Limited Business

Description

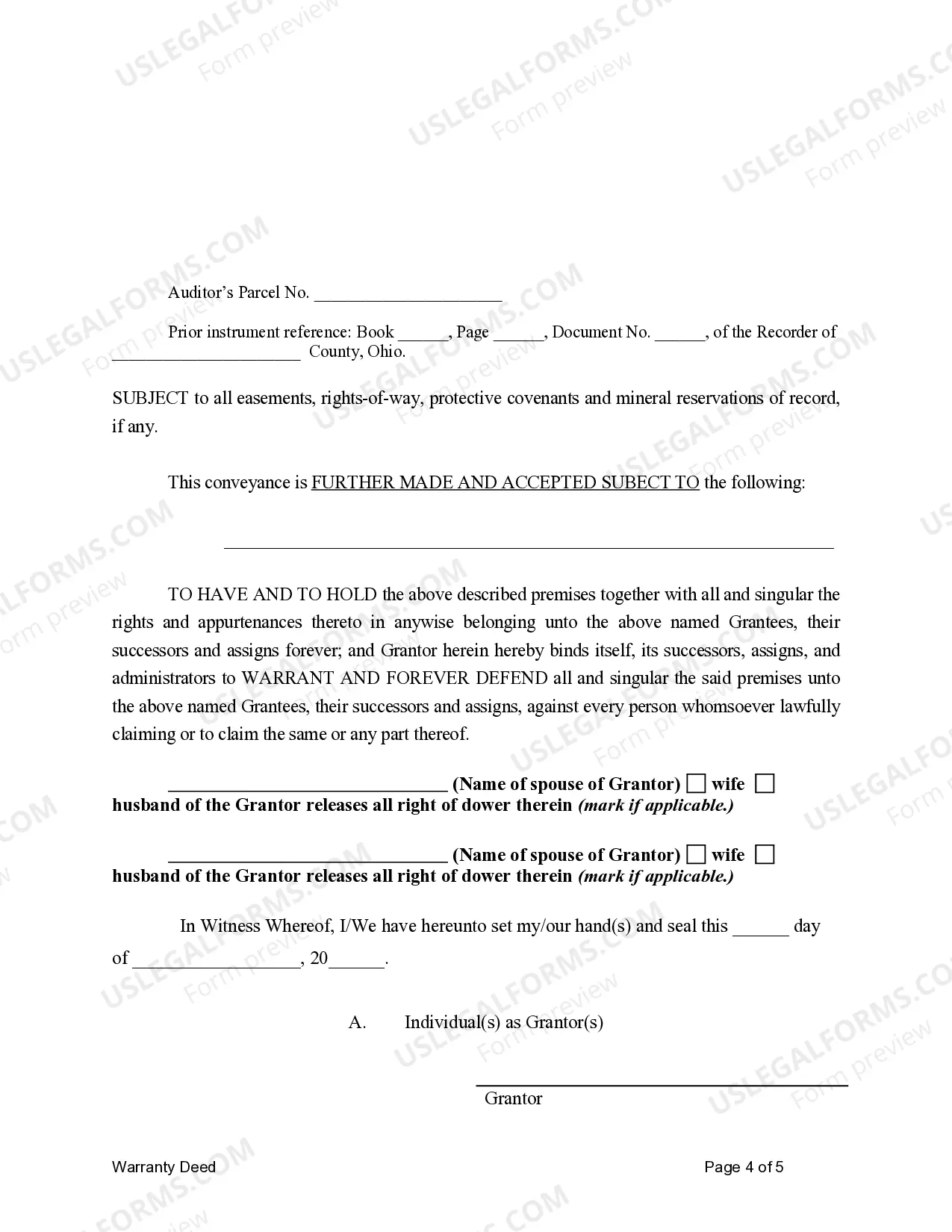

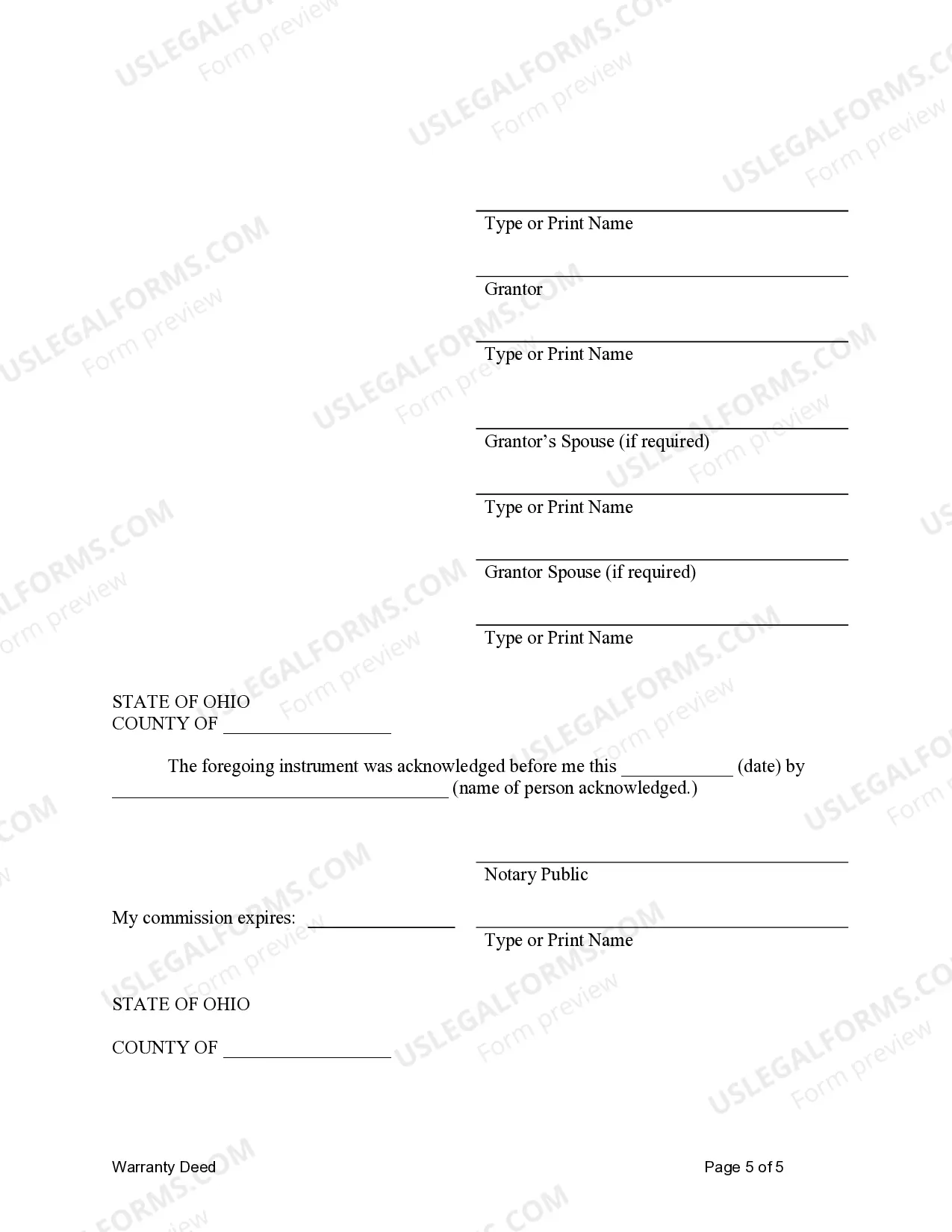

How to fill out Ohio Warranty Deed From Limited Partnership Or LLC Is The Grantor, Or Grantee?

- Log into your existing account or create a new one on the US Legal Forms website.

- Explore the extensive library and review the preview of the specific form you need.

- Confirm that the form aligns with your local jurisdiction by checking the description.

- If necessary, use the Search tab to find alternative templates that suit your needs.

- Select the template and click the Buy Now button, then choose your preferred subscription plan.

- Complete your purchase by entering your credit card or PayPal information.

- Download your selected form to your device and access it in the My Forms section whenever required.

Using US Legal Forms means gaining access to a vast library of over 85,000 editable legal templates, more than any competitor, ensuring you find what you need without hassle. Plus, premium expert assistance is available to guarantee your documents are accurate and legally sound.

In conclusion, leveraging US Legal Forms can eliminate the stress of dealing with legal documentation in a limited business context. Don't hesitate—start streamlining your legal processes today!

Form popularity

FAQ

To be classified as a limited company, your business must be registered as such and adhere to laws governing limited entities. This includes having shareholders, issuing shares, and maintaining separate financial accounts. Achieving limited business status not only provides liability protection but also enhances your company’s credibility with clients and investors.

A limited company qualifies by being registered with the appropriate state authority and following legal requirements, such as filing annual returns. It must have at least one shareholder and one director. This status provides liability protection to the owners, distinguishing it as a limited business, and ensures compliance with specific regulations.

A limited company is a specific type of business organization that limits its owners' liability, while an LLC, or Limited Liability Company, combines characteristics of a corporation and a partnership. Both entities protect personal assets, but an LLC often provides more flexibility in management and tax treatment. Understanding these distinctions allows you to choose the right path for your limited business.

To identify if you are a limited company, check your business registration documents. A limited company typically has 'Limited' or 'Ltd' in its name. Furthermore, the ownership of a limited company is divided into shares held by shareholders, which can also indicate its status as a limited business. Using resources like US Legal Forms can help clarify your business structure.

