Living Trust Forms Oklahoma

Description

Form popularity

FAQ

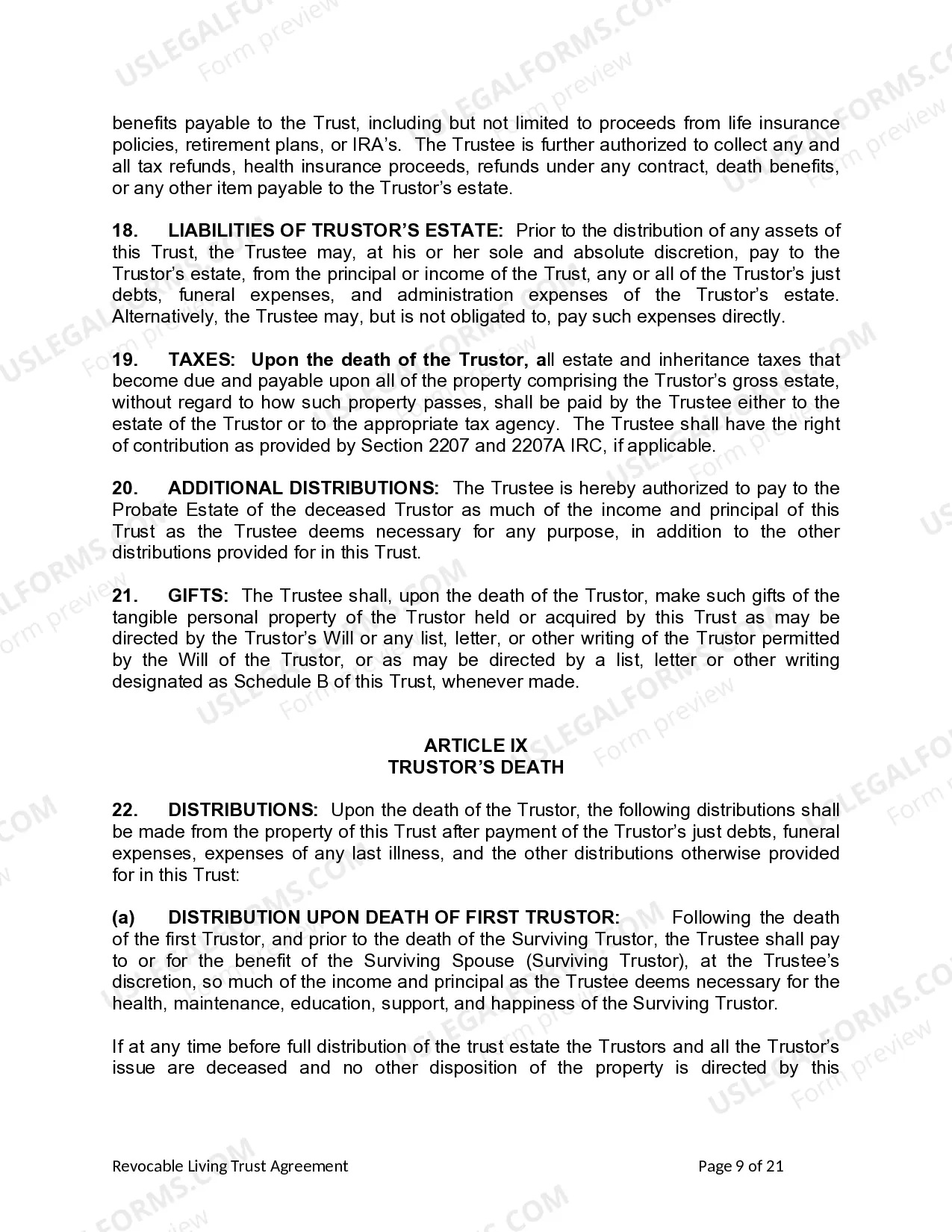

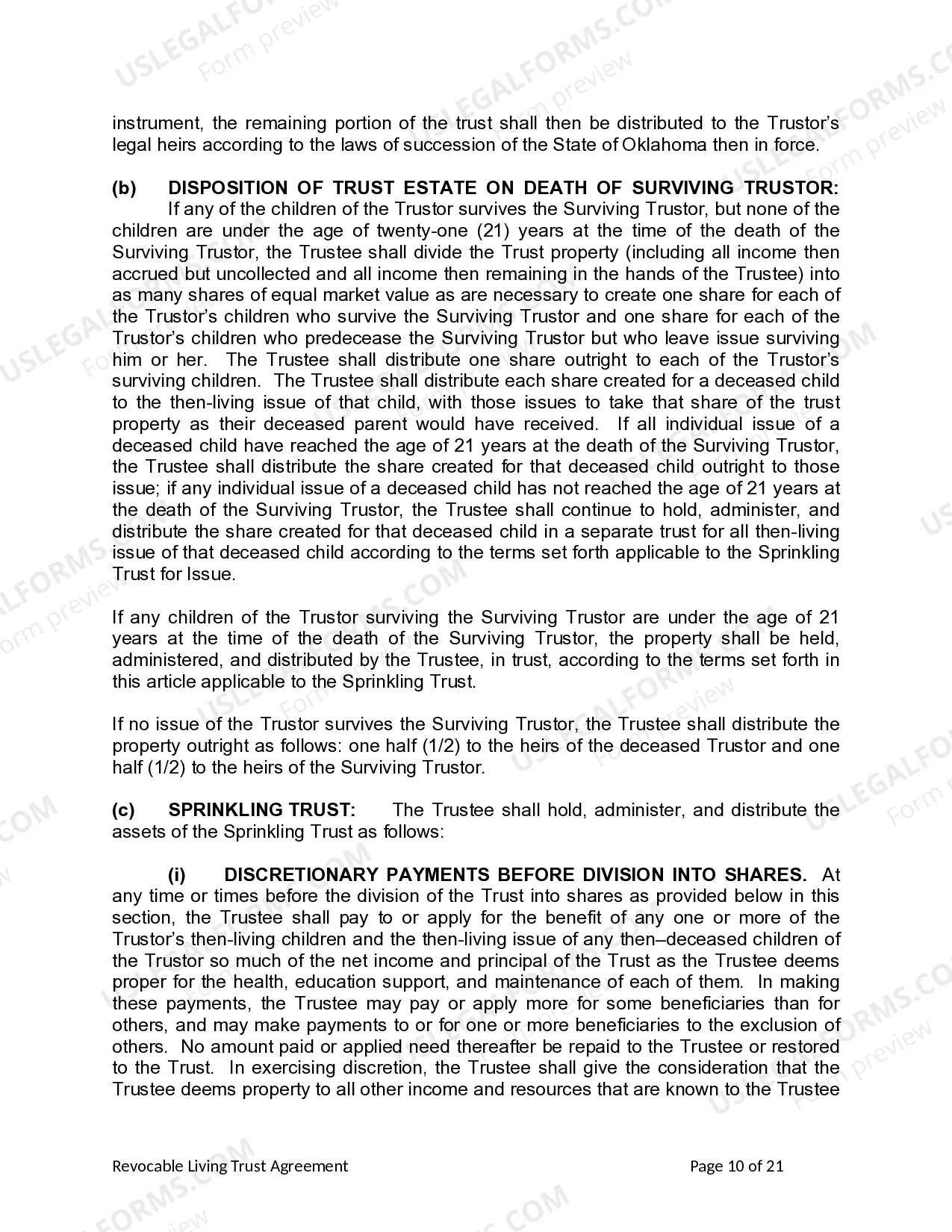

To create a living trust in Oklahoma, you typically need a trust declaration, which outlines the terms of the trust, and a property transfer document to move your assets into the trust. Additionally, you may require a pour-over will to handle any assets not included in the trust. Using living trust forms Oklahoma from US Legal Forms simplifies this process by providing customizable and legally compliant templates. This ensures you have all necessary documents without confusion.

No, a trust does not need to be filed with the court in Oklahoma. This feature makes living trusts a preferred method for many individuals seeking to manage their assets privately. However, ensure that your trust documentation is complete and stored properly to avoid any issues later. For assistance with creating your living trust, explore the resources available at US Legal Forms, including living trust forms Oklahoma to help you start.

Some assets should generally not be placed in a living trust, such as retirement accounts, life insurance policies, and certain jointly owned properties. These assets often have their own beneficiary designations which may be more effective. It's also recommended to keep your primary residence in your name rather than the trust for protection against claims. For tailored advice, refer to US Legal Forms for expert guidance on living trust forms Oklahoma.

To put everything in a living trust, you will need to transfer ownership of your assets to the trust. This involves changing the titles of real estate, bank accounts, and other property to reflect the trust as the new owner. It's important to update beneficiary designations on any applicable accounts as well. Consider utilizing US Legal Forms to streamline this process with proper living trust forms Oklahoma.

In Oklahoma, a living trust does not need to be filed with the court. This is one of the advantages of having a living trust, as it allows you to maintain privacy concerning your assets. However, it is crucial to ensure that all documentation is correctly completed and stored securely. US Legal Forms provides comprehensive resources to assist you in creating your living trust forms Oklahoma, ensuring everything is in order.

