Subcontractor Business

Description

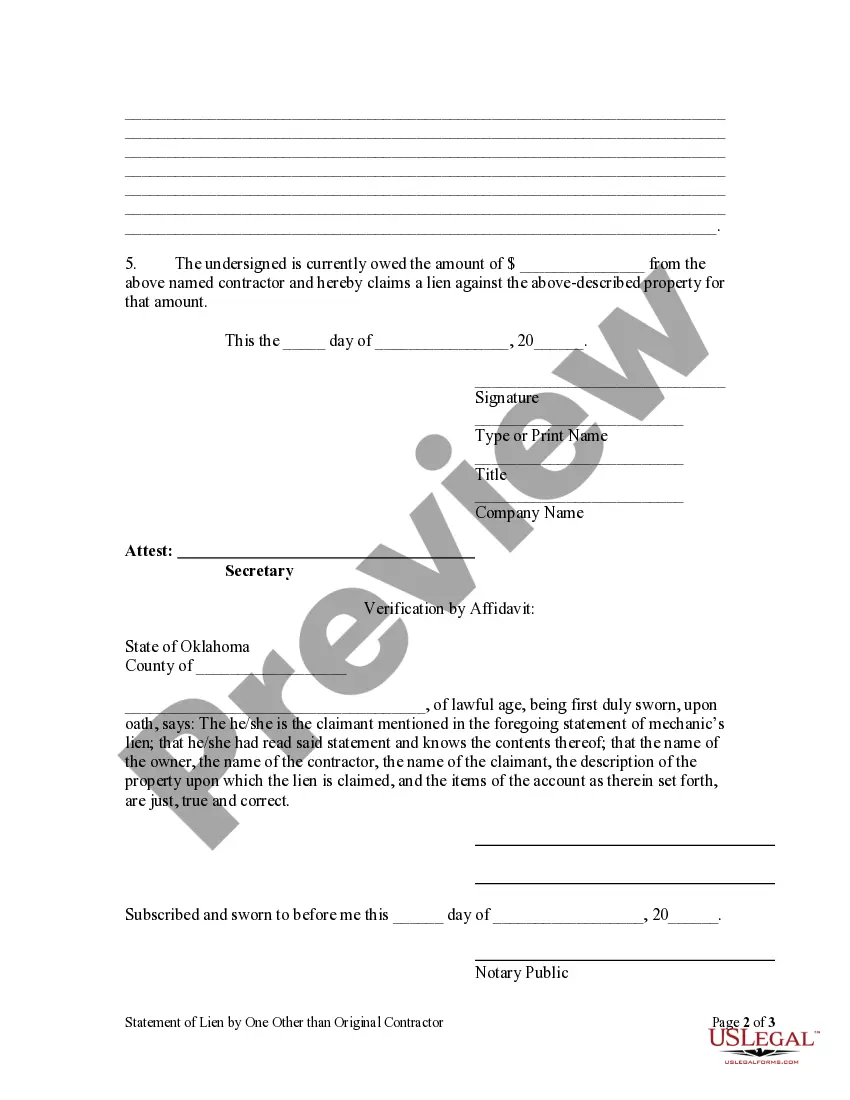

How to fill out Oklahoma Statement Of Lien - Subcontractor And Other By Corporation?

- Log in to your account if you're a returning user, ensuring your subscription is active. If it's expired, renew based on your payment plan.

- For new users, start by reviewing the Preview mode and detailed descriptions of the available forms. Confirm that the one you select meets your specific needs and complies with local regulations.

- If you don't find the right form, utilize the Search function to identify a suitable template that correctly addresses your requirements.

- Proceed to purchase the document by clicking the Buy Now button. Choose a subscription plan that fits your needs, and create an account to access the complete library.

- Finalize your purchase by providing your payment information. You can pay via credit card or PayPal.

- After purchase, download your selected form directly to your device. You can also find it later in the My Forms menu within your account for future access.

