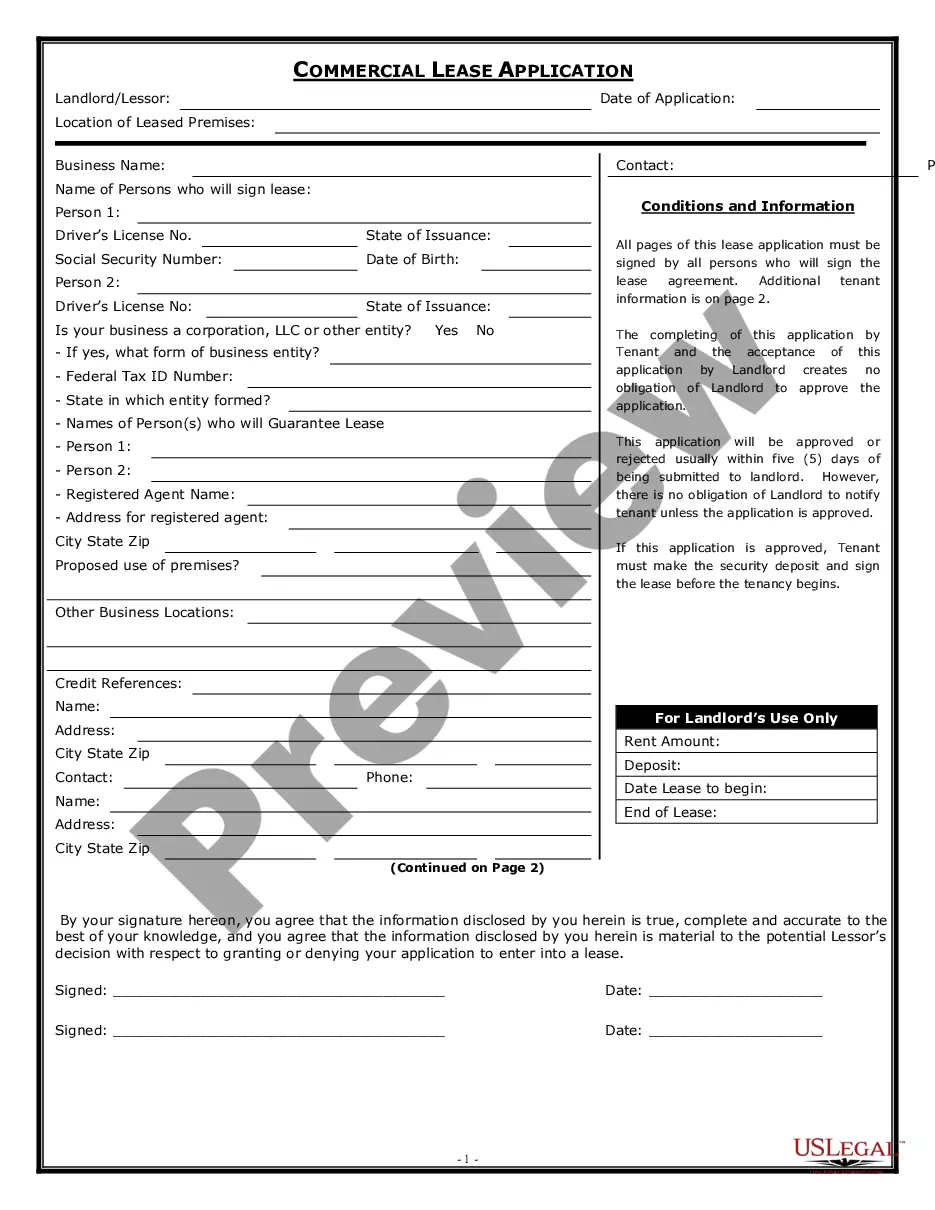

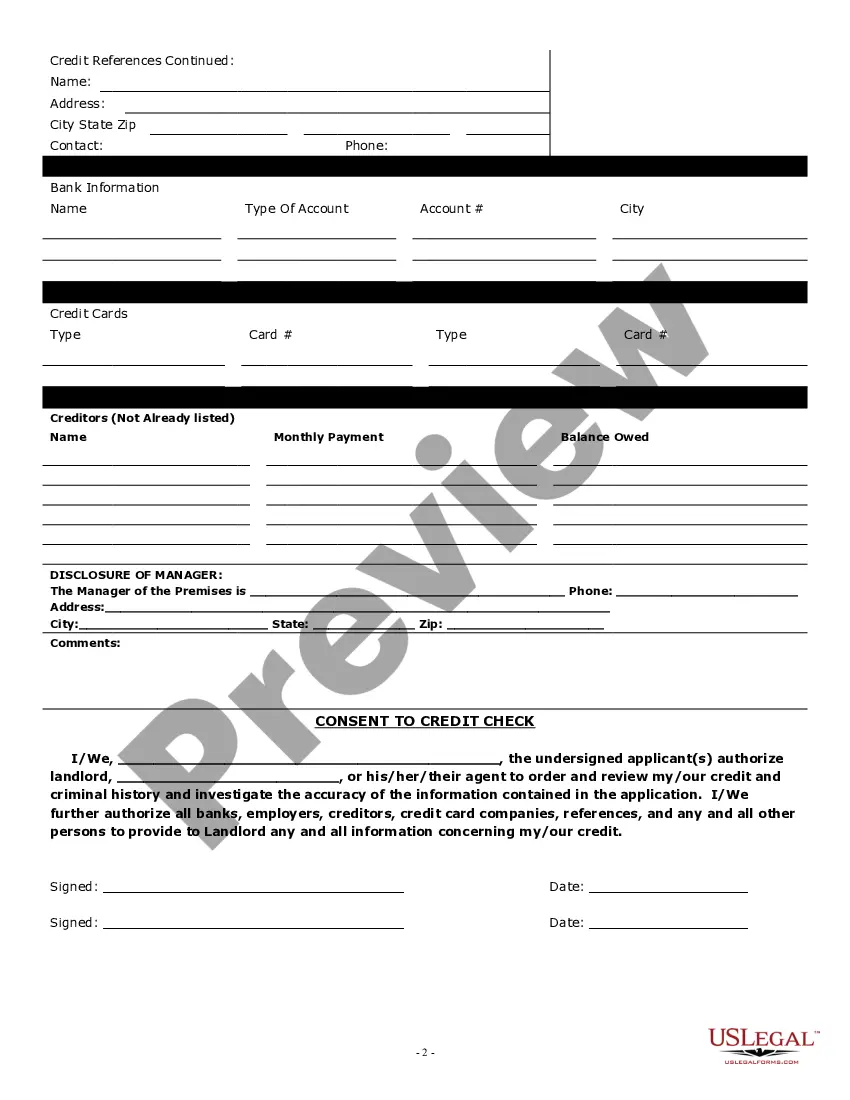

Oklahoma Rental Application With Credit Check

Description

How to fill out Oklahoma Rental Application With Credit Check?

Individuals often link legal documentation with complexity that only a professional can handle.

In a sense, this is accurate, as preparing an Oklahoma Rental Application With Credit Check necessitates a significant understanding of subject criteria, including state and local statutes.

Nonetheless, with US Legal Forms, everything has become simpler: pre-made legal documents for any personal and business circumstance tailored to state laws are compiled in a single online library and are now accessible to everyone.

All templates in our library are reusable: once obtained, they remain stored in your profile. You can access them anytime through the My documents tab. Explore all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current documents categorized by state and purpose, making it easy to find the Oklahoma Rental Application With Credit Check or any other specific template in just a few minutes.

- Existing users with an active subscription should Log In to their account and select Download to retrieve the form.

- New users on the platform must first set up an account and subscribe before they can download any legal documentation.

- Here is a step-by-step guide on how to obtain the Oklahoma Rental Application With Credit Check.

- Review the page content carefully to verify it meets your requirements.

- Examine the form description or view it using the Preview option.

- If the previous sample doesn't match your needs, look for another one using the Search field in the header.

- Click Buy Now once you identify the appropriate Oklahoma Rental Application With Credit Check.

- Select a pricing plan that aligns with your requirements and budget.

- Create an account or Log In to continue to the payment page.

- Complete your payment for the subscription using PayPal or your credit card.

- Choose the format for your sample and click Download.

- Print your document or upload it to an online editor for faster completion.

Form popularity

FAQ

To fill out an Oklahoma rental application with credit check alongside a co-signer, start by providing all required personal information for both parties. Make sure to include financial details, such as income and credit history, clearly and accurately. Both you and your co-signer should review the application together to avoid any discrepancies, bolstering your application’s credibility.

Some landlords may hesitate to accept cosigners due to concerns about liability or financial risk. They might prefer tenants who can qualify independently with their own financial strength. Understanding these factors can help you prepare a more compelling Oklahoma rental application with credit check that directly addresses any potential landlord reservations.

