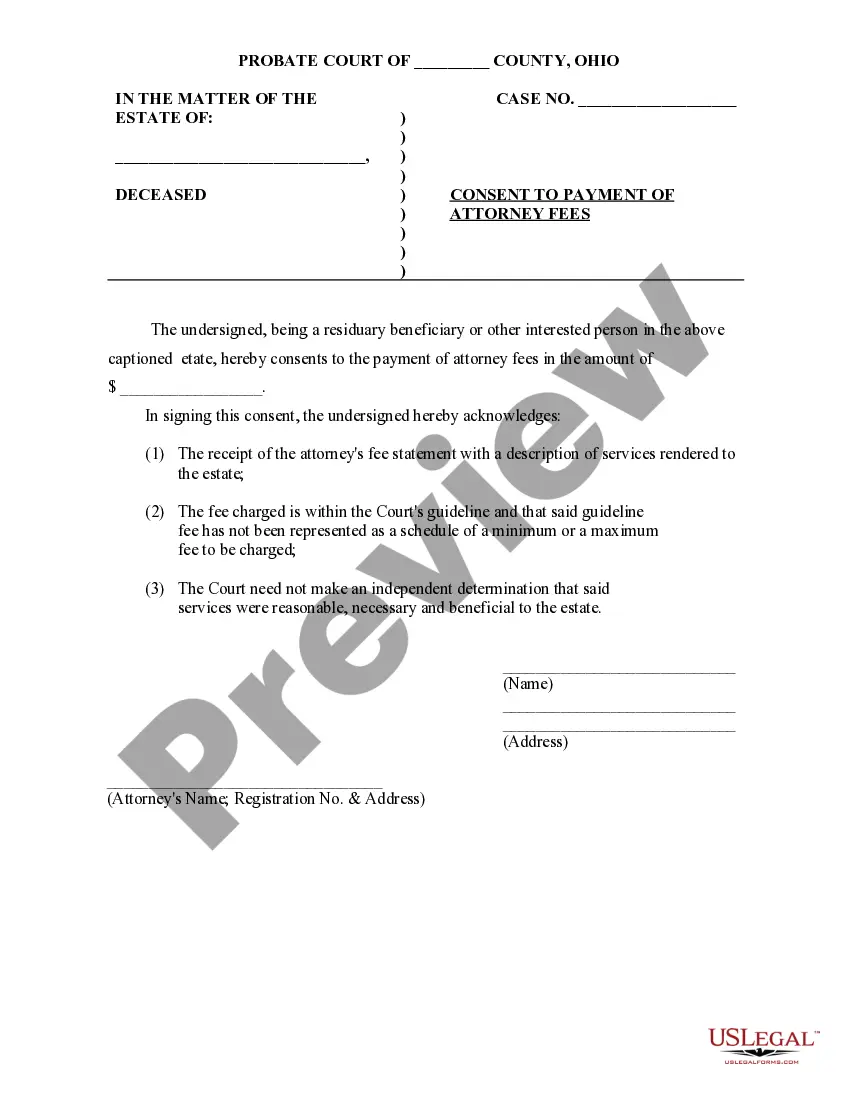

This sample form is a Consent to Payment of Attorney Fees document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

Payment Attorney Fees For Probate

Description

Form popularity

FAQ

Generally, the estate pays probate attorney fees in California. This means the costs are drawn from the assets left by the deceased, not out-of-pocket by the heirs. The exact fees depend on the size of the estate and the complexity of the probate process. Utilizing tools from USLegalForms can help clarify these fees upfront.

To avoid probate fees in California, consider creating a living trust. This method allows you to transfer assets without going through probate, which can incur high attorney fees. Additionally, you can gift assets while you are alive, thus bypassing the probate process altogether. Be sure to consult with a reliable resource like USLegalForms to explore options that might minimize payment attorney fees for probate.

Yes, you can handle probate without a lawyer in California. However, it may require significant time and effort to understand the process. Navigating court rules and preparing necessary documents can be complex. Using a platform like USLegalForms can simplify the steps and reduce the payment attorney fees for probate.