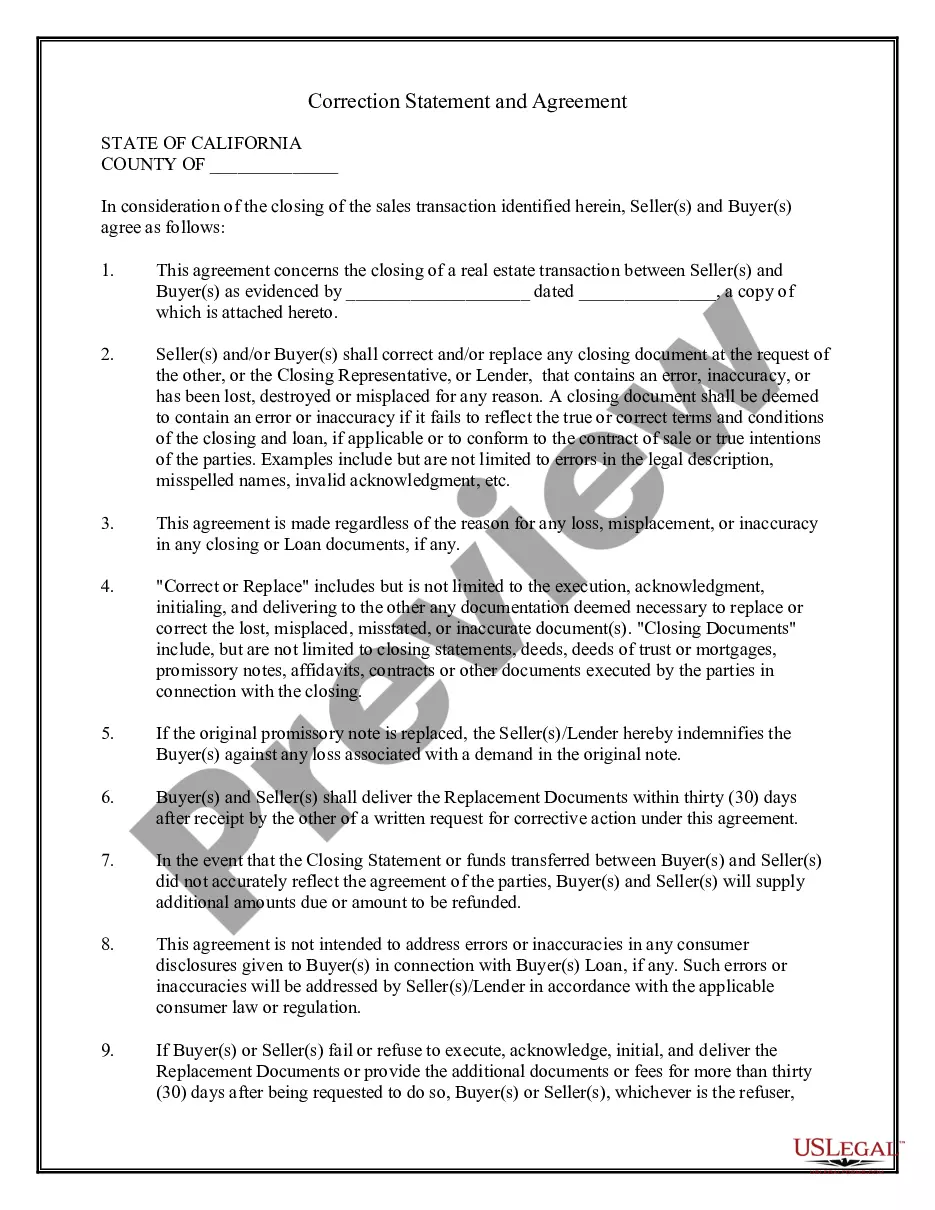

With US Legal Forms, you gain access to a robust collection of legal documents, often at a lower price than competitors. Plus, you can consult with premium experts to ensure your forms are completed accurately and legally sound.

Start your journey with US Legal Forms today and take the hassle out of managing your subcontractor business documentation. Visit us now to get started!

