Revocation Living Trust With A Will

Description

How to fill out Ohio Revocation Of Living Trust?

- If you're an existing user, log in to your account to download the necessary template by clicking the Download button. Ensure your subscription is active, and if not, renew it as per your chosen payment plan.

- For first-time users, start by reviewing the Preview mode and form descriptions. Confirm that the selected form matches your needs and complies with your local jurisdiction requirements.

- If you find any discrepancies, use the Search feature to locate the correct template. Once you've ensured it meets your criteria, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan, which requires account registration for resource access.

- Complete your transaction by entering your credit card details or opting for PayPal for payment.

- Finally, download your form and save it to your device, which you can also access later through the My Forms section of your profile.

US Legal Forms empowers both individuals and attorneys to efficiently execute legal documents thanks to its extensive library of over 85,000 fillable forms and packages.

Take control of your estate planning today. Visit US Legal Forms to begin your journey towards securing your legacy with ease!

Form popularity

FAQ

There are several reasons someone might choose to revoke a living trust with a will. Changes in personal circumstances, such as marriage or divorce, can prompt this decision. Additionally, if the trust no longer aligns with your financial goals or family dynamics, you may find it necessary to revoke it. Understanding the revocation process is crucial, and platforms like US Legal Forms can guide you through the necessary steps to easily manage changes to your trust.

When considering the revocation of a living trust with a will, many people wonder which holds more power. Generally, a trust can bypass the lengthy probate process, which often gives it an advantage over a will. Additionally, a living trust can manage assets during your lifetime, while a will only takes effect after your passing. Therefore, while both documents are important, a revocable living trust often provides more flexibility and control.

Determining whether your parents should place their assets in a trust depends on their specific estate planning goals. A trust can help avoid probate and ensure a smoother transfer of assets. However, it may also come with complexities that require careful consideration. Consulting with experts can help your parents evaluate their options effectively, particularly regarding a revocation living trust with a will.

