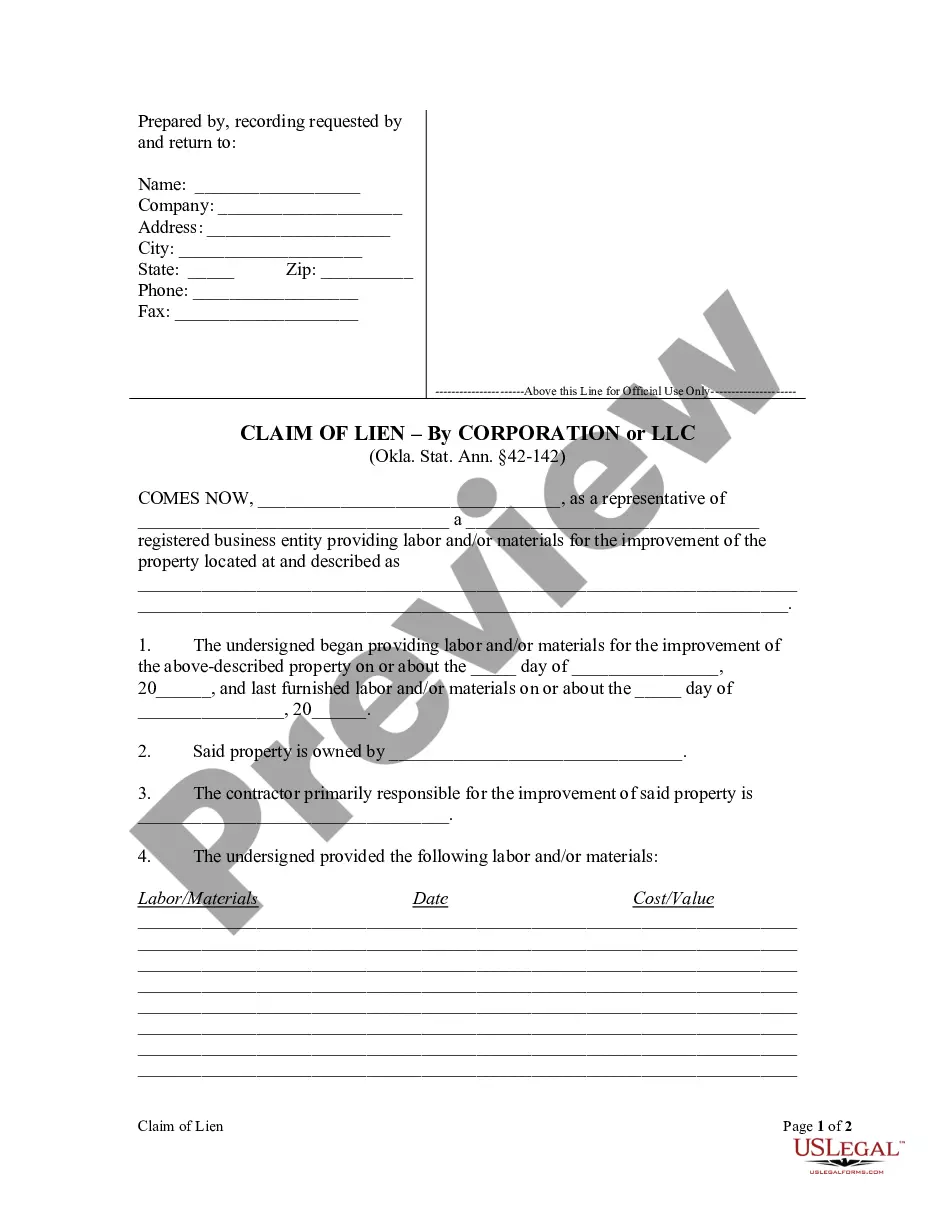

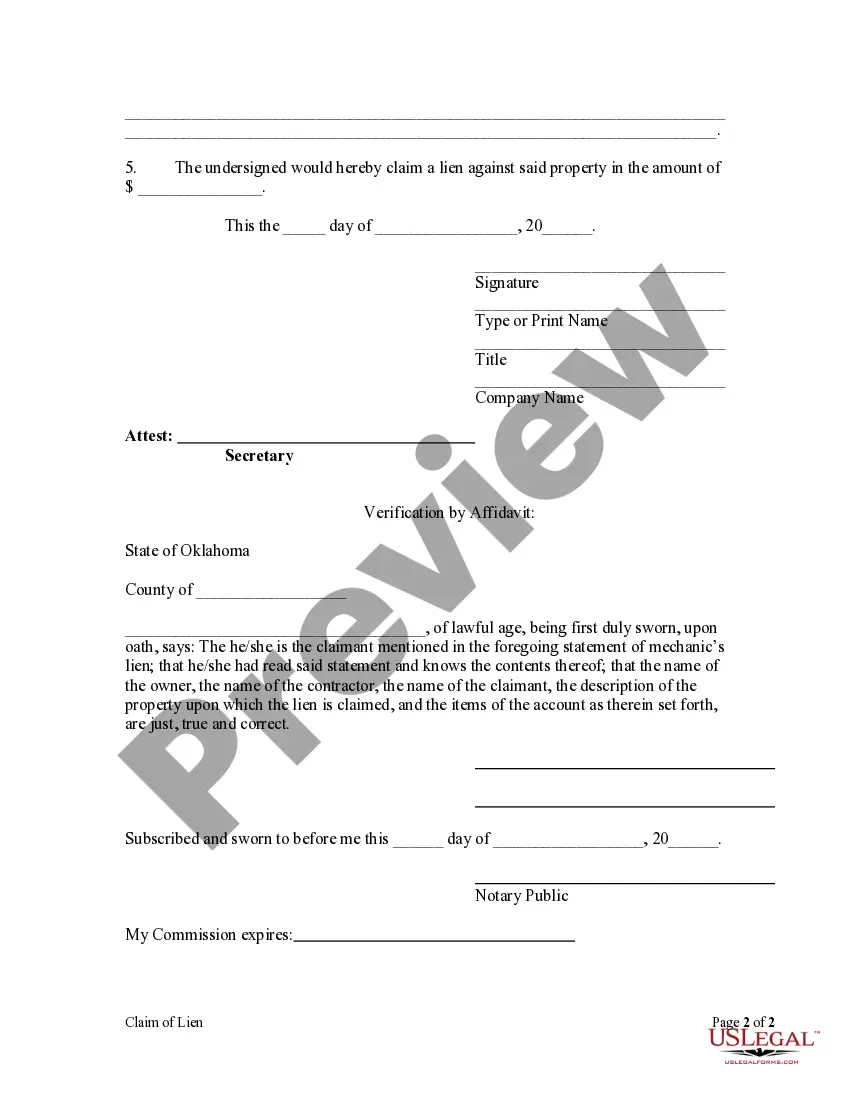

Any person who shall, under oral or written contract with the owner of any tract or piece of land, perform labor, furnish material or lease or rent equipment used on said land shall have a lien upon the whole of said tract or piece of land. Any person claiming a lien as aforesaid shall file in the office of the county clerk of the county in which the land is situated a statement setting forth the amount claimed and the items thereof as nearly as practicable, the names of the owner, the contractor, the claimant, and a legal description of the property subject to the lien, verified by affidavit. Such statement shall be filed within four (4) months after the date upon which material or equipment used on said land was last furnished or labor last performed under contract.

Ok Lien Oklahoma Withholding Form

Description

Form popularity

FAQ

Oklahoma tax forms are readily available on the Oklahoma Tax Commission's website. They provide downloadable forms for various tax filings, including income tax and withholding forms. You can also use websites like uslegalforms for easier access to the Ok lien oklahoma withholding form and other related documents. This ensures you have the most up-to-date forms at your fingertips.

You can look up Oklahoma tax liens through the Oklahoma Tax Commission's official website. They provide a searchable database that makes it easy to find tax lien information by entering specific criteria. Understanding the status of your liens can help you manage your taxes effectively, especially when dealing with the Ok lien oklahoma withholding form. Consider using uslegalforms for more guidance on this topic.

Yes, Oklahoma provides several state tax forms for individuals, businesses, and other entities. The primary income tax form is the 511 form for residents and the 511NR for non-residents. It's important to familiarize yourself with these forms to ensure proper filing. If you need help, uslegalforms offers various resources to guide you.

Yes, Oklahoma has its own version of the federal W-4 form. This form helps employees calculate the correct amount of state withholding tax. Be sure to fill out the Oklahoma W-4 accurately to avoid any issues with your state income tax. Resources like uslegalforms can assist you in obtaining this form easily.

