs.