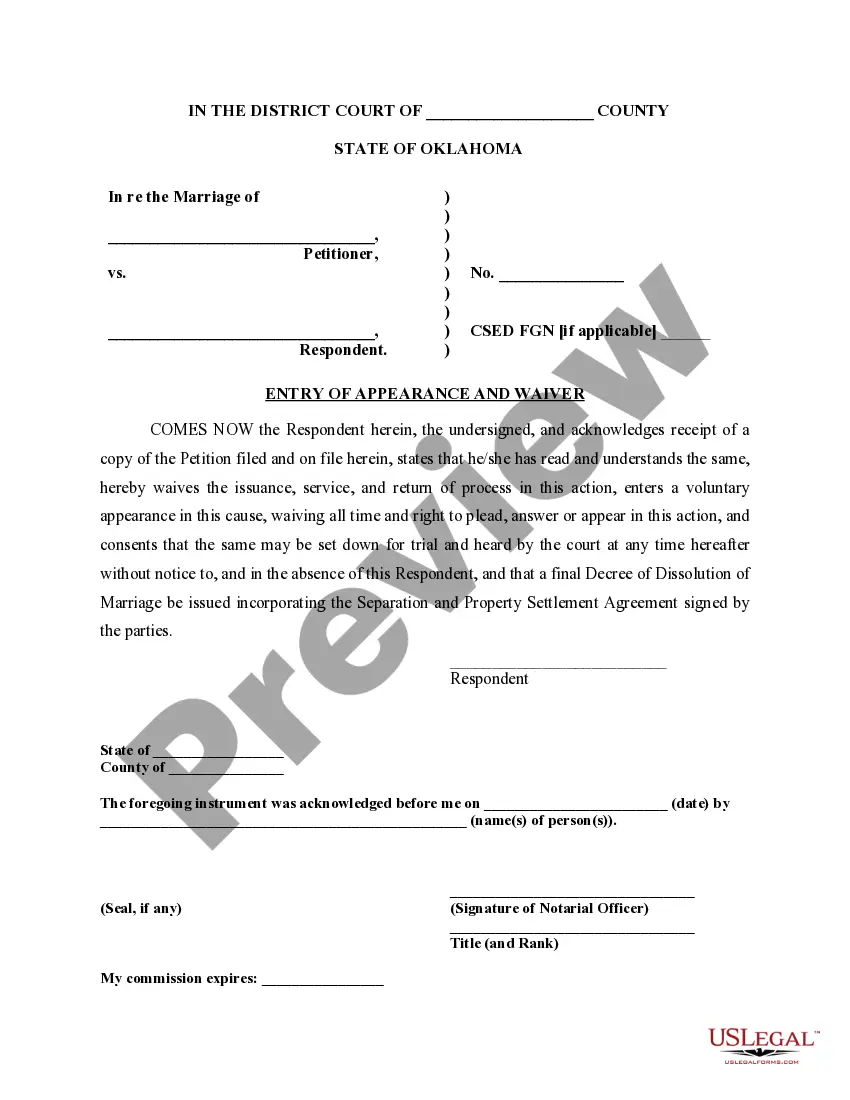

Oklahoma Divorce Waiver Form For Minor

Description

How to fill out Oklahoma Entry Of Appearance And Waiver?

Dealing with legal documents and processes can be an arduous addition to your daily routine.

Oklahoma Divorce Waiver Form For Minor and similar documents typically necessitate searching for them and grasping how to fill them out properly.

For this reason, whether you are managing financial, legal, or personal affairs, having an all-encompassing and accessible online library of forms at your fingertips will be immensely beneficial.

US Legal Forms stands as the leading online resource for legal templates, boasting over 85,000 state-specific documents and various tools to help you complete your paperwork swiftly.

Is it your initial experience with US Legal Forms? Register and create a free account in a matter of minutes to gain access to the form library and Oklahoma Divorce Waiver Form For Minor. Afterwards, follow the outlined steps below to finish your form: Make certain you have located the correct document utilizing the Review feature and examining the document details. Choose Buy Now when ready, and select the monthly subscription option that suits you best. Hit Download then fill out, sign, and print the document. US Legal Forms possesses 25 years of experience assisting users in managing their legal documents. Acquire the document you require now and improve any procedure without breaking a sweat.

- Browse the collection of relevant documents available to you with just one click.

- US Legal Forms offers state- and county-specific documents accessible at any time for downloading.

- Safeguard your document management processes with a superior service that allows you to create any form within minutes without additional or concealed charges.

- Simply Log In to your account, locate Oklahoma Divorce Waiver Form For Minor and obtain it instantly in the My documents section.

- You can also retrieve previously downloaded documents.

Form popularity

FAQ

In the United States, donations made to qualified charitable organizations are tax deductible for the donor. This includes donations made through charity auctions, as long as the organization conducting the auction is a qualified charity and the donated item is used for the organization's tax-exempt purposes.

Under IRS rules, your organization must provide a written disclosure statement of the FMV of the goods or services received by any donor who makes a payment of more than $75 that's partly a contribution and partly for those items. Such disclosures are often required for charitable auction bids exceeding $75.

Here are some tips to accurately record the in-kind donations you collect in advance of your auction: Know each item's fair market value (FMV). ... Record each in-kind donation as a debit and a credit. ... Adjust your record of each item after the event. ... Total all of your in-kind donation values.

Accounting for the sale of a donated auction item In summary, the net effect of the transactions is that total contribution revenue should equal the amount of cash received. If all the donations are received in the same period as the auction, one entry could be used to record the cash received and the revenue.

Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for an item over its fair market value. The donor must be able to show, however, that he or she knew that the value of the item was less than the amount paid.