Joint Custody Plan Oklahoma Template For Child

Description

How to fill out Oklahoma Parenting Plan Order?

Locating a reliable source for obtaining the latest and most pertinent legal samples is a significant part of managing bureaucracy.

Selecting the appropriate legal documents requires accuracy and meticulousness, which is why it is crucial to source Joint Custody Plan Oklahoma Template For Child exclusively from reputable providers, such as US Legal Forms. An incorrect template can squander your time and prolong your situation.

Eliminate the stress associated with your legal documentation. Explore the extensive US Legal Forms library, where you can discover legal samples, verify their relevance to your circumstances, and download them instantly.

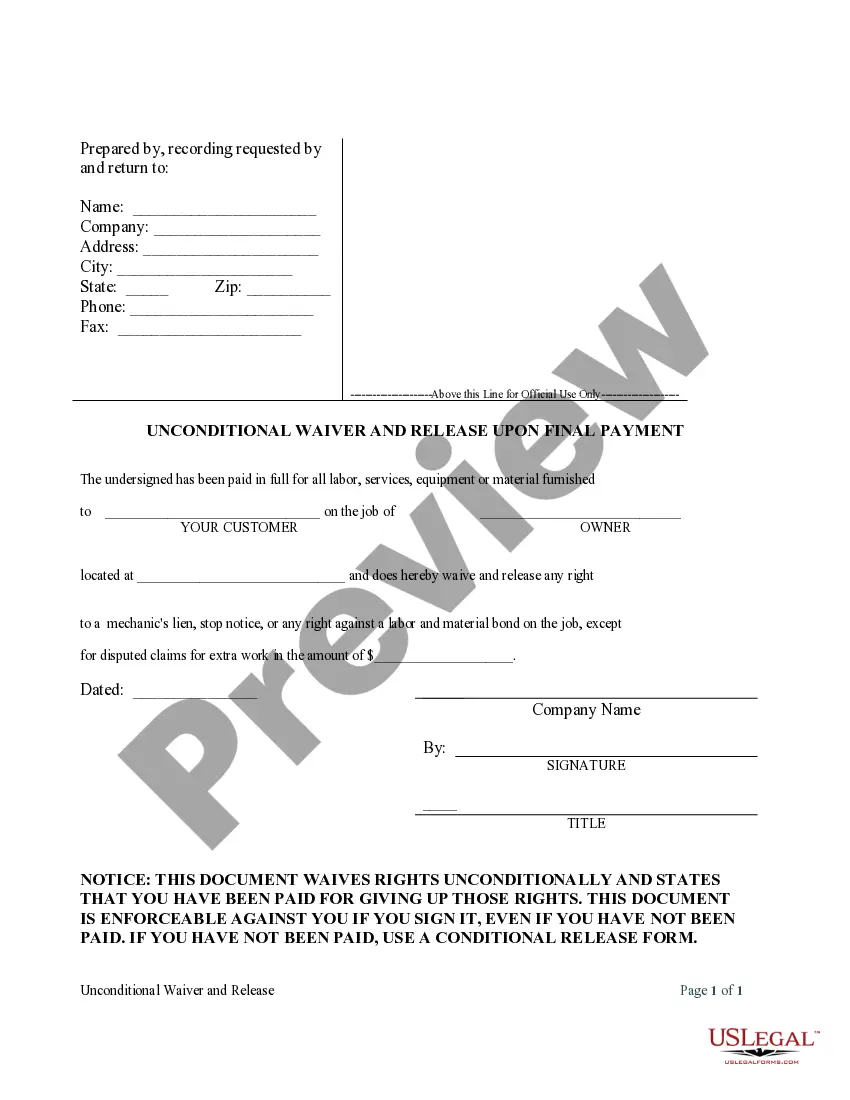

- Use the library navigation or search function to find your sample.

- Review the form's information to determine if it suits the requirements of your state and locality.