Yes, Oklahoma imposes a state income tax which includes withholding tax. This tax applies to residents and non-residents who earn income in the state. If you're working in Oklahoma, understanding the Ok lien oklahoma withholding form is essential for compliance. Make sure to consult with tax professionals or use resources like uslegalforms to navigate this process.

The decision to put 0 or 1 for withholding depends on your specific financial circumstances and tax situation. If you put 0, you increase the amount withheld, which may result in a refund during tax season. Alternatively, entering 1 may result in less withholding, potentially leading to a tax bill. Carefully assess your income and expenses, and refer to your Ok lien oklahoma withholding form to make the best decision.

Claiming yourself on the VA 4 form is generally advisable if you do not have dependents. By claiming yourself, you indicate that you are responsible for your own taxes, which helps determine the appropriate amount to withhold from your paycheck. If you are unsure, consider consulting with a tax professional to assess your situation better. Pair this with the guidelines from your Ok lien oklahoma withholding form for a complete understanding of your tax liabilities.

When claiming exemptions in Wisconsin, it is essential to evaluate your personal and financial situation carefully. Generally, individuals can claim themselves and dependents as exemptions. However, more exemptions usually reduce State withholding but may lead to owing taxes at year-end. It is advisable to review your withholding amounts in conjunction with your Ok lien oklahoma withholding form to ensure an accurate tax liability assessment.

The 500 B form in Oklahoma is used for reporting and remitting Oklahoma income tax withholding. Employers must file this form to summarize their withholding activities over a reporting period. By properly submitting the 500 B form, employers ensure compliance with state tax laws and effectively manage tax liability. This form often accompanies your Ok lien oklahoma withholding form for a comprehensive reporting process.

Yes, Oklahoma provides a state withholding form known as the OK W-4. This form is essential for both employees and employers, as it determines how much state income tax should be withheld from your paycheck. You can find this form on the Oklahoma Tax Commission's website or through other tax resources. It is crucial for accurately completing your Ok lien oklahoma withholding form.