Renting with a cosigner typically involves both parties completing the Oklahoma rental application with credit check together. The landlord will likely require the cosigner's financial details, including income and credit information. By presenting a united front, both you and your cosigner can enhance the overall strength of your application.

When filling out an Oklahoma rental application with credit check, include contacts who can vouch for your creditworthiness. You may list previous landlords, financial institutions, or personal references who understand your payment history. Choosing the right references can significantly influence a landlord’s perception of your reliability.

Having a cosigner can enhance your chances of securing an apartment, especially with an Oklahoma rental application with credit check. A cosigner provides additional security to landlords, which may make them more willing to approve your application. However, it’s important to discuss all responsibilities and obligations with your cosigner to ensure a smooth rental experience.

Filling out an Oklahoma rental application with a credit check that includes a cosigner is straightforward. First, provide your personal information, including your current address, employment details, and income. Next, fill out the cosigner's information, making sure to include their consent for a credit check. Finally, submit each application, ensuring that the credit check requirement is clearly understood by both parties, as this will greatly assist your rental process.

Passing a credit check for renting depends on your credit history and score. If your score aligns with the landlord's requirements, you stand a good chance of approval. An Oklahoma rental application with credit check will reveal your creditworthiness, so it’s advisable to assess your credit beforehand. For a detailed understanding and support, consider using uslegalforms to prepare effectively.

Most landlords prefer a minimum credit score of 600 to 650 when reviewing an Oklahoma rental application with credit check. However, acceptance can depend on various factors, including your rental history and income stability. Some landlords may be flexible and consider unique circumstances. Consulting uslegalforms can provide insights into the expectations and help you navigate these requirements effectively.

Getting an apartment with a 500 credit score is challenging, but it is not impossible. Some landlords may accept lower scores with additional stipulations, such as larger deposits or co-signers. It’s beneficial to be honest and explain your situation to potential landlords. Using uslegalforms can assist you in preparing a strong application that showcases your strengths, even with a lower credit score.

Yes, a credit score of 600 can qualify you for many rental options, especially with an Oklahoma rental application with credit check. While some landlords may have stricter criteria, others may accept this score if you meet additional requirements, like showing stable income. It helps to present a well-rounded application, so consider working with uslegalforms to enhance your chances.