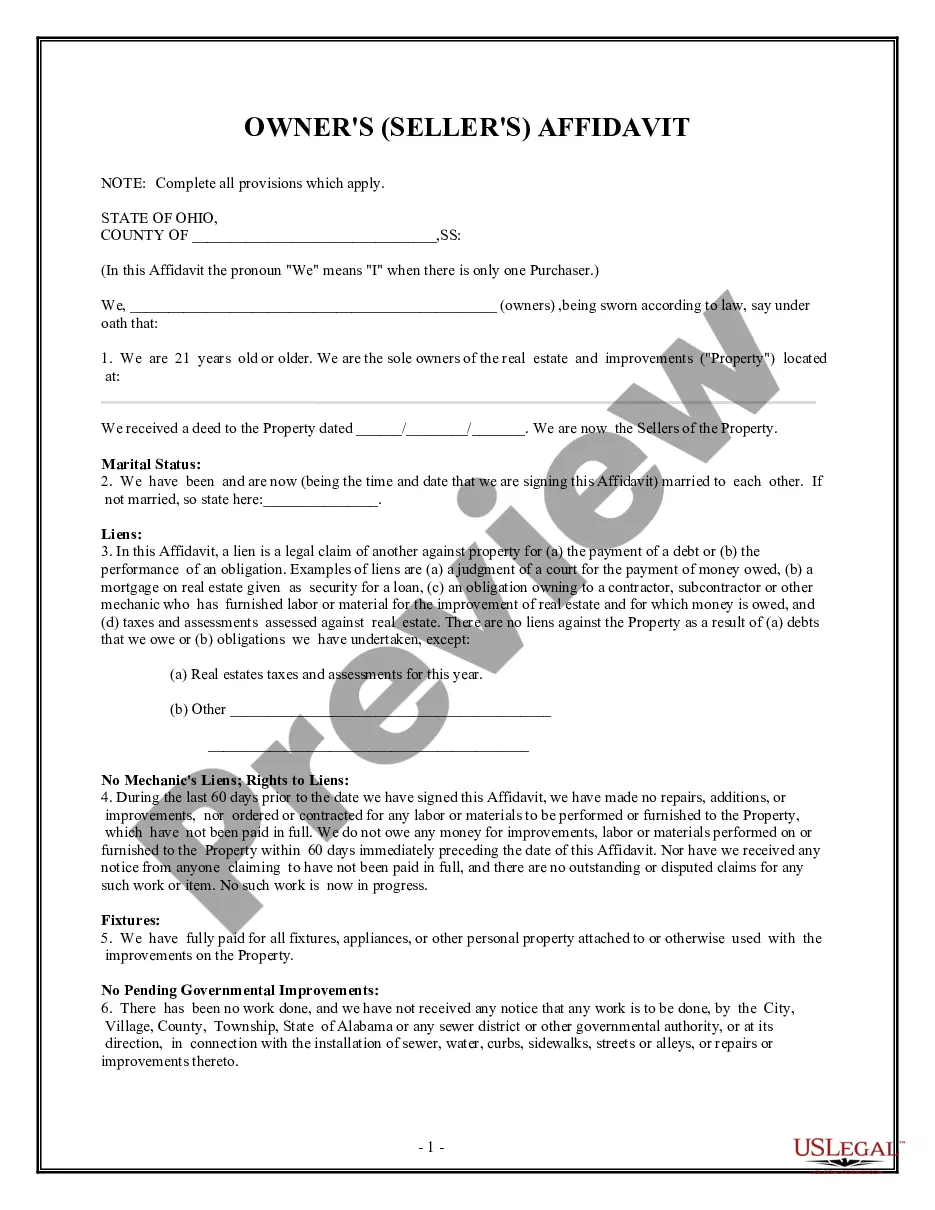

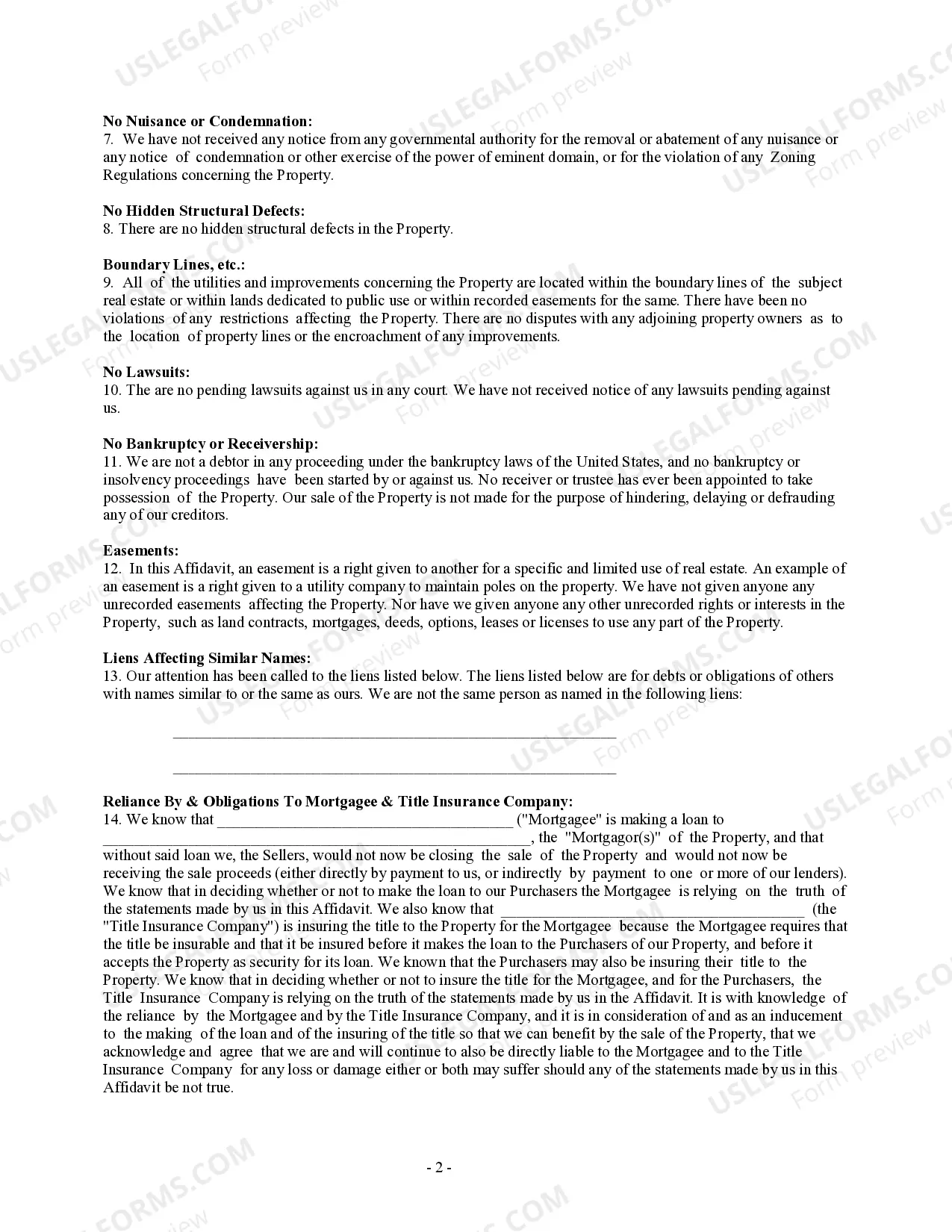

Seller Affidavit Real Estate Form

Description

How to fill out Ohio Owner's Or Seller's Affidavit Of No Liens?

Bureaucracy demands precision and accuracy.

If you do not handle the completion of documents like Seller Affidavit Real Estate Form regularly, it may lead to some miscommunications.

Selecting the correct template from the outset will ensure that your document submission proceeds smoothly and avert any inconveniences of resending a file or repeating the same task from the start.

If you are not a subscribed user, finding the needed template would involve a few additional steps.

- You can always obtain the appropriate template for your documentation in US Legal Forms.

- US Legal Forms is the largest online forms repository that houses over 85 thousand templates for various fields.

- You can acquire the most current and suitable version of the Seller Affidavit Real Estate Form by merely searching for it on the platform.

- Locate, store, and download templates in your profile or check the description to confirm you have the correct one at hand.

- With an account at US Legal Forms, it's simple to obtain, keep in one location, and navigate through the templates you saved for quick access.

- While on the website, click the Log In button to sign in.

- Then, proceed to the My documents page, where your forms list is maintained.

- Explore the description of the forms and download the ones you need at any time.

Form popularity

FAQ

In order to avoid issues with FIRPTA, the seller will sign an Affidavit and certify status. Otherwise, various pesky IRS forms, such as Form 8288 may be required.

(6) Qualified substitute The term qualified substitute means, with respect to a disposition of a United States real property interest (A) the person (including any attorney or title company) responsible for closing the transaction, other than the transferor's agent, and (B) the transferee's agent.

A qualified substitute may be (i) an attorney, title company, or escrow company (but not the Seller's agent) responsible for closing the transaction, or (ii) the Buyer's agent. 2.

BOSTON Merger and acquisition agreements almost universally require the target or seller to deliver at closing a so-called FIRPTA certificate i.e., an affidavit that either the target is not a United States real property holding corporation or that the seller is not a foreign person, in each case in accordance

FIRPTA, which was established in 1980 stands for Foreign Investment Real Property Tax Act. This is essentially a prepayment of anticipated tax due on the gain of the sale of a U.S. real property interest. A refund may be issued when taxes are filed, if an overpayment is made.