Sample Trust Deed For Property Malaysia

Description

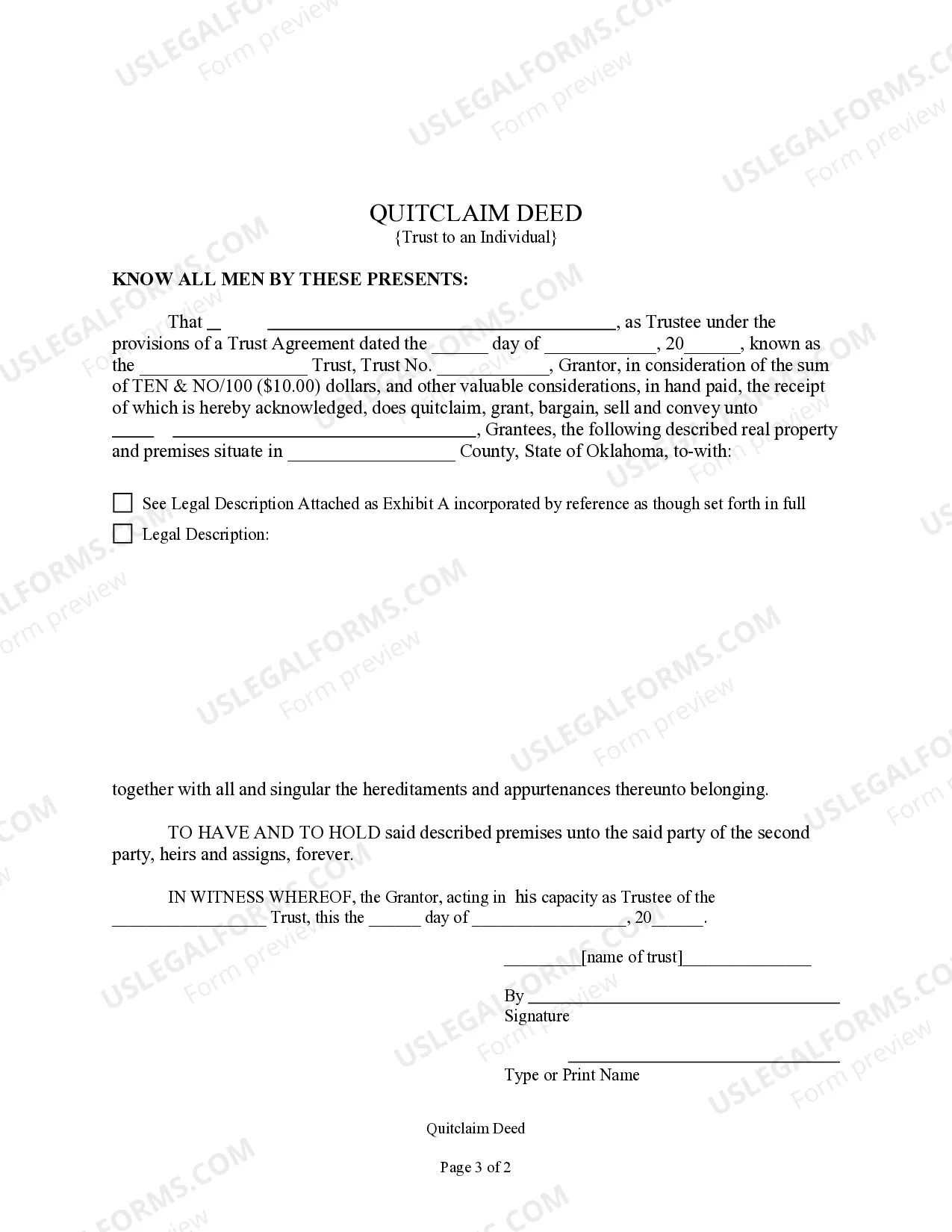

How to fill out Oklahoma Quitclaim Deed - Trust To An Individual?

Well-prepared formal documentation is one of the essential assurances for preventing problems and legal disputes, but obtaining it without the aid of an attorney may require time.

Whether you require to swiftly locate a current Sample Trust Deed For Property Malaysia or other molds for employment, family, or business events, US Legal Forms is consistently available to assist.

The process is even simpler for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the selected document. Furthermore, you can access the Sample Trust Deed For Property Malaysia at any time later, as all documents ever acquired on the platform remain available within the My documents tab of your profile. Save time and resources on preparing official documents. Experience US Legal Forms today!

- Confirm that the form is appropriate for your situation and locality by reviewing the description and preview.

- Search for another sample (if necessary) using the Search bar in the page header.

- Press Buy Now when you locate the right template.

- Select the pricing option, Log In to your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Sample Trust Deed For Property Malaysia.

- Press Download, then print the sample to complete it or incorporate it into an online editor.

Form popularity

FAQ

A Trust Deed can be worth the investment, especially when it protects your property and clarifies your intentions for asset distribution. By utilizing a Sample trust deed for property Malaysia, you ensure your assets are handled according to your wishes, providing peace of mind. Additionally, a well-structured trust can alleviate future disputes among beneficiaries, making it a sound choice for many estate plans.

One downside of a trust involves the potential complexities and costs of establishing and managing it. Trusts might require professional guidance and legal fees, which can add up over time. Additionally, if not properly executed, the intended benefits of a Sample trust deed for property Malaysia may not be fully realized, leading to complications for the beneficiaries.

Yes, a Trust Deed can influence your bank account, particularly if the account holds assets included in the trust. Typically, your bank account should reflect the terms of the Trust Deed, including any required notifications to your bank. Moreover, for those managing property through a Sample trust deed for property Malaysia, it’s essential to be aware of how your finances intersect with your assets in the trust.

At the end of a Trust Deed, the assets that were placed in trust are distributed according to the terms established in the deed. This process typically involves a thorough review to ensure all obligations have been met. After distribution, the Trust Deed effectively ceases to exist, allowing individuals to move forward with clear ownership. Understanding a Sample trust deed for property Malaysia can help clarify these processes.

Yes, a trust deed is recognised as a legal instrument in Malaysia. It provides clarity on the management and distribution of assets for the beneficiaries. Consulting a legal professional or using a reliable template can help ensure your trust deed meets all necessary legal standards.

Forming a trust in Malaysia involves drafting a trust deed and appointing a trustee. You should identify the property and the beneficiaries in the deed. Utilizing a sample trust deed for property Malaysia can simplify this process and ensure that all legal requirements are met.

A trustee can sell trust property in Malaysia, but this must be done in accordance with the trust deed. The trustee has a fiduciary duty to act in the beneficiaries' best interests. It's essential to consult the deed to ensure compliant actions that benefit all parties involved.

Yes, trusts can be effectively used in Malaysia for managing and distributing assets. They offer a way to safeguard property for future generations or specific beneficiaries. A sample trust deed for property Malaysia can guide you in setting up a trust that aligns with your goals.

In Malaysia, a trust deed is a legal document that establishes a trust. It allows a trustee to manage property on behalf of beneficiaries. This document is crucial for ensuring the correct distribution of assets, especially in complex family situations.

A sample trust deed for property Malaysia outlines the terms under which the property is held for the benefit of beneficiaries. It specifies the trustee's powers and responsibilities, ensuring that the property is managed according to the grantor's wishes. Understanding this document is essential for anyone interested in estate planning.