Form popularity

FAQ

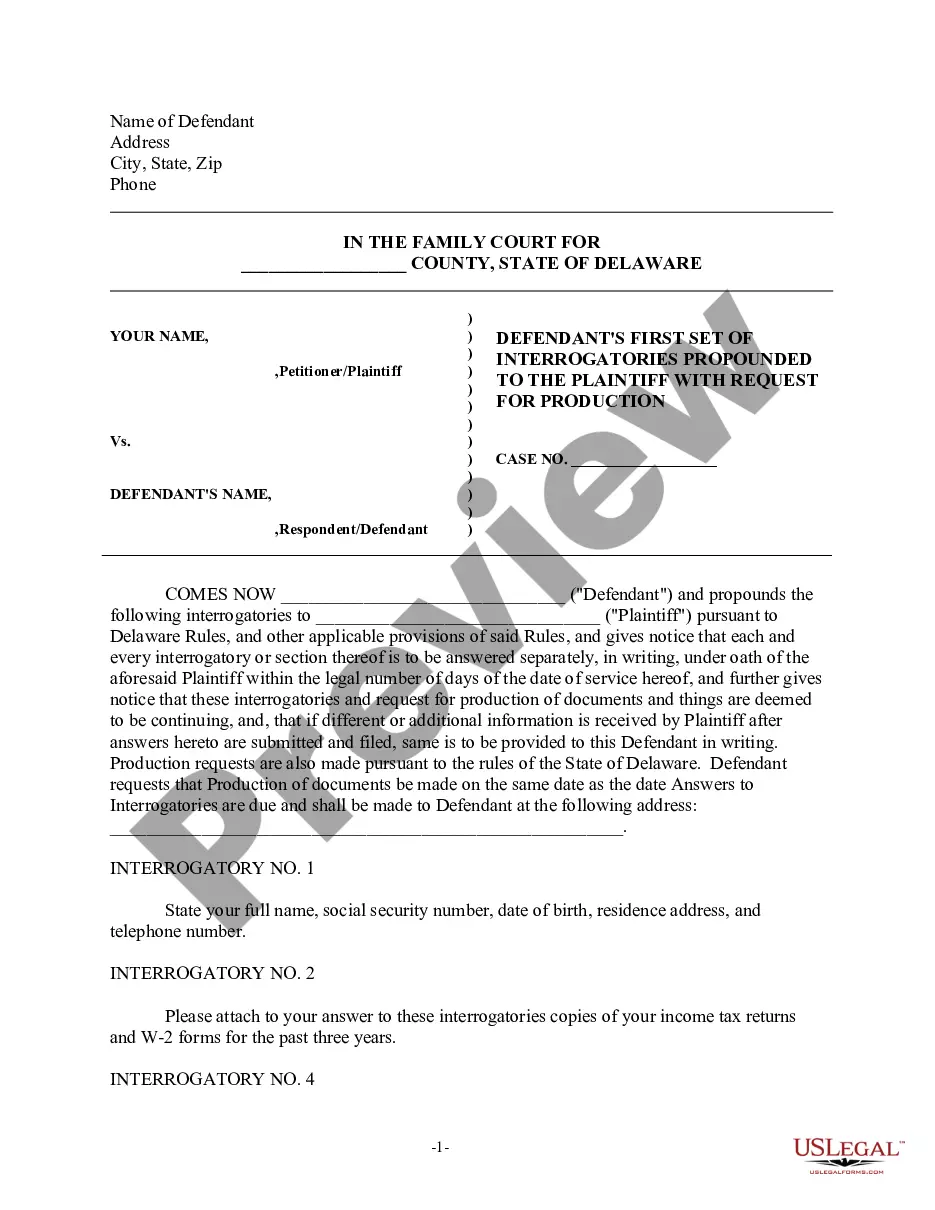

You should provide a W9 form for the subcontractor to complete, which allows you to gather their tax identification information. This form is crucial in maintaining accurate records for your invoice and tax filings. Ensuring that this form is submitted correctly will support the smooth operation of your subcontractor business.

As a subcontractor, you will report your income and expenses on a Schedule C form when you file your personal tax return. It's crucial to track your income and expenses throughout the year, as this information will affect your tax liability. Using tools or platforms that assist with bookkeeping can streamline this process for your subcontractor business.

You need several key documents for your subcontractor, such as a signed contract, a W9 form, and any relevant licensing information. This documentation provides clarity on the work being done and establishes a formal agreement. Keeping thorough records is vital to the efficiency of your subcontractor business.

Subcontractors should provide a completed W9 form, evidence of any necessary licenses or certifications, and a signed contract reflecting the terms of the work. These documents help establish a clear understanding of the expectations in your subcontractor business. Ensuring that you have these documents on hand can streamline your processes.

To hire a subcontractor, you typically need a written agreement or contract outlining the scope of work, payment terms, and deadlines. Additionally, you should collect a W9 form and any relevant licenses or certifications required for their specific trade. Proper paperwork helps protect both parties in your subcontractor business.

Yes, you need a W9 form for subcontractors. This form provides essential information, such as the subcontractor's name, address, and taxpayer identification number. Keeping accurate records with a W9 helps ensure compliance when you manage your subcontractor business.

Subcontractors typically receive a 1099-NEC form, rather than a 1099-MISC, for their services. This change reflects the IRS's updated reporting requirements for non-employee compensation. It's essential for anyone in the subcontractor business to understand these distinctions for accurate tax reporting.

Contractors generally fill out W9 forms to provide their information to clients. Clients then use the W9 to prepare necessary tax documents, such as the 1099. This practice is widely recognized in the subcontractor business and ensures compliance with tax regulations.

Employees do not fill out a 1099 form; instead, independent contractors do. They should ensure they gather their income information and prepare a W9 for their client. If you are exploring subcontractor business opportunities, it’s critical to know which forms apply to your status.

Yes, a subcontractor often needs an Employer Identification Number (EIN) if they have employees or operate as a corporation or partnership. This number helps in managing taxes and can even enhance credibility with clients. Thus, obtaining an EIN is a smart move for those in the subcontractor business.