Revocation Living Trust With A Beneficiary

Description

How to fill out Oklahoma Revocation Of Living Trust?

- Visit the US Legal Forms website and log in to your account if you are an existing user. Otherwise, create a new account to get started.

- In the search bar, type 'Revocation living trust with a beneficiary' and check the forms available. Make sure to read the preview mode and form descriptions.

- If the initial form does not match your needs, utilize the search tab to find more suitable templates.

- Once you locate the correct document, click on the 'Buy Now' button and select your preferred subscription plan. Create your account if you haven't done so already.

- Enter your payment details, either by credit card or PayPal, and complete your purchase.

- After purchasing, download the form directly to your device. You can also access it later in the 'My Forms' section of your profile.

By following these steps, you can efficiently revoke your living trust with a beneficiary while ensuring that all legal requirements are met. US Legal Forms provides you with a reliable toolset to make this process smooth.

Take action now—visit US Legal Forms and simplify your legal documentation today!

Form popularity

FAQ

Deciding whether to put assets in a trust depends on your family's unique situation. A revocation living trust with a beneficiary can provide significant benefits, including avoiding probate and protecting assets from potential creditors. However, it is crucial for your parents to discuss their specific needs with a legal advisor to determine the best course of action for their estate planning.

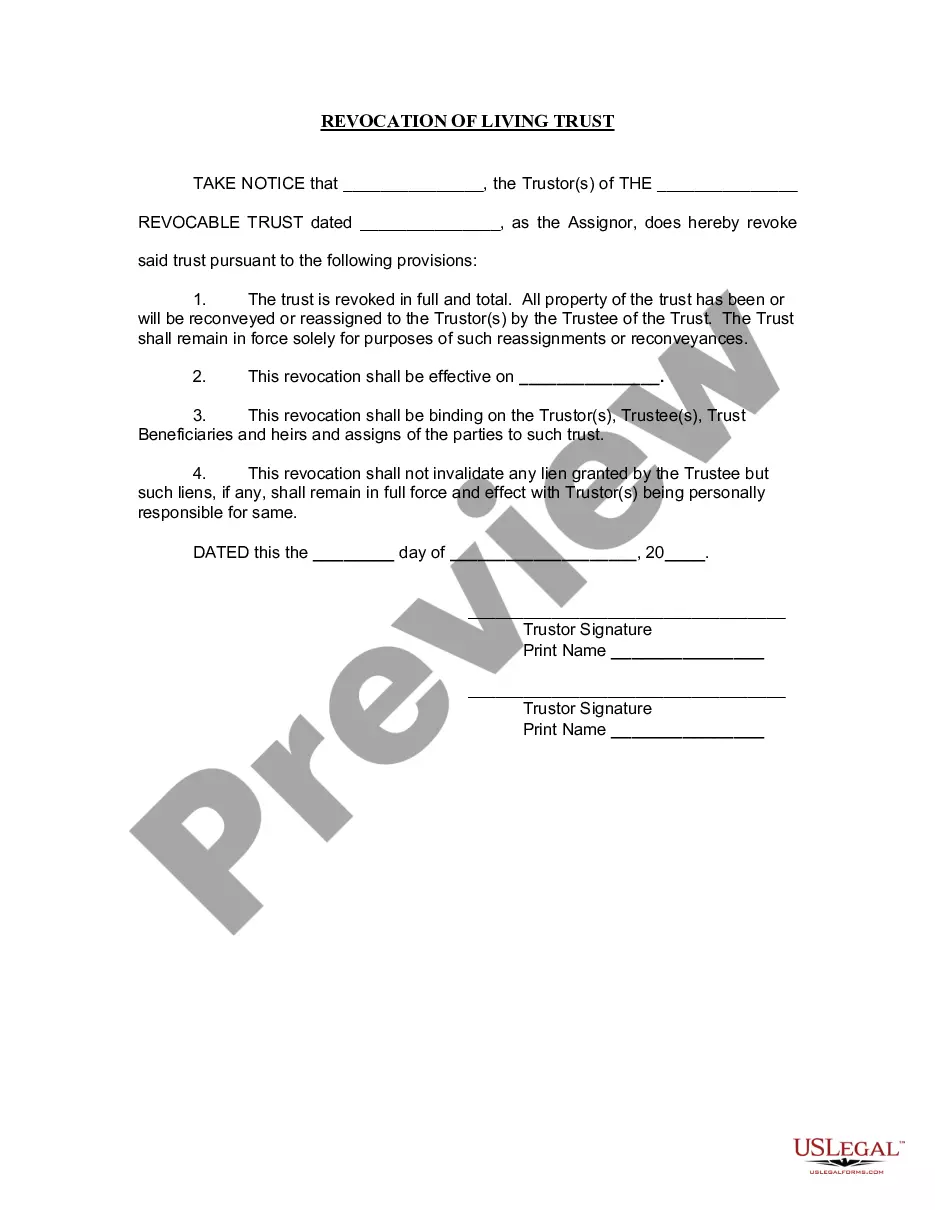

A sample revocation of living trust document typically states the intention to invalidate a previous trust. Such a document clearly outlines that all assets from the revocation living trust with a beneficiary will revert to the grantor. It is essential to ensure that this document is properly executed to avoid any confusion regarding asset ownership.

One downside of putting assets in a trust is the loss of direct control over those assets. Once assets are placed in a revocation living trust with a beneficiary, the trust administrator manages them according to the trust's terms. This can create a disconnect between the original owner and their assets, complicating access when unexpected needs arise.

The primary disadvantage of a family trust lies in the potential complexity and ongoing maintenance requirements. A revocation living trust with a beneficiary must be properly managed and updated to avoid disputes later on. Moreover, if not correctly structured, a family trust may fail to shield assets from creditors or intended tax benefits.

One significant mistake parents often make when establishing a trust fund is failing to choose the right beneficiaries. If parents do not fully understand the implications of a revocation living trust with a beneficiary, they may inadvertently create complications for their heirs. It’s important to clearly designate beneficiaries who will manage the trust effectively, ensuring their intentions are honored.

Revoking a revocable trust with a beneficiary is quite straightforward. Typically, you can do this by drafting a written document that specifies your intention to revoke the trust. It is important to follow the guidelines set forth in your original trust agreement to ensure compliance. Using a service like US Legal Forms can simplify the process, as they provide templates and resources tailored for revocation living trust with a beneficiary.

The 5 year rule for trusts relates to the period in which a beneficiary can receive distributions without facing adverse tax implications. This rule states that certain distributions must occur within five years to avoid penalties or increased taxes. In managing a revocation living trust with a beneficiary, being aware of this timeline can help ensure efficient and compliant asset distribution.

A trust can be terminated by mutual consent of all beneficiaries and the trustee, by the terms of the trust itself, or by operation of law. In cases of a revocation living trust with a beneficiary, the grantor may also revoke the trust unilaterally if they are still of sound mind. Understanding these termination methods is crucial for proper trust management.

A living trust does not inherently override a beneficiary designation found in insurance policies or retirement accounts. Instead, it works in concert with these designations. However, in situations involving a revocation living trust with a beneficiary, it can provide clarity and enforce the wishes of the grantor regarding asset distribution.

A revocation of living trust is the process by which a grantor formally cancels their trust, rendering it ineffective. This action may involve signing a revocation document and, in some cases, notifying the beneficiaries. Understanding the implications of this revocation is vital, especially in the context of a revocation living trust with a beneficiary, as it affects how assets are distributed.