To file a living trust in Oklahoma, begin by obtaining the necessary living trust forms Oklahoma offers. Complete these forms with accurate information about your assets and beneficiaries. Once you have filled out the forms, there is no need to file them with the court, but keeping them in a safe place is essential. You can also consider using US Legal Forms to find reliable templates and guidance for creating your living trust.

The downside of putting assets in a trust often includes losing direct control over those assets. Once assets are transferred, they belong to the trust, not the individual. This may impact your parents' access to those resources. Utilizing living trust forms Oklahoma can clarify these issues, but it's essential to consider how this change aligns with their overall financial strategy.

One downfall of having a trust is the ongoing management it requires, which can become burdensome over time. This includes maintaining accurate records and handling tax filings. While living trust forms Oklahoma help establish the trust initially, keeping it updated and compliant is crucial. Consider whether you have the time and resources to manage this effectively.

Putting assets in a trust can be a wise decision for many families, as it encourages efficient asset management and can simplify the inheritance process. For your parents, considering living trust forms Oklahoma can provide a clear way to safeguard their assets and outline their wishes. Having these discussions with them can ensure they understand the benefits and responsibilities of creating a trust.

Trust funds can expose assets to potential mismanagement if the trustee is not carefully selected. Furthermore, families may face tax challenges if the trust is not structured correctly. By using dependable living trust forms Oklahoma, you can minimize risks and set a solid foundation for managing your assets. Always consider working with knowledgeable individuals to oversee these aspects.