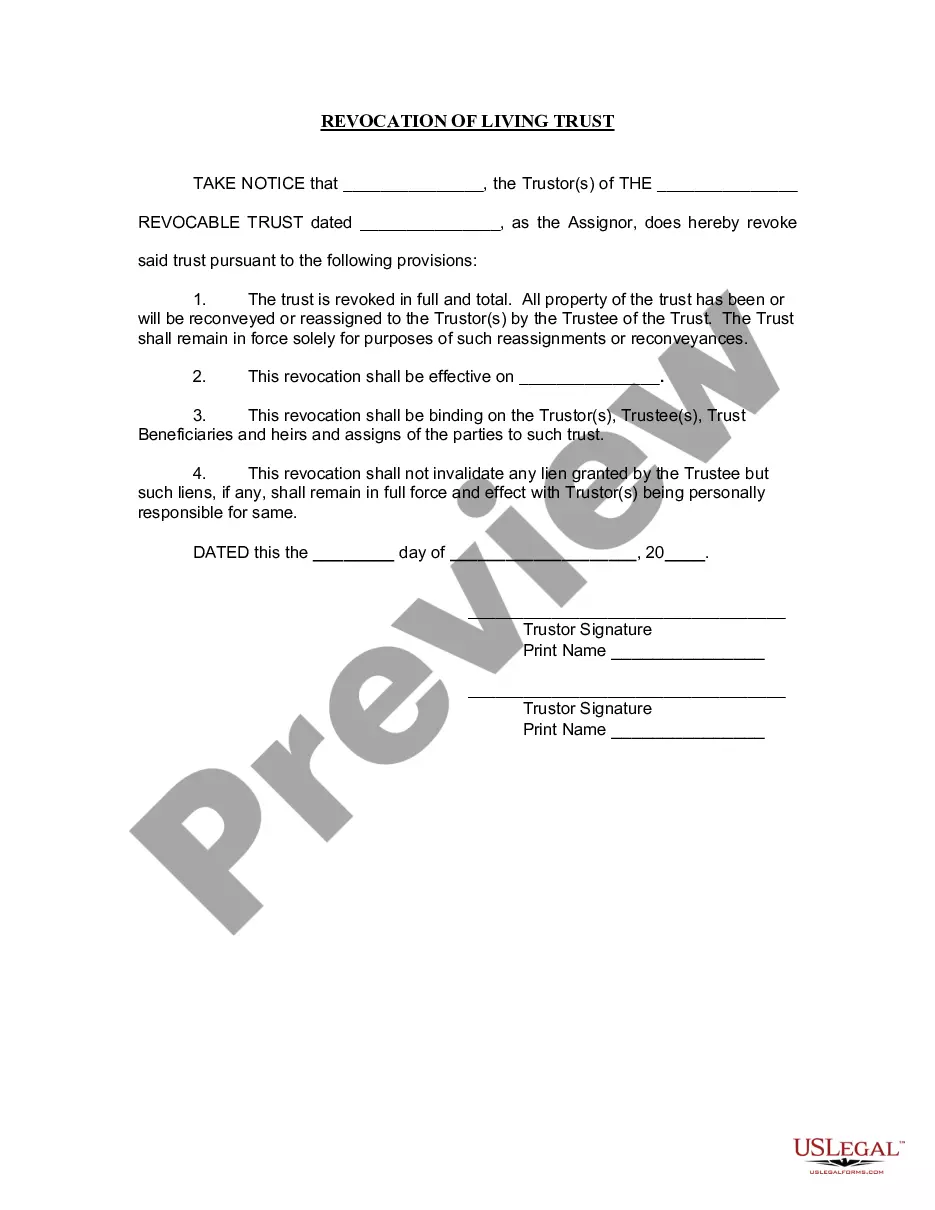

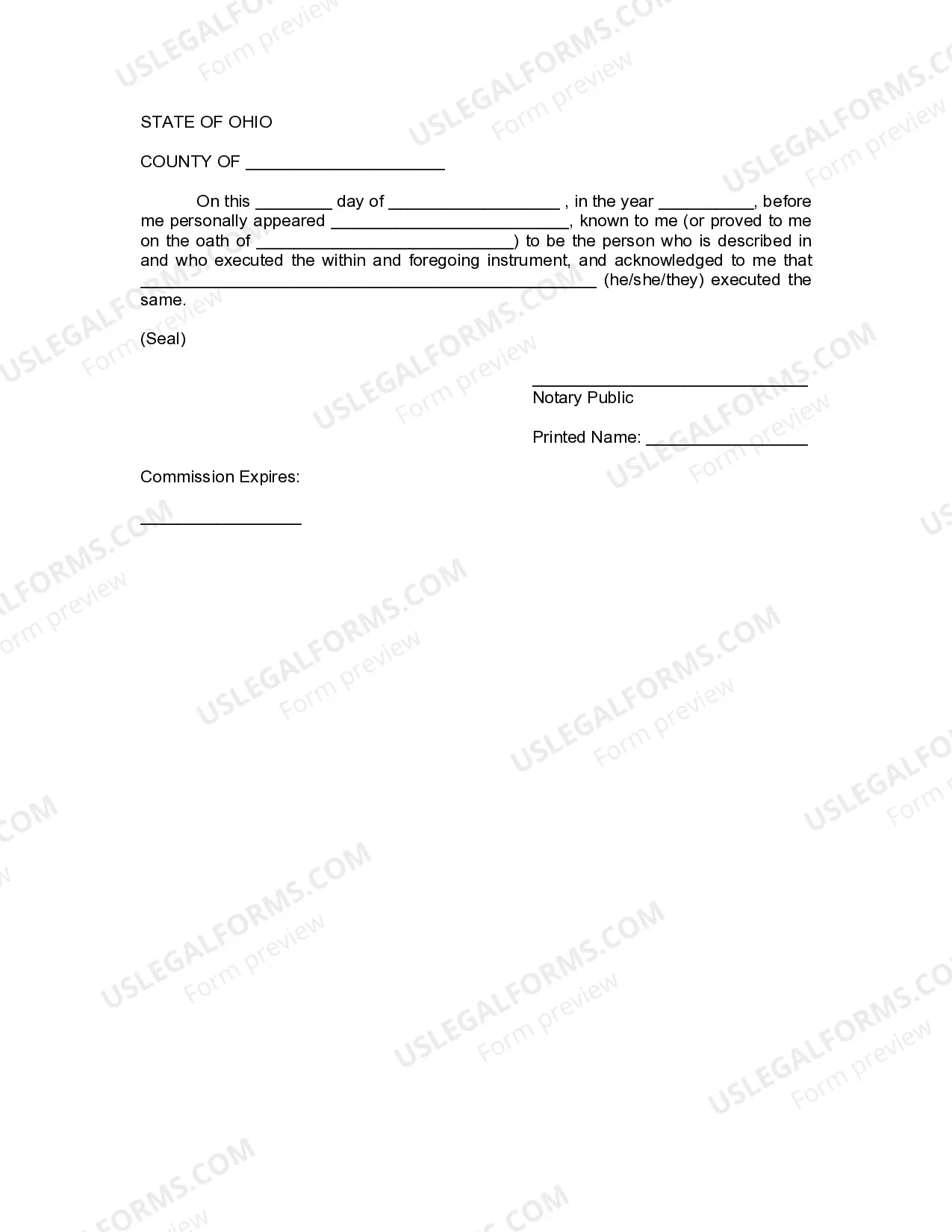

To revoke a revocable living trust, you need to prepare a formal document that expresses the desire to revoke the trust. This document should specify the trust being revoked and include the necessary signatures. Having a legal professional assist you ensures that the revocation process follows state laws accurately, especially when it comes to a revocation living trust with a will.

One potential downfall of having a trust is that it doesn't protect assets from creditors. Trusts can be beneficial for estate planning, but they do not offer the immunity some might expect. It's also important to note that trusts may require ongoing management. A well-structured revocation living trust with a will can address these concerns proactively.

A family trust can come with disadvantages, such as limited control over assets. Once assets are placed in the trust, the trustee manages them, which may not align with the family's immediate needs or wishes. Furthermore, if not managed well, a family trust may lead to disputes among heirs. Understanding the implications of a revocation living trust with a will can help mitigate these issues.

One of the biggest mistakes parents often make is failing to fund the trust adequately. A trust fund is only as effective as the assets it contains. Additionally, neglecting to revise the trust as family circumstances change can lead to complications. Utilizing a revocation living trust with a will allows for adjustments as needed.

A revocation of a living trust typically involves a written document that explicitly states the intention to revoke the trust. This document should be signed and dated to ensure its validity. Therefore, seeking guidance from legal experts in preparing a revocation living trust with a will is advisable to ensure all requirements are met.

Yes, a will can override a living trust under certain conditions. If the will explicitly states different distribution instructions than those in the living trust, the will takes precedence. However, to achieve a harmonious estate plan, consider incorporating a revocation living trust with a will to clarify your intentions and minimize potential conflicts among beneficiaries. Consulting legal resources can help ensure your directives are consistent and enforced.

A form to dissolve a revocable trust typically includes a declaration of revocation that states your intention to cancel the trust. You must fill out this form according to your state's legal requirements, ensuring that it is signed and dated. It's wise to consult resources on uslegalforms for accurate templates and guidance. Understanding the process of revocation living trust with a will will help you make informed decisions regarding your estate.