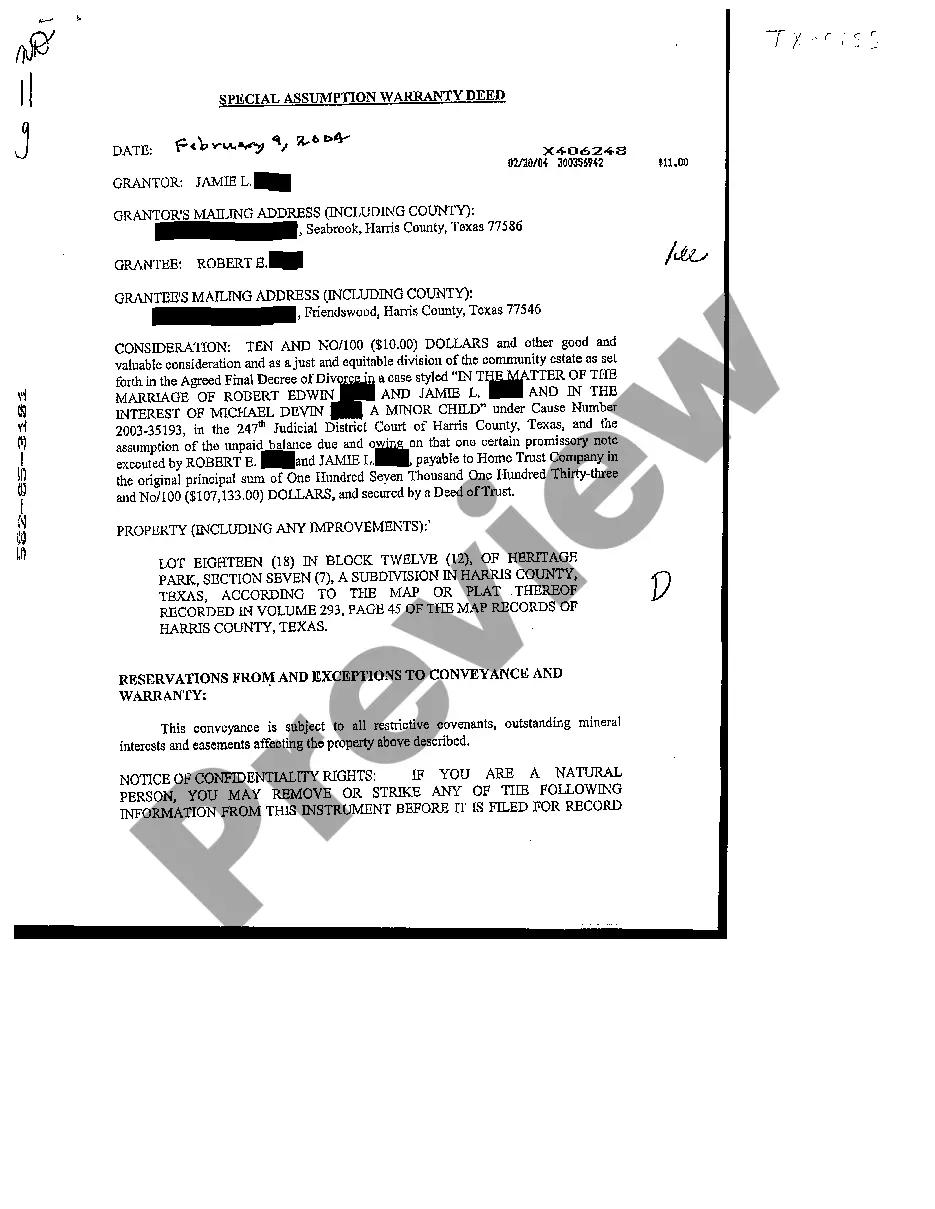

- Preview the form, if available, to verify it is the document you need.

- Return to the search and find the correct template if the Joint Custody Plan Oklahoma Template For Child does not fit your needs.

- If you are confident about the form's suitability, download it.

- As a registered user, click Log in to verify your identity and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Choose the pricing plan that aligns with your needs.

- Proceed to the registration to complete your transaction.

- Finalize your purchase by selecting a payment option (credit card or PayPal).

- Select the document format for downloading Joint Custody Plan Oklahoma Template For Child.

- Once you have the form on your device, you may edit it using the editor or print it out and fill it in manually.

Form popularity

FAQ

On the state level, New Hampshire also directly taxes LLCs making income over certain thresholds through a business profits tax and a business enterprise tax. While it has no general state income tax, LLC members may be subject to a tax on interest and dividend income until it is phased out in 2027.

In New Hampshire, starting a small business, particularly a sole proprietorship is possible without filing any legal documents with the state. All of the licensing and permits can be done within the city or county.

New Hampshire's business profits tax is charged at a flat rate. For 2020 through 2021, the tax rate is 7.7%. For 2022 and later the rate lowers to 7.6%.

All business organizations, including Limited Liability Companies (LLC), taxed as a partnership federally must file Form NH-1065 return provided they have conducted business activity in New Hampshire and their gross business income from everywhere is in excess of $92,000.

New Hampshire, however, is different: It does require sole proprietorships to pay both the business profits tax and the business enterprise tax. The sole proprietor, however, does not owe state tax on the income they ultimately receive from the business.

The business profits tax is imposed on any enterprise, whether corporation, partnership, limited liability company, proprietorship, association, business trust, real estate trust, or other form of organization organized for gain or profit and carrying on any business in New Hampshire.

Sole proprietorships and general partnerships do not need to file formation paperwork with the state. It's only when forming a separate legal entity, like an LLC or corporation, that you need to file with the Secretary of State. To form a New Hampshire LLC, file your New Hampshire Certificate of Formation for $100.

All business organizations, including corporations, fiduciaries, partnerships, proprietorships, single member limited liability companies (SMLLC), and homeowners' associations which are part of a group of related business organizations operating a unitary business as defined in RSA 77-A:1, XIV engaged in business ...