Limited in business refers to the concept of limited liability that restricts the financial obligations of owners. This essential feature allows business owners to enjoy a unique balance between risk and opportunity. Limited businesses can access liability protection, making them an attractive choice for new entrepreneurs and established firms alike. If you’re considering this model, platforms like uslegalforms can provide the tools needed to set up your limited business properly.

When a business has ‘limited’ in its title, it signifies that it operates as a limited company. This indicates to everyone that the company has a distinct legal identity from its owners and shareholders. In a limited business, personal liability is confined to the amount invested in the company, protecting personal assets in most circumstances. It is an essential distinction for those wanting to ensure financial security while managing a business.

Businesses use the term ‘limited’ to indicate their limited liability status. This label communicates to customers, partners, and creditors that the owners do not bear personal responsibility for the company’s debts. A limited business can enhance credibility and foster trust among stakeholders. Such a structure also often attracts investors who seek reduced risk when considering financial support.

In business, the term ‘limited’ refers to the limited liability of the owners. This means that the financial responsibility of shareholders is restricted to their investment in the company. If the business incurs debts or faces legal issues, the personal assets of the owners generally remain protected. This aspect is crucial for entrepreneurs looking to minimize risk while pursuing business ventures.

A limited company is a type of business structure that protects its owners from personal liability. In a limited business, the company's finances are separate from the personal finances of its shareholders. This setup allows for reduced risks, as owners are only liable up to the amount they have invested in the business. Choosing a limited company structure can be a smart move, especially for those looking to grow their enterprise.

Whether you should file separately with your LLC depends on your unique circumstances, including income and tax situation. If you are part of a multi-member LLC, separate filings will be necessary. However, as a single-member limited business, combining your personal and LLC income on one return can simplify